U.S. Peripheral Artery Disease Market Size, Share, & Industry Analysis Report

By Device Type (Endovascular Devices, Surgical Devices), By Anatomical Site, By End Use – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6018

- Base Year: 2024

- Historical Data: 2020-2023

Overview

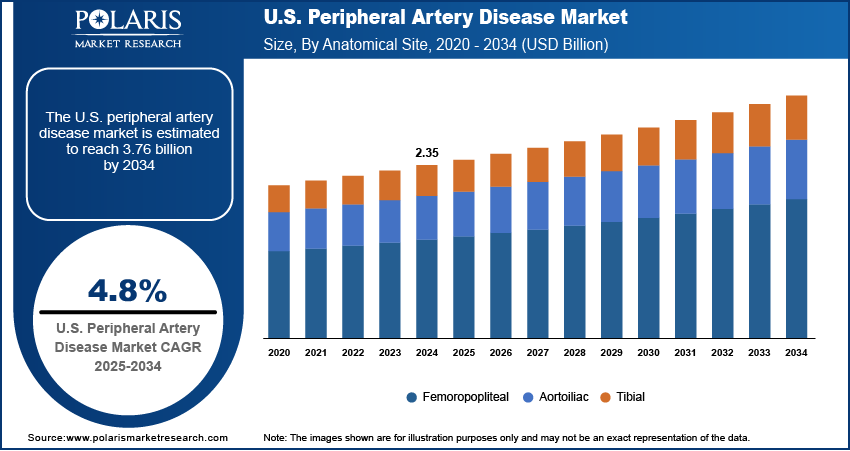

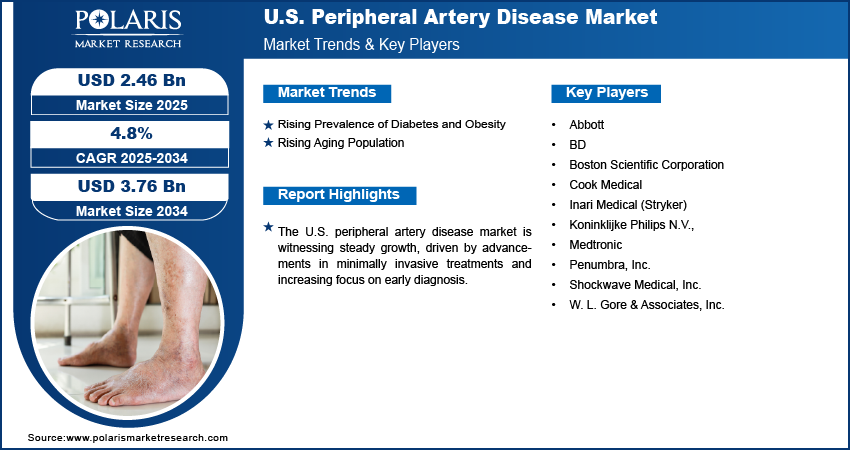

The U.S. peripheral artery disease market size was valued at USD 2.35 billion in 2024, growing at a CAGR of 4.8% from 2025 to 2034. The increasing prevalence of chronic conditions such as diabetes and obesity, coupled with a rapidly aging population, is elevating the peripheral artery disease incidence rates. Simultaneously, the shift toward minimally invasive treatment options and supportive government healthcare policies with enhanced reimbursement frameworks are accelerating expansion opportunities.

Key Insights

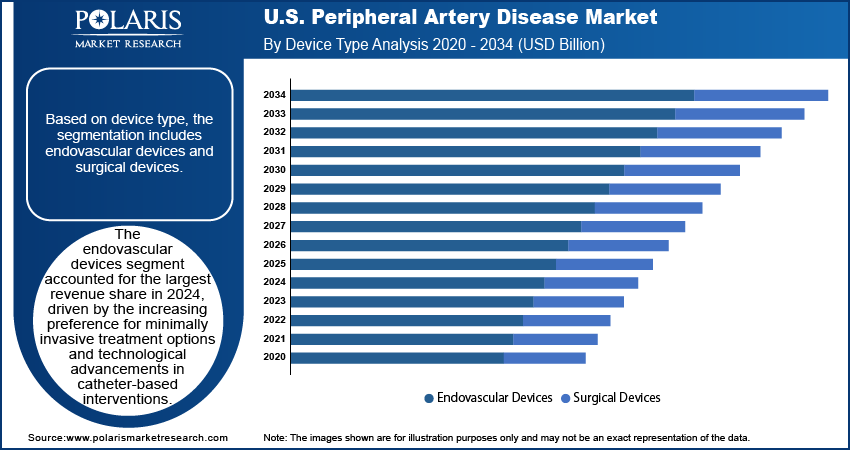

- The endovascular devices segment accounted for the largest revenue share in 2024.

- The femoropopliteal segment held a significant share of the market in 2024, primarily due to the high incidence of atherosclerotic lesions in this anatomical region.

- The growth of the hospital segment is driven by the availability of advanced vascular care infrastructure and skilled interventional teams.

Peripheral artery disease (PAD) refers to the narrowing or blockage of arteries, primarily in the legs, due to the buildup of fatty deposits that restrict blood flow. The rising preference for minimally invasive procedures is shaping the PAD treatment landscape. Procedures, such as angioplasty and stent placement, offer reduced recovery time, lower risk of complications, and improved patient comfort compared to traditional surgical interventions. This shift toward less invasive options is encouraging broader adoption among both healthcare providers and patients, driving the demand for advanced interventional devices and techniques. The growing adoption of such procedures is expected to contribute to the U.S. PAD market evolution as healthcare systems focus on optimizing outcomes and resource efficiency.

Government initiatives, improved reimbursement policies, and awareness campaigns play a critical role in the expansion of the U.S. peripheral artery disease market. Various national health authorities and nonprofit organizations are investing in early detection, patient education, routine screening programs, and peripheral artery interventions to improve diagnosis rates and reduce the disease burden. In 2022, the U.S. Department of Health and Human Services reported that Medicare spent over USD 600 million on peripheral artery interventions, including atherectomy and angioplasty with a stent. Enhanced reimbursement coverage for PAD-related diagnostics and treatment procedures has increased patient access to timely care, particularly among underserved populations. In parallel, awareness programs are improving public understanding of PAD risk factors and symptoms, promoting earlier intervention and adherence to treatment. These efforts collectively foster a supportive ecosystem for market growth and help bridge existing gaps in PAD management.

Industry Dynamics

- The increasing prevalence of diabetes and obesity is elevating demand for peripheral artery disease (PAD) interventions, as these metabolic conditions accelerate atherosclerosis development.

- Demographic shifts toward older populations are driving industry growth due to the strong correlation between aging and two critical risk factors: decreased immunity and increased prevalence of chronic conditions, both of which heighten the demand for healthcare products and services.

- High procedure costs and limited reimbursement policies restrict patient access to advanced PAD treatments, especially in developing countries.

- Growing adoption of telemedicine and remote monitoring creates new ways to manage PAD patients efficiently.

Rising Aging Population: The growing aging population is driving the demand for peripheral artery disease management across the U.S.. Rising age is a well-established risk factor for arterial stiffening and plaque accumulation. According to a June 2025 U.S. Census Bureau report, the population aged 65 and above increased by 3.1%, reaching 61.2 million in the U.S. in 2024. Aging individuals are more likely to experience impaired circulation and endothelial dysfunction, making them susceptible to PAD with age. Furthermore, older adults often present with multiple comorbidities, including cardiovascular conditions, which increase the complexity and frequency of PAD cases. This demographic trend is expanding the patient pool and placing greater focus on tailored therapeutic approaches, continuous monitoring, and long-term disease management solutions, thereby driving the U.S. peripheral artery disease market expansion.

Rising Prevalence of Diabetes and Obesity: Diabetes and obesity contribute to the development and progression of atherosclerosis, the underlying cause of PAD. According to a May 2024 CDC report, diabetes affected approximately 38.4 million across all age groups, representing 11.6% of the total U.S. population. Chronic hyperglycemia in diabetes accelerates arterial damage, while obesity is closely linked to metabolic syndrome, hypertension, and dyslipidemia, all of which elevate PAD risk. The increasing burden of these metabolic disorders is leading to a higher number of individuals being diagnosed with PAD, thereby boosting the demand for early diagnosis, effective management strategies, and advanced interventional treatments. Therefore, the rising prevalence of diabetes and obesity is boosting the U.S. peripheral artery disease market growth.

Segmental Insights

Device Type Analysis

Based on device type, the U.S. peripheral artery disease market is bifurcated into endovascular devices and surgical devices. The endovascular devices segment accounted for a larger revenue share in 2024, driven by the increasing preference for minimally invasive surgery options and technological advancements in catheter-based interventions. These devices, such as stents, balloons, and atherectomy tools, are preferred for their ability to restore blood flow with reduced procedural risk and quicker recovery times compared to open surgery. The rising adoption of image-guided techniques and drug-eluting technologies has further enhanced the clinical outcomes of endovascular procedures. Moreover, expanding indications for these devices across various stages of PAD and growing physician confidence in their long-term efficacy are contributing to their dominant share.

Anatomical Site Analysis

In terms of anatomical site, the U.S. peripheral artery disease market segmentation includes aortoiliac, femoropopliteal, and tibial. The femoropopliteal segment held a significant share of the market in 2024, primarily due to the high incidence of atherosclerotic lesions in this anatomical region. This segment includes the superficial femoral and popliteal arteries, which are commonly affected by PAD and are prone to restenosis and occlusion. The accessibility of this area for endovascular interventions, combined with the availability of specialized devices tailored to its unique biomechanical environment, has made it a focal point for treatment. Additionally, clinical attention toward improving patency rates and limb salvage in femoropopliteal disease is driving innovation, thereby sustaining the segment's leading position in the anatomical site segmentation.

End Use Analysis

The segmentation, based on end use, includes hospitals, outpatient facilities, and others. The hospital segment growth is driven by the availability of advanced vascular care infrastructure and skilled interventional teams. Hospitals are equipped with comprehensive diagnostic imaging service, hybrid operating rooms, and emergency care capabilities, making them the primary choice for both elective and urgent PAD procedures. The integration of multidisciplinary teams, such as vascular surgeons, interventional radiologists, and cardiologists, supports holistic patient management. Furthermore, hospitals often serve as referral centers for complex or high-risk cases, which require specialized equipment and post-procedural monitoring, contributing to their strong presence.

Key Players and Competitive Analysis

The U.S. PAD treatment landscape is advancing rapidly, driven by technological innovations in endovascular devices and strategic investments from industry players. The market is characterized by a strong healthcare infrastructure and high adoption of minimally invasive therapies, such as atherectomy systems and intravascular lithotripsy (IVL) technologies. Competitive intelligence reveals a growing focus on outpatient environments and value-based care models, with small and medium-sized U.S. firms pioneering bioresorbable stents and advanced drug-coated balloons. Major trends include the integration of AI-powered diagnostics and localized manufacturing to mitigate supply chain risks. Vendor strategies highlight clinical data to differentiate product offerings, particularly in real-world evidence generation, as seen in BD’s XTRACT Registry for its Rotarex System. Moreover, rising diabetes and hypertension prevalence continue to fuel demand, with expansion opportunities in ambulatory surgical centers and community-based care. Future development will prioritize cost-effective, sustainable solutions aligned with U.S. reimbursement policies and regulatory frameworks.

A few major companies operating in the U.S. peripheral artery disease market include Abbott; BD; Boston Scientific Corporation; Cook Medical; Inari Medical (Stryker); Koninklijke Philips N.V.; Medtronic; Penumbra, Inc.; Shockwave Medical, Inc.; and W. L. Gore & Associates, Inc.

Key Players

- Abbott

- BD

- Boston Scientific Corporation

- Cook Medical

- Inari Medical (Stryker)

- Koninklijke Philips N.V.,

- Medtronic

- Penumbra, Inc.

- Shockwave Medical, Inc.

- W. L. Gore & Associates, Inc.

Industry Developments

- May 2025: BD launched the XTRACT Registry, a real-world study evaluating its Rotarex Atherectomy System for PAD treatment. The multi-center study will track 600 patients across 100 sites, assessing 30-day to 12-month outcomes.

- March 2025: Shockwave Medical launched its Javelin Peripheral IVL Catheter in the U.S. for treating calcified peripheral artery disease. The forward-firing intravascular lithotripsy platform addresses vessel narrowing while maintaining the safety profile of existing IVL technologies.

U.S. Peripheral Artery Disease Market Segmentation

By Device Type Outlook (Revenue, USD Billion, 2020–2034)

- Endovascular Devices

- Surgical Devices

By Anatomical Site Outlook (Revenue, USD Billion, 2020–2034)

- Aortoiliac

- Femoropopliteal

- Tibial

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Outpatient Facilities

- Others

U.S. Peripheral Artery Disease Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.35 Billion |

|

Market Size in 2025 |

USD 2.46 Billion |

|

Revenue Forecast by 2034 |

USD 3.76 Billion |

|

CAGR |

4.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 2.35 billion in 2024 and is projected to grow to USD 3.76 billion by 2034.

The U.S. market is projected to register a CAGR of 4.8% during the forecast period.

A few of the key players in the market are Abbott; BD; Boston Scientific Corporation; Cook Medical; Inari Medical (Stryker); Koninklijke Philips N.V.; Medtronic; Penumbra, Inc.; Shockwave Medical, Inc.; and W. L. Gore & Associates, Inc.

The endovascular devices segment accounted for a larger revenue share in 2024.

The hospital segment growth is driven by the availability of advanced vascular care infrastructure and skilled interventional teams.