U.S. Risk Management Market Size, Share, Trends, Industry Analysis Report

By Component (Solution, Services), By Deployment, By Risk Type, By Organization Size, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6193

- Base Year: 2024

- Historical Data: 2020-2023

Overview

The U.S. risk management market size was valued at USD 5.99 billion in 2024, growing at a CAGR of 14.1% from 2025 to 2034. Stringent federal regulations across finance, healthcare, and energy sectors drive adoption of advanced risk management systems. Companies prioritize tools that support audit trails, reporting accuracy, and regulatory alignment to avoid penalties and ensure operational transparency in complex legal environments.

Key Insights

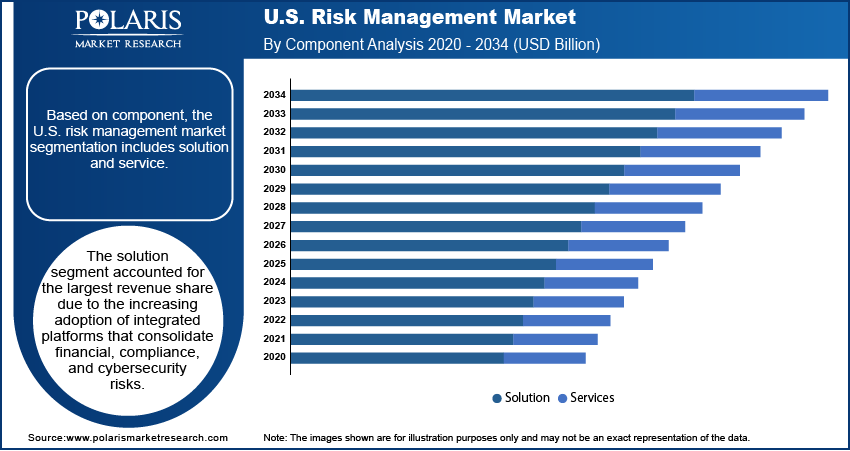

- The solution segment led in 2024 due to rising demand for integrated platforms that unify financial, compliance, and cybersecurity risk management.

- The cloud-based segment captured the largest share in 2024, driven by enterprise needs for scalability, cost efficiency, and remote access.

- The financial risk segment dominated in 2024, fueled by concerns over interest rate volatility, credit risk, and liquidity challenges.

- The BFSI segment held the largest revenue share in 2024, due to high regulatory pressure, fraud risks, and digital transformation across banks and financial institutions.

Industry Dynamics

- Increasing regulatory complexity across industries is driving demand for automated and integrated risk management solutions in the U.S.

- Rising frequency of cyberattacks and data breaches is accelerating adoption of advanced risk monitoring and response platforms.

- AI-powered analytics enable real-time threat detection and predictive risk modeling for proactive decision-making in enterprise environments.

- High implementation costs and integration challenges with legacy systems limit adoption, especially among small and mid-sized organizations.

Market Statistics

- 2024 Market Size: USD 5.99 billion

- 2034 Projected Market Size: USD 22.36 billion

- CAGR (2025–2034): 14.1%

The U.S. risk management market encompasses solutions, services, and systems that help organizations identify, assess, mitigate, and monitor potential threats to operations, finances, reputation, and compliance. These tools enable proactive decision-making and strategic planning by minimizing exposure to internal and external risks across diverse sectors such as finance, healthcare, manufacturing, and IT. Rising demand for artificial intelligence, machine learning, and automation in risk management is reshaping enterprise risk ecosystems. Automated workflows, predictive analytics, and real-time dashboards improve decision-making, enabling organizations to detect anomalies and minimize risk exposure more efficiently.

The widespread adoption of hybrid work and cloud-based infrastructure creates complex risk profiles. In the U.S., firms seek centralized, cloud-native platforms to manage compliance, monitor endpoints, and safeguard distributed networks against operational, legal, and cybersecurity risks. Moreover, increasing reliance on vendors, service providers, and outsourcing partners introduces new risks. Organizations are adopting third-party risk management platforms to monitor partner performance, ensure contract compliance, and minimize exposure from external dependencies across diverse supply chains.

Drivers and Opportunities

Surge in Cybersecurity Incidents: Cybersecurity has become a top concern for U.S. organizations facing a sharp rise in ransomware, phishing schemes, and supply chain attacks. According to the U.S. Department of Health and Human Services, in 2024, healthcare data breaches affected over 52 million individuals. Fintech companies are dealing with large volumes of sensitive financial data and must adhere to strict regulatory standards, making risk oversight essential. These threats are no longer isolated events but part of a growing pattern targeting both public and private sectors. Enterprises are actively deploying integrated risk management tools to identify vulnerabilities, track anomalies, and coordinate faster responses to incidents. The need to protect digital assets, customer data, and operational continuity is leading to increased investment in cyber risk solutions. These platforms help ensure continuous monitoring, automate threat intelligence, and align cybersecurity efforts with broader enterprise risk strategies.

Stringent Regulatory Compliance Frameworks: Stringent regulatory oversight in sectors such as finance, healthcare, and energy is pushing companies to strengthen their risk management practices. According to the U.S. Department of the Treasury, in April 2024, financial institutions were mandated to enhance risk management frameworks to address evolving cyber and operational threats under the new Financial Services Sector Risk Management Plan. Compliance requirements around data protection, financial disclosures, and operational safety are growing in complexity. Organizations are implementing systems that provide clear audit trails, generate timely compliance reports, and support risk-based decision-making. Risk management platforms are being chosen for their security features and ability to simplify regulatory workflows. These systems enable businesses to demonstrate accountability, manage internal controls, and stay aligned with ever-evolving federal and state-level mandates without disrupting their core operations.

Segmental Insights

Component Analysis

Based on component, the U.S. risk management market segmentation includes solution and service. The solution segment accounted for the largest revenue share due to increasing adoption of integrated platforms that consolidate financial, compliance, and cybersecurity risks. Organizations are prioritizing solutions that offer real-time analytics, automated workflows, and centralized dashboards to enhance decision-making and reduce operational disruptions. Demand is particularly high among regulated sectors such as banking, energy, and healthcare, where risk exposure needs to be continuously monitored and controlled. These solutions help reduce manual errors, improve compliance accuracy, and support enterprise-wide risk visibility. The ability to customize these platforms to meet sector-specific needs further strengthens their market position.

The service segment is expected to register the highest CAGR from 2025 to 2034 due to rising demand for specialized consulting, implementation, and managed risk services. Companies are increasingly turning to external experts to guide risk framework development, audit readiness, and system optimization. The complexity of evolving risk environments, such as dynamic regulatory changes and cyber threats, has made in-house risk management insufficient for many enterprises. Service providers bring deep expertise, industry-specific experience, and flexible support models that allow organizations to scale their risk capabilities. This shift toward outsourcing enhances operational resilience without overburdening internal teams.

Deployment Analysis

In terms of deployment, the U.S. risk management market segmentation includes on-premises and cloud-based. The cloud-based segment held the largest revenue share in 2024 due to growing enterprise demand for scalable, cost-efficient, and remotely accessible platforms. Organizations are choosing cloud deployments to enable real-time data sharing, collaborative risk assessments, and seamless updates across departments. These systems provide faster deployment cycles and integrate easily with existing business applications. Data security, disaster recovery, and compliance tracking are improved through cloud-native architecture, making them particularly appealing to sectors dealing with distributed teams and remote operations. The lower upfront costs and predictable subscription models have also encouraged adoption across mid-sized firms.

The on-premises segment is expected to register a significant CAGR from 2025 to 2034, driven by demand from organizations that handle sensitive data or operate in highly regulated industries. Businesses in sectors such as defense, banking, and government prefer on-premises deployment to maintain full control over data infrastructure, security protocols, and compliance enforcement. This approach supports customized risk policies, localized data storage, and restricted network access, which are vital in high-stakes environments. Companies that require minimal external dependencies and prefer in-house IT teams for maintenance are expected to continue favoring on-premises systems, sustaining steady demand.

Risk Type Analysis

In terms of risk type, the segmentation includes financial risk, compliance risk, cybersecurity risk, enterprise risk, operational risk, and others. The financial risk segment held the largest revenue share in 2024 due to rising concerns over interest rate volatility, credit exposure, and liquidity management in an uncertain economic environment. Businesses across sectors are deploying financial risk management tools to assess exposure, stress test scenarios, and ensure capital adequacy. Regulatory mandates such as Dodd-Frank and Basel III have reinforced the need for transparent financial controls and reporting mechanisms. Advanced analytics, real-time monitoring, and algorithm-based forecasting are being used to mitigate losses and improve investment decisions. Financial institutions and large corporates view this segment as critical to maintaining fiscal health and investor confidence.

The cybersecurity risk segment is expected to register the highest CAGR from 2025 to 2034 due to escalating cyberattacks targeting critical infrastructure, financial systems, and personal data. In the U.S., companies are responding by integrating cyber risk modules into broader risk management frameworks. Tools that detect breaches, analyze vulnerabilities, and support rapid response protocols are gaining traction across sectors. Cloud migration, remote workforces, and digital transformation initiatives have expanded attack surfaces, making proactive cyber risk management essential. AI-driven threat intelligence, behavioral monitoring, and compliance reporting features are being widely adopted to stay ahead of increasingly sophisticated cyber threats.

End Use Analysis

In terms of end use, the U.S. risk management market segmentation includes BFSI, IT & telecom, government, defense, and aerospace, healthcare & life science, retail & consumer goods, manufacturing, energy & utilities, and others. The BFSI segment held the largest revenue share in 2024 due to its high exposure to regulatory scrutiny, financial fraud, and digital risks. Financial institutions are heavily investing in platforms that monitor transaction risks, manage credit exposure, and ensure regulatory compliance across jurisdictions. The integration of risk systems with core banking platforms enables real-time insights into market, operational, and compliance risks. Frequent audits and the need to maintain trust among stakeholders have made risk management a strategic priority for banks and insurance firms. Customizable tools that support regulatory updates and fraud detection are increasingly deployed to protect operations.

The IT & telecom segment is expected to register a significant CAGR from 2025 to 2034 driven by mounting pressure to manage network security, data privacy, and technology infrastructure risks. Enterprises in this sector deal with vast volumes of sensitive information, requiring continuous monitoring and rapid response systems. Risk management platforms are being used to manage system uptime, ensure regulatory compliance (such as FCC and GDPR), and mitigate software vulnerabilities. Cloud service providers, internet infrastructure firms, and mobile operators are adopting integrated tools that align operational continuity with cyber resilience and compliance needs.

Key Players and Competitive Analysis

The competitive landscape of the U.S. risk management market is shaped by continuous innovation and strategic collaborations. Industry analysis indicates that companies are actively pursuing market expansion strategies, including targeted acquisitions and joint ventures, to broaden their product portfolios and enhance service delivery. Mergers and acquisitions are frequently used to integrate niche technologies and expand customer reach. Post-merger integration efforts focus on streamlining platforms, improving system interoperability, and maximizing operational efficiencies.

Strategic alliances between software providers and consulting firms are increasing, aiming to deliver tailored, end-to-end risk management solutions. Technological advancements such as AI-driven analytics, automation, and real-time monitoring are central to product development strategies. Competitors are also emphasizing regulatory compliance and data privacy features to meet sector-specific requirements. Vendors differentiate themselves by providing scalable, user-friendly platforms that address enterprise-wide risks while supporting governance and audit processes. These dynamics underline a highly responsive and rapidly evolving competitive environment across the U.S. risk management market.

Key Players

- BitSight

- FIS U.S.

- Fiserv

- IBM Corporation

- LogicGate, Inc.

- MetricStream

- Microsoft Corporation

- Moody's Corporation

- NAVEX U.S.

- Oracle Corporation

- Qualys, Inc.

- Riskonnect, Inc.

- SAS Institute Inc.

- ServiceNow

U.S. Risk Management Industry Developments

April 2025: FIS U.S. launched the Treasury and Risk Manager Quantum Cloud Edition, a cloud-native platform offering real-time cash visibility, risk analysis, and enterprise integration for corporate treasury functions.

December 2024: NAVEX U.S. released its first Risk Resilience Guide, offering a practical framework for proactive U.S. Risk Management, covering regulatory changes, third-party risks, and strategies for building organizational resilience.

U.S. Risk Management Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Solutions

- Risk Assessment & Analysis

- Risk Control & Monitoring

- Risk Reporting & Analytics

- Others

- Services

- Professional Services

- Managed Services

By Deployment Outlook (Revenue, USD Billion, 2020–2034)

- On-Premises

- Cloud-Based

By Risk Type Outlook (Revenue, USD Billion, 2020–2034)

- Financial Risk

- Compliance Risk

- Cybersecurity Risk

- Enterprise Risk

- Operational Risk

- Others

By Organization Size Outlook (Revenue, USD Billion, 2020–2034)

- Large Enterprises

- Small and Medium-Sized Enterprises

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- BFSI

- IT & Telecom

- Government, Defense, and Aerospace

- Healthcare & Life Science

- Retail & Consumer Goods

- Manufacturing

- Energy & Utilities

- Others

U.S. Risk Management Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.99 billion |

|

Market Size in 2025 |

USD 6.82 billion |

|

Revenue Forecast by 2034 |

USD 22.36 billion |

|

CAGR |

14.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 5.99 billion in 2024 and is projected to grow to USD 22.36 billion by 2034.

The U.S. market is projected to register a CAGR of 14.1% during the forecast period.

A few of the key players in the market are BitSight; FIS U.S.; Fiserv; IBM Corporation; LogicGate, Inc.; MetricStream; Microsoft Corporation; Moody's Corporation; NAVEX U.S.; Oracle Corporation; Qualys, Inc.; Riskonnect, Inc.; SAS Institute Inc.; and ServiceNow.

The solution segment accounted for the largest revenue share due to increasing adoption of integrated platforms that consolidate financial, compliance, and cybersecurity risks.

The cloud-based segment held the largest revenue share in 2024 due to growing enterprise demand for scalable, cost-efficient, and remotely accessible platforms.