US Surgical Dressings Market Size, Share, & Industry Analysis Report

: By Product (Primary and Secondary), Application, and End Use – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 125

- Format: PDF

- Report ID: PM5694

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

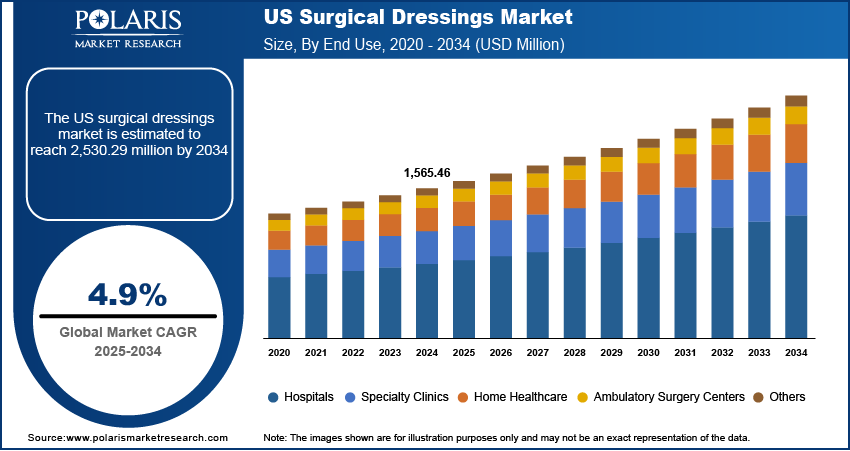

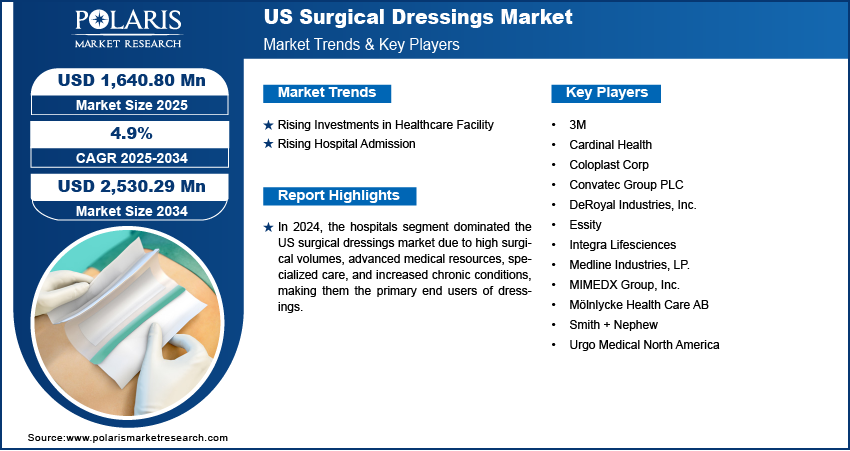

The US surgical dressings market size was valued at USD 1,565.46 million in 2024. It is projected to grow from USD 1,640.80 million in 2025 to USD 2,530.29 million by 2034, exhibiting a CAGR of 4.9% during 2025–2034.

Surgical dressings are sterile medical materials used to cover and protect surgical wounds, promoting healing and preventing infection. They help absorb exudate, maintain a moist environment, and provide a barrier against external contaminants.

The growing number of surgical procedures in the US drives the surgical dressings market growth. According to the International Society of Aesthetic Plastic Surgery, the US conducted over 6.1 million aesthetic plastic surgeries in 2023, the highest globally. There is a higher demand for post-operative wound management solutions as more people undergo surgeries, including orthopedic and cosmetic procedures. These dressings, particularly antimicrobial dressings, are crucial in preventing surgical site infections and promoting healing. The rise in surgeries is also linked to an increase in chronic wound treatment needs, thereby driving the demand for surgical dressing products across the country.

To Understand More About this Research: Request a Free Sample Report

Chronic wounds, such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, are becoming increasingly common, especially among the aging population. According to the Centers for Disease Control, 11.6% of the US population had diabetes in 2021, leading to a number of wounds, such as diabetic foot ulcers. These types of wounds require specialized care, and the demand for advanced wound care products is growing to manage these long-term conditions. Effective post-operative wound management solutions are needed to promote healing, reduce complications, and for infections control, thereby fueling the US surgical dressings market expansion.

Market Dynamics

Rising Investments in Healthcare Facility

The US has seen significant investments in healthcare infrastructure, leading to the expansion and modernization of hospitals and healthcare facilities. In December 2024, Advocate Health Care invested USD 1 billion in Chicago’s South Side. These improvements increase the capacity for surgeries and wound care treatments, which, in turn, boosts the demand for surgical dressings. Hospitals can offer more specialized wound care with better-equipped healthcare facilities, incorporating advanced wound care supplies such as hydrogel dressings and foam dressings for effective post-surgical and chronic wound management, thereby driving the US surgical dressings market development.

Rising Hospital Admissions

Rising hospital admissions due to increasing cases of chronic diseases and seasonal influenza have led to an increased need for surgical dressings. According to the American Hospital Association, in 2023, 31,967,073 hospital admissions were recorded in community hospitals alone across the US. Infections like these often result in surgeries or prolonged wound care, further driving demand for antimicrobial coating dressings. These dressings help prevent surgical site infections and support faster recovery. The demand for effective wound management products grows as hospitals see more patients requiring surgical interventions and wound care, thereby fueling the US surgical dressings market expansion.

Segment Analysis

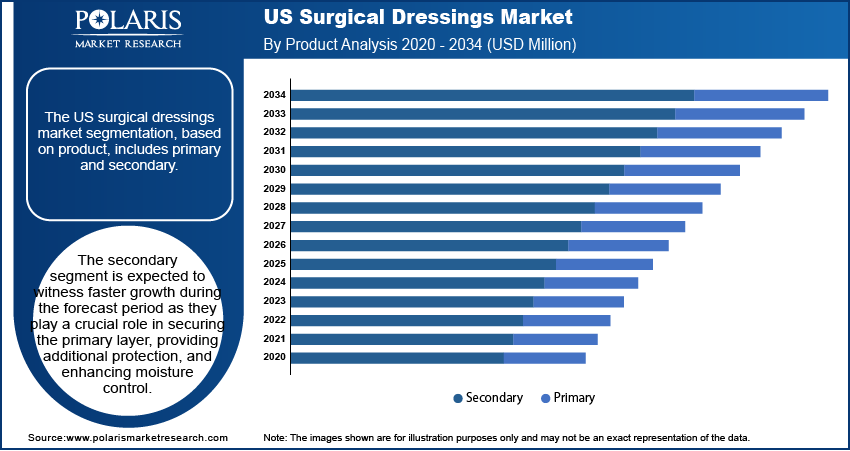

Market Assessment by Product

The US surgical dressings market segmentation, based on product, includes primary and secondary. The secondary segment is expected to witness fastest growth during the forecast period. Secondary dressings, such as foam dressings, film dressings, and gauze wraps, play a crucial role in securing the primary layer, providing additional protection, and improving moisture control. Their increasing use in post-operative advance wound care management, especially for chronic and surgical wounds, is driving demand. Growing patient preference for advanced wound care products and improved healing outcomes is further driving the segmental growth.

Market Evaluation by End Use

The market segmentation, based on end use, includes hospitals, specialty clinics, home healthcare, ambulatory surgery centers, and others. The hospitals segment dominated the industry in 2024, owing to the high volume of surgical procedures performed in hospitals, which require specialized wound care solutions. Hospitals are equipped with advanced medical resources and staffed with specialized healthcare professionals, enabling them to manage a wide range of surgical wounds effectively. The increasing prevalence of chronic conditions, such as diabetes-related wounds, further contributes to the demand for surgical dressings in hospital settings, thereby driving the segmental growth.

Key Players and Competitive Analysis

The US surgical dressings market is currently experiencing a paradigm shift driven by numerous enterprises that are striving for innovation and differentiation. Leading global players in this sector leverage their robust research and development capabilities alongside advanced technologies to sustain their competitive advantage. These organizations are actively engaging in strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new market segments.

Emerging companies are making a significant impact by launching innovative products specifically designed to cater to the nuanced needs of distinct market niches. The relentless evolution of product technology and enhanced functionalities further exacerbates the competitive dynamics within this landscape, compelling all players to adapt and improve their offerings continuously. A few major players include Smith + Nephew; Mölnlycke Health Care AB; Convatec Group PLC; Essity; DeRoyal Industries, Inc.; Coloplast Corp; 3M; Integra Lifesciences; Medline Industries, LP.; Cardinal Health; MIMEDX Group, Inc.; and Urgo Medical North America.

3M Company, originally founded in 1902 as Minnesota Mining and Manufacturing Company, is a diversified technology and science corporation headquartered in St. Paul, Minnesota. The company has operations in over 70 countries and sales in approximately 200 countries; 3M business operates in various industries, including industrial, safety, healthcare, and consumer markets. The company’s portfolio features more than 60,000 products categorized into key business segments. The safety & industrial segment offers personal protective equipment, adhesives, abrasives, and tapes for industries such as automotive and construction. In the transportation & electronics segment, 3M provides solutions for automotive OEMs and electronic components. The healthcare segment focuses on medical supplies, dental products, and health information systems for hospitals and clinics. Meanwhile, the Consumer segment includes home improvement items, office supplies, and consumer health products. 3M operates manufacturing facilities across various regions, including North America, and significant operations in Asia Pacific, particularly in India and China. The company also maintains a robust presence throughout Europe. 3M offers a comprehensive range of medical bandages and dressings, including adhesive foam, transparent film, antimicrobial, non-adherent, and compression products for wound care, securement, and skin closure applications

Smith and Nephew PLC, a medical equipment manufacturing company, specializes in healthcare, orthopedic reconstruction, knee replacement, medical devices, extremities, negative pressure wound therapy, ENT, ligament repair, wound care, hip replacement, trauma, sports medicine, Robotics, medical supplies, and exudate management. The company offers Smith + Nephew Academy products, procedures, indications, and therapies. Under Smith + Nephew Academy, the company offers courses in ENT (ear, nose, and throat), orthopedics, and wound care. Its product portfolio includes categories of wound management, ear, nose and throat, orthopedics, and sports medicine. The Wound Management category includes ALLEVYN foam dressings, antimicrobial dressings, cellular and tissue products, gels, films, skincare, scar care, and skin substitutes. The nose-throat category is segmented into ears, including Tula Tympanostomy System products and the WEREWOLF COBLATIONS system. The nose segment includes CMC dissolvable nasal dressings, turbinator, halo wand, ENTACT septal stapler, and the throat segment includes COBLATION wands for adenotonsillectomy, COBLATION technology for adenotonsillectomy, EVAC 70 XTRA, and XTRA HP wands. Extremities reconstruction (foot and ankle), hip arthroplasty, knee arthroplasty, robotic-assisted surgery, and trauma (hip fractures) are segmented under the orthopedic category. The sports medicine category is further divided into access, hip repair, foot and ankle, shoulder, visualization, and resection–mechanical.

Key Companies in US Surgical Dressings Market

- 3M

- Cardinal Health

- Coloplast Corp

- Convatec Group PLC

- DeRoyal Industries, Inc.

- Essity

- Integra Lifesciences

- Medline Industries, LP.

- MIMEDX Group, Inc.

- Mölnlycke Health Care AB

- Smith + Nephew

- Urgo Medical North America

US Surgical Dressings Industry Developments

In January 2024, Coloplast launched Biatain Silicone Fit in the US, featuring 3DFit Technology for pressure injury prevention and wound management, designed to improve care and simplify workflows for healthcare providers.

In January 2023, ConvaFoam was launched in the US by Convatec as an advanced foam dressing solution, designed to simplify wound care for healthcare professionals, patients, and caregivers through enhanced technology and educational support.

US Surgical Dressings Market Segmentation

By Product Outlook (Revenue USD Million, 2020–2034)

- Primary

- Foam Dressing

- Alginate Dressing

- Others

- Secondary

- Absorbents

- Bandages

- Others

By Application Outlook (Revenue USD Million, 2020–2034)

- Diabetes Related Surgeries

- Cardiovascular Related Surgeries

- Ulcers

- Burns

- Transplant Sites

- Others

By End Use Outlook (Revenue USD Million, 2020–2034)

- Hospitals

- Specialty Clinics

- Home Healthcare

- Ambulatory Surgery Centers

- Others

US Surgical Dressings Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,565.46 million |

|

Market Size Value in 2025 |

USD 1,640.80 million |

|

Revenue Forecast in 2034 |

USD 2,530.29 million |

|

CAGR |

4.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1,565.46 million in 2024 and is projected to grow to USD 2,530.29 million by 2034.

The market is projected to register a CAGR of 4.9% during the forecast period.

The key players in the market are Smith + Nephew; Mölnlycke Health Care AB; Convatec Group PLC; Essity; DeRoyal Industries, Inc.; Coloplast Corp; 3M; Integra Lifesciences; Medline Industries, LP.; Cardinal Health; MIMEDX Group, Inc.; and Urgo Medical North America.

The hospital segment dominated the market in 2024 due to high volume of surgical procedures performed in hospitals, which require specialized wound care solutions.

The secondary segment is expected to witness faster growth in the forecast period as they play a crucial role in securing the primary layer, providing additional protection, and enhancing moisture control.