U.S. Tremfya Market Size, Share, Trends, Industry Analysis Report

By Application [Plaque Psoriasis, Psoriatic Arthritis (PsA), Others], By Distribution Channel – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 120

- Format: PDF

- Report ID: PM5924

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

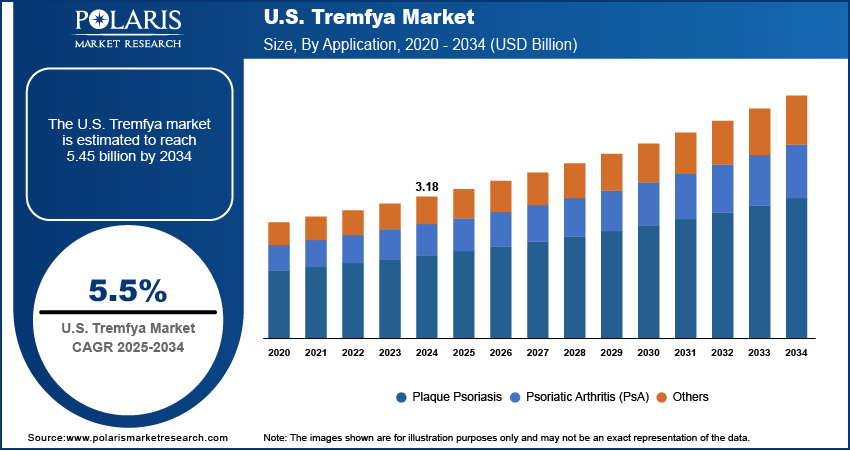

The U.S. Tremfya market size was valued at USD 3.18 billion in 2024 and is anticipated to register a CAGR of 5.5% from 2025 to 2034. The increasing number of people having chronic plaque psoriasis and psoriatic arthritis in the U.S. propels Tremfya demand.

The Tremfya market involves the sales and distribution of guselkumab, a biologic medication that targets the IL-23 pathway to treat various immune-mediated conditions. This includes moderate to severe plaque psoriasis, active psoriatic arthritis, and recently, moderately to severely active Crohn's disease and ulcerative colitis.

Patient support programs play a crucial role in driving the U.S. Tremfya market by enhancing patient adherence and persistence to psoriasis treatment. Biologic therapies often involve complex administration, potential side effects, and significant costs, which can create barriers to consistent use. Comprehensive support programs, including educational resources, financial assistance, and nurse support, help patients navigate these challenges.

The ongoing education and awareness among healthcare providers regarding Tremfya's efficacy, safety, and appropriate use are significant drivers for its adoption in the U.S. market. As new data emerges and indications expand, it is crucial for physicians, specialists, and other healthcare professionals to be well-informed about the drug's benefits and how it compares to other available treatments. This knowledge empowers them to confidently prescribe Tremfya to suitable patients.

Market Concentration & Characteristics

The Tremfya market in the U.S. demonstrates a strong focus on innovation, driven by its biologic design that selectively targets the IL-23 pathway to treat chronic plaque psoriasis and psoriatic arthritis. Ongoing clinical development is centered on enhancing long-term efficacy, improving patient adherence, and reducing adverse effects. Technological advancements in biologic engineering and formulation approaches contribute to the evolving treatment landscape. Innovation remains critical for retaining market differentiation and addressing unmet needs in inflammatory and autoimmune disorders. A robust pipeline of emerging IL-23 inhibitors and oral alternatives continues to add momentum to this competitive segment.

Entry into the U.S. Tremfya market is highly restricted due to the complex nature of biologic drug development and the substantial investment required for clinical trials and regulatory filings. The FDA mandates comprehensive evidence of safety, efficacy, and quality, which creates long development timelines and high upfront costs. Additionally, intellectual property protections and exclusivity provisions delay biosimilar entry. Biologic production requires advanced manufacturing capabilities and regulatory compliance, making it difficult for new players to gain physician confidence or secure access to payer networks.

The regulatory environment in the U.S. plays a critical role in shaping market behavior. The FDA’s stringent approval criteria and post-marketing surveillance requirements enforce high standards for product safety and effectiveness. Regulatory policies also govern product labeling, promotional practices, and reimbursement terms. Any shift in national healthcare policy, such as reforms affecting drug pricing or formulary structures, can influence market access and treatment guidelines. To remain competitive, companies must monitor and adapt to these regulatory and policy developments.

Tremfya competes in a crowded immunology market alongside other biologics and oral agents for psoriasis and psoriatic arthritis. Key therapeutic alternatives include TNF-alpha inhibitors, IL-17 inhibitors, and traditional systemic medications. With biosimilars expected to enter post-exclusivity, pricing pressure is likely to increase. Factors such as comparative efficacy, safety, and convenience (e.g., dosing frequency) play a key role in product selection by physicians and patients. The availability of multiple treatment options raises competition, potentially impacting Tremfya’s market share and pricing flexibility.

While the U.S. represents the largest share of Tremfya’s revenue due to its established healthcare infrastructure and higher biologic uptake, global expansion strategies continue to focus on untapped growth in regions such as Asia-Pacific and Latin America. In the U.S., continued access initiatives aim to improve patient affordability and adherence, especially among underinsured populations. Effective navigation of payer systems, strategic contracting, and clinician engagement remain central to maintaining and growing Tremfya’s U.S. market position.

Industry Dynamics

Growing Prevalence of Autoimmune Diseases

The rising number of individuals in the U.S. affected by chronic autoimmune conditions, specifically moderate to severe plaque psoriasis and psoriatic arthritis, is fueling the U.S. Tremfya market growth. These conditions often require long-term management and advanced therapies to control symptoms and improve patients' quality of life. As more people are diagnosed, the demand for effective treatments that can offer sustained relief increases.

A study titled "Psoriasis Statistics" from the National Psoriasis Foundation in 2022 stated that over 8 million people in the U.S. have psoriasis, and about 30% of those affected by psoriasis also develop psoriatic arthritis. This high prevalence, coupled with the chronic nature of these diseases, means a steady and growing patient population is seeking advanced therapeutic options. This consistent patient pool significantly contributes to the overall growth of the U.S. Tremfya market.

Expanding Therapeutic Indications and Clinical Efficacy

Tremfya's increasing market presence is significantly driven by its expanding approvals for various autoimmune conditions and its proven effectiveness in clinical trials. Initially approved for plaque psoriasis and psoriatic arthritis, the drug has recently received approvals for other debilitating diseases such as Crohn's disease and ulcerative colitis. These expanded indications allow Tremfya to reach a wider patient base in need of targeted therapies.

Clinical research has consistently demonstrated Tremfya's strong efficacy. For instance, according to an NCBI Bookshelf review of "Clinical Review Report: Guselkumab (Tremfya)" in 2018, guselkumab showed statistically significant improvements in skin clearance and joint symptoms in patients suffering from moderate to severe plaque psoriasis and active psoriatic arthritis. The review of the VOYAGE 1 and VOYAGE 2 trials in the same report highlighted that a statistically significant number of patients achieved a PASI 90 response (90% reduction in PASI score) with guselkumab compared to placebo at week 16. Furthermore, the FDA approved Tremfya for adults affected by moderately to severely active Crohn's disease in March 2025 and for ulcerative colitis in September 2024, as noted on Drugs.com's "Tremfya (guselkumab) FDA Approval History." Hence, expanding therapeutic indications and clinical efficacy of guselkumab drives the U.S. Tremfya market expansion.

Segmental Insights

Application Analysis

The plaque psoriasis segment held the largest share in 2024, largely due to the widespread occurrence of moderate to severe plaque psoriasis, which affects a substantial portion of the population and often requires systemic treatments. Tremfya has established itself as a highly effective biologic therapy for this condition, demonstrating significant skin clearance in clinical trials. The National Psoriasis Foundation in their 2022 "Psoriasis Statistics" noted that over 8 million people in the U.S. have psoriasis. The broad patient base, combined with the proven efficacy of Tremfya, continues to make it a primary treatment choice for dermatologists and patients, thereby contributing to its significant market share in this application. The long-term nature of the disease also ensures a steady demand for ongoing treatment, contributing to this segment's leading position.

The others segment, which includes newer indications such as Crohn's disease and ulcerative colitis, is anticipated to register the highest growth rate during the forecast period. The recent regulatory approvals for these inflammatory bowel diseases (IBD) are opening up entirely new patient populations for the drug. For example, Johnson & Johnson's press releases in September 2024 and March 2025 announced FDA approvals for Tremfya in treating moderately to severely active ulcerative colitis and Crohn's disease, respectively. These approvals provide a significant opportunity for market expansion, as Tremfya becomes a treatment option for a broader range of complex autoimmune conditions, ultimately driving substantial future growth in this segment.

Distribution Channel Analysis

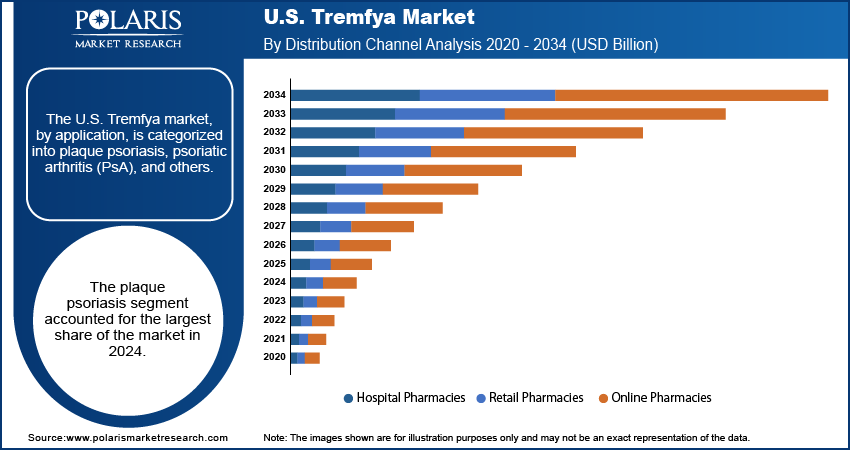

The hospital pharmacies segment held the largest share in 2024. This is largely attributed to the nature of biologic medications, which often require specialized handling, precise administration, and close patient monitoring, all of which are readily available within a hospital setting. Hospitals have established systems for the procurement and storage of complex drugs such as Tremfya, ensuring their quality and availability. Furthermore, many patients initiating biologic therapies often do so in a hospital or clinic setting, allowing for initial administration and close monitoring by healthcare professionals. This structured environment, coupled with established procurement systems for high-cost drugs, solidifies the leading position of hospital pharmacies in Tremfya's distribution.

The online pharmacies segment is anticipated to register the highest growth rate during the forecast period, driven by increasing digital infrastructure and a growing patient preference for convenient home delivery of medications. For chronic conditions, which often require regular refills of medications such as Tremfya, online pharmacies offer a streamlined and accessible option. The rise in penetration of telehealth services has also played a role in connecting patients with specialists and facilitating online prescription fulfillment. The general trend toward digital health, accelerated by recent global health events, has pushed more patients and healthcare providers to utilize online platforms for medication access. This shift, combined with the potential for cost savings and improved accessibility in underserved areas, positions online pharmacies for rapid expansion in the distribution of specialty medications such as Tremfya.

Competitive Insights

In the US, Johnson & Johnson Services, Inc. holds a dominant position in the Tremfya market, driven by strong regulatory approvals, favorable formulary placements, and effective patient support programs. The company’s expansion into new indications, such as ulcerative colitis, and continued investment in real-world data have reinforced its market presence. Meanwhile, domestic players like Coherus BioSciences and Amgen are positioning themselves for future biosimilar competition as Tremfya nears patent expiration. Rising pricing pressures and value-based care initiatives are expected to reshape market dynamics, with affordability and clinical differentiation playing a key role in sustaining long-term competitiveness.

Key Players

Industry Developments

May 2025: Johnson & Johnson announced new data from the Phase 3 ICONIC-TOTAL- Icotrokinra, demonstrating substantial skin clearance in patients with challenging-to-treat scalp and genital psoriasis. By Week 16, 66% of those with scalp psoriasis and 77% with genital psoriasis achieved site-specific clear or nearly clear skin with the investigational treatment.

March 2025: Johnson & Johnson reported that the FDA approved Tremfya as the first IL-23 inhibitor available in both subcutaneous and intravenous formulations for adults with moderate to severely active Crohn’s disease. This approval introduces more flexible treatment options and extends Tremfya’s indication beyond psoriasis and arthritis to include Crohn’s disease.

U.S. Tremfya Market Segmentation

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Plaque Psoriasis

- Psoriatic Arthritis (PsA)

- Others

By Distribution Channel Outlook (Revenue – USD Billion, 2020–2034)

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

U.S. Tremfya Market Report Scope:

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.18 billion |

|

Market Size in 2025 |

USD 3.35 billion |

|

Revenue Forecast by 2034 |

USD 5.45 billion |

|

CAGR |

5.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 3.18 billion in 2024 and is projected to grow to USD 5.45 billion by 2034.

The market is projected to register a CAGR of 5.5% during the forecast period.

Johnson & Johnson remains the key player in the market

The plaque psoriasis segment accounted for the largest share of the market in 2024.

The online pharmacies segment is expected to witness the fastest growth during the forecast period.