U.S. Wind Turbine Market Size, Share, Trend, Industry Analysis Report

By Axis (Horizontal, Vertical), By Installation, By Connectivity, By Rating, By Application – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6157

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

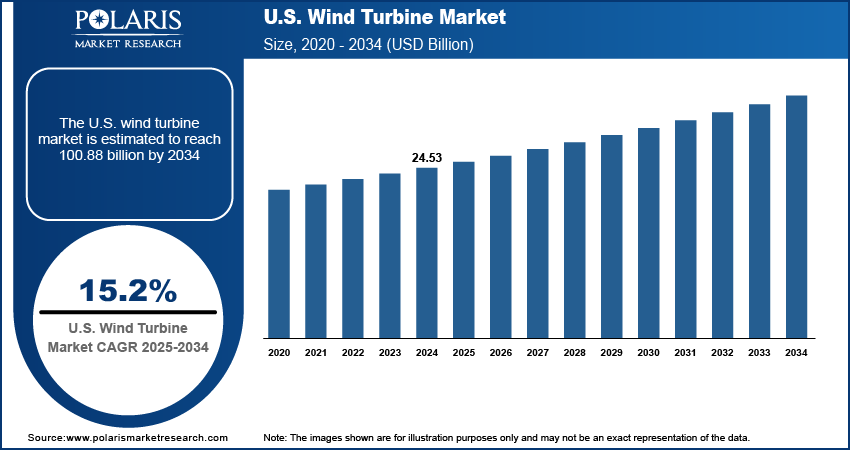

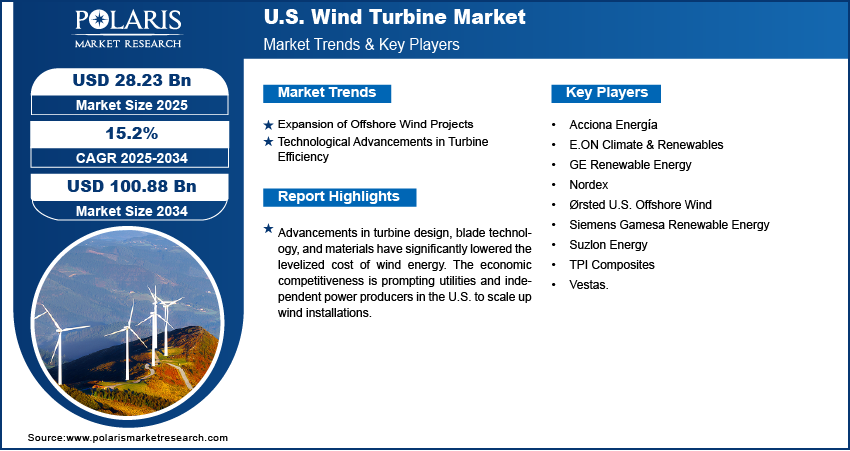

The U.S. wind turbine market size was valued at USD 24.53 billion in 2024, growing at a CAGR of 15.2% from 2025 to 2034. Advancements in turbine design, blade technology, and materials have significantly lowered the levelized cost of wind energy. This economic competitiveness is prompting utilities and independent power producers in the U.S. to scale up wind installations.

Key Insights

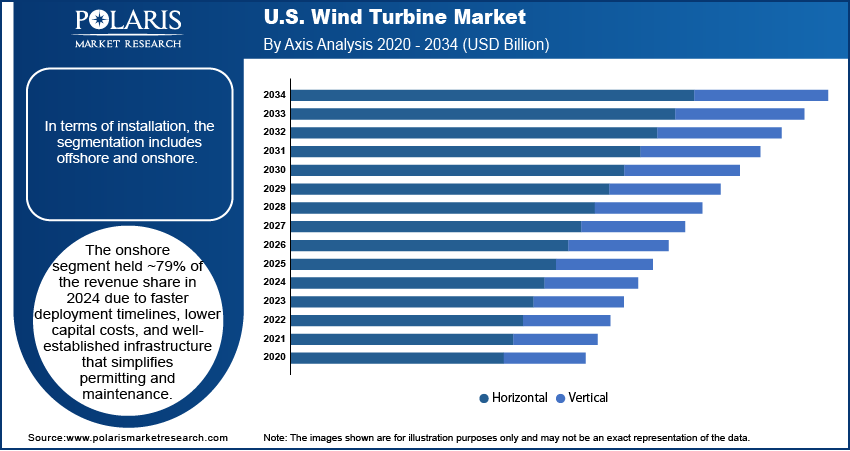

- The horizontal segment held the largest revenue share in 2024, driven by its high efficiency and scalability, making it ideal for utility-scale wind projects.

- The onshore segment held ~79% of the revenue share in 2024, owing to shorter deployment timelines and lower capital investments.

- The commercial & industrial segment accounted for the largest revenue share in 2024, driven by growing demand from large energy consumers seeking to reduce operational costs and lower their carbon emissions.

Industry Dynamics

- Rising corporate demand for renewable energy is driving wind turbine installations across the U.S. to meet sustainability goals and reduce electricity costs.

- Federal tax incentives and state-level renewable mandates are accelerating investments in onshore and offshore wind energy projects across the U.S.

- Expansion of offshore wind projects along the East Coast creates new growth potential for large-scale turbine deployment and domestic manufacturing.

- High upfront costs and lengthy permitting processes for transmission infrastructure slow down project development and grid integration of new wind capacity.

Market Statistics

- 2024 Market Size: USD 24.53 billion

- 2034 Projected Market Size: USD 100.88 billion

- CAGR (2025–2034): 15.2%

To Understand More About this Research: Request a Free Sample Report

The wind turbine market refers to the industry focused on the manufacturing, installation, and maintenance of wind turbines used to generate electricity by converting wind energy into mechanical power. It includes both onshore and offshore wind technologies and supports the global transition toward clean, renewable energy sources. Extension of production tax credits (PTC) and investment tax credits (ITC) under federal clean energy policies is encouraging large-scale wind energy projects. These incentives reduce capital costs and accelerate investments in wind turbine deployment across onshore and offshore sites. For instance, the American Clean Power Association reports that the U.S. has over 73,000 wind turbines generating 153 GW of capacity, making wind the fourth-largest electricity source. This capacity powers around 46 million homes.

Several U.S. states have implemented ambitious RPS targets that mandate a minimum share of electricity from renewable sources. These standards are driving consistent demand for wind turbines to meet clean energy obligations and diversify energy supply. Moreover, major corporations are signing power purchase agreements (PPAs) for wind-generated electricity to meet sustainability goals. This trend is expanding the market beyond traditional utility buyers, creating stable demand for wind turbine installations.

Drivers & Opportunities

Expansion of Offshore Wind Projects: Offshore wind energy is becoming a critical part of the U.S. renewable energy strategy, driven by federal and state-level initiatives. In May 2025, the U.S. Department of the Interior approved over 15 gigawatts of clean energy capacity from offshore wind projects, which represents ~50% of the 30-gigawatt target set for 2030. The approved projects are projected to provide power to ~5.25 million homes, significantly contributing to the nation’s renewable energy portfolio. The East Coast, in particular, is witnessing a surge in activity, with multiple lease auctions held and new sites opened for commercial-scale projects. Major investments are flowing into port infrastructure, turbine manufacturing hubs, and grid interconnection capabilities to support the logistics and power transmission needs of offshore wind farms. These efforts are enabling the installation of high-capacity turbines capable of generating substantial clean electricity.

Technological Advancements in Turbine Efficiency: Technological advancements in wind turbines are making wind energy a more viable and efficient power source across diverse terrains in the U.S. Manufacturers are focusing on developing taller towers and longer, lighter blades that can capture more wind at higher altitudes. Improved aerodynamic designs and the integration of smart controls allow turbines to adapt dynamically to changing wind conditions, optimizing power output and reducing wear and tear. These innovations are particularly useful in expanding wind energy development into areas that previously lacked strong wind resources. Enhanced turbine efficiency improves project economics and also strengthens investor confidence, encouraging further deployment and reinforcing the U.S. wind energy market's long-term growth trajectory.

Segmental Insights

Axis Analysis

Based on axis, the U.S. wind turbine market segmentation includes horizontal and vertical. The horizontal segment accounted for the largest revenue share in 2024 due to its high efficiency and scalability offered by its design in utility-scale projects. This configuration allows for consistent alignment with wind direction, enhancing energy capture and system stability. The mature supply chain and widespread industry familiarity have made horizontal axis turbines the default choice for large-scale deployments across onshore wind farms. Their high power output and easier integration with existing grid infrastructure have positioned them as the most cost-effective and preferred solution in the U.S. wind energy landscape, particularly in areas such as the Midwest and Great Plains with consistent wind patterns.

The vertical segment is expected to register the highest CAGR from 2025 to 2034 driven by growing interest in decentralized wind generation and compact installations in urban or space-limited environments. Vertical turbines offer operational advantages in turbulent wind conditions, making them suitable for rooftop and small-scale applications. Technological improvements in design efficiency, noise reduction, and aesthetics are enabling broader acceptance among commercial and residential users. Federal and local incentives promoting clean energy adoption, coupled with efforts to diversify wind generation across multiple terrains, are likely to accelerate demand. Increasing research initiatives and pilot projects are also boosting confidence in this segment’s long-term viability.

Installation Analysis

In terms of installation, the U.S. wind turbine market segmentation includes offshore and onshore. The onshore segment held ~79% of the revenue share in 2024 due to faster deployment timelines, lower capital costs, and well-established infrastructure that simplifies permitting and maintenance. The availability of vast land areas, particularly in wind-rich states such as Texas and Iowa, supports utility-scale installations. Established transmission networks and lower project risks compared to offshore sites have made onshore projects more appealing to investors. The onshore wind market benefits from streamlined regulatory processes and state-level renewable energy targets, which further facilitate rapid adoption and project expansion.

The offshore segment is expected to register the highest CAGR from 2025 to 2034 due to substantial investments in marine infrastructure, policy incentives, and higher capacity factors achievable over water. Offshore wind farms benefit from stronger and more consistent wind speeds, increasing overall energy output. Technological advancements in floating turbines and deepwater foundations are opening up new deployment zones beyond the shallow continental shelf. Strategic federal leasing and regional commitments, particularly in the Northeast, are accelerating project development. Offshore wind also reduces land use conflicts, allowing energy generation near dense coastal population centers without requiring significant land acquisition.

Connectivity Analysis

In terms of connectivity, the U.S. wind turbine market segmentation includes grid connected and standalone. The grid-connected segment held the largest revenue share in 2024 due to its role in utility-scale wind integration into regional transmission systems. Grid-tied turbines support bulk electricity production, ensuring reliable power supply and enabling participation in wholesale electricity markets. Regulatory frameworks and incentives, such as renewable portfolio standards (RPS), have driven grid-based projects, while improved grid infrastructure supports seamless connection and distribution. Enhanced smart grid management and forecasting tools have also improved the ability of wind projects to match demand patterns and contribute to grid stability.

The standalone systems segment is expected to record the highest CAGR from 2025 to 2034, fueled by rising adoption in remote and off-grid locations where centralized power infrastructure is lacking or economically unviable. These systems offer resilience and energy independence, especially in rural, agricultural, or island communities. Technological improvements in hybrid integration with batteries and solar are enhancing reliability, making standalone turbines more attractive for microgrids and backup power applications. Federal funding for rural electrification and disaster-resilient infrastructure is also likely to boost uptake in this segment.

Application Analysis

In terms of application, the U.S. wind turbine market segmentation includes residential, commercial & industrial, and others. The commercial & Industrial segment held the largest revenue share in 2024 due to increasing interest among large energy consumers in lowering operational costs and reducing carbon footprints. Businesses are integrating wind turbines to meet sustainability goals and hedge against energy price volatility. Large commercial campuses and manufacturing facilities are leveraging on-site wind energy as part of broader energy transition strategies. Tax incentives and corporate renewable energy procurement programs are also supporting investment in medium-scale wind installations. The segment’s growth is reinforced by favorable ROI and visibility in ESG reporting.

The residential segment is projected to witness the highest CAGR from 2025 to 2034, fueled by consumer interest in clean, self-generated power and increased awareness of energy independence. Technological advancements in small-scale turbines, ease of installation, and improved aesthetics are making wind systems more viable for home use. Incentives such as investment tax credits, net metering policies, and local clean energy mandates are encouraging homeowners to explore wind energy. The combination of affordability, regulatory support, and rising electricity costs is likely to further stimulate demand in the residential segment.

Key Players and Competitive Analysis

The competitive landscape of the U.S. wind turbine market is shaped by a mix of mature players and emerging innovators leveraging diverse market expansion strategies. Industry analysis reveals increased focus on domestic manufacturing, driven by energy security goals and federal support policies. Companies are pursuing mergers and acquisitions to consolidate regional presence, enhance supply chain efficiency, and gain access to proprietary blade and drivetrain technologies. Strategic alliances between turbine manufacturers, utility firms, and offshore developers are fostering collaboration on large-scale projects. Joint ventures are increasingly being used to pool technical expertise and mitigate investment risks in offshore ventures.

Post-merger integration efforts are emphasizing vertical integration and digital asset optimization. Technological advancements in modular turbine design, smart sensors, and predictive maintenance are key competitive differentiators. Players are also investing heavily in research focused on taller towers, larger rotors, and hybrid integration systems to improve output and meet evolving performance benchmarks in both onshore and offshore segments.

Key Players

- Acciona Energía

- E.ON Climate & Renewables

- GE Renewable Energy

- Nordex

- Orsted U.S. Offshore Wind

- Siemens Gamesa Renewable Energy

- Suzlon Energy

- TPI Composites

- Vestas

U.S. Wind Turbine Industry Developments

May 2025: SeaTwirl launched a two-blade floating wind turbine designed to optimize performance in offshore environments. This turbine configuration aims to enhance energy capture and reduce material costs by leveraging simplified aerodynamics, while the floating platform allows for deployment in deeper waters where traditional fixed turbines may not be feasible.

September 2024: Vestas successfully appointed for its offshore wind contract in the U.S., securing a substantial order for the 810 MW Empire Wind 1 project.

U.S. Wind Turbine Market Segmentation

By Axis Outlook (Revenue, USD Billion, 2020–2034)

- Horizontal (HAWTs)

- Vertical (VAWTs)

By Installation Outlook (Revenue, USD Billion, 2020–2034)

- Onshore

- Offshore

By Connectivity Outlook (Revenue, USD Billion, 2020–2034)

- Grid Connected

- Stand Alone

By Rating Outlook (Revenue, USD Billion, 2020–2034)

- 100 kW

- 100 kW to 250 kW

- > 250 kW to 500 kW

- > 500 kW to 1 MW

- 1 MW to 2 MW

- > 2 MW

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial & Industrial

- Others

U.S. Wind Turbine Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 24.53 billion |

|

Market Size in 2025 |

USD 28.23 billion |

|

Revenue Forecast by 2034 |

USD 100.88 billion |

|

CAGR |

15.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 24.53 billion in 2024 and is projected to grow to USD 100.88 billion by 2034.

The U.S. market is projected to register a CAGR of 15.2% during the forecast period.

A few of the key players in the market are Acciona Energía, E.ON Climate & Renewables, GE Renewable Energy, Nordex, Orsted U.S. Offshore Wind, Siemens Gamesa Renewable Energy, Suzlon Energy, TPI Composites, and Vestas.

The horizontal axis segment accounted for the largest revenue share in 2024 due to high efficiency and scalability offered by its design in utility-scale projects.

The onshore segment held ~79% of the revenue share in 2024 due to faster deployment timelines, lower capital costs, and well-established infrastructure that simplifies permitting and maintenance.