Vascular Imaging Market Share, Size, Trends, Industry Analysis Report

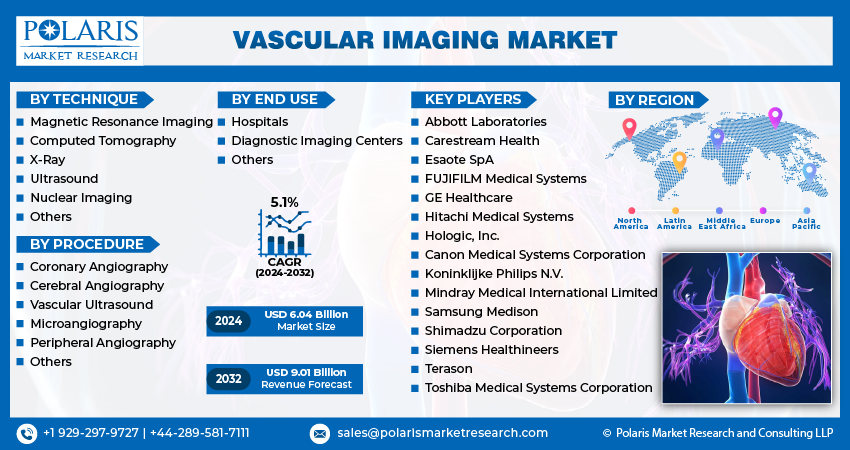

By Technique (Magnetic Resonance Imaging, Computed Tomography, X-Ray, Ultrasound, Nuclear Imaging, Others); By Procedure; By End Use; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 119

- Format: PDF

- Report ID: PM4661

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

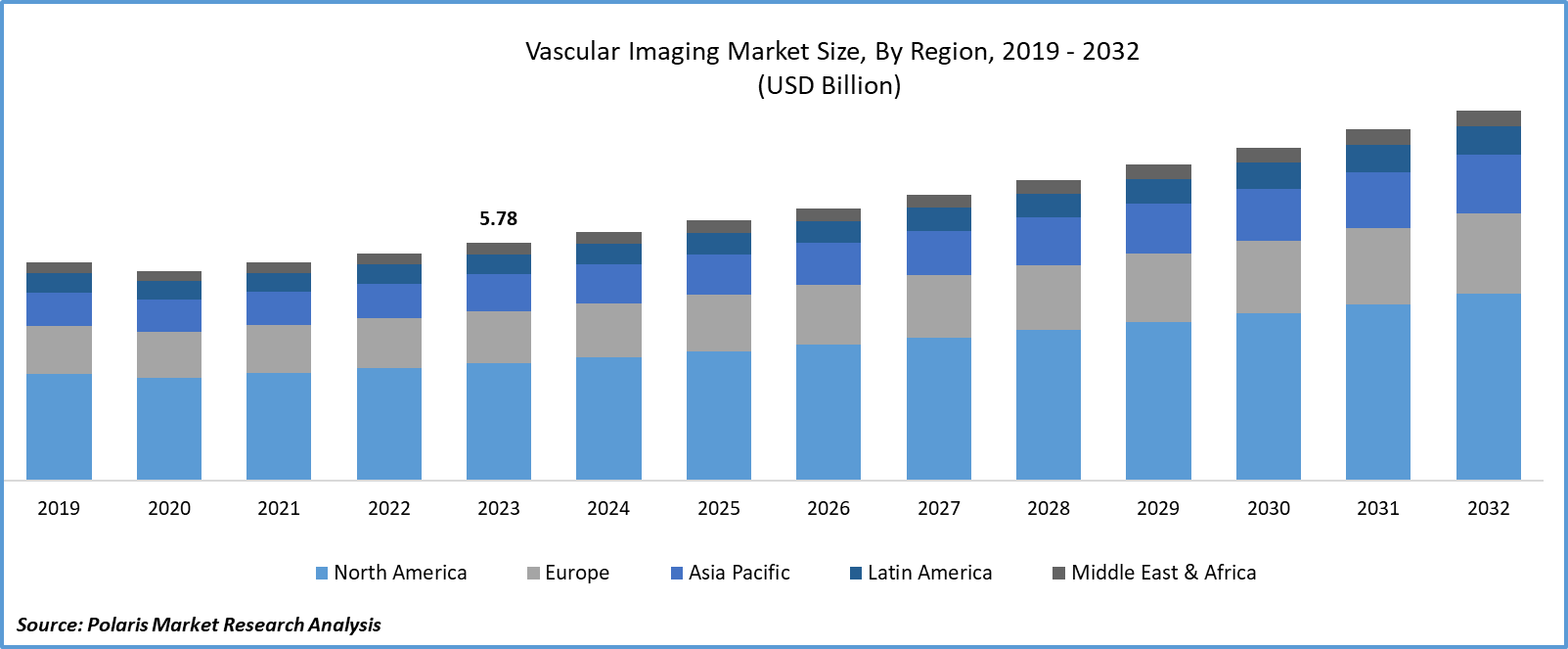

- Global vascular imaging market size was valued at USD 5.78 billion in 2023.

- The market is anticipated to grow from USD 6.04 billion in 2024 to USD 9.01 billion by 2032, exhibiting the CAGR of 5.1% during the forecast period.

Market Introduction

The vascular imaging market is witnessing rapid growth due to the increasing adoption of minimally invasive procedures (MIPs) in vascular interventions. MIPs offer benefits like reduced trauma and quicker recovery, prompting healthcare providers to favor them for various vascular conditions. Vascular imaging, utilizing modalities such as ultrasound, CT, MRI, and fluoroscopy, plays a crucial role in guiding MIPs by providing detailed anatomical information. The growing preference for minimally invasive approaches is driving demand for advanced vascular imaging technologies, enabling more precise procedures and improved patient outcomes. Technological advancements like high-resolution imaging systems further enhance the capabilities of vascular imaging, fostering continued growth in the market.

To Understand More About this Research:Request a Free Sample Report

In addition, companies operating in the market are introducing new products to expand market reach and strengthen presence.

- For instance, in October 2023, Abbott revealed the introduction of its latest vascular imaging platform, featuring the innovative Ultreon 1.0 Software, in the Indian market. This intra-vascular imaging software integrates optical coherence tomography (OCT) with artificial intelligence (AI), offering physicians a holistic perspective of blood flow and obstructions within coronary arteries.

Technological advancements in imaging modalities are propelling significant growth in the vascular imaging market. These advancements include high-resolution ultrasound, faster MRI and CT scanning protocols, and the integration of artificial intelligence for automated image analysis. Additionally, advancements in image-guided interventions and the development of portable imaging devices have expanded access to vascular imaging in various clinical settings. These innovations enhance diagnostic accuracy, reduce interpretation time, and improve patient outcomes, driving the adoption of vascular imaging services.

Industry Growth Drivers

Rising incidence of cardiovascular diseases is projected to spur the product demand

The vascular imaging market is growing due to the increasing incidence of cardiovascular diseases (CVDs) worldwide. These conditions, including coronary artery disease and stroke, contribute significantly to global morbidity and mortality. Vascular imaging plays a crucial role in diagnosing and managing CVDs, enabling healthcare providers to visualize blood vessel abnormalities and guide treatment decisions effectively. With aging populations, sedentary lifestyles, and rising rates of obesity and diabetes fueling the prevalence of cardiovascular diseases, the demand for vascular imaging technologies is rising. Healthcare providers are investing in advanced systems and technologies to meet this demand, driving expansion in the vascular imaging market.

Growing aging population is expected to drive vascular imaging market growth

The vascular imaging market is growing due to the expanding aging population worldwide. With age, individuals face heightened risks of vascular-related conditions like atherosclerosis, peripheral arterial disease, and venous thromboembolism. This demographic shift has propelled demand for vascular imaging technologies such as ultrasound, magnetic resonance angiography (MRA), computed tomography angiography (CTA), and catheter angiography. These modalities aid in evaluating vascular health, identifying abnormalities, and guiding treatment decisions. Additionally, the rising prevalence of chronic conditions like diabetes, hypertension, and obesity among the elderly further amplifies the demand for advanced vascular imaging solutions.

Industry Challenges

High cost of imaging equipment is likely to impede the market growth

The vascular imaging market faces challenge from the high cost of imaging equipment, restricting its widespread adoption. Advanced modalities like magnetic resonance angiography, computed tomography angiography, and ultrasound machines demand substantial capital investment for purchase, installation, and maintenance. Moreover, personnel training and result interpretation expenses further inflate costs. This financial burden poses challenges, particularly for healthcare facilities in resource-constrained regions. Additionally, ongoing maintenance and upgrade costs restrict affordability and accessibility of vascular imaging services. Furthermore, high upfront investments may deter healthcare providers from embracing the latest technological advancements, compromising imaging quality and patient care outcomes.

Report Segmentation

The vascular imaging market analysis is primarily segmented based on technique, procedure, end use, and region.

|

By Technique |

By Procedure |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Technique Analysis

Computed tomography segment is expected to experience significant growth during the forecast period

The computed tomography (CT) segment is expected to experience significant growth during the forecast period. CT imaging provides high-resolution, three-dimensional visualization of blood vessels, facilitating detailed assessment of vascular anatomy and pathology, particularly for complex conditions like arterial stenosis and aneurysms. Continuous technological advancements, including faster scan times and improved image reconstruction algorithms, enhance diagnostic accuracy and efficiency while reducing patient discomfort and radiation exposure. Additionally, the rising prevalence of cardiovascular diseases globally drives demand for non-invasive imaging modalities like CT angiography. The expanding applications of CT imaging in preoperative planning, treatment guidance, and postoperative monitoring further contribute to its projected growth.

By Procedure Analysis

Coronary Angiography segment held significant market revenue share in 2023

The coronary angiography segment held significant revenue share in 2023 due to its crucial role in diagnosing coronary artery disease (CAD), a major global health concern. As CAD prevalence rises with aging populations and unhealthy lifestyles, demand for coronary angiography remains high. It is the standard for assessing coronary artery anatomy, identifying blockages, and guiding interventions like percutaneous coronary intervention (PCI) or coronary artery bypass grafting (CABG). Technological advancements in catheters, imaging systems, and software improve procedural efficiency and patient safety.

By End Use Analysis

Hospitals segment held significant revenue share in 2023

The hospitals segment held significant revenue share in 2023. Hospitals serve as primary centers for vascular imaging procedures, offering a wide range of services including angiography, ultrasound, CT angiography, and magnetic resonance angiography. Hospitals have advanced imaging departments equipped with state-of-the-art equipment and skilled personnel, enabling comprehensive vascular imaging services. They receive referrals from primary care physicians and other healthcare providers, contributing to high patient volume and revenue. Additionally, hospitals invest in upgrading their imaging infrastructure and acquiring new technologies to maintain competitiveness and further drive revenue growth in the vascular imaging market.

Regional Insights

Asia-Pacific is expected to experience significant growth during the forecast period

Asia-Pacific is expected to experience growth during the forecast period due to expanding healthcare infrastructure and increased investments. Rising cardiovascular disease prevalence, driven by aging populations and changing lifestyles, fuels demand for advanced diagnostic tools. Technological advancements and heightened awareness among healthcare professionals and patients further propel adoption. Government initiatives aimed at enhancing healthcare infrastructure and accessibility also play a crucial role in industry expansion.

In 2023, North America region accounted for a significant market share. North America's significant presence in the vascular imaging market is fueled by advanced healthcare infrastructure, widespread access to cutting-edge diagnostic facilities, and a high prevalence of cardiovascular diseases. The region's demand for vascular imaging modalities such as angiography, ultrasound, CT angiography, and magnetic resonance angiography remains consistently high due to conditions like coronary artery disease and stroke. Additionally, North America hosts key manufacturers of vascular imaging equipment, benefiting from favorable healthcare reimbursement policies and substantial investments in research and development.

Key Market Players & Competitive Insights

The vascular imaging market is characterized by a wide range of participants, and the anticipated arrival of new entrants is set to heighten competitive pressures. Key players in the industry consistently upgrade their technologies, aiming to sustain a competitive edge by prioritizing effectiveness, dependability, and safety. These entities focus on strategic initiatives such as forging partnerships, enhancing product offerings, and engaging in joint ventures. Their objective is to surpass rivals in the sector, ultimately securing a notable vascular imaging market share.

Some of the major players operating in the global vascular imaging market include:

- Abbott Laboratories

- Canon Medical Systems Corporation

- Carestream Health

- Esaote SpA

- FUJIFILM Medical Systems

- GE Healthcare

- Hitachi Medical Systems

- Hologic, Inc.

- Koninklijke Philips N.V.

- Mindray Medical International Limited

- Samsung Medison

- Shimadzu Corporation

- Siemens Healthineers

- Terason

- Toshiba Medical Systems Corporation

Recent Developments

- In August 2023, GE HealthCare introduced the Vscan Air SL, a portable, cordless ultrasound imaging device designed for quick evaluations of cardiovascular and vascular patients.

- In July 2023, Konica Minolta Healthcare Americas, Inc., unveiled PocketPro H2, a novel wireless handheld ultrasound tool tailored for general imaging in point-of-care settings. The innovative PocketPro H2 linear wireless handheld ultrasound system is specifically designed for various applications, including musculoskeletal (MSK), pain management, vascular access, and needle guidance.

- In December 2023, BD introduced the SiteRite 9 Ultrasound System, an ultrasound platform aimed at enhancing clinician productivity during the placement of peripherally inserted central catheters (PICCs), central venous catheters, IV lines, and similar vascular access devices.

Report Coverage

The vascular imaging market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, techniques, procedures, end uses, and their futuristic growth opportunities.

Vascular Imaging Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 6.04 billion |

|

Revenue forecast in 2032 |

USD 9.01 billion |

|

CAGR |

5.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Vascular Imaging Market report covering key segments are technique, procedure, end use, and region.

Vascular Imaging Market Size Worth $9.01 Billion By 2032

Global vascular imaging market exhibiting the CAGR of 5.1% during the forecast period.

Asia-Pacific is leading the global market

key driving factors in Vascular Imaging Market are rising incidence of cardiovascular diseases