Vibration Control Systems Market Share, Size, Trends & Industry Analysis Report

By System Type (Motion Control, Vibration Control); By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM3795

- Base Year: 2024

- Historical Data: 2020-2023

The global Vibration Control Systems Market was valued at USD 5.1 billion in 2024 and is expected to grow at a CAGR of 9.40% from 2025 to 2034. Increasing need for structural safety and machinery efficiency is a key growth factor.

Industry Trends

The global vibration control systems (VCS) market encompasses the production, distribution, and utilization of devices aimed at controlling or mitigating undesirable vibrations in various mechanical and structural systems.

These systems are categorized into passive, hybrid, and active types, each offering unique approaches to vibration reduction. Passive systems rely on inertia and mass dampers to absorb vibrations, effectively reducing oscillations caused by external forces. Hybrid systems combine passive elements with powered components for enhanced control, while active systems utilize sophisticated technology like accelerometers and electronic controllers to counteract vibrations in real time. Various market key players provide tailored solutions to address vibration challenges across various industries, ensuring improved comfort, safety, and structural stability.

To Understand More About this Research:Request a Free Sample Report

- For instance, in February 2024, BAE Systems filed a patent for an active vibration control system featuring an electromagnetic actuator capable of actively managing vibrations in diverse structures like vehicles. The system employs a driving mechanism and control mechanism to manipulate at least two vibration modes, with the ability to adjust vibration modes by regulating current flow to the actuator.

Active vibration control systems are particularly vital in precision industrial processes where even minor vibrations can lead to significant errors or damage. By applying precise forces to counteract external vibrations, these systems help maintain stable platforms for delicate operations. In sectors like aerospace and automotive engineering, active vibration control plays a critical role in ensuring smooth performance and longevity of components. Additionally, active systems are essential in reducing vibrations in dynamic structures like helicopters, where stability is paramount for safe operation.

A vibration monitoring system tool used to detect, measure, and analyze vibrations in machinery and structures. By continuously monitoring vibration levels, these systems can identify potential issues such as misalignment, imbalance, wear, or other mechanical problems that could lead to equipment failure or reduced performance. Vibration monitoring systems utilize sensors to collect data on vibration frequencies and amplitudes, which are then analyzed to provide insights into the health and condition of the monitored equipment. This proactive approach allows for early detection of abnormalities, enabling timely maintenance or corrective actions to prevent costly downtime, improve operational efficiency, and extend the lifespan of machinery and structures. To determine these vibrations, some market players have introduced monitoring tools in the market.

- For instance, in November 2023, Worldsensing introduced its latest wireless Vibration Meter, utilizing tri-axial MEMS accelerometer technology for long-term monitoring. It offers extended battery life and a wider communication range to ensure compliance with regulatory standards for industries like construction and mining. The device employs an advanced algorithm to detect vibration parameters.

Key factors propelling market expansion include increased focus on achieving mechanical balance and stability, especially in automobiles and industrial machinery. VCS plays a critical role in reducing wear and tear, energy loss, crack formation, and other negative consequences associated with excessive vibrations. Applications span multiple industries, such as automotive, aerospace and defense, electrical and electronics, oil and gas, and healthcare.

Key Takeaways

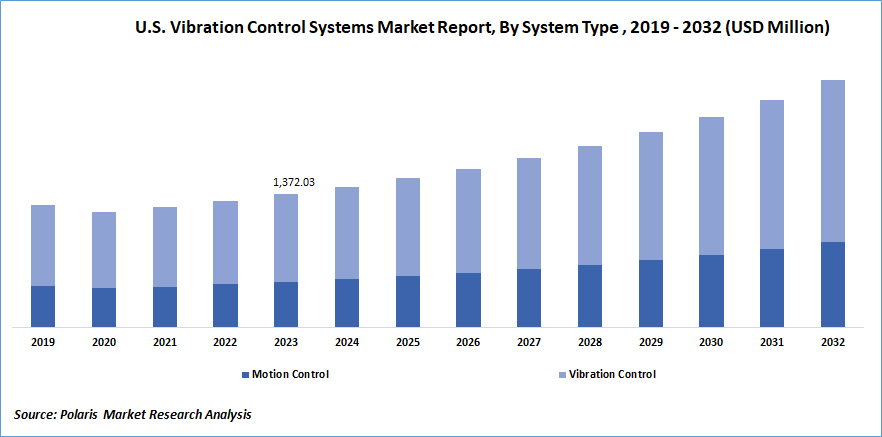

- North America dominated the market and contributed over 30% of vibration control systems market share in 2023

- By system type category, the vibration control segment dominated the vibration control systems market share in 2024

- By application category, the industrial manufacturing accounted for the largest vibration control systems market share.

What are the market drivers driving the demand for the Vibration Control Systems market?

- Advancements in sensor technology and increasing demand for vibration control in machinery and structures

Advancements in sensor technology are fundamentally reshaping the landscape of vibration control systems, particularly in active applications. These systems now leverage advanced sensors to detect vibrations swiftly and accurately, enabling real-time responses to dynamic environmental changes. Industries such as aerospace are embracing these technologies, integrating innovations like shape memory alloys and smart materials to create self-adjusting structures that autonomously adapt to varying vibration conditions. Moreover, the integration of sensors into these systems enhances operational efficiency and predictive maintenance capabilities, crucial for achieving automation and predictive maintenance goals in the era of Smart Factories and Industry 4.0.

The demand for vibration control is rising across industrial and construction sectors, driven by the need for enhanced reliability, efficiency, and safety. Active vibration control systems are increasingly adopted to maintain precise positioning and alignment, particularly in industries like aerospace and defense where precision is paramount. Additionally, the integration of vibration control systems into vehicles not only enhances fuel efficiency but also ensures better safety and comfort for workers and passengers, contributing to a safer working environment and reducing the risk of accidents. Furthermore, advancements in passive vibration damping techniques and the emergence of smart materials offer cost-effective solutions for managing vibrations in machinery and structures, providing reliable performance without significant investment in active systems.

Which factor is restraining the demand for vibration control systems?

- High initial investment cost

The substantial initial investment costs associated with vibration control systems pose a significant barrier to adoption, encompassing procurement, installation, and ongoing maintenance expenses. While these systems offer benefits such as early detection of machinery issues and minimized downtime, uncertainty about long-term ROI hinders widespread adoption. Industries like oil and gas, utilities, and transportation drive demand, leading to the development of new products. Despite the high costs, vibration control systems play a critical role in ensuring safety, operational efficiency, and structural integrity across various industries, justifying their investment.

Report Segmentation

The market is primarily segmented based on system type, application, and region.

|

By System Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By System Type Insights

Based on system type analysis, the market has been segmented on the basis of Motion Control, and Vibration Control. The vibration control segment held the largest vibration control systems market share of around 65% in 2023. Vibration control is crucial for managing and minimizing oscillations in mechanical and structural environments, ensuring stability and longevity. Methods like isolators, dampers, and tuned mass absorbers, along with specialized materials, are employed to mitigate vibrations. It plays a pivotal role in driving the growth of the vibration control market by enhancing equipment performance, extending lifespan, and reducing maintenance costs. Industries prioritize operational efficiency and regulatory compliance, leading to increased demand for advanced vibration control solutions. Market expansion is fueled by technological advancements, diverse applications across industries, and global industrialization trends. Rising awareness about the benefits of vibration control in optimizing performance and minimizing disruptions further drives sustained market growth.

By Application Insights

Based on application category analysis, the market has been segmented on the basis of aerospace, electronics, automotive, oil & gas, industrial manufacturing, food & beverages, rail, marine, energy & utilities, white goods, construction, pharmaceuticals, and others. The industrial manufacturing segment accounted for the largest vibration control systems market share of around 19% in 2023. Vibration control systems in industrial manufacturing mitigate harmful machinery-generated vibrations, ensuring product quality, equipment integrity, and worker safety. They reduce friction, prevent wear and tear, and maintain machining accuracy, enhancing product consistency and tool longevity. Mitsubishi Heavy Industries and Hutchinson offer advanced systems for structural stability and vehicle comfort. These systems also support predictive maintenance strategies, detecting early equipment issues to minimize downtime and maintenance costs, ultimately boosting operational efficiency and profitability.

Regional Insights

North America

The North American vibration control systems market is mainly driven by growing demand for products and services being offered by varied sectors, including healthcare, aerospace and defense, mining, oil, and gas industries. North America is a dominating region being focused on technological advancements followed by research and development activities by major players existing in the region. Owing to the early adoption of technology in the region is prompting federal agencies to implement rules and regulations, which is also a major factor that influences the demand for vibration control systems and their implementation in workspaces. For instance, the Canadian Centre for Occupational Health and Safety has proposed Measurement, Control, and Standards associated with the vibration of tools and machinery coupled with its impact on the health of workers. Therefore, such laws further instruct companies to adopt vibration control systems to minimize loss of production and detrimental impact on workers' health tends to drive its market growth.

Asia Pacific

The Asia Pacific region is undergoing rapid modernization and development, driven by factors like industrialization, rising qualification rates, and per capita income growth. Economic expansion in countries like China, India, Singapore, and Australia fuels industrial and construction activities, with the construction sector experiencing significant growth. Construction sites increasingly rely on vibration control systems to protect both architectural structures and workers' health from excessive vibrations. Regulations such as the Control of Vibration at Work Regulations 2005 aim to mitigate health risks associated with vibration exposure. As construction activity surges, demand for vibration control systems like anti-vibration mounts and rubber dampers rises, reflecting the sector's growing importance in ensuring safety and structural integrity amidst rapid urbanization and development.

Competitive Landscape

The Vibration Control Systems market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant Vibration Control Systems market share.

Some of the major players operating in the global market include:

- Continental AG

- Hutchinson SA

- Kinetics Noise Control, Inc.

- LISEGA SE

- PARKER HANNIFIN CORP

- Resistoflex

- Sentek Dynamics Incorporated

- Stabilus Group

- SUMITOMO MITSUI CONSTRUCTION CO., LTD.

- Trelleborg Group

Recent Developments

- In September 2024, Kinetic Noise Control Inc. introduced the updated version of their KSR 3.0 Vibration Isolation Rail. This latest version is available in two variants - fully assembled and partially assembled and is designed to provide improved vibration isolation.

- In January 2024, Worldsensing launched a wireless Vibration Meter for long-term civil engineering monitoring. It features advanced sensors, long battery life, and complies with international vibration standards to ensure infrastructure safety.

- In October 2023, Stabilus SE agreed to acquire the business of DESTACO, a supplier of industrial automation components, from Dover Corporation, a global diversified industrial manufacturer headquartered in the USA.

- In March 2023, Continental launched a range of Shock Absorbing Mount (SAM) Springs that are designed to provide high-quality shock absorption in industrial applications.

Report Coverage

The Vibration Control Systems market report emphasizes key regions across the globe to provide users with a better understanding of the product. The report also provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, system type, application, and futuristic growth opportunities.

Vibration Control Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 5.6 Billion |

|

Revenue Forecast in 2034 |

USD 12.3 Billion |

|

CAGR |

9.40% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By System Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

TVibration Control Systems Market Size Worth USD 12.3 Billion By 2034.

Key players in the vibration control systems market are include Continental AG, Stabilus Group, Hutchinson SA, SUMITOMO MITSUI CONSTRUCTION CO.

North America contribute notably towards the global vibration control systems market.

Vibration Control Systems Market exhibiting a CAGR of 9.40% during the forecast period.

The vibration control systems market report covering key segments are system type, application, and region.