Vibration Monitoring Market Size, Share, Trends, Industry Analysis Report

: By Offering, Monitoring Process, Deployment Type (On-Premise and Cloud), Application, Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast 2025–2034

- Published Date:Mar-2025

- Pages: 128

- Format: PDF

- Report ID: PM1628

- Base Year: 2024

- Historical Data: 2020-2023

Vibration Monitoring Market Overview

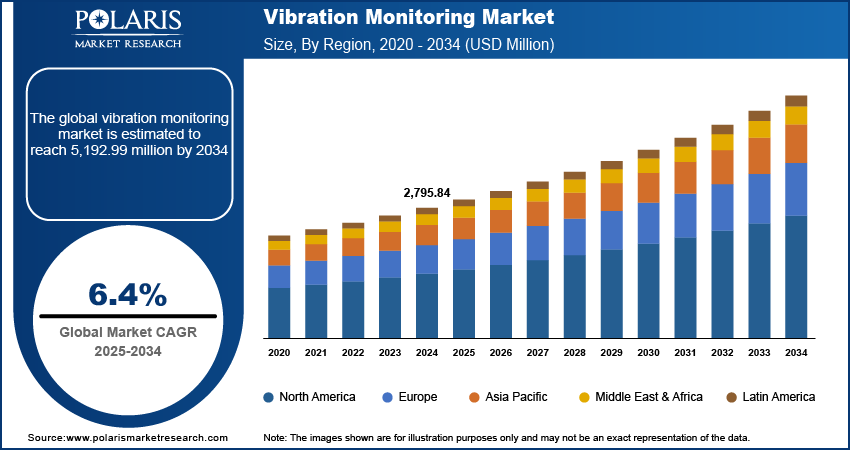

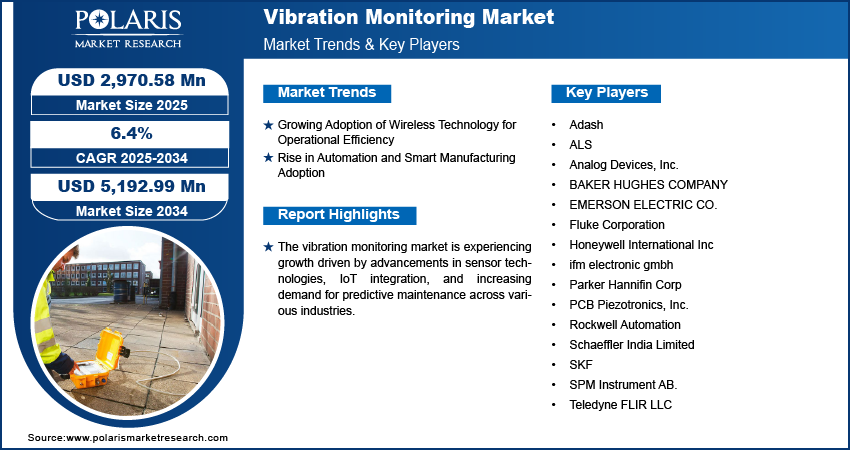

The global vibration monitoring market size was valued at USD 2,795.84 million in 2024. The market is projected to grow from USD 2,970.58 million in 2025 to USD 5,192.99 million by 2034, exhibiting a CAGR of 6.4% from 2025 to 2034.

Vibration monitoring is a crucial technique for measuring and analyzing machine vibrations, ensuring reliability and efficiency in rotating and reciprocating equipment. By collecting frequency and amplitude data through advanced sensors, it detects irregularities in components like gears and bearings. This proactive approach helps predict failures, reduces unplanned downtime, and enhances overall machinery performance and maintenance efficiency.

The integration of advanced technologies such as the Internet of Things (IoT) technology is revolutionizing the industry by improving connectivity and real-time data sharing. Modern vibration monitoring equipment, often equipped with Wi-Fi capabilities, allows seamless communication of machine performance data to engineering teams, ensuring timely interventions. Additionally, advancements in sensor design and the incorporation of Artificial Intelligence (AI) algorithms into vibration monitoring systems are key drivers of vibration monitoring market growth. For instance, in March 2024, POLYN Technology launched VibroSense for Tire Monitoring, a Neuromorphic Front-End solution leveraging NASP technology to analyze in-tire vibration data with 95% accuracy. This innovation improves driving safety by informing systems such as ADAS and ABS about road conditions while optimizing tire monitoring power efficiency. These innovations enable more precise diagnostics and predictive maintenance, meeting the evolving demands of industries. The increasing adoption of these solutions highlights their importance in optimizing operational efficiency and reducing maintenance costs across various industrial sectors.

To Understand More About this Research: Request a Free Sample Report

Vibration Monitoring Market Dynamics

Growing Adoption of Wireless Technology for Operational Efficiency

The increasing adoption of wireless technology is driving the vibration monitoring market expansion, as it improves operational efficiency by allowing seamless data transformation and real-time monitoring of machinery. Wireless systems eliminate the need for extensive cabling, reducing installation costs and complexities, particularly in remote or hard-to-reach locations. These technologies facilitate the integration of IoT-based sensors and cloud connectivity, allowing maintenance teams to access vibration data remotely and make timely decisions. The flexibility of wireless solutions also supports scalability, making them ideal for modern, dynamic industrial environments. For instance, in November 2023, Worldsensing launched the Vibration Meter, a wireless sensor for continuous vibration monitoring. It features a tri-axial MEMS accelerometer, extended battery life, and broader communication range, aiding industries in maintaining building integrity and community comfort. Additionally, wireless technology continues to play a major role in advancing vibration monitoring systems as industries increasingly prioritize predictive maintenance to minimize downtime and optimize performance.

Rise in Automation and Smart Manufacturing Adoption

The rise in automation and smart manufacturing adoption particularly drives the vibration monitoring market expansion by enabling advanced systems that ensure machinery operates at optimal efficiency. There is a greater need to monitor the health of machines continuously to prevent breakdowns and reduce downtime as industries move toward automated processes. Vibration monitoring systems equipped with IoT and AI capabilities can provide real-time data and predictive insights, allowing for automated responses and maintenance scheduling. The integration of vibration sensors in smart factories enhances overall system reliability and safety, aligning with the industry's push for more efficient, data-driven operations. For instance, in December 2024, the Ministry of Heavy Industries (MHI) launched four Smart Advanced Manufacturing and Rapid Transformation Hub (SAMARTH) Centres in India to promote Industry 4.0 solutions. These centres aim to boost competitiveness in the capital goods sector by offering training and consultancy to MSMEs, focusing on smart technologies and conducting 500 digital maturity assessments, without providing financial assistance. Additionally, this transition towards automation creates a growing demand for vibration monitoring solutions, ensuring better operational control and proactive maintenance strategies.

Vibration Monitoring Market Segment Analysis

Vibration Monitoring Market Assessment by Deployment Type

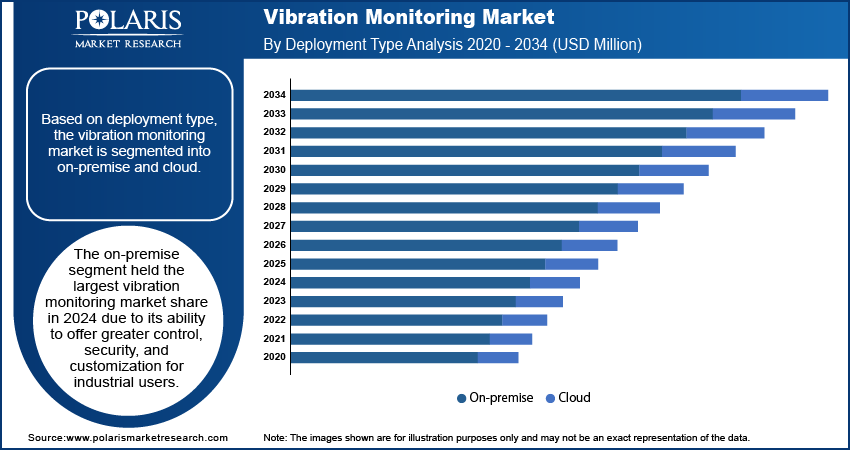

The global vibration monitoring market segmentation, based on deployment type, includes on-premise and cloud. The on-premise segment held the largest vibration monitoring market share in 2024 due to its ability to offer greater control, security, and customization for industrial users. On-premise systems are typically preferred by industries with strict data privacy and security requirements, as they allow organizations to store and manage data internally, reducing potential risks associated with cloud-based solutions. Additionally, on-premise vibration monitoring systems enable real-time data processing and analysis without relying on internet connectivity, which is crucial for industries in remote or highly regulated environments. The ability to integrate with existing legacy systems and provide more tailored solutions further contributes to the widespread adoption of on-premise vibration monitoring solutions.

Vibration Monitoring Market Evaluation by Industry

The global vibration monitoring market segmentation, based on industry, includes oil & gas, power generation, mining & metals, chemicals, automotive, aerospace, food & beverages, and other industries. The automotive segment is expected to witness the highest CAGR due to the growing demand for advanced monitoring solutions in the production and maintenance of vehicles. Vibration monitoring plays a critical role in ensuring the reliability, safety, and performance of automotive components such as engines, brakes, and tires. The need for real-time monitoring of vibration levels to predict potential failures and improve product quality is rising as the automotive industry increasingly adopts automation, electric vehicles, and advanced manufacturing techniques. Furthermore, strict regulations regarding vehicle safety and performance are driving the adoption of vibration monitoring technologies.

Vibration Monitoring Market Regional Insights

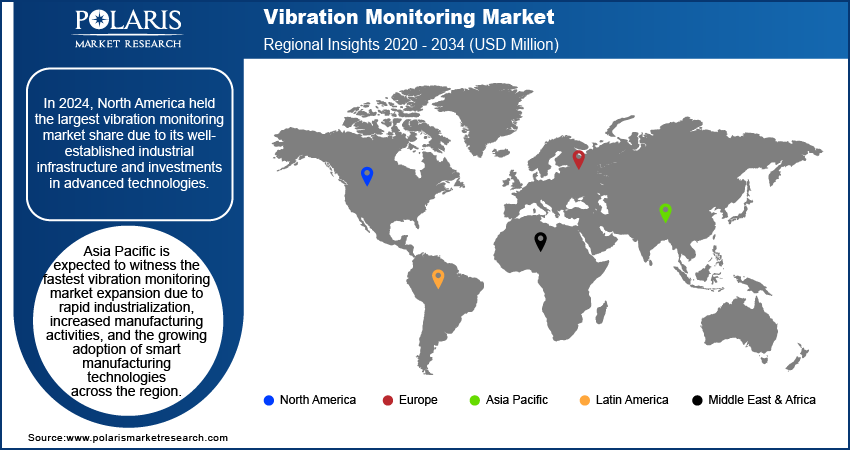

By region, the study provides vibration monitoring market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest market share due to its well-established industrial infrastructure and investments in advanced technologies. The region includes major industries, including oil & gas, automotive, power generation, and aerospace, all of which require reliable vibration monitoring solutions to ensure operational efficiency and prevent costly downtime. Additionally, the growing emphasis on predictive maintenance and asset management in North America has increased the adoption of vibration monitoring systems. Government regulations focused on industrial safety and the push for smart manufacturing further boost market demand. For instance, in December 2024, the US Department of Energy allocated USD 70.8 million to support small- and medium-sized manufacturers in the automotive, battery recycling, and smart manufacturing sectors. This funding aims to improve federal partnerships with state and local governments, ensuring that investments in climate, clean energy, and other areas reach disadvantaged communities.

Asia Pacific is expected to witness the fastest growth due to rapid industrialization, increased manufacturing activities, and the growing adoption of smart manufacturing technologies across the region. Countries such as China, India, and Japan are leading the way in industrial development, with a strong focus on improving operational efficiency and minimizing downtime. The region's demand for predictive maintenance solutions is rising as industries aim to reduce operational costs and enhance machine reliability. Moreover, government initiatives promoting the adoption of Industry 4.0 and digital transformation are further fueling market growth.

Vibration Monitoring Market – Key Players and Competitive Insights

The competitive landscape features a mix of global leaders and regional players aiming for vibration monitoring market share through innovation, strategic partnerships, and geographical expansion. Prominent global players such as Emerson Electric Co., SKF, Honeywell International Inc., and others leverage strong R&D capabilities, extensive distribution networks, and technological advancements to deliver advanced product offerings, including wireless and cloud-based solutions. Vibration monitoring market trends indicate a rising demand for predictive maintenance and real-time monitoring solutions, driven by industries increasing focus on operational efficiency and cost reduction. According to market statistics, the market is expected to grow substantially, fueled by the need to monitor machinery health in sectors such as oil & gas, power generation, and automotive.

Regional companies target localized needs by offering cost-effective and customized solutions. Competitive strategies include mergers and acquisitions, partnerships with industrial players, and the introduction of innovative vibration monitoring technologies to meet the growing demand for reliable and efficient monitoring systems. These developments highlight the importance of technological innovation, regional growth, and strategic alliances in driving the expansion of the vibration monitoring market. A few key major players are BAKER HUGHES COMPANY; EMERSON ELECTRIC CO.; SKF; Schaeffler India Limited; Parker Hannifin Corp; Honeywell International Inc; Rockwell Automation; Analog Devices, Inc.; ALS; Teledyne FLIR LLC.

Honeywell International Inc. is a multinational conglomerate corporation headquartered in Charlotte, North Carolina. The company offers in the product of four areas, including building technologies, aerospace, safety & productivity solutions (SPS), and performance materials and technologies (PMT). Honeywell Aerospace provides aircraft engines, avionics, flight management systems, and services to airlines, airports, manufacturers, space programs, and militaries. Moreover, in 2020, the company acquired Ballard Unmanned Systems to expand the product portfolio of aerospace segments. It operates for various industries such as aerospace and travel, commercial real estate, energy, healthcare, life sciences, logistics & warehouse, retail, and utilities. The Home and Building Technologies segment offers products, solutions, software, and technologies that allow homeowners to maintain control and connectivity to their comfort, energy, and security. The Performance Materials and Technologies segment manufactures and develops process technologies, materials, and automation solutions. Moreover, the Safety and Productivity Solutions segment provides software, products, and connected solutions, including footwear and personal protection equipment designed for play, work, and outdoor activities.

Rockwell Automation is a US based company specializing in industrial automation. It offers a range of products that include Allen-Bradley brands, FactoryTalk software, and LifecycleIQ Services. Headquartered in Milwaukee, the company serves customers in over 100 countries globally. Rockwell Automation provides asset optimization and workforce station services such as equipment repair, remanufacturing, on-site field services, asset and equipment inventory management, applications remote support and monitoring, and training services. The company offers a diverse portfolio that encompasses hardware, software, design, analytics, and data solutions. This includes manufacturing execution systems (MES), human-machine interface (HMI), performance monitoring, maintenance, industrial communications, XR/augmented reality, industrial analytics, industrial automation control, industrial cybersecurity and networks, industrial solutions for digital transformation, motion and robotics, safety solutions, smart manufacturing, automotive and tire, process automation control, infrastructure, and more. Hardware includes condition monitoring, connection devices, circuit & load protection, distributed control systems, drives, energy monitoring, independent cart technology, industrial computers & monitors, industrial control products, input/output Modules, human machine interface (HMI), and lighting control. Studio 5000, emulate3D digital twin, factoryTalk vault, arena simulation, factoryTalk logix echo, factoryTalk design studio, and factoryTalk twin studio are included in the Design category. Analytics and Data include factoryTalk historian, factoryTalk dataMosaix, factoryTalk energy manager, factoryTalk analytics, and thingworx IIoT. The company offers HMI products, which include factoryTalk View and factoryTalk Optix.

List of Key Companies in Vibration Monitoring Market

- Adash

- ALS

- Analog Devices, Inc.

- BAKER HUGHES COMPANY

- EMERSON ELECTRIC CO.

- Fluke Corporation

- Honeywell International Inc

- ifm electronic gmbh

- Parker Hannifin Corp

- PCB Piezotronics, Inc.

- Rockwell Automation

- Schaeffler India Limited

- SKF

- SPM Instrument AB.

- Teledyne FLIR LLC

Vibration Monitoring Industry Developments

April 2024: IMI Sensors, a manufacturer of industrial vibration monitoring instrumentation, announced the release of Model 674A91, a fully programmable accelerometer featuring the IO-Link universal protocol for industrial vibration monitoring.

April 2024: Timken, a global player in engineered bearings and industrial motion products launched a new wireless sensor and condition monitoring solution. The solution uses temperature and vibration monitoring to help users detect a failure or major change before it occurs.

Vibration Monitoring Market Segmentation

By Offering Outlook (Revenue, USD Million, 2020–2034)

- Hardware

- Vibration Analyzer

- Vibration Meter

- Accelerometers

- Proximity Probes

- Velocity Sensors

- Vibration Transmitters

- Other Hardware

- Software

- Services

By Monitoring Process Outlook (Revenue, USD Million, 2020–2034)

- Online Vibration Monitoring

- Portable Vibration Monitoring

By Deployment Type Outlook (Revenue, USD Million, 2020–2034)

- On-premise

- Cloud

By Application Outlook (Revenue, USD Million, 2020–2034)

- Motors

- Pumps

- Chillers

- Fans

- Compressors

- Turbines

- Bearings

- Other Applications (Gearboxes, Conveyors)

By Industry Outlook (Revenue, USD Million, 2020–2034)

- Oil & Gas

- Power Generation

- Mining & Metals

- Chemicals

- Automotive

- Aerospace

- Food & Beverages

- Other Industries

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Vibration Monitoring Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,795.84 million |

|

Market Size Value in 2025 |

USD 2,970.58 million |

|

Revenue Forecast by 2034 |

USD 5,192.99 million |

|

CAGR |

6.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global vibration monitoring market size was valued at USD 2,795.84 million in 2024 and is projected to grow to USD 5,192.99 million by 2034.

The global market is projected to register a CAGR of 6.4% during the forecast period.

In 2024, North America held the largest vibration monitoring market share.

A few key players in the market are BAKER HUGHES COMPANY; EMERSON ELECTRIC CO.; SKF; Schaeffler India Limited; Parker Hannifin Corp; Honeywell International Inc; Rockwell Automation; Analog Devices, Inc.; ALS; Teledyne FLIR LLC.

The automotive segment is expected to witness the highest vibration monitoring market revenue.