Virtual Clinical Trials Market Size, Share, & Industry Analysis Report

: By Design (Observational Trials, Interventional Trials, and Expanded Access Trials), Indication, Phases, and Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 118

- Format: PDF

- Report ID: PM1731

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

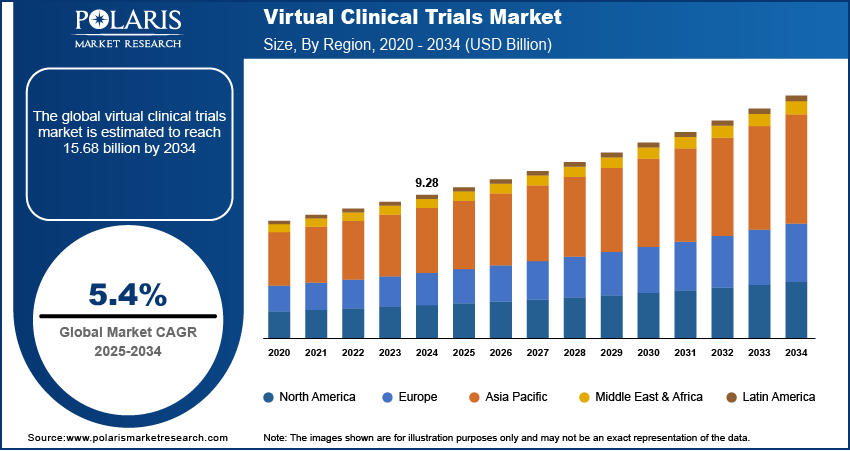

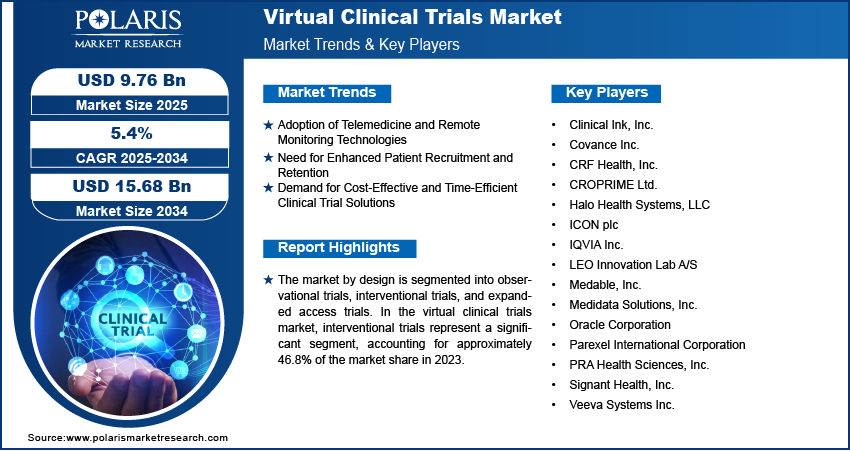

The virtual clinical trials market size was valued at USD 9.28 billion in 2024. The market is projected to grow from USD 9.76 billion in 2025 to USD 15.68 billion by 2034, exhibiting a CAGR of 5.4% during 2025–2034. The market is driven by the increasing adoption of digital health technologies, rising demand for patient-centric trials, cost efficiency, and growing need for decentralized research models to enhance accessibility, patient recruitment, and real-time data collection globally.

Key Insights

- Interventional trials lead the market due to their structured design and effectiveness in evaluating treatment outcomes using virtual platforms.

- Oncology dominates demand, driven by rising cancer prevalence and the urgency for faster, patient-friendly therapeutic research methods.

- Phase II trials holds a major share during th, supported by increased use of decentralized tools that improve enrollment, compliance, and real-time data collection.

- North America leads the market with strong digital health adoption, favorable regulations, and robust clinical research infrastructure.

- Asia Pacific experiences rapid growth due to outsourcing trends, diverse patient pools, and government backing for decentralized clinical trial innovations.

Industry Dynamics

- Rising demand for virtual clinical trials is driven by the need for decentralized research, patient-centric approaches, and increased access to diverse populations.

- Market expansion is supported by digital health innovations, growing adoption of telemedicine, favorable regulatory frameworks, and cost-effective trial models.

- Challenges like data security concerns, limited digital infrastructure, and varying global regulations may restrict market scalability.

- Advances in AI-based patient monitoring, remote data capture, eConsent platforms, and wearable technology are improving trial efficiency, compliance, and real-time insights.

Market Statistics

- 2024 Market Size: USD 9.28 billion

- 2034 Projected Market Size: USD 15.68 billion

- CAGR (2025-2034): 5.4%

- North America: Largest market in 2024

AI Impact on Virtual Clinical Trials Market

- AI analyzes patient data to identify ideal candidates, improving recruitment speed, accuracy, and diversity in virtual clinical trials.

- Integration of AI enables real-time monitoring and predictive analytics, enhancing trial efficiency, patient adherence, and safety oversight.

- AI-powered tools assist in adaptive trial design, optimizing protocols and reducing trial duration through continuous data analysis and feedback loops.

- AI streamlines data management, automates reporting, and ensures data integrity, accelerating approvals and reducing manual workload in decentralized clinical trial settings.

To Understand More About this Research: Request a Free Sample Report

The virtual clinical trials market involves using digital technologies to conduct clinical trials remotely, reducing the need for physical site visits. This market is driven by factors such as increasing adoption of telemedicine, the need to enhance patient recruitment and retention, and the demand for cost-effective and time-efficient clinical trial solutions. The integration of artificial intelligence, real-world data, and decentralized trial models are key trends shaping the market. Regulatory support for remote monitoring and the growing prevalence of chronic diseases further contribute to the market growth.

Market Dynamics

Adoption of Telemedicine and Remote Monitoring Technologies

The increasing integration of telemedicine and remote monitoring technologies is significantly fueling the market expansion. These advancements enable real-time data collection and patient monitoring, reducing the need for physical site visits. For instance, the US Food and Drug Administration has supported the use of remote monitoring devices to facilitate decentralized clinical trials, enhancing patient participation and data accuracy.

Need for Enhanced Patient Recruitment and Retention

Virtual clinical trials offer greater flexibility and accessibility, addressing challenges in patient recruitment and retention. Traditional trials often face obstacles due to geographic limitations and patient inconvenience. By utilizing digital platforms, virtual trials can reach a more diverse patient population, improving enrollment rates and adherence. This approach aligns with the FDA's guidance on conducting clinical trials during the COVID-19 pandemic, which emphasizes the importance of participant safety and trial continuity through remote methods.

Demand for Cost-Effective and Time-Efficient Clinical Trial Solutions

The pursuit of cost-effective and time-efficient solutions is propelling the adoption of virtual clinical trials. By minimizing the reliance on physical infrastructure and streamlining data collection processes, these trials can significantly reduce expenses and accelerate timelines. The FDA recognized the potential of decentralized trials to enhance efficiency and has provided guidance to support their implementation.

Segment Insights

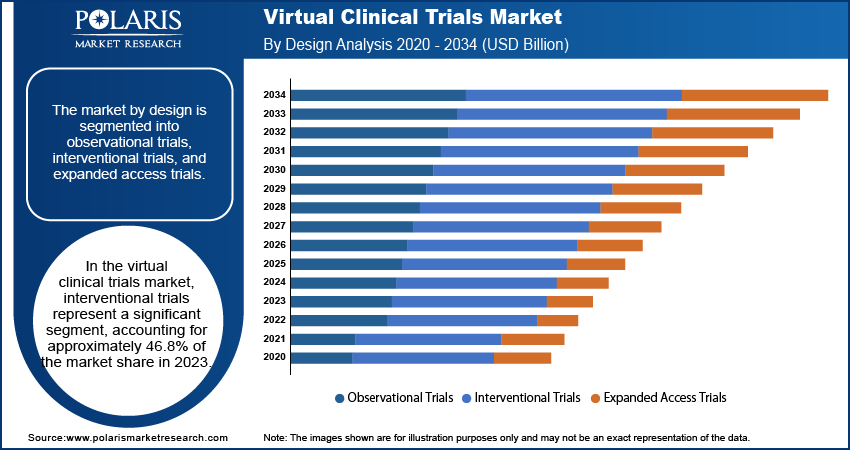

By Design Insights

The virtual clinical trials market segmentation, based on design, includes observational trials, interventional trials, and expanded access trials. The interventional trials segment accounted for the largest market share in 2024. This prominence is attributed to the increasing number of studies aimed at developing new treatments across various diseases and the digital transformation of laboratory processes. The COVID-19 pandemic further accelerated the adoption of interventional virtual trials, as traditional methods posed higher infection risks, leading to a preference for remote and decentralized approaches.

Observational trials also play a crucial role in the virtual clinical trials landscape. These trials are particularly well-suited for chronic diseases and less interventional studies, including areas such as cardiovascular diseases, immunology, gastrointestinal issues, dermatology, respiratory conditions, and endocrinology. The flexibility and adaptability of observational trials make them integral to the comprehensive assessment of various medical interventions in real-world settings.

By Indication Insights

The virtual clinical trials market segmented by indication into CNS, autoimmune/inflammation, cardiovascular disease, metabolic/endocrinology, oncology, infectious disease, genitourinary, and ophthalmology. The oncology segment held a prominent position in 2024, driven by the increasing global incidence of cancer and the necessity for innovative treatment approaches. Virtual clinical trials offer a safer and more convenient alternative for oncology patients, by enabling remote participation and monitoring. This approach not only ensures patient safety but also facilitates the continuous advancement of cancer research and oncology clinical trials.

The cardiovascular disease segment is also experiencing rapid growth within the market. The rising prevalence of cardiovascular conditions worldwide necessitates efficient and effective research methodologies. Virtual clinical trials provide a flexible and patient-centric approach, allowing for broader participation and real-time data collection. This method enhances the efficiency of trials and accelerates the development of new treatments for cardiovascular diseases.

By Phases Insights

The virtual clinical trials market segmentation, based on phases, includes Phase I, Phase II, Phase III, and Phase IV. The phase II trials hold a dominant position in the market. This prominence is due to the adoption of decentralized clinical trial tools and platforms in Phase II procedures, which enhance patient participation and streamline data collection. Virtual clinical trials in Phase II offer substantial value to the biopharmaceutical industry by expediting the gathering of time-sensitive patient data and reducing delays in approvals and site payments.

Phase III trials are also anticipated to experience the highest virtual clinical trials market CAGR over the forecast period. The integration of digital technologies, such as big data, artificial intelligence, and cloud computing, offers opportunities to reimagine clinical trial processes in Phase III. Some pharmaceutical companies are conducting virtual trials alongside traditional onsite trials in Phase III to gather additional data from diverse patient populations globally. This approach aims to automate data collection, increase patient engagement and retention, and provide real-time data access to trial investigators.

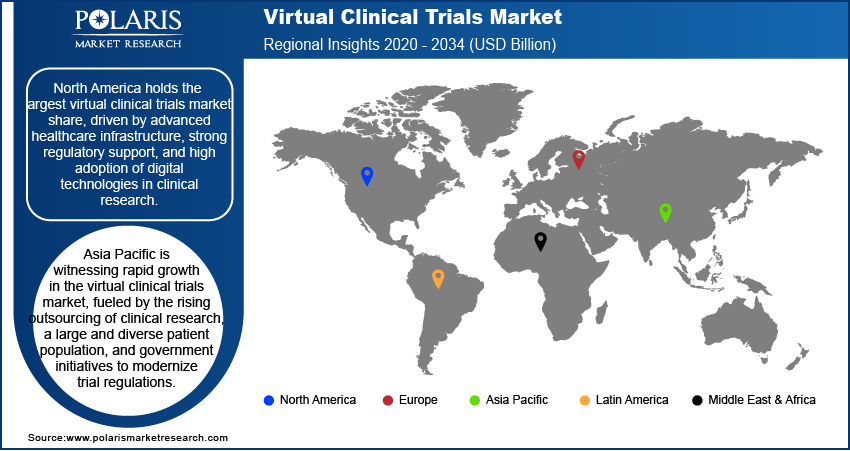

Regional Insights

By region, the study covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America holds the largest market share, driven by advanced healthcare infrastructure, strong regulatory support, and high adoption of digital technologies in clinical research. The presence of major pharmaceutical companies, contract research organizations, and technology firms further accelerates market growth in the region.

Europe is a well-established market for virtual clinical trials, driven by regulatory support, increasing digital transformation in healthcare, and the presence of major pharmaceutical and biotechnology companies. The European Medicines Agency has been actively promoting decentralized trial methodologies, facilitating greater adoption across the region. Countries such as Germany, the United Kingdom, and France are key contributors, with well-developed healthcare infrastructures and strong investments in clinical research. Additionally, collaborations between research institutions and technology providers are fostering innovation in remote patient monitoring and data management.

The virtual clinical trials market in Asia Pacific is witnessing rapid growth, fueled by the rising outsourcing of clinical research, a large and diverse patient population, and government initiatives to modernize trial regulations. Countries such as China, India, and Japan are emerging as key hubs due to their cost advantages, growing digital health ecosystems, and increasing participation in global drug development. The expansion of telemedicine, adoption of wearable technologies, and improving internet penetration further support market growth in the region. Additionally, regulatory bodies are working towards harmonizing guidelines to enhance the adoption of decentralized trial models.

Key Players and Competitive Insights

Several key players are actively contributing to advancements in decentralized research methodologies. ICON plc, a global provider of outsourced development and commercialization services, offers comprehensive solutions across various therapeutic areas. IQVIA Inc. integrates data analytics and technology to enhance clinical trial efficiency and patient engagement. Medable, Inc. specializes in digital platforms that facilitate remote patient interactions and data collection. Clinical Ink provides eSource solutions to streamline data capture and management in clinical trials. Signant Health focuses on patient-centric solutions, offering electronic clinical outcome assessments and patient engagement tools. Oracle Corporation delivers cloud-based applications and platforms to support virtual clinical trial processes. PRA Health Sciences offers a range of services, including decentralized clinical trial solutions, to support drug development. LEO Innovation Lab focuses on developing digital solutions to improve patient engagement in clinical research. Covance, a subsidiary of Laboratory Corporation of America Holdings, provides comprehensive drug development services, including virtual trial capabilities.

The competitive landscape is characterized by rapid technological advancements and strategic collaborations. Companies are increasingly focusing on integrating digital tools such as wearable devices, telemedicine platforms, and electronic patient-reported outcomes to enhance data accuracy and patient engagement. For instance, Medable, Inc. developed a comprehensive platform enabling remote patient interactions, which has been pivotal during the COVID-19 pandemic. Similarly, ICON plc has expanded its decentralized trial offerings through strategic partnerships, enhancing its global reach and service capabilities. These companies are investing in research and development to innovate and improve their virtual trial platforms to maintain a competitive edge. Emphasis is placed on user-friendly interfaces, data security, and compliance with regulatory standards to ensure the integrity of clinical trial data. Additionally, firms are exploring artificial intelligence and machine learning to predict patient outcomes and streamline trial processes. The focus on patient-centric approaches, coupled with technological innovation, is driving the evolution of the virtual clinical trials market.

Medable Inc. provides a global cloud platform that enables collaboration among sponsors, patients, providers, and contract research organizations in clinical trials. Their offerings include digital and decentralized clinical trial screening, electronic consent, telehealth visits, electronic clinical outcome assessments, and remote patient monitoring. Medable aims to streamline clinical research processes and accelerate the development of effective therapies.

ICON plc is a global provider of outsourced drug and device development and commercialization services to pharmaceutical, biotechnology, medical device, and government organizations. The company offers a comprehensive range of services, including clinical development, consulting, and laboratory services, supporting clients across various therapeutic areas. ICON focuses on enhancing clinical trial efficiency and effectiveness through innovative solutions.

List of Key Companies

- Clinical Ink, Inc.

- Covance Inc.

- CRF Health, Inc.

- CROPRIME Ltd.

- Halo Health Systems, LLC

- ICON plc

- IQVIA Inc.

- LEO Innovation Lab A/S

- Medable, Inc.

- Medidata Solutions, Inc.

- Oracle Corporation

- Parexel International Corporation

- PRA Health Sciences, Inc.

- Signant Health, Inc.

- Veeva Systems Inc.

Market Developments

- January 2025: ICON plc expanded its portfolio of artificial intelligence tools designed to deliver efficiencies across the clinical trial process, including study startup, document management, resource forecasting, and metrics reporting. This initiative reflects ICON's commitment to leveraging technology to improve clinical trial operations.

- October 2023: Medable announced a partnership with Pluto Health to improve and optimize access to clinical trials. This collaboration aims to enhance patient experience by integrating digital platforms, thereby facilitating easier recruitment and monitoring of participants.

Virtual Clinical Trials Market Segmentation

By Design Outlook (Revenue USD Billion, 2020–2034)

- Observational Trials

- Interventional Trials

- Expanded Access Trials

By Indication Outlook (Revenue USD Billion, 2020–2034)

- CNS

- Autoimmune/Inflammation

- Cardiovascular Disease

- Metabolic/Endocrinology

- Oncology

- Infectious Disease

- Genitourinary

- Ophthalmology

By Phases Outlook (Revenue USD Billion, 2020–2034)

- Phase I

- Phase II

- Phase III

- Phase IV

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 9.28 billion |

|

Market Size Value in 2025 |

USD 9.76 billion |

|

Revenue Forecast by 2034 |

USD 15.68 billion |

|

CAGR |

5.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The virtual clinical trials market has been segmented into detailed segments of design, indication, phases. Moreover, the study provides the reader with a detailed understanding of the different segments at both the and regional levels.

Growth/Marketing Strategy: Companies in the virtual clinical trials market focus on growth through technological advancements, strategic partnerships, and geographic expansion. Digital tools such as artificial intelligence, big data analytics, and blockchain are being integrated to improve patient recruitment, data collection, and regulatory compliance. Collaborations with pharmaceutical companies, healthcare providers, and technology firms enhance service offerings and market reach. Investments in patient-centric approaches, including mobile health applications and wearable devices, drive engagement and retention. Additionally, regulatory approvals and compliance with evolving guidelines play a crucial role in ensuring market credibility and adoption.

FAQ's

The virtual clinical trials market size was valued at USD 9.28 billion in 2024 and is projected to grow to USD 15.68 billion by 2034.

The market is projected to register a CAGR of 5.4% during the forecast period, 2024-2034.

North America had the largest market share driven by advanced healthcare infrastructure, strong regulatory support, and high adoption of digital technologies in clinical research.

Key players in the virtual clinical trials market include Clinical Ink, Inc.; Covance Inc.; CRF Health, Inc.; CROPRIME Ltd.; Halo Health Systems, LLC; ICON plc; IQVIA Inc.; LEO Innovation Lab A/S; Medable, Inc.; Medidata Solutions, Inc.; Oracle Corporation; Parexel International Corporation; PRA Health Sciences, Inc.; Signant Health, Inc.; and Veeva Systems Inc

The interventional trials segment accounted for the larger share of the market in 2024 the increasing number of studies aimed at developing new treatments across various diseases and the digital transformation of laboratory processes.

The oncology segment holds a prominent position in 2024, driven by the increasing global incidence of cancer and the necessity for innovative treatment approaches.

Virtual clinical trials, also known as decentralized clinical trials, are research studies conducted using digital technologies to enable remote participation by patients. These trials leverage telemedicine, mobile applications, electronic health records, wearable devices, and online patient monitoring to collect data without requiring participants to visit physical trial sites. This approach enhances patient accessibility, reduces costs, and accelerates study timelines while maintaining compliance with regulatory standards. Virtual clinical trials are widely used in various therapeutic areas, including oncology, cardiology, and infectious diseases, to streamline drug development and improve clinical research efficiency.

A few key trends in the market are described below: Adoption of Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are being used for patient recruitment, data analysis, and predictive modeling to improve trial efficiency. Integration of Wearable Devices and Remote Monitoring: Wearables and biosensors enable continuous data collection, enhancing real-time monitoring and patient engagement. Expansion of Telemedicine in Clinical Research: Telehealth solutions facilitate virtual consultations, reducing the need for in-person visits and improving patient accessibility. Increasing Use of Blockchain for Data Security: Blockchain technology is being explored to enhance data transparency, security, and integrity in virtual trials.

A new company entering the virtual clinical trials market can focus on developing advanced digital platforms with AI-driven patient recruitment, real-time remote monitoring, and secure data management. Offering blockchain-based solutions for data security and regulatory compliance can enhance credibility. Specializing in emerging therapeutic areas, such as rare diseases and personalized medicine, can create differentiation. Expanding services in high-growth regions like Asia Pacific and Latin America can provide market entry advantages. Partnering with pharmaceutical firms, healthcare providers, and regulatory agencies can strengthen market positioning and accelerate adoption.