Vitamin K2 Market Size, Share, Trends, Industry Analysis Report

: By Product Type (MK-4 & Combination Drugs and MK-7 Drugs), Source, Form, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025 –2034

- Published Date:Dec-2024

- Pages: 116

- Format: PDF

- Report ID: PM1669

- Base Year: 2024

- Historical Data: 2020-2023

Vitamin K2 Market Overview

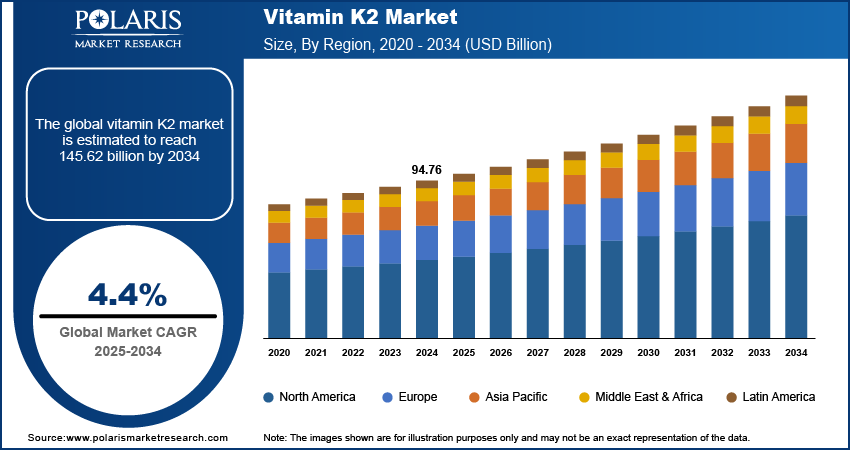

The global vitamin K2 market size was valued at USD 94.76 billion in 2024. The market is projected to grow from USD 98.77 billion in 2025 to USD 145.62 billion by 2034, exhibiting a CAGR of 4.4% during 2025 –2034.

The global vitamin K2 market refers to the commercial sector focused on the production, distribution, and consumption of vitamin K2. Vitamin K2 is a fat-soluble vitamin essential for bone health, cardiovascular function, and blood clotting. The market growth is driven by the increasing consumer awareness of the health benefits of vitamin K2, particularly its role in preventing osteoporosis and improving heart health. Other key factors, such as the rising prevalence of bone-related diseases, the increasing aging global population, and the expanding dietary supplement sector, boost the vitamin K2 market development. Trends include the growing demand for natural and plant-based vitamin K2 sources, as well as an increase in the use of K2 in functional foods and beverages. Additionally, technological advancements in manufacturing processes and the growing integration of vitamin K2 in personal care products are contributing to market expansion.

To Understand More About this Research: Request a Free Sample Report

Vitamin K2 Market Dynamics

Growing Demand for Bone Health Supplements

As awareness of the importance of bone density and the risks associated with bone-related conditions such as osteoporosis rises, consumers are turning to vitamin K2 as an essential nutrient to support bone health. Vitamin K2 works by activating proteins that regulate calcium in the body, directing it to the bones and preventing it from accumulating in the arteries. This trend is especially significant in aging populations, where osteoporosis is more prevalent. A study from the National Osteoporosis Foundation indicates that osteoporosis affects ∼ 10 million Americans, with an additional 44 million at risk, creating a substantial market for vitamin K2-based supplements. Thus, the increasing demand for bone health supplements boosts the vitamin K2 market expansion.

Rising Popularity of Natural and Plant-Based Sources

Consumers are increasingly seeking natural and non-synthetic sources of nutrients, with a growing preference for plant-based supplements. Vitamin K2 derived from natural sources such as fermented soybeans (natto) or chickpeas is becoming more popular, especially among vegetarians and vegans who may lack sufficient K2 in their diets. The trend toward plant-based alternatives is fueled by broader shifts toward plant-based diets and clean-label products. According to a report by the Plant Based Foods Association, the plant-based food market in the U S grew by 27% in 2020, signaling a strong consumer shift toward plant-based products, which likely include vitamin K2. As a result, producers are expanding their product offerings to meet this demand, including plant-based Vitamin K2 in supplements and functional foods. Therefore, the rising preference for natural and plant-based products is fueling the vitamin K2 market development.

Integration of Vitamin K2 in Functional Foods and Beverages

Consumers are increasingly interested in foods and drinks that offer health benefits beyond basic nutrition. Manufacturers are incorporating vitamin K2 into a wide range of functional food products, such as dairy alternatives, fortified snacks, and even beverages such as smoothies and juices. This trend is aligned with the broader functional food movement, which sees products enriched with vitamins, minerals, and other bioactive compounds aimed at enhancing overall well-being. Hence, the rising inclusion of vitamin K2 in functional foods and beverages fuels the vitamin K2 market growth.

Vitamin K2 Market Segment Insights

Vitamin K2 Market Outlook – Product Type-Based Insights

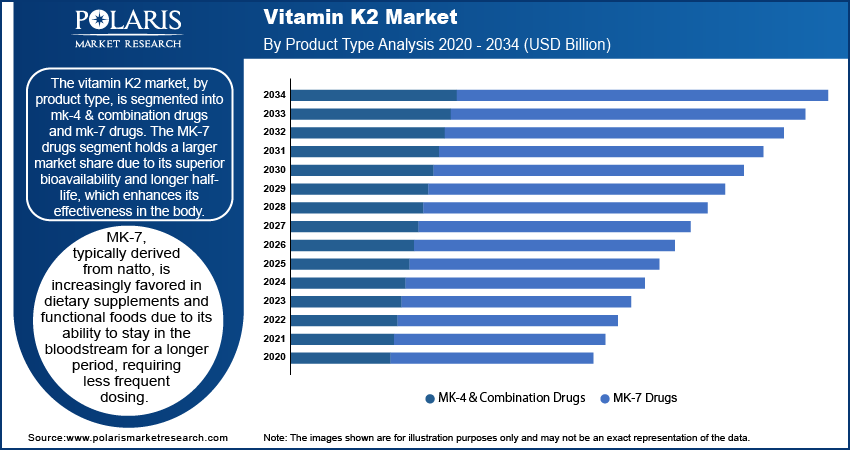

The vitamin k2 market, by product type, is segmented into mk-4 & combination drugs and mk-7 drugs. The MK-7 drugs segment holds a larger market share due to its superior bioavailability and longer half-life, which enhances its effectiveness in the body. MK-7, typically derived from natto, is increasingly favored in dietary supplements and functional foods due to its ability to stay in the bloodstream for a longer period, requiring less frequent dosing. This characteristic has made MK-7 particularly popular in products targeting bone health, cardiovascular function, and general wellness. MK-4, although effective, is more commonly used in combination drugs and therapeutic treatments, particularly in higher dosages for osteoporosis and certain heart conditions, but its shorter half-life requires more frequent dosing, which may limit its appeal in consumer markets compared to MK-7.

MK-7 products are registering the highest growth as well, driven by the expanding demand for natural and bioavailable vitamin K2 in dietary supplements and functional foods. The increasing preference for non-synthetic, plant-based sources has also driven the market for the MK-7 drugs segment, particularly in vegan and vegetarian segments. As consumers continue to seek natural alternatives to support bone density and cardiovascular health, MK-7 is positioned to benefit from these ongoing trends. In contrast, MK-4 is expected to experience steady growth, particularly within the pharmaceutical sector for therapeutic use, though its growth rate is not as rapid as that of MK-7.

Vitamin K2 Market Assessment – Source-Based Insights

The vitamin K2 market, by source, is segmented into natural and synthetic. The natural segment holds a larger market share. Natural vitamin K2, typically derived from fermented foods such as natto, cheeses, and fermented soy products, is preferred by consumers seeking products that align with organic and clean-label trends. The growing demand for plant-based, non-synthetic nutrients is driving the natural segment growth, particularly in dietary supplements and functional foods. Consumers are increasingly prioritizing natural and plant-based options due to their perceived safety and efficacy, which has significantly contributed to the strong presence of natural vitamin K2 in the market.

The natural source segment is also registering the highest growth, fueled by rising awareness of the health benefits of Vitamin K2, especially in bone and cardiovascular health. This growth is further supported by an increasing consumer shift toward organic and sustainably sourced products. As the trend for natural and minimally processed ingredients continues to gain traction, manufacturers are expanding their natural vitamin K2 offerings. The synthetic source segment, while still relevant, is seeing slower growth as consumers opt for the perceived superior benefits of naturally sourced vitamin K2. Nonetheless, synthetic vitamin K2 is expected to maintain a presence, particularly in pharmaceutical applications where cost-efficiency and mass production are prioritized.

Vitamin K2 Market Evaluation – Form-Based Insights

The vitamin K2 market, by form, is segmented into capsules & tablets, powder, and oil. The capsules & tablets segment holds the largest market share. This segment benefits from their widespread use in dietary supplements due to their convenience, accurate dosage, and ease of consumption. Capsules and tablets are favored by consumers seeking daily supplementation for bone and cardiovascular health, making them the most common form for retail and online distribution. The popularity of these forms is also driven by their long shelf life and ease of incorporation into daily health regimens, further solidifying their dominant position in the market.

The powder segment is registering the highest growth, especially in the functional food and beverage sectors, where vitamin K2 is increasingly being incorporated into products such as smoothies, energy bars, and fortified beverages. The versatility of powder allows for easier formulation and incorporation into various products, which has helped fuel its growth. Additionally, powders often offer higher concentrations of vitamin K2 per serving, appealing to consumers looking for customized dosages. The oil segment, while the smallest in market share, is growing steadily due to its use in specialized applications, including nutraceuticals and personal care products, where vitamin K2 is valued for its fat-soluble properties that enhance absorption.

Vitamin K2 Market Evaluation – Application-Based Insights

The vitamin K2 market, by application, is segmented into food & pharmaceutical and nutraceutical. The food & pharmaceutical segment holds a larger market share. This segment benefits from the widespread use of vitamin K2 in functional foods, dietary supplements, and pharmaceutical applications targeting bone health and cardiovascular well-being. The pharmaceutical sector particularly drives demand for higher-potency vitamin K2 in prescription medications for conditions such as osteoporosis, contributing to its dominant market position. The inclusion of vitamin K2 in functional foods such as fortified dairy products, plant-based alternatives, and snacks is also expanding the reach of this application segment, catering to health-conscious consumers seeking added nutritional benefits in their daily diets.

The nutraceutical segment is registering the highest growth, driven by the increasing consumer preference for preventive health measures and the rising demand for dietary supplements. As more consumers focus on wellness and disease prevention, the nutraceutical industry is seeing an upsurge in the development of vitamin K2-based supplements, particularly in the bone health and cardiovascular categories. The growing popularity of natural and plant-based supplements, along with increasing awareness about the role of vitamin K2 in overall health, is accelerating growth within the nutraceutical space. This trend is expected to continue as the segment evolves with innovations in supplement formulations and delivery systems to cater to diverse consumer needs.

Vitamin K2 Market Regional Insights

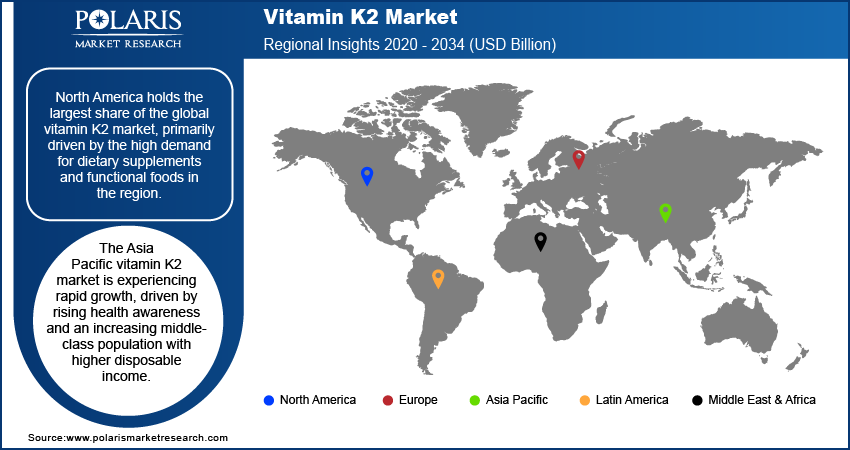

By region, the study provides vitamin K2 market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the global market, primarily driven by the high demand for dietary supplements and functional foods in the region. The strong consumer awareness regarding health and wellness, particularly related to bone and cardiovascular health, has contributed to the widespread use of vitamin K2 supplements. Additionally, the presence of well-established pharmaceutical and nutraceutical industries, coupled with the increasing prevalence of osteoporosis and other bone-related conditions, has propelled market growth in North America. The region also benefits from the rising trend toward natural and organic products, further driving the adoption of vitamin K2 in various health and wellness products. Furthermore, the large number of aging individuals in North America, who are more susceptible to bone diseases, further reinforces the region’s dominant position in the market.

Europe holds a significant share of the global vitamin K2 market revenue, driven by increasing awareness of the health benefits of vitamin K2, particularly in bone health and cardiovascular care. The aging population in Europe is a key factor, as osteoporosis and other bone-related disorders are more prevalent among older adults. Countries such as Germany, the UK, and France are leading the demand for vitamin K2 supplements, especially in the pharmaceutical and nutraceutical sectors. The European market also benefits from a growing trend toward natural and organic products, with consumers increasingly opting for plant-based vitamin K2 sources. Additionally, Europe has strong regulations governing the quality and safety of dietary supplements, ensuring consumer trust and further driving market growth.

The Asia Pacific vitamin K2 market is experiencing rapid growth, driven by rising health awareness and an increasing middle-class population with higher disposable income. Countries such as Japan, China, and South Korea are significant contributors to this growth, particularly in the areas of functional foods and dietary supplements. The region’s long-standing tradition of consuming fermented foods such as natto, a natural source of vitamin K2, supports the demand for vitamin K2 products. As the population ages in countries such as Japan, the demand for bone health supplements is increasing, further expanding the market. Additionally, the growing popularity of plant-based diets in countries such as India is pushing the demand for natural vitamin K2 products. The market in this region is also benefiting from the rising trend of preventive healthcare, with consumers seeking ways to manage health proactively.

Vitamin K2 Market – Key Players and Competitive Insights

Key players in the vitamin K2 market are NattoPharma, Kappa Bioscience, DSM Nutritional Products, and Gnosis by Lesaffre. Other active companies include Zhejiang Medicine Co., Ltd.; and Sports Research Corporation, which offers a range of vitamin K2 products for supplements and functional foods. Additionally, companies such as NOW Foods, MaryRuth Organics, and Herbalife Nutrition contribute to the market growth by offering plant-based vitamin K2 options. Nutraceutical giants such as Nature's Way and Life Extension also participate in the vitamin K2 market, supplying dietary supplements. Other notable players include Longlife, Green Valley, and Vital Nutrients, which focus on providing high-quality vitamin K2 formulations to consumers. These companies are key contributors to the expansion of the vitamin K2 sector across different regions.

The competitive landscape of the vitamin K2 market is characterized by several strategies, such as product innovation, strategic partnerships, and regional expansion. Companies are focusing on launching new formulations and enhancing the bioavailability of their products to meet the increasing consumer demand for more effective vitamin K2 supplements. Partnerships between key players and research institutions are also enabling the development of high-quality, clinically backed vitamin K2 products. Additionally, as consumers continue to shift toward natural and plant-based products, manufacturers are increasingly emphasizing the use of natural sources such as natto for vitamin K2 extraction. This trend is evident in the offerings of companies such as Kappa Bioscience and NattoPharma, which specialize in naturally sourced vitamin K2.

The vitamin K2 market is also marked by the need for companies to maintain product quality and meet stringent regulatory standards, particularly in regions such as Europe and North America. As the market expands, companies are working to enhance their supply chains and ensure that their products are effective and safe. This includes improvements in manufacturing processes and more robust testing methods. Moreover, the rise of e-commerce and direct-to-consumer sales has led companies to increasingly focus on online channels to reach a wider audience. With growing consumer interest in preventive health, Vitamin K2 manufacturers are likely to see continued competition around innovation, sourcing, and product quality in the coming years.

NattoPharma is a key player in the vitamin K2 market, known for its focus on the development and production of natural vitamin K2 sourced from fermented soybeans, specifically MK-7. The company is involved in research, formulation, and distribution of Vitamin K2 products used in dietary supplements, functional foods, and beverages. NattoPharma is highly recognized for its work in advancing the science of vitamin K2 and its impact on bone and cardiovascular health.

Kappa Bioscience is another significant player in the vitamin K2 market, specializing in MK-7 and MK-4 forms of vitamin K2. The company focuses on providing high-quality vitamin K2 for use in nutritional supplements and functional foods, catering to various regions globally. Kappa Bioscience is known for its commitment to research and sustainability in the production of vitamin K2.

List of Key Companies in the Vitamin K2 Market

- NattoPharma

- Kappa Bioscience

- DSM Nutritional Products

- Gnosis by Lesaffre

- Zhejiang Medicine Co., Ltd.

- Sports Research Corporation

- NOW Foods

- MaryRuth Organics

- Herbalife Nutrition

- Nature's Way

- Life Extension

- Longlife

- Green Valley

- Vital Nutrients

Vitamin K2 Industry Developments

In May 2023, NattoPharma announced an expansion of its production capacity to meet the increasing global demand for MK-7, aiming to enhance availability and supply to markets worldwide.

In June 2022, Kappa Bioscience announced a partnership with Balchem to incorporate its Vitamin K2 into a new range of fortified dairy products, expanding its presence in the functional foods market.

Vitamin K2 Market Segmentation

By Product Type Outlook

- MK-4 & Combination Drugs

- MK-7 Drugs

By Source Outlook

- Natural

- Synthetic

By Form Outlook

- Capsules & Tablets

- Powder

- Oil

By Application Outlook

- Food & Pharmaceutical

- Nutraceutical

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Vitamin K2 Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 94.76 billion |

|

Market Size Value in 2025 |

USD 98.77 billion |

|

Revenue Forecast by 2034 |

USD 145.62 billion |

|

CAGR |

4.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Product Type By Source Form By Form By Application |

|

Regional Scope |

North America Europe Asia Pacific Latin America Middle East & Africa |

|

Competitive Landscape |

Vitamin K2 Industry Trends Analysis (2024) Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

PDF + Excel |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global vitamin K2 market size was valued at USD 94.76 billion in 2024 and is projected to grow to USD 145.62 billion by 2034.

The global market is projected to register a CAGR of 4.4% 2025 –2034.

North America had the largest share of the global market in 2024.

A few key players in the vitamin K2 market are NattoPharma, Kappa Bioscience, DSM Nutritional Products, and Gnosis by Lesaffre. Other active companies include Zhejiang Medicine Co., Ltd .; Thorne Research, Inc .; and Sports Research Corporation, which offer a range of vitamin K2 products for supplements and functional foods.

The MK-7 drugs segment accounted for a larger share of the global market in 2024

The natural segment dominated the vitamin K2 market share in 2024.

Vitamin K2 is a fat-soluble vitamin that plays a critical role in regulating calcium in body, promoting bone health, cardiovascular health, and proper blood clotting. It works by activating proteins that help bind calcium to bones and teeth while preventing its buildup in the arteries, thereby supporting bone density and reducing the risk of cardiovascular diseases. Vitamin K2 exists in two primary forms —MK-4 and MK-7, with MK-7 being more commonly found in dietary supplements due to its longer half-life and better bioavailability. It is naturally found in fermented foods such as natto (fermented soybeans), certain cheeses, and animal-based products. Additionally, vitamin K2 is taken as a dietary supplement to support overall health.

A few key vitamin K2 market trends are described below: o Increasing Awareness of Bone and Cardiovascular Health: Growing consumer focus on bone health and preventing cardiovascular diseases is driving demand for vitamin K2 supplements. o Rising Adoption of Natural and Plant-Based Products: Consumers are shifting toward natural, organic, and plant-based sources of vitamin K2, such as those derived from fermented foods, such as natto. o Expansion in Functional Foods and Beverages: Vitamin K2 is being increasingly incorporated into fortified foods and beverages, catering to health-conscious consumers seeking convenient nutrition. o Aging Population: The rising number of older adults, especially in developed regions, is boosting the demand for vitamin K2 due to its benefits in bone density and overall health.

A new company entering the vitamin K2 market must focus on product innovation, particularly by enhancing the bioavailability and effectiveness of vitamin K2 supplements. Developing natural, plant-based, and vegan-friendly formulations could tap into the growing demand for organic and clean-label products. Additionally, targeting functional foods and beverages, such as fortified snacks or dairy alternatives, would provide new consumer touchpoints. Collaborating with health professionals and conducting clinical studies to validate the benefits of vitamin K2 could help establish credibility. Investing in digital marketing strategies, including influencer partnerships and e-commerce platforms, would effectively reach the health-conscious consumer base.

Companies manufacturing, distributing, or purchasing vitamin K2 and related products, and other consulting firms must buy the report.