Wallpaper Market Size, Share, & Industry Analysis Report

By Product (Vinyl-based, Nonwoven, Paper, Fabric, and Others), By End Use, and By Region – Market Forecast, 2025 - 2034

- Published Date:Aug-2025

- Pages: 120

- Format: PDF

- Report ID: PM1999

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

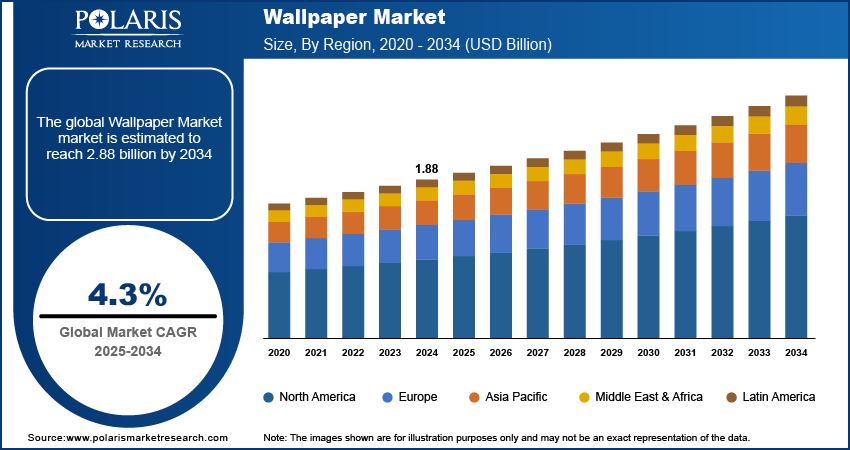

The global wallpaper market size was valued at USD 1.88 billion in 2024 and is projected to grow at a CAGR of 4.3% during the forecast period. Increasing renovation and remodeling activities and growing preference for personalized and aesthetically appealing living and working environments are key factors propelling market development.

Key Insights

- The vinyl-based wallpaper segment accounted for the largest market share in 2024. The segment’s dominance is primarily attributed to the widespread use of highly functional materials.

- The residential segment is anticipated to register the highest CAGR during the projection period, owing to increased home renovation activities and growing consumer emphasis on personalized interior aesthetics.

- North America led the global market in 2024. The robust demand for premium and customized wallcovering solutions drives the region’s leading market share.

- Asia Pacific is anticipated to register significant growth during the projection period. The expanding construction sector in the region is fueling the demand for decorative wall coverings.

Industry Dynamics

- The rising prioritization of interior aesthetics by consumers for personalizing and improving their living spaces drives market demand.

- Technological advancements in printing technology and the introduction of innovative materials and eco-friendly options are contributing to the market expansion.

- The growing trend of home remodeling is expected to fuel the demand for wallpaper products in the coming years.

- High cost of premium and eco-friendly materials may present market challenges.

Market Statistics

2024 Market Size: USD 1.88 billion

2034 Projected Market Size: USD 2.88 billion

CAGR (2025-2034): 4.3%

North America: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

The market has seen substantial growth, driven by rising demand for aesthetically pleasing interior solutions across residential, commercial, and smart hospitality sectors. Innovations in materials, such as vinyl, fabric, and eco-friendly options, have expanded the product range, catering to diverse consumer preferences. Technological advancements such as digital printing have enabled customizable designs, further enhancing appeal.

Wallpaper refers to a decorative material used to cover and enhance the appearance of interior walls, typically available in rolls and featuring various patterns, colors, or textures. It serves both aesthetic and functional purposes, providing style and surface protection. The rise in renovation and remodeling activities across both residential and commercial spaces is accelerating the adoption of wallpapers. Quick installation, cost-efficiency, and easy maintenance make wallpapers a preferred choice, especially in urban areas undergoing frequent interior upgrades.

The growing trend of home remodeling is driving demand for wallpaper products, particularly among consumers eager to explore new designs. Manufacturers and retailers need to understand these demographics and their preferences to develop effective products and marketing strategies tailored to specific customer segments. This approach helps increase future product consumption. In March 2022, Graham & Brown Ltd partnered with the British heritage brand Laura Ashley to launch a new wallpaper collection. The collection featured 80 designs and murals, incorporating "paste the wall" technology for easier installation. Moreover, increasing consumer preference for personalized and aesthetically appealing living and working environments is a significantly driving the growth. Wallpaper allows for a wide range of textures, patterns, and finishes, aligning with evolving interior design trends and boosting demand.

Market Dynamics

Rising Demand for Home Decor

Rising demand for home decor is a major driver as consumers increasingly prioritize interior aesthetics to personalize and improve their living spaces. This trend is fueled by greater awareness of design options through social media, home improvement shows, and online platforms. Wallpapers offer a cost-effective and versatile solution compared to alternatives such as paint, enabling homeowners to experiment with colors, textures, and patterns. For instance, in April 2023, IKEA invested USD 2.2 billion in its US operations to expand and improve its home decor offerings, aligning with this broader trend, highlighting the demand for both functional and aesthetic home improvements. The growing popularity of home renovation projects, particularly during periods of extended time spent at home, has further propelled demand. Additionally, urbanization and rising disposable incomes allow consumers to invest in stylish and innovative home decor solutions, including wallpapers.

Technological Advancements in Printing and Materials

Technological advancements in printing and material innovation are playing a pivotal role in transforming the overall landscape. The integration of high-resolution digital printing technology has enabled the production of intricate, customizable designs with enhanced color accuracy and visual depth, catering to the evolving demands of modern consumers. This progress allows manufacturers to respond swiftly to design trends and consumer preferences, shortening product development cycles and improving supply chain responsiveness. The industry has shifted towards eco-friendly solutions, reducing its carbon footprint management issues while offering products free from harsh scents, making them suitable for health-conscious consumers and providing relief to individuals with allergies or infectious respiratory disease. This dual progress in print and material technology is significantly contributing to the growth by enhancing both product appeal and functional performance, particularly among environmentally conscious and design-driven customers. Additionally, new wallpaper types, such as grass cloth wallpapers, have been developed to offer enhanced features. These wallpapers provide a superior finish compared to traditional paint, especially for walls with rough exteriors, adding both aesthetic value and functional protection against wall damage. As a result, these technological innovations are driving the expansion, offering consumers attractive, durable, and environmentally friendly options.

Segment Analysis

Market Assessment Outlook

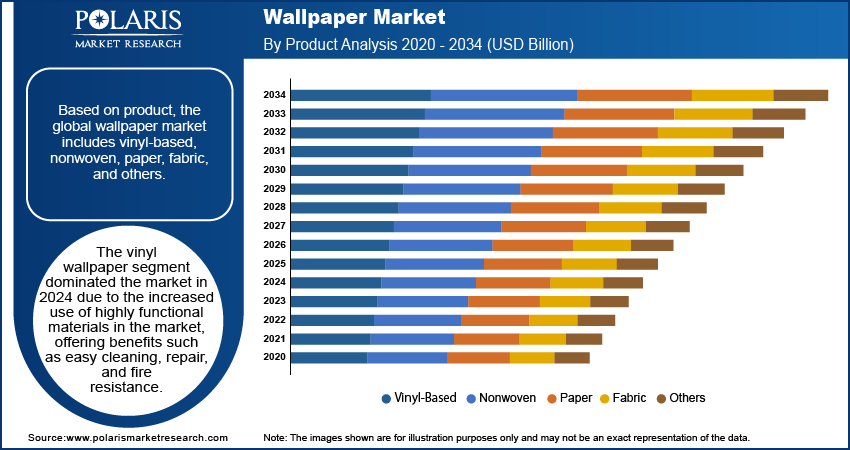

The global wallpaper market segmentation, based on product, includes vinyl-based, nonwoven, paper, fabric, and others. In 2024, the vinyl-based wallpaper segment led the market, driven by the widespread use of highly functional materials that offer benefits such as easy cleaning, repairability, and fire resistance. This segment continues to grow as consumers seek durable and low-maintenance options for their interiors. Additionally, there is an increasing demand for eco-friendly wallpapers, with vinyl wallpapers being more energy-efficient to produce compared to traditional paper wallpapers. This eco-conscious shift is further fueling the growth of the vinyl-based wallpaper segment, as consumers prioritize sustainability without compromising on quality or design.

The nonwoven wallpaper segment is expected to witness the fastest CAGR over the forecast period due to its superior durability, easy installation, and enhanced breathability compared to traditional paper-based options. Technological innovations in fiber bonding and substrate manufacturing have resulted in wallpapers that resist warping, shrinkage, and tearing, even under fluctuating environmental conditions. Consumer demand for low-maintenance, eco-friendly interiors is accelerating adoption across both new construction and renovation projects. Interior designers and contractors favor nonwoven wallpapers for their reusability and seamless application, especially in high-traffic areas. These characteristics are contributing to its growth, particularly in the premium and mid-range residential design sectors.

Market Evaluation by End Use Outlook

The global market segmentation, based on end use, includes commercial and residential. The residential segment is expected to grow during the forecast period due to the rising trend of home renovation and personalization. Consumers are increasingly opting for wallpapers as a cost-effective and aesthetically appealing alternative to traditional wall paints. Additionally, the growing availability of innovative designs, textures, and eco-friendly options, such as PVC-free or lead-free wallpapers, is driving demand. The preference for creating unique interior themes and improved durability of modern wallpapers further fuels this growth.

The residential segment is expected to witness the fastest CAGR over the forecast period due to increased home renovation activities, rising disposable incomes, and growing consumer emphasis on personalized interior aesthetics. Dynamics are being influenced by the expanding urban middle class and millennial homebuyers seeking customizable, design-centric wall coverings that reflect lifestyle preferences. Homeowners are adopting wallpapers as a flexible alternative to traditional paint, capitalizing on options that offer easy removal, moisture resistance, and diverse design patterns. This shift in consumer behavior is contributing to its expansion, particularly in emerging countries experiencing rapid housing development and changing aesthetic sensibilities

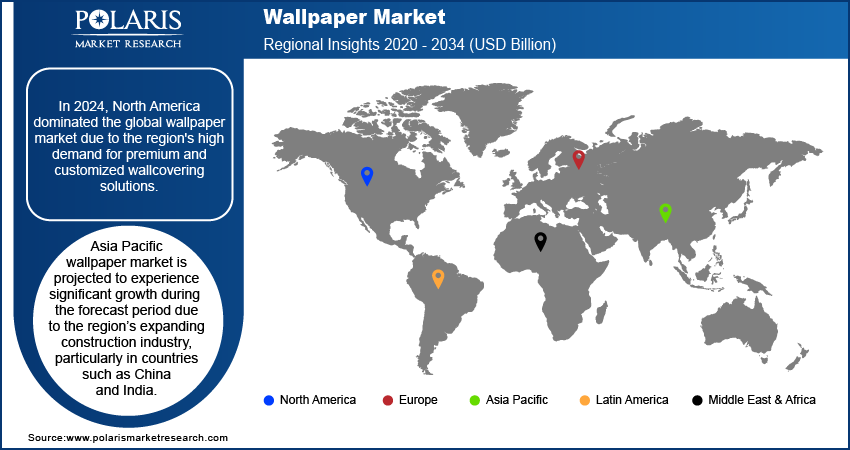

Market Regional Insights

By region, the study provides insights into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. In 2024, North America wallpaper market dominated due to the region's high demand for premium and customized wallcovering solutions. Factors such as strong consumer spending on home renovation and interior design, coupled with a preference for sustainable and innovative materials, contributed to this dominance. Additionally, advancements in digital printing technologies and the growing popularity of eco-friendly wallpapers further boosted its growth. The region's well-established construction industry and rising trends in luxury home decor also played a significant role in strengthening its global position.

The Asia Pacific wallpaper market is projected to experience significant growth during the forecast period. This is due to the region’s expanding construction industry, particularly in countries such as China and India, which is driving demand for decorative wall coverings in both residential and commercial spaces. Additionally, increasing urbanization, rising disposable incomes, and changing consumer preferences toward aesthetic and eco-friendly home decor are further fueling this growing trend of home renovation and interior design, especially in emerging countries, is also contributing to the increasing popularity of wallpaper as an affordable and customizable decor option. In May 2021, Sangetsu secured an exclusive licensing agreement with Sanderson Design Group Plc for Morris & Co. wallpapers in Taiwan, Singapore, Korea, and Japan.

The Europe wallpaper market is experiencing steady growth, driven by increasing demand for premium interior décor solutions and a growing trend toward customization in residential and commercial spaces. Consumer preference for eco-friendly, washable, and durable materials such as nonwoven and vinyl wallpapers is contributing to its expansion. Renovation activities across Western Europe and the revival of heritage-inspired designs are also influencing product innovation and aesthetic diversity. In addition, the hospitality and retail sectors are increasingly adopting wallpaper to create distinctive interior identities. Technological advancements in digital printing and sustainable raw materials continue to shape the competitive landscape across the European countries.

Key Players and Competitive Analysis Report

The competitive landscape of the global wallpaper industry is shaped by a mix of well-established international brands and regional players, each striving to capture significant share through innovation, product differentiation, and strategic partnerships. Leading global companies such as Sherwin-Williams, AS Creation, and Saint-Gobain leverage their strong distribution networks and R&D capabilities to offer a wide range of decorative wallcoverings, including eco-friendly and sustainable options. The market is increasingly focused on technological advancements, with trends such digital printing and the introduction of smart wallpapers gaining momentum. Additionally, the growing demand for innovative materials such as lead-free vinyl and recyclable textiles reflects consumer preferences for sustainable and customizable solutions. The global industry is projected to grow steadily, driven by the rising demand for home decor, urbanization, and renovation trends. Regional players, particularly in emerging regions such as Asia Pacific, are capitalizing on the demand for affordable and locally tailored designs. Strategic initiatives, including collaborations with designers, expanding product portfolios, and focusing on eco-friendly solutions, are propelling the growth of the market. These trends highlight the role of innovation, sustainability, and regional strategies in driving the expansion of the wallpaper industry.

A few major players are 4Walls, AS Creation Tapeten AG, Asian Paints, Brewster, Erismann & Cie. GmbH, F. Schumacher & Co., Graham & Brown, Grandeco, Gratex, Laura Ashley Holdings PLC, LEN-TEX Corporation, Lilycolor Co., Marburger Tapetenfabrik, Osborne & Little, Sangetsu Corp., ShinHan WallCovering, Tapetenfabrik Gebr. Rasch GmbH & Co. KG, The Romo Group, and York Wallcoverings.

A.S. Création Tapeten AG, established in 1974, is a top European wallpaper manufacturer based in Germany. The company specializes in high-quality wallpapers and decorative fabrics with a catalog of over 6,500 products. It has a presence in 100 countries and is known for its innovative designs and global reach. In March 2022, A.S. Création introduced the Hygge collection, featuring wallpapers adorned with pampas grass and reed grass patterns enhanced by gloss effects, showcasing a natural color palette.

Asian Paints, established in 1942, is a leading manufacturer of paints and coatings, offering innovative solutions for interior and exterior walls. Renowned for its extensive range of colors and textures, it also provides expert services in waterproofing, wood and metal paints, and interior design. On April 15, 2024, Asian Paints introduced Neo Bharat Latex Paint, expanding into a new category to meet rising urban demand. The affordable range offers over 1,000 shades, aiming to capture more share.

List of Key Companies

- 4Walls

- AS Creation Tapeten AG

- Asian Paints

- Brewster

- Erismann & Cie. GmbH

- F. Schumacher & Co.

- Graham & Brown

- Grandeco

- Gratex

- Sanderson Design Group

- Lilycolor Co.

- Marburger Tapetenfabrik

- Osborne & Little

- Sangetsu Corp.

- ShinHan WallCovering

- Tapetenfabrik Gebr. Rasch GmbH & Co. KG

- The Romo Group

- York Wallcoverings

Market Developments

May 2025: Roland DG Corporation showcased DIMENSE 3D printing technology at Kitchen & Bath China alongside Panasonic Housing Solutions, featuring its 2 mm texture capability.

February 2024: Asian Paints introduced the Sabyasachi Collection, featuring luxurious wall coverings in vintage hues and shimmering mica paper. This collaboration offers handcrafted artistry from the Sabyasachi Art Foundation, creating memorable interiors with exquisite designs.

April 2023: The Romo Group partnered with Alice Temperley, founder and creative director of Temperley London, to launch a new collection. The collection includes wallpapers, pillows, fabrics, and trimmings. It features 12 distinct wallpaper patterns showcasing a range of designs, from animal prints and exotic chinoiserie to lush botanicals.

May 2022: Sanderson Design Group PLC, a high-end interior design and furniture company, collaborated with the Emery Walker Trust on a new sponsorship arrangement. As part of this partnership, the Morris & Co. brand will showcase a range of fabrics, wallpapers, bedding, and homewares inspired by the artifacts at Emery Walker's House, a museum dedicated to the Arts and Crafts movement.

April 2021: SANDERSON DESIGN GROUP PLC launched its Live Beautiful sustainability strategy. The company committed to becoming net carbon zero by 2030 and aiming to be the top employer in the interior design and furnishings sector.

Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Vinyl-Based

- Nonwoven

- Paper

- Fabric

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Commercial

- Residential

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Wallpaper Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1.88 billion |

|

Market Size Value in 2025 |

USD 1.96 billion |

|

Revenue Forecast in 2034 |

USD 2.88 billion |

|

CAGR |

4.3 % from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global wallpaper market size was valued at USD 1.88 billion in 2024 and is projected to grow to USD 2.88 billion by 2034

The global market is projected to grow at a CAGR of 4.3 % during the forecast period 2025-2034.

North America held the largest share in the global market in 2024.

The key players in the market are 4Walls, AS Creation Tapeten AG, Asian Paints, Brewster, Erismann & Cie. GmbH, F. Schumacher & Co., Graham & Brown, Grandeco, Gratex, Laura Ashley Holdings PLC, LEN-TEX Corporation, Lilycolor Co., Marburger Tapetenfabrik, Osborne & Little, Sangetsu Corp., ShinHan WallCovering, Tapetenfabrik Gebr. Rasch GmbH & Co. KG, The Romo Group, and York Wallcoverings.

The vinyl-based category dominated the market in 2024.

The residential segment is anticipated to grow during the forecast period in the global market.