Wax Melts Market Share, Size, Trends, Industry Analysis Report

By Product (Paraffin, Soy Wax, Palm Wax, Beeswax), By Pack, By Application, By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Jul-2023

- Pages: 114

- Format: PDF

- Report ID: PM3644

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

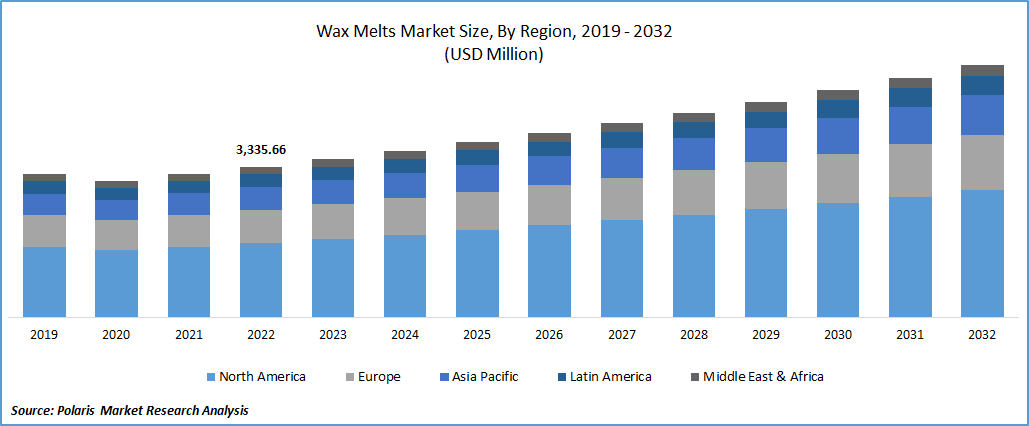

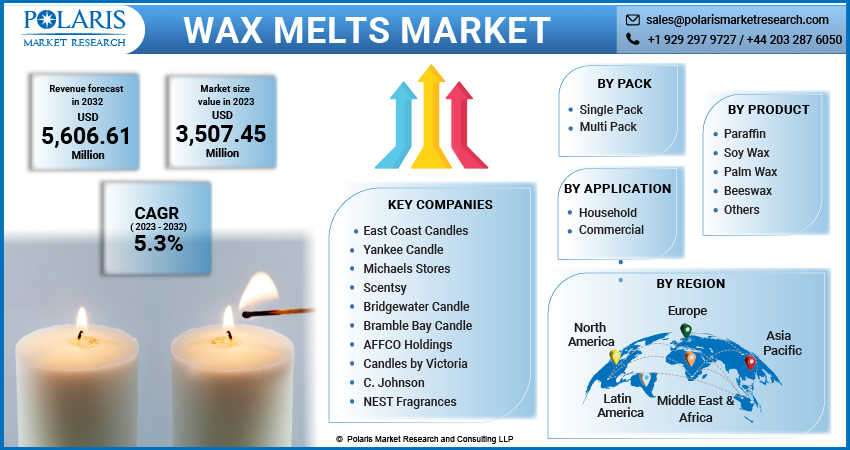

The global wax melts market was valued at USD 3,335.66 million in 2022 and is expected to grow at a CAGR of 5.3% during the forecast period.

Wax melts are becoming increasingly popular due to their non-flammable property, which safety-conscious consumers highly value. Unlike traditional candles, wax melts do not involve an open flame, making them a safer alternative and reducing the risk of accidental fires and associated hazards. This safety feature has positioned wax melts as a practical and viable option for creating a pleasant home ambiance, attracting consumers who prioritize safety in their purchasing decisions.

To Understand More About this Research: Request a Free Sample Report

Businesses can capitalize on this trend by promoting wax melts as a versatile, practical, and safe option for creating a desired home atmosphere. With a wide range of fragrances and designs available, wax melts offer consumers a variety of options to choose from. The practicality of wax melts, with their long-lasting fragrance and ease of use, make them an attractive option for consumers.

The COVID-19 pandemic has also significantly impacted the demand for home fragrance products, including wax melts. A January 2022 article by The Vogue revealed that 85% of people worldwide used home fragrances more frequently during the pandemic, leading to a surge in sales within the candles and wax melts industry. Furthermore, consumers are now seeking natural and eco-friendly options for wax melts free from harmful chemicals, aligning with sustainable practices and contributing to a healthier living environment.

For Specific Research Requirements, Request for a Customized Report

Growth Drivers

With more people at home, DIY projects and personalization have become more popular. Even in the wax melts market, customers are now looking for ways to create their wax melts or buy customizable options with their preferred scents and designs. This trend toward personalization allows individuals to have unique wax melts that match their preferences and tastes.

The U.S. Fire Administration reported 42 candle-related fires per day in 2022. This highlights the potential safety hazards of using traditional candles. The increase in fire accidents has made consumers more aware of the risks of using open-flame candles in homes and other settings. By promoting wax melts as a safer alternative, businesses can build trust and confidence among customers. Wax melts are non-flammable, which helps address concerns about fire hazards, making them a reliable and secure home fragrance solution. This approach can attract safety-conscious consumers and drive demand for these products.

Report Segmentation

The market is primarily segmented based on product, pack, application, and region.

|

By Product |

By Pack |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Paraffin wax segment accounted for the largest market share in 2022

The Paraffin wax segment accounted for the largest market share in 2022. This segment's popularity can be attributed to its affordability and wide availability, making it a preferred choice among consumers. It is commonly used in candle making due to its ability to hold a significant amount of the fragrance and its compatibility.

To meet the growing consumer demand, market players focus on incorporating innovative scents into paraffin wax melts that resonate with their target audience. In addition, companies are investing more in research and development activities to enhance their product offerings. For instance, in January 2022, Yankee Candle introduced a range of products, including single wax melts, medium square jars with three wicks, and big square jars with two wicks, as part of their Well Living Collection. Such initiatives aim to increase product visibility, attract consumers, and drive revenue growth for these companies.

The palm wax segment is anticipated to be the fastest-growing segment, with a healthy CAGR over the study period. Palm wax, derived from hydrogenated palm oil, is gaining popularity as an alternative to conventionally produced wax. This eco-friendly option offers similar burning qualities to paraffin wax but with reduced environmental toxicity. To ensure responsible sourcing and production, non-profit organizations like the Roundtable on Sustainable Palm Oil (RSPO) play a vital role in regulating and certifying palm oil from ethical farms. As of 2022, approximately 3.51 million hectares of production areas globally have received RSPO certification.

Palm wax melts highly regarded for their capacity to hold a substantial amount of fragrance oil, making them ideal for creating unique and captivating scents. The market is witnessing a growing demand for intricate fragrance blends encompassing floral, herbal, and fruity notes. This trend reflects consumers' desire for more complex and sophisticated aromas in their wax melt products.

Households segment accounted for the largest market share in 2022

The household segment accounted for the largest market share in 2022. Wax melts serve multiple purposes in a household setting, such as eliminating unpleasant odors, freshening rooms, creating a calming ambiance, and adding coziness. They are commonly used in living rooms, bedrooms, bathrooms, and kitchens, providing a welcoming and comfortable environment. By opting for wax melts, consumers can enjoy the benefits of fragrance without the open flame associated with traditional candles. This makes wax melts safer for household applications, providing a hassle-free and convenient way to introduce pleasant scents into daily living spaces. The dominance of wax melts for household applications in the market signifies their widespread appeal and recognition as a desirable home fragrance solution.

The commercial segment is expected to register a healthy growth rate. This growth can be attributed to the rising demand for multi-pack candles used in various commercial settings, particularly for aromatherapy purposes. There has been a notable increase in awareness regarding the benefits of aromatherapy, which involves using fragrances to enhance well-being and promote relaxation. Aromatherapy has gained popularity as a means of self-care, with individuals seeking therapeutic scents to create a soothing and rejuvenating environment.

North America region dominated the global market in 2022

The North America region dominated the global market with a considerable revenue share in 2022. This strong market presence can be attributed to the growing popularity of scented candles, particularly among millennials, in the United States. The millennial demographic places a significant emphasis on self-care and mental well-being, leading to a heightened interest in fragranced candles. Millennials are willing to invest in premium fragranced candles as part of their self-care routines. This demographic segment's focus on mental well-being has significantly impacted the U.S. wax melts market, driving its growth. Overall, the rising trend of self-care, the increased importance placed on mental well-being, and the COVID-19 pandemic have all played a role in the sales of home fragrance products, positively influencing the wax melts market in the United States.

Competitive Insight

Key players include East Coast Candles, Yankee Candle, Michaels Stores, Scentsy, Bridgewater Candle, Bramble Bay Candle, AFFCO Holdings, Candles by Victoria, C. Johnson, and NEST Fragrances.

Recent Developments

- In November 2021, LUMIRA introduced the Botanica fragrance as the latest addition to their Gardens collection. This fragrance draws inspiration from the Australian Botanic Garden located in Mount Annan. The Botanica Candle, part of the collection, offers customers the opportunity to experience the scent long-term.

Wax Melts Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 3,507.45 million |

|

Revenue forecast in 2032 |

USD 5,606.61 million |

|

CAGR |

5.3% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Product, By Pack, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

East Coast Candles, Yankee Candle, Michaels Stores, Scentsy, Bridgewater Candle, Bramble Bay Candle, AFFCO Holdings, Candles by Victoria, C. Johnson, and NEST Fragrances |

FAQ's

The wax melts market report covering key segments are product, pack, application, and region.

Wax Melts Market Size Worth $5,606.61 Million By 2032.

The global wax melts market is expected to grow at a CAGR of 5.3% during the forecast period.

North America is leading the global market.

key driving factors in wax melts market are increasing DIY projects and personalization.