Wood Protein Market Share, Size, Trends, Industry Analysis Report

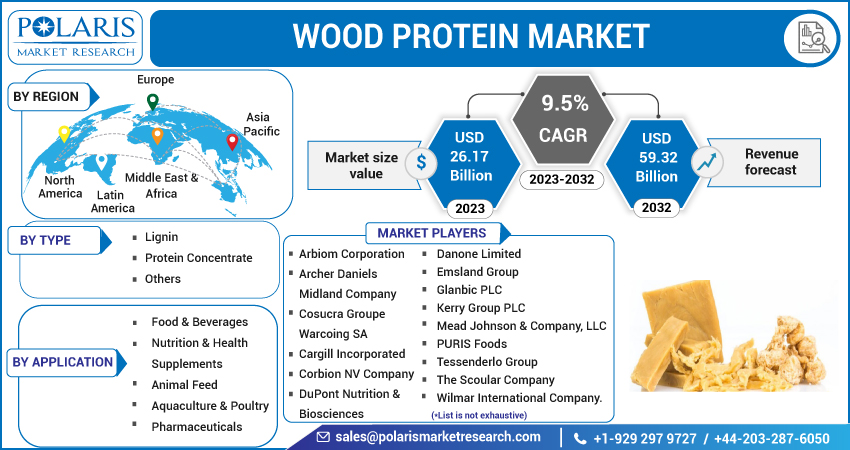

By Type; By Application (Food & Beverages, Nutrition & Health, Supplements, Animal Feed, Aquaculture & Poultry, Pharmaceuticals, Others); By Region; Segment Forecast, 2023 - 2032

- Published Date:Jun-2023

- Pages: 114

- Format: PDF

- Report ID: PM3397

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

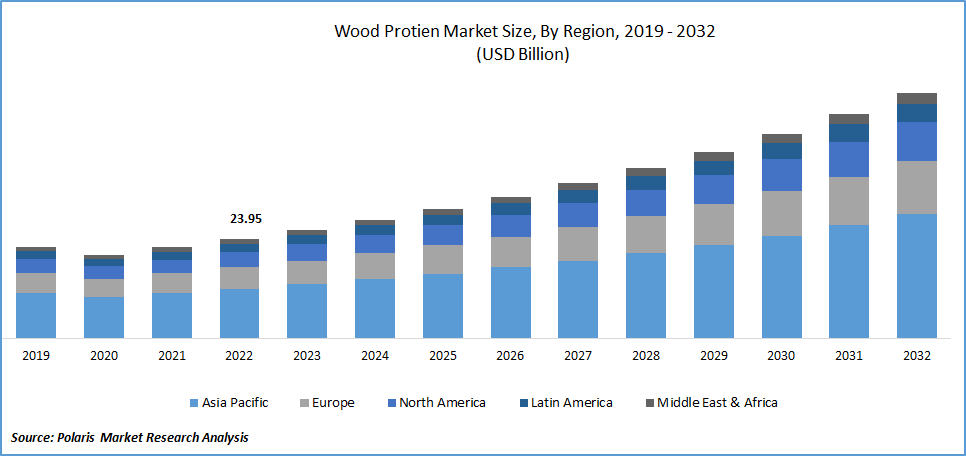

The global wood protein market was valued at USD 23.95 billion in 2022 and is expected to grow at a CAGR of 9.5% during the forecast period. Biopolymers are used to create the complicated chemical elements that makeup wood. Polysaccharides like cellulose, hemicellulose, and polyphenolic fractions including lignin constitute the majority of its components. Organic and inorganic substances such as extractives and ashes are secondary ingredients, and they have an impact on their color, odor, and strength. These substances have useful qualities that food and feed manufacturers want for their products.

To Understand More About this Research: Request a Free Sample Report

Research into wood-derived protein as a reliable feed element with considerable advantages is developing. The goal is to manufacture high-quality wood-derived proteins in commercially successful quantities for food solutions that can assist suppliers in meeting rising feed demand as development moves forward. Human wood-derived protein could give manufacturers alternative plant-based protein choices at a time when customers are increasingly looking for more environmentally friendly solutions.

In light of a variety of factors, including rising demand for meat alternatives as a result of health and environmental concerns, product innovation in the food industry, increased availability of plant-based foods, and growing consumer awareness of their benefits, the wood protein market is becoming more and more significant. Also, the industry is expanding as a result of the rising numbers of vegetarians and vegans as well as the movement towards flexitarianism. Compared to animal-based proteins, wood proteins are thought to be more environmentally friendly and sustainable, and as a result, they are crucial in tackling issues like food security and climate change.

Additionally, consumption patterns among millennials are changing significantly from those of previous generations, as seen by the rising tendency them embracing flexitarian and meat-free diets. Across the food value chain, companies from farmers to merchants have already started to invest in these opportunities. In February 2022, the Pharmaceutical Pension Fund of Finland invested €10 million in Finnish food technology startup Solar Foods to develop, among other things, a commercial production plant for the firm's patented "thin air" Solein protein. Some firms prepare for or protect themselves against the decreased demand for animal products by investing in companies that provide alternatives. During the past several years, several well-known people, businesses, and investors have invested in or funded market participants.

The COVID-19 pandemic caused a supply chain. Fewer raw materials and finished goods were available as a result, which had an impact on this market's overall revenue and its below-average growth in 2020. The wood protein sector saw substantial growth as a result of the COVID-19 outbreak. Because of the pandemic, more people are aware of zoonotic viral illnesses, which may also be spread through cattle. A diet rich in alternative proteins can help minimize the effects of viral infections since it contains a richness of macronutrients, micronutrients, and antioxidants.

This industry has had to deal with previously unheard-of amounts of demand from both manufacturers and consumers, particularly for retail products like meat substitutes and plant-based milk. A few best practice approaches for the alternative protein sector were also inspired by the COVID-19 pandemic. For instance, the FDA loosened its restrictions on the sale of meat substitutes. In particular for plant-based protein products and insect protein, governments declared a relaxation of certain of the competition law criteria imposed on alternative proteins.

For Specific Research Requirements, Request for a Sample Report

Industry Dynamics

Growth Drivers

Many customers have shifted to plant proteins over the past several years because they are seen as healthier and more environmentally friendly alternatives to meat products. Plants are the main source of wood proteins because of their low environmental effect and substantial health advantages. Insect, lab-grown meat, and algal proteins are some further alternatives to animal proteins, but the need for plant-based proteins is what drives up the market for all proteins. This aspect is anticipated to accelerate market expansion due to the availability of plants and cutting-edge technologies that have a little negative impact on the environment.

Additionally, even during the past several years, nutritional supplements and other health supplements have been increasingly popular across the world. Millennials are the primary consumers of functional proteins, which are employed in activities such as body toning, competitive sports, and muscle-building.

Also, customers select numerous nutritious functional supplements as meal replacements in the treatment of diabetes, chronic diseases, and underweight disorders. Moreover, nutritional supplements for cancer patients are frequently employed to strengthen the body's natural defenses against the disease. With the variety of uses for functional proteins, their market share in the worldwide market will rise in the years to come.

Report Segmentation

The market is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The food & beverages segment is expected to witness the fastest growth

Rising consumer awareness, and rising demand of the protein-rich foods are primarily responsible for its high growth. People from all stages of life now make up the protein consumer group as it becomes more widely consumed. The health advantages of protein and drinks with functional proteins are especially appealing to those in their middle years and older. Individuals' bodies use protein less effectively as they become older to maintain healthy muscle. As a consequence, individuals are adding enough protein to their meals regularly.

Also, functional proteins are used in a variety of applications in functional food and beverage products, including baked goods, bars, snacks, bakery, drinks, meat-free options, culinary products, emulsified and restructured products, pet food, breakfast cereals, patties & sausages, general protein fortification, poultry, dairy alternatives, frozen desserts, infant foods, meats, sauces, protein bars, seafood, beverages, savory snacks, loose minced meat, ice cream, and others. Functional foods are widely employed in the food and beverage industry because of their many uses, which include enhancing food texture and enhancing flavor and taste.

The animal feed sector is expected to hold the significant revenue share

Animal nutrition segment had the highest revenue share. Wood protein is generally used as an animal feed supplement for chicken, fish, and other species. Demand from producers of the animal feed for its high digestibility & protein ranging from 40-70% is ever rising. Animal nutrition firms will be successful in sectors including aquaculture and pet food.

The preferences of consumers for items made from meat and poultry are continually changing, posing new problems for industrial animal farms. Numerous farm owners express worry about the kind and caliber of feed provided to the livestock. The need for alternate protein sources, such as processed animal protein, is expanding quickly as soybean meal costs rise. To combat this, manufacturers are implementing new equipment and technologies to boost output effectiveness and handle current production issues.

North America is expected to witness significant growth

North America anticipated to the highest growth of the market in the region. Due to rising consumer knowledge about the consumption of insect-based goods and the need for nutrient-dense food items, the market is anticipated to have the highest growth by the year 2030. The significant development opportunity for new players and product launches in Mexico and Canada is expected to raise the need for insect protein during the projected period.

Furthermore, due to the expanding customer bases in developing nations like China, and Thailand, the Asia Pacific area is anticipated to develop at a revenue-based high CAGR for the perojected year. In addition, nations like Thailand and Indonesia are among the major producers of insects used as raw materials and have a long history of protein-eating.

Wood protein is mostly used in the European nations for use in the animal nutrition, & personal care industries. Moreover, recent approvals of the insect protein for use in the animal feed, especially for the pigs & poultry. Throughout the projected period, the market is anticipated to be driven by the high demand for wood protein from the developed nations.

Competitive Insight

Some of the major players operating in the global market include Arbiom Corporation, Archer Daniels, Cosucra Groupe, Cargill Incorporated, Corbion NV, DuPont Nutrition, Danone Limited, Emsland, Glanbic, Kerry Group, Mead Johnson, PURIS Foods. Tessenderlo, The Scoular Company, and Wilmar International.

Recent Developments

- In April 2022, Cargil (US) announced the introduction of its Radipure pea protein product lines to the Middle East, Turkey, Africa, and Indian markets to fulfill the growing demand for pea protein as an alternative source of protein in these countries.

Wood Protein Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 26.17 billion |

|

Revenue forecast in 2032 |

USD 59.32 billion |

|

CAGR |

9.5% from 2023-2032 |

|

Base year |

2022 |

|

Historical data |

2019- 2021 |

|

Forecast period |

2023- 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Arbiom Corporation, Archer Daniels Midland Company, Cosucra Groupe Warcoing SA, Cargill Incorporated, Corbion NV Company, DuPont Nutrition & Biosciences, Danone Limited, Emsland Group, Glanbic PLC, Kerry Group PLC, Mead Johnson & Company, LLC, PURIS Foods. Tessenderlo Group, The Scoular Company, and Wilmar International Company. |

FAQ's

The global wood protein market size is expected to reach usd 59.32 billion by 2032.

Top market players in the Wood Protien Market Arbiom Corporation, Archer Daniels, Cosucra Groupe, Cargill Incorporated, Corbion NV, DuPont Nutrition.

North America contribute notably towards the global Wood Protien Market.

The global wood protein market expected to grow at a CAGR of 9.5% during the forecast period.

The Wood Protien Marke report covering key segments are type, application, and region.