Wound Gel Market Size, Share, Trends, & Industry Analysis Report

By Gel Type (Amorphous Hydrogel, Impregnated Gauze, Hydrogel Sheets, and Others), By Wound Type, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5779

- Base Year: 2024

- Historical Data: 2020-2023

Overview

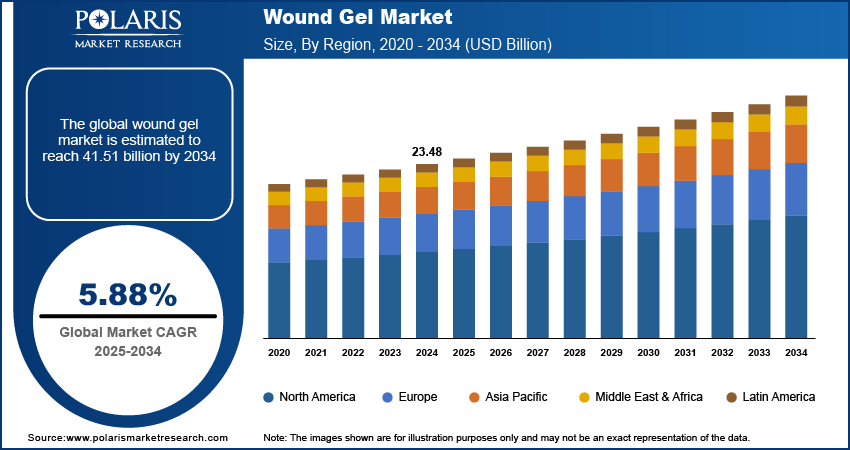

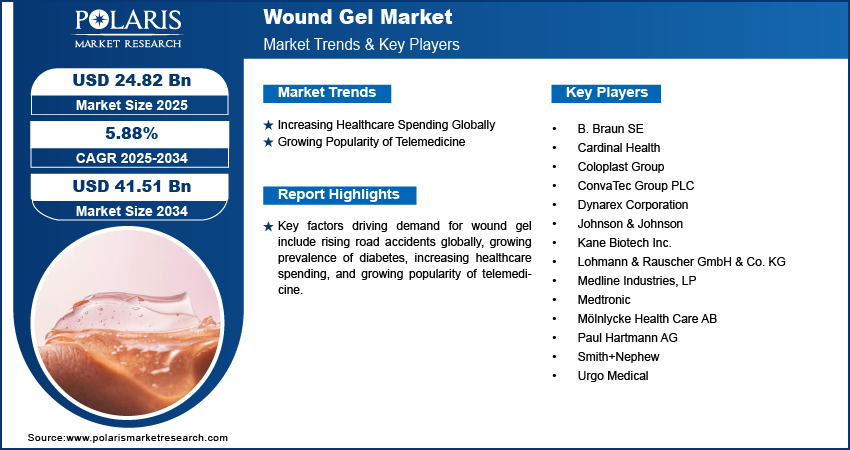

The global wound gel market size was valued at USD 23.48 billion in 2024, growing at a CAGR of 5.88% during 2025–2034. Key factors driving demand for wound gel include rising road accidents globally, growing prevalence of diabetes, increasing healthcare spending, and increasing popularity of telemedicine.

Wound gel refers to a type of advanced wound care product designed to create and maintain a moist environment that supports natural healing processes. Healthcare professionals apply this gel directly to various types of wounds, including surgical incisions, diabetic foot ulcers, pressure sores, venous leg ulcers, and burns. The primary function of the gel lies in its ability to hydrate dry or necrotic tissue, promote autolytic debridement, and protect the wound from external contaminants. Manufacturers formulate these gels using water-based or polymer-based ingredients that provide optimal moisture balance while allowing oxygen to reach the wound bed. Some variants also include antimicrobial agents such as silver or iodine to prevent bacterial infections and accelerate tissue regeneration. Clinicians choose wound gels based on wound type, exudate level, and healing stage, ensuring that each application addresses specific clinical needs.

The rising road accidents globally is driving the market growth. According to Department of Transportation, in 2022, 42,514 lives were lost on US roads, an increase of over 10% compared to 2020. Road accident victims usually sustain complex and irregularly shaped wounds, driving medical staff to adopt wound gels such as hydrogels for their ability to fill irregular shaped wounds without causing additional trauma. Additionally, in emergency care units, doctors use these gels to treat individuals affected by road accident injuries by creating a moist healing environment that fuels tissue regeneration and reduces the need for more invasive procedures. Therefore, as incidences of road traffic increase across both developed and developing countries, the need for wound gel also rises.

The wound gel demand is driven by the growing prevalence of diabetes worldwide. Diabetes impairs blood circulation and damages nerves, which slows the natural healing process and increases the risk of ulcers in even minor wounds. Healthcare providers turn to wound gels to manage these ulcers effectively as wound gels maintain a moist environment, promote autolytic debridement, and support tissue regeneration. The International Diabetes Federation estimated that 1 in 8 adults globally will have diabetes by 2050. Hence, as diabetes cases rise, healthcare providers increasingly recommend wound gels to prevent complications such as amputations, driving market growth.

Industry Dynamics

Increasing Healthcare Spending Globally

Governments and private healthcare providers worldwide are allocating more funds toward improving patient outcomes, leading to greater adoption of specialized treatments for acute and chronic wounds. Hospitals, clinics, and home care providers are also investing in wound gels due to their ability to offer superior healing benefits compared to traditional dressings. Additionally, increasing spending is raising awareness about advanced wound care options in rural areas, encouraging both healthcare providers and patients to choose wound gels over traditional dressings. Therefore, the increasing healthcare spending globally is fueling the demand for wound gels.

Growing Popularity of Telemedicine

The increasing popularity of telemedicine is driving healthcare providers to recommend easy-to-use, effective treatment options that do not require constant clinical supervision. Wound gels fit this model perfectly as they offer simple application, promote moist healing, and reduce the frequency of dressing changes. Telemedicine platforms also educate patients on proper wound care techniques, raising awareness about the benefits of hydrogel-based products in maintaining moisture and promoting healing, leading to their high adoption. Moreover, telemedicine is expanding the reach of health services in rural and underserved areas. Hence, as the penetration of telemedicine increases, the demand for wound gel also rises.

Segmental Insights

By Gel Type Analysis

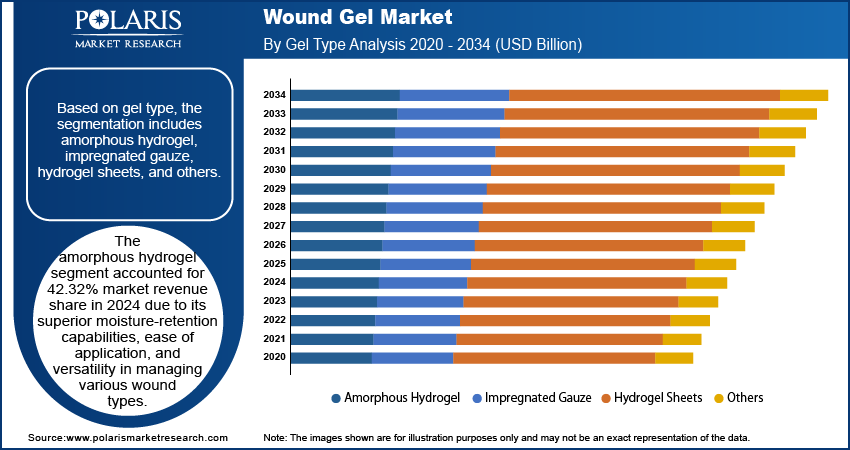

Based on gel type, the segmentation includes amorphous hydrogel, impregnated gauze, hydrogel sheets, and others. The amorphous hydrogel segment accounted for 42.32% market revenue share in 2024 due to its superior moisture-retention capabilities, ease of application, and versatility in managing various wound types. Clinicians widely preferred amorphous formulations for treating dry or necrotic wounds, pressure ulcers, diabetic foot ulcers, and post-operative wounds as they create an ideal moist wound environment that promotes autolytic debridement and accelerates healing. Hospitals and wound care centers favored these gels for their ability to fill irregular wound shapes and minimize trauma during dressing changes. Furthermore, the increasing prevalence of chronic wounds driven by rising rates of diabetes, obesity, and aging populations across major regions such as North America and Europe contributed to the dominance of the segment. For instance, World Health Organization in its report stated that in 2022, 2.5 billion adults aged 18 years and older in the US were overweight.

The hydrogel sheet segment is projected to grow at a robust pace during the forecast period, owing to its ability to offer advanced features such as cooling effects, longer wear time, and ease of handling, which make it highly suitable for burns, radiation dermatitis, and surgical wounds. The structured form of the hydrogel sheet provides better protection and consistent moisture levels, reducing the need for frequent dressing changes and lowering the risk of infection. Additionally, ongoing innovations in polymer-based hydrogel sheets, coupled with growing demand for advanced wound care solutions in both acute and outpatient settings, are further projected to fuel the adoption of hydrogel sheets across global healthcare systems in the coming years.

By Wound Type Analysis

In terms of wound type, the segmentation includes surgical wound, diabetic ulcers, pressure ulcers, venous ulcers, burns, and others. The diabetic ulcers segment held the largest revenue share in 2024 due to the rising prevalence of diabetes across the world and the high recurrence rate of diabetic foot ulcers. Patients having uncontrolled blood sugar levels often experience delayed wound healing and a higher risk of infections, which necessitates the use of advanced wound care products. Healthcare providers across hospitals, clinics, and home care settings increasingly rely on hydrating gels to manage these chronic wounds, as they maintain an optimal moist environment, promote granulation, and support autolytic debridement. The aging population, combined with unhealthy dietary patterns, has contributed to the growing diabetic and diabetic ulcer population, particularly in countries such as the US, China, and India, leading to high adoption of wound gel.

By End Use Analysis

Based on end use, the segmentation includes hospitals, clinics, ambulatory centers, home healthcare, and others. The home healthcare segment is projected to hold 24.53% revenue share in 2034 due to rising demand for convenient, cost-effective, and patient-centered wound management. Aging populations, particularly in North America, Europe, and parts of Asia, are driving the need for in-home chronic wound care, especially for diabetic ulcers, pressure sores, and post-operative wounds. Patients prefer easy-to-use and less invasive dressing options that require minimal clinical supervision, making gel-based treatments ideal for home settings. Moreover, the expansion of telemedicine services, remote monitoring tools, and supportive reimbursement frameworks for home healthcare services is projected to enhance the adoption of wound care products in home healthcare settings.

Regional Analysis

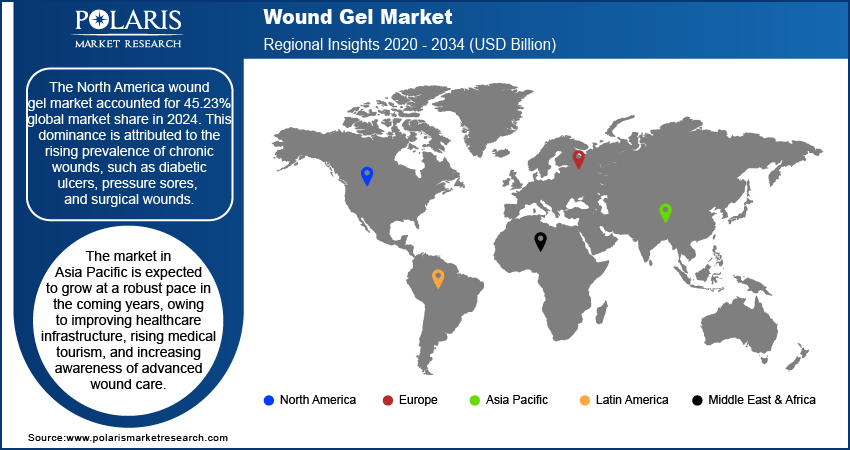

The North America wound gel market accounted for 45.23% global revenue share in 2024. This dominance is attributed to the rising prevalence of chronic wounds, such as diabetic ulcers, pressure sores, and surgical wounds, due to an aging population and increasing diabetes cases. Advanced healthcare infrastructure and high awareness about advanced wound care products further boosted the adoption of wound gel. Additionally, the presence of key players and continuous innovations in hydrogel-based wound dressings contributed to the market growth. Favorable reimbursement policies and a strong focus on infection prevention also propelled demand for wound gel in the region.

US Wound Gel Market Insight

The market in the US held 54.35% of the share in North America in 2024. This dominance is attributed to the high incidence of chronic diseases, including diabetes and obesity. The growing preference for minimally invasive surgery and advanced wound care solutions, such as hydrogels, supported market growth in the country. Government initiatives promoting wound care research and the presence of major pharmaceutical and medical device companies fueled product development. Additionally, increasing surgical procedures and a focus on reducing hospital-acquired infections (HAIs) in the US drove demand for effective wound management solutions such as wound gel.

Asia Pacific Wound Gel Market

The market in Asia Pacific is expected to grow at a robust pace in the coming years, owing to improving healthcare infrastructure, rising medical tourism, and increasing awareness of advanced wound care. Countries such as China, Japan, and Australia are witnessing higher adoption due to aging populations and a surge in chronic wounds. Economic development and increasing healthcare expenditure in the region are further supporting market expansion.

India Wound Gel Market Overview

The wound gel market in India is growing due to the rising prevalence of diabetes-related wounds, burns, and traumatic injuries. Increasing healthcare spending, government initiatives to improve wound care access, and the expansion of private healthcare facilities are further contributing to the market expansion. For instance, according to the Ministry of Finance of India, the total health expenditure of the country between FY15 and FY22 increased from 29.0% to 48.0%. Moreover, the growing middle class and rising awareness of advanced wound care products are propelling the market growth.

Europe Wound Gel Market

In Europe, demand for wound gels is driven by an aging population, high rates of chronic wounds, and strong government support for advanced wound care solutions. Countries such as Germany, the UK, and France are leading the market due to established healthcare systems and high adoption of innovative medical technologies. Strict regulations ensuring product efficacy and safety are further boosting consumer confidence, leading to high demand. Additionally, increasing surgical procedures and a focus on home healthcare for wound management are contributing to sustained market growth in the region.

Key Players & Competitive Analysis Report

The wound gel industry is highly competitive, with key players such as Smith+Nephew, ConvaTec Group PLC, Mölnlycke Health Care AB, and Coloplast Group dominating the industry through innovation, extensive product portfolios, and strong distribution networks. These companies focus on advanced wound care solutions, including hydrogels, antimicrobial gels, and collagen-based formulations, catering to chronic wounds, burns, and surgical injuries. Emerging players such as Urgo Medical and Paul Hartmann AG are gaining share with specialized offerings such as UrgoStart and HydroTac, focusing on diabetic ulcers. Medline Industries and Cardinal Health compete through cost-effective solutions, serving large healthcare systems and outpatient clinics. Meanwhile, Johnson & Johnson and Medtronic leverage their surgical expertise to integrate wound gels into post-operative care.

A few major companies operating in the wound gel market include B. Braun SE; Cardinal Health; Coloplast Group; ConvaTec Group PLC; Dynarex Corporation; Johnson & Johnson; Kane Biotech Inc.; Lohmann & Rauscher GmbH & Co. KG; Medline Industries, LP; Medtronic; Mölnlycke Health Care AB; Paul Hartmann AG; Smith+Nephew; and Urgo Medical.

Key Players

- B. Braun SE

- Cardinal Health

- Coloplast Group

- ConvaTec Group PLC

- Dynarex Corporation

- Johnson & Johnson

- Kane Biotech Inc.

- Lohmann & Rauscher GmbH & Co. KG

- Medline Industries, LP

- Medtronic

- Mölnlycke Health Care AB

- Paul Hartmann AG

- Smith+Nephew

- Urgo Medical

Industry Developments

November 2023: Kane Biotech Inc., in partnership with ProgenaCare Global LLP, announced the launch of Revive, an antimicrobial wound gel.

May 2023: Kane Biotech Inc. announced that it had received 510(k) clearance for its coactiv+ antimicrobial wound gel from the US Food and Drug Administration (FDA) for the management of ulcers.

Wound Gel Market Segmentation

By Gel Type Outlook (Revenue, USD Billion, 2020–2034)

- Amorphous Hydrogel

- Impregnated Gauze

- Hydrogel Sheets

- Others

By Wound Type Outlook (Revenue, USD Billion, 2020–2034)

- Surgical Wound

- Diabetic Ulcers

- Pressure Ulcers

- Venous Ulcers

- Burns

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Clinics

- Ambulatory Centers

- Home Healthcare

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Wound Gel Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 23.48 Billion |

|

Market Size in 2025 |

USD 24.82 Billion |

|

Revenue Forecast by 2034 |

USD 41.51 Billion |

|

CAGR |

5.88% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 23.48 billion in 2024 and is projected to grow to USD 41.51 billion by 2034.

The global market is projected to register a CAGR of 5.88% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are B. Braun SE; Cardinal Health; Coloplast Group; ConvaTec Group PLC; Dynarex Corporation; Johnson & Johnson; Kane Biotech Inc.; Lohmann & Rauscher GmbH & Co. KG; Medline Industries, LP; Medtronic; Mölnlycke Health Care AB; Paul Hartmann AG; Smith+Nephew; and Urgo Medical.

The amorphous hydrogel segment dominated the market share in 2024.

The home healthcare segment is expected to witness the fastest growth during the forecast period.