WTTx Market Share, Size, Trends, Industry Analysis Report

By Component; By Operating Frequencies; By Organization Size (SMEs, Large Enterprises); By Region; Segment Forecast, 2022 -2030

- Published Date:Oct-2022

- Pages: 115

- Format: PDF

- Report ID: PM2712

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

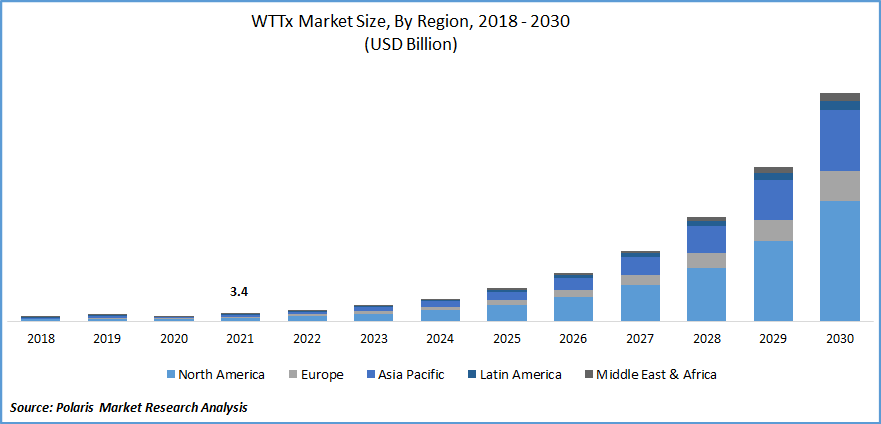

The WTTx market was valued at USD 3.4 billion in 2021 and is expected to grow at a CAGR of 46.2% during the forecast period. The growing demand for wireless broadband WTTx is due to its beneficial properties, such as easy maintenance, cost-effectiveness, fast deployment, and rich services.

Know more about this report: Request for sample pages

The demand for WTTx or fixed wireless access is driven by the decrease in connectivity gaps and increased utilization of data service. Furthermore, Internet service providers (ISPs) have come up with many opportunities as many are increasingly taking fixed broadband subscriptions.

Increasing government spending and initiatives to establish smart cities is expected to spur the market’s growth. As more governments are funding broadband and regulators perceive wireless as a viable alternative to landline connections in urban areas, more operators are adopting FWA, especially the upgraded 5G version, for providing broadband internet services.

Rising consumer adoption of home broadband which consists of fiber, existing cables, or DSL, is given access to the particular device due to price consciousness. So, a surge in less expensive routers and 5G mobile cross-selling is supposed to benefit WTTx.

Furthermore, WTTx is supposed to accelerate due to the lack of fixed-line infrastructure when the 5g spectrum expands into lower-income countries such as Thailand and parts of Africa.

The Covid-19 pandemic negatively impacted the WTTx market due to the partial closure of many enterprises during lockdowns. The production of the components was halted, which delayed the installations in numerous commercial sectors.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Applications requiring broadband access have been in high demand, and this trend seems to continue. Home networking has become more important than before due to the Covid-19 pandemic. Also, the demand for it continued due to work-from-home tendency even after the pandemic, which resulted in the implementation of internet fibers. These affirmatory factors are expected to propel the WTTx market.

Moreover, WTTx can be used to discover potential broadband and constantly adopt GSM and UMTS network resources, lowering investment risks for operators and ultimately driving the demand for WTTx.

Technological improvements and rising competitors influenced the WTTx market. ISPs have more options and efficiency due to new and developing standards-based technologies in network and antenna hardware, customer premises equipment (CPE), and wireless telecoms software and services. Technology vendors are increasing rapidly, stimulating competition, innovation, and reduced costs.

Report Segmentation

The market is primarily segmented based on component, operating frequencies, organization size, and region.

|

By Component |

By Operating Frequencies |

By Organization Size |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Hardware is expected to account for the largest market share in 2021

The hardware component is anticipated to witness considerable growth during the forecast period. It is further categorized as access units, CPE, and others. The customer premises equipment (CPE) is expected as the fastest growing sub-segment as this device can repeat mobile signals such as 4G and Wi-Fi signals.

Customer Premise Equipment (CPE) is networking equipment kept at the user terminal and used to deploy wireless broadband. CPE devices convert wireless signals like 3G, 4G, and 5G, and wired broadband transmissions into LAN signals that terminal devices can use. CPE is a combination of a wireless access point and a router. It enables multiple devices to connect to the internet simultaneously by converting 4G/5G signals to Wi-Fi signals and supplying them to networking hardware.

24 GHz & above frequency acquires the largest market share in 2021

24 GHz & above operational frequency accounts for the largest market revenue in 2021. Speeds of more than 1 Gbps are possible with millimeter wave (mmWave) 5Gallh, which works in a band above 24 GHz and has access to enormous volumes of data. This is the spectrum that mobile operators now use for their 5G networks, including Verizon for its service, and T-Mobile and AT&T.

mmWave’s extraordinary speed and capacity enable it to demonstrate the advantages of 5G very quickly. When combined with Massive MIMO, the high bands, which are TDD-based, offer a large capacity.

Large Enterprises accounted the largest market share in 2021

Large enterprises acquired the largest market revenue in 2021 as large enterprises are more likely to adopt the wireless broadband solution than small enterprises. To provide WTTx solutions to their customers, most mobile network operators are deploying to the 28 GHz spectrum for 5G. The US and South Korea have given their approval for its use.

The spectrum has become a suggested band for the initial deployments of 5G-based WTTx networks. To provide customers with a better experience, technologies like AR/VR are used in homes and various sectors, including healthcare, education, retail, automotive, and location-based (LBVR). Consequently, these enterprises are widely implementing WTTx solutions.

North America dominated the regional market

Top IT, telecom, and wireless solution providers have their corporate headquarters in North American countries. The rise in corporate investments in wireless technology and the company's initiatives to provide dependable, affordable solutions in the US and Canada are projected to drive demand for WTTx solutions.

This region invests more in technological advancements and developments than other regions. The WTTx ecosystem includes a number of vendors, including Qualcomm and UScellular, which collaborate with the leading market players in this area. The demand for WTTx solutions in this area has increased due to the growing demand for high-speed internet and the expansion of network connectivity in both urban and rural areas of the country.

Competitive Insight

Some of the major players operating in the global market include Airspan, Anritsu, AVSystem, BLiNQ Networks, Cohere Technologies, CommScope, Digi International, EDX, Eltel Group, Ericsson, Fibocom, Gemtek, Huawei, Inseego, Jaton Technology Ltd, Kelly, Keysight Technologies, Lumine, Nokia, Qualcomm, Remcom, Samsung, Tarana Wireless, Technicolor, Telrad Networks.

Recent developments

In May 2022, Qualcomm collaborated with Viettel to develop a next generation 5G radio unit with massive Distribution Units and MIMO capabilities.

In October 2021, Ericsson collaborated with Nex-Tech Wireless to support the deployment of wireless 5G capabilities in Kanas. In this Ericsson spectrum sharing will be used by Nex-Tech Wireless in conjunction with Ericsson radio system products and solutions.

WTTx Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 4.88 billion |

|

Revenue forecast in 2030 |

USD 101.88 billion |

|

CAGR |

46.2 % from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Operating Frequencies, By Organization Size, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Airspan, Anritsu, AVSystem, BLiNQ Networks, Cohere Technologies, CommScope, Digi International, EDX, Eltel Group, Ericsson, Fibocom, Gemtek, Huawei, Inseego, Jaton Technology Ltd, Kelly, Keysight Technologies, Lumine, Nokia, Qualcomm, Remcom, Samsung, Tarana Wireless, Technicolor, Telrad Networks. |