Connected Worker Market Size, Share, Trends, Industry Analysis Report

By Component (Hardware, Software, Services), By Technology, By Deployment, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM1554

- Base Year: 2024

- Historical Data: 2020-2023

Overview

The global connected worker market size was valued at USD 7.79 billion in 2024, growing at a CAGR of 22.3% from 2025 to 2034. Connected worker demand grows as manufacturers prioritize efficiency and cost reduction, while enhancing safety via real-time monitoring. 5G and IoT adoption enable seamless data integration, accelerating smarter, safer industrial workflows.

Key Insights

- The hardware segment accounted for USD 2.85 billion in revenue in 2024.

- The on-premise segment is expected to register a CAGR of 21.1% during the forecast period.

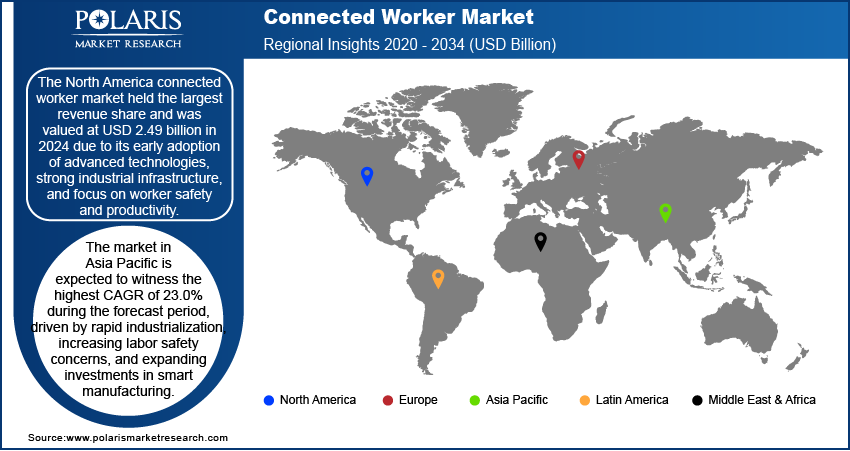

- The North America connected worker market held the largest revenue share and was valued at USD 2.49 billion in 2024.

- The U.S. held significant revenue share in North America in 2024, due to its advanced industrial base and strong focus on digital transformation across various sectors, such as manufacturing, construction, and energy.

- The market in Asia Pacific is expected to record the highest CAGR of 23.0% during the forecast period.

Industry Dynamics

- The advent of 5G technology and the growing adoption of private networks enable faster, more reliable, and low-latency communication across industrial environments.

- The increasing adoption of IoT platforms enables connected worker ecosystems to integrate wearables and sensors for real-time data, predictive maintenance, and task optimization, enhancing productivity and bridging human-automation gaps.

- The cost associated with establishing connected worker infrastructure is extremely high, which is expected to pose a major challenge for the adoption of connected worker technology.

- Concerns about data breaches and unauthorized access in connected worker systems delay investment, as they require strong cybersecurity measures to protect sensitive operational and employee data.

Market Statistics

- 2024 Market Size: USD 7.79 billion

- 2034 Projected Market Size: USD 58.00 billion

- CAGR (2025-2034): 22.3%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

A connected worker refers to an employee equipped with digital tools and technologies, such as wearable devices, mobile applications, and real-time data systems, that enable seamless interaction with machines, processes, and teams across industrial environments. This concept is gaining traction as manufacturing companies increasingly prioritize high production efficiency and operational cost reduction. Through connected worker solutions, manufacturers monitor workflows in real-time, optimize resource allocation, and proactively identify inefficiencies across their production lines. For instance, in February 2025, Pegasystems introduced the Pega Customer Engagement Blueprint, a generative AI-powered tool designed to help teams create precise and scalable customer engagement programs, enhancing collaboration and efficiency across marketing, customer experience, and AI initiatives. This example highlights how AI innovations are transforming customer engagement strategies. The integration of IoT, AI, and analytics enables organizations to streamline operations, minimize downtime, and facilitate more informed decision-making at every level of the production chain.

The potential of connected workers for enhancing workplace safety boosts growth opportunities. In high-risk industrial environments, connected technologies provide real-time location tracking, environmental monitoring, and predictive alerts to mitigate accidents and ensure worker well-being. Wearable sensors and smart devices help detect hazardous conditions and trigger automated responses, enabling faster incident response and reducing the incidence of injuries. A March 2025 report by the Singapore Ministry of Manpower revealed a rise in workplace fatal injuries, increasing from 3.4 per 100,000 workers in 2023 to 3.7 per 100,000 workers in 2024. These technologies safeguard the workforce and enhance compliance with regulatory standards, making connected worker platforms a vital investment in modern industrial operations.

Drivers & Opportunities

Advent of 5G and increasing adoption of private networks: The advent of 5G technology and the growing adoption of private 5G networks are driving significant growth opportunities. According to a June 2025 5G Americas report, global network deployments, with 706 LTE networks and 366 5G networks, reflect worldwide network operations, highlighting the ongoing expansion of wireless connectivity infrastructure. These advancements enable faster, more reliable, and low-latency communication across industrial environments, which is critical for real-time data exchange between workers, machines, and enterprise systems. Private 5G networks provide dedicated bandwidth and enhanced security, making them ideal for mission-critical operations in sectors such as manufacturing, oil and gas, and mining. This seamless connectivity enhances remote collaboration, supports augmented reality (AR)-based training and maintenance, and ensures continuous monitoring of worker health and safety, ultimately fostering more agile and efficient operations.

Increasing adoption of IoT platforms: The increasing adoption of IoT platforms is another vital enabler for the connected worker ecosystem. According to data from 5G Americas and Omdia, global IoT subscriptions currently stand at 3.4 billion, complemented by 6.7 billion smartphone subscriptions. IoT platforms serve as the backbone for integrating various connected devices, such as wearables, smart sensors, and mobile tools, into a centralized system for data collection, analysis, and actionable insights. These platforms support predictive maintenance, contextual awareness, and dynamic task allocation, empowering workers with real-time information that enhances productivity and situational responsiveness. IoT-driven connected worker solutions play a significant role in bridging the gap between human capabilities and intelligent automation as organizations transition toward digital transformation, driving operational excellence across various industries.

Segmental Insights

Component Analysis

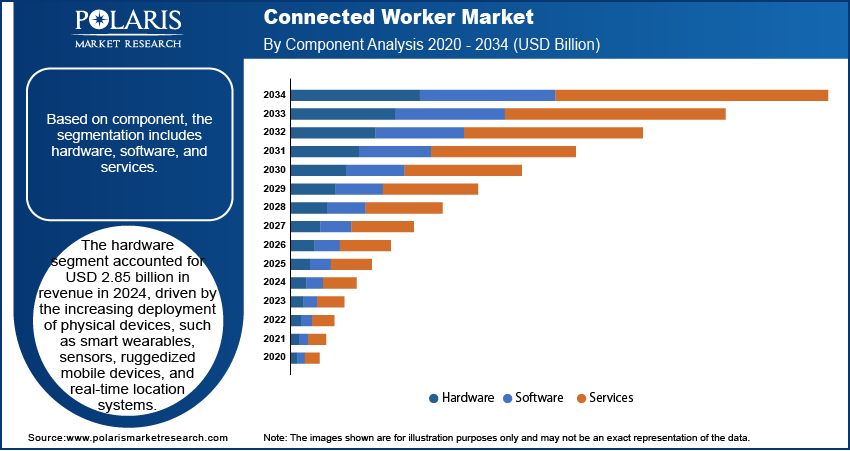

Based on component, the segmentation includes hardware, software, and services. The hardware segment accounted for USD 2.85 billion in revenue in 2024, driven by the increasing deployment of physical devices, such as smart wearables, sensors, ruggedized mobile devices, and real-time location systems. These tools form the foundation of connected worker ecosystems, enabling seamless communication, data collection, and safety monitoring in industrial environments. Demand for these hardware components has surged as organizations prioritize operational visibility and automation. Additionally, the need for durable and high-performance devices in challenging environments, such as manufacturing, oil and gas, and construction, has contributed greatly to the segment's strong revenue growth.

The services segment is expected to witness robust growth during the forecast period as enterprises increasingly aim for end-to-end support for implementing and maintaining connected worker solutions. Services such as integration, consulting, system design, and ongoing support are critical for aligning hardware and software within complex industrial infrastructures. Moreover, companies require tailored service offerings to ensure optimal device performance, data security, and user adoption as digital transformation continues to deepen. This shift toward long-term service partnerships and managed services is expected to drive the expansion of this segment significantly.

Technology Analysis

In terms of technology, the segmentation includes RFID location triangulation, Wi-Fi, cellular, Bluetooth, low-power wide-area network (LPWAN), wireless field area network (WFAN), and zigbee. The RFID location triangulation segment was valued at USD 2.33 billion in 2024 owing to its effectiveness in tracking personnel and assets in real-time with high accuracy. Industries with vast or hazardous environments, such as mining or logistics, benefit from RFID systems to ensure worker safety, monitor equipment usage, and enhance workflow visibility. The relatively low cost and ease of deployment of RFID infrastructure also contribute to its widespread adoption. Its ability to provide location data without relying on constant connectivity makes it a preferred choice across sectors that prioritize operational continuity and reliability.

The Wi-Fi segment captured 20.72% revenue share in 2024 due to its widespread availability, scalability, and ability to support high-speed connectivity across various facilities. In connected worker environments, Wi-Fi enables real-time communication, data syncing, and cloud access without the need for specialized infrastructure. Its integration with existing enterprise networks offers a cost-effective solution for deploying connected applications. Additionally, the compatibility of Wi-Fi with a wide range of wearable technology and sensors further boosts its utility in digitally transforming workforces in indoor and semi-remote operations.

Deployment Analysis

The segmentation, based on deployment, includes on-premise and cloud. The on-premise segment is expected to capture 36.78% share as organizations with strict data security, latency, and compliance requirements prioritize in-house infrastructure. Industries such as defense, manufacturing, and energy often opt for on-premise systems to maintain full control over sensitive operational data and ensure uninterrupted service, even in isolated environments. Additionally, the ability to customize systems based on specific operational protocols and regulatory standards supports continued investments in this deployment approach, especially where cloud access is limited or restricted.

The cloud segment is expected to register a CAGR of 23.1% during the forecast period due to its flexibility, scalability, and cost efficiency. Cloud deployment enables real-time analytics, remote monitoring, and seamless updates across multiple sites without the need for extensive infrastructure. Cloud platforms offer a unified and centralized environment for managing workforce data, ensuring compliance, and facilitating the use of collaboration tools as companies adopt digital transformation. Additionally, the growing integration of cloud, AI, and IoT technologies further strengthens its appeal for forward-looking enterprises across various industries.

End Use Analysis

The segmentation, based on end use, includes manufacturing, construction, mining, oil & gas, and others. The manufacturing segment accounted for USD 2.05 billion in 2024, driven by its ongoing push toward Industry 4.0 and the need for optimized operational efficiency. Connected worker platforms facilitate process automation, reduce downtime, and improve asset utilization by allowing workers to interact with digital systems in real-time. Moreover, safety compliance, predictive maintenance, and enhanced productivity tracking are additional benefits that drive adoption in this sector. These capabilities enable manufacturers to achieve leaner operations, adapt quickly, and meet increased production demands.

The construction segment captured 20.63% share of the market in 2024 as the industry faces constant pressure to improve jobsite safety, productivity, and coordination. Connected technologies enable real-time workforce tracking, equipment monitoring, and digital reporting, which are crucial in managing large and dynamic project environments. The adoption of wearables, digital checklists, and AR/VR tools supports streamlined communication and risk minimization, particularly for workers who are often distributed across complex sites. This push for digitization is further driven by the industry's need to reduce delays and cost overruns.

Regional Analysis

The North America connected worker market held the largest share of 31.46% in 2024 due to its early adoption of advanced technologies, strong industrial infrastructure, and focus on worker safety and productivity. The region benefits from a mature ecosystem of tech providers, robust investments in industrial automation, and a high level of digital literacy among its workforce. An April 2024 IFR report noted a 12% increase in industrial robot installations, totaling 44,303 units, in the U.S. in 2023, reflecting increasing automation investments by manufacturers. Manufacturing, construction, and energy companies across North America are increasingly integrating connected solutions into their operations to stay competitive and compliant with regulatory standards. Moreover, the presence of major technology vendors supports rapid innovation and deployment across industries.

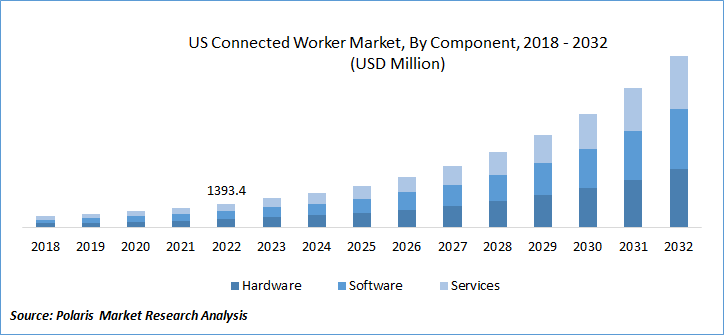

U.S. Connected Worker Market Insight

The U.S. held the dominating share of 80.51% in North America due to its advanced industrial base and strong focus on digital transformation across various sectors, such as manufacturing, construction, and energy. High technology adoption rates, coupled with robust regulatory frameworks for workplace safety and efficiency, have facilitated the widespread integration of connected worker solutions. Additionally, the presence of leading technology vendors and early investments in IoT infrastructure further reinforces the country’s dominant position in the region.

Asia Pacific Connected Worker Market Trends

The market in Asia Pacific is expected to register the highest CAGR of 23.0% during the forecast period driven by rapid industrialization, increasing labor safety concerns, and expanding investments in smart manufacturing. Countries in the region are aggressively upgrading their industrial capabilities with automation and IoT integration. A June 2025 IFR report revealed India installed 8,510 industrial robots in 2023, reflecting a 59% year-on-year surge in automation adoption. The data highlights the accelerating modernization of manufacturing efforts across the nation. The growing workforce size and increasing need for workforce management solutions create favorable conditions for the adoption of connected worker solutions. Moreover, government initiatives promoting digital transformation in various industries further support the market's growth across Asia Pacific.

India Connected Worker Market Overview

The market in India is projected to capture 21.08% share in Asia Pacific by 2034 due to rapid industrialization, a growing focus on worker safety, and increased deployment of digital tools in the manufacturing and construction sectors. Government initiatives supporting the adoption of Industry 4.0 and workforce digitization have accelerated the integration of smart devices and platforms. Additionally, the large labor force and rising demand for productivity enhancement solutions are driving greater acceptance of connected worker technologies across diverse industrial applications.

Europe Connected Worker Market Outlook

The market in Europe is projected to reach USD 110.1 billion by 2034, driven by the region’s focus on sustainability, operational efficiency, and occupational health regulations. European industries are investing in digital tools to meet strict environmental and safety standards while enhancing competitiveness through innovation. The region’s emphasis on smart factories and workforce digital upskilling is fostering greater deployment of connected solutions. Additionally, collaborations between industrial enterprises and tech firms across Europe are facilitating the development and adoption of integrated platforms that enhance worker safety and productivity.

UK Connected Worker Market Analysis

The UK market growth is driven by the country’s push toward smart manufacturing and digital innovation in industrial operations. Companies are increasingly adopting connected technologies to meet stringent health and safety regulations while improving workforce efficiency. Moreover, strong collaboration between industrial enterprises and digital solution providers supports the integration of wearables, sensors, and real-time communication tools, positioning the UK as a progressive adopter of connected workforce strategies.

Key Players and Competitive Analysis

The connected worker landscape is witnessing transformative growth, driven by technological advancements in IoT, AI, and wearable devices, which enhance real-time decision-making and operational efficiency. Industry trends indicate strong revenue growth potential, particularly in developed markets such as North America and Europe, where manufacturers are prioritizing digitization to address labor shortages and mitigate supply chain disruptions. Meanwhile, emerging markets in Asia Pacific present latent demand and opportunities, fueled by rising industrialization and government initiatives, such as India’s AI mission.

Competitive intelligence and strategy highlight key players, such as Honeywell and Zebra Technologies, leveraging strategic investments in AR/VR and predictive analytics to strengthen their regional footprint. Small and medium-sized businesses are adopting scalable solutions to enhance safety and productivity, while joint ventures between tech firms and industrial giants are accelerating innovation. Sustainability strategies and transformations are becoming increasingly critical, with connected tools helping to reduce waste and energy consumption.

Future development strategies will rely on interoperability, 5G integration, and shifts in economic and geopolitical landscapes that influence adoption rates. Additionally, expert insights suggest that expansion opportunities lie in sectors such as oil and gas and pharmaceuticals, where real-time data can help mitigate risks.

A few major companies operating in the market include Accenture Plc.; Intel Corp.; 3M; Honeywell International, Inc; Fujitsu Ltd.; Zebra Technologies Corp.; SAP SE; TELUS; TATA Consultancy Services Limited; and Wipro Ltd.

Key Players

- 3M

- Accenture Plc.

- Fujitsu Ltd.

- Honeywell International, Inc

- Intel Corp.

- SAP SE

- TATA Consultancy Services Limited

- TELUS

- Wipro Ltd.

- Zebra Technologies Corp.

Industry Developments

- June 2025: IFS acquired TheLoops, integrating autonomous AI agents into industrial workflows. This enables AI-driven task execution (beyond tracking), prioritizing resilience, productivity, and ROI. The platform emphasizes security and governance, marking a shift toward agentic automation in mission-critical operations.

- September 2024: Rockwell Automation launched its Plex-powered connected worker solution, designed to improve shop-floor productivity, quality, and safety through advanced industrial automation and digital tools.

Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Hardware

- Smart Glasses/Eyewear

- Smart Headgear

- Hearing Protection Devices

- Protective Textiles

- Mobile Devices

- Others

- Software

- Workforce Task Management

- Workforce Analytics

- Mobile Learning

- Services

- Consulting

- Training & Implementation

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- RFID Location Triangulation

- Wi-Fi

- Cellular

- Bluetooth

- Low-Power Wide-Area Network (LPWAN)

- Wireless Field Area Network (WFAN)

- Zigbee

By Deployment Outlook (Revenue, USD Billion, 2020–2034)

- On-premise

- Cloud

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Manufacturing

- Construction

- Mining

- Oil & Gas

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 7.79 Billion |

|

Market Size in 2025 |

USD 9.49 Billion |

|

Revenue Forecast by 2034 |

USD 58.00 Billion |

|

CAGR |

22.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 7.79 billion in 2024 and is projected to grow to USD 58.00 billion by 2034.

The global market is projected to register a CAGR of 22.3% during the forecast period.

The North America connected worker market held the largest revenue share and was valued at USD 2.49 billion in 2024.

A few of the key players in the market are Accenture Plc.; Intel Corp.; 3M; Honeywell International, Inc; Fujitsu Ltd.; Zebra Technologies Corp.; SAP SE; TELUS; TATA Consultancy Services Limited; and Wipro Ltd.

The hardware segment accounted for USD 2.85 billion revenue in 2024.

The cloud segment is expected to witness a higher CAGR of 23.1% during the forecast period.