Acidulants Market Share, Size, Trends, Industry Analysis Report

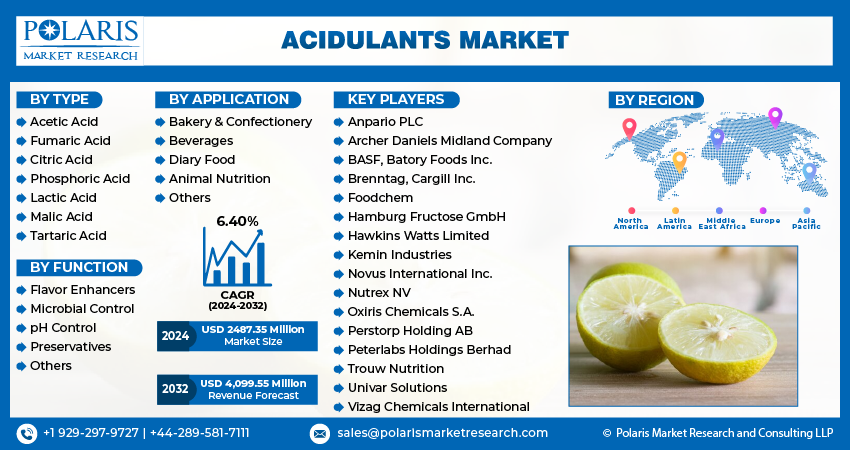

By Type (Acetic Acid, Fumaric Acid, Citric Acid, Phosphoric Acid, Lactic Acid, Malic Acid, and Tartaric Acid); By Function; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM3656

- Base Year: 2023

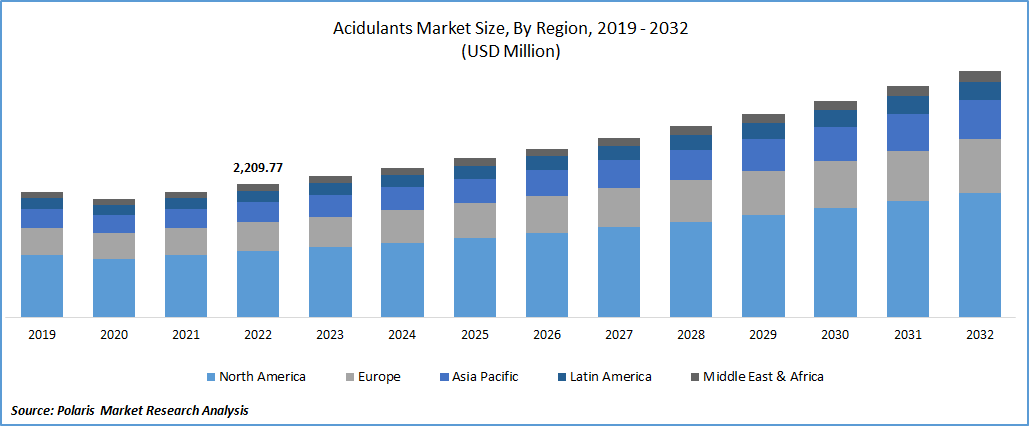

- Historical Data: 2019-2022

Report Outlook

The global acidulants market size and share was valued at USD 2343.69 million in 2023 and is expected to grow at a CAGR of 6.40% during the forecast period.

The significant expansion of the global food processing industry and an increasing number of consumers consuming beverages and ready-to-eat meals, mainly due to the emergence of hectic life schedules and lack of time among them, along with the growing awareness regarding the benefits associated with organic food and ingredients are the primary factors boosting the market growth at a rapid pace.

An acidulant is a chemical compound that acts as an additive in the production of food and beverages. It’s commonly used to give sour, tart, or acidic flavor to food products or enhance their perceived sweetness. Also, it can function as a leaving agent or emulsifier in some kinds of processed foods. Furthermore, acidulants can work as raising agents, buffering agents, and coloring agents. They have antimicrobial properties, which halt bacteria growth and prevent early spoilage of the product.

There are several different types of acidulants, including acetic acid, ascorbic acid, citric acid, fumaric acid, lactic acid, and phosphoric acid. Citric acid is commonly used in food products such as cookies, jelly and jam, snacks, ice cream, and sauces. Ascorbic acid is used in alcoholic beverages, drinks, syrups, sauces, cereals, and multivitamins. The rapid increase in the demand for instant beverages and the introduction of low or even no-calorie drinks are the major factors driving the acidulants market demand.

To Understand More About this Research: Request a Free Sample Report

In addition, manufacturers are exploring novel formulations and combinations of acidulants to cater to evolving consumer tastes and preferences, which includes developing acidulants with enhanced stability, controlled release properties, or targeted functionality for specific applications, thereby fostering market growth.

For instance, in March 2023, ADM announced the launch of the Knwble Grwn brand, which mainly aims to provide consumers with wholesome and plant-based food ingredients that are sourced sustainably. The newly launched brand will produce products using regenerative agricultural practices, which helps protect the environment and complements the company’s other sustainability initiatives.

Moreover, various advanced extraction techniques have been introduced in recent years, including solvent extraction, supercritical fluid extraction, and membrane separation, which help to improve the efficiency, yield, and purity of acidulants. These techniques also offer enhanced extraction selectivity, reduced solvent usage, and increased sustainability in acidulant production, creating new revenue opportunities for the players operating in the market.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the acidulants market. The rapid spread of the deadly virus had forced countries to take necessary actions like lockdown measures and restrictions on trade activities, which led to the temporary closure of various manufacturing facilities and huge disruptions in global supply chains. However, the pandemic has raised awareness regarding health and wellness, increasing demand for acidulants to be used in food products due to their healthy properties.

The acidulants market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Industry Dynamics

Growth Drivers

Increasing Demand for Instant Beverages and Other Drinks

The rapid increase in the demand for instant beverages, fermented drinks, and carbonated drinks globally, particularly among the young generation and millennials, and the introduction to low or even no-calorie drinks, gaining health-conscious consumers traction, are key factors driving the acidulants market growth. Additionally, consumers are now shifting towards sustainable products that are manufactured with the help of sustainable ingredients. Hence the demand for ingredients like acetic and citric acid is rapidly increasing.

Furthermore, acidulants have antimicrobial properties that help restrict the growth of harmful bacteria, fungi, and other microorganisms in food products, which makes them an essential ingredient for food safety and preservation, further propelling the market. Apart from this, with consumers becoming increasingly aware of foodborne illnesses and demanding safer products, using acidulants as preservatives to extend the shelf life of food items is increasing and acting as a major driver of the global market.

Report Segmentation

The market is primarily segmented based on type, function, application, and region.

|

By Type |

By Function |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type

Citric Acid Segment Dominated the Market in 2022

The citric acid segment dominated the market with a substantial revenue share in 2022 and is projected to maintain its dominance throughout the forecast period, mainly accelerated by its widespread and growing use in the production of various types of food & beverages, dairy goods, and confectionery products along with the surging natural and clean label trends among consumers across the globe. Additionally, citric acid offers various health benefits, including aiding digestion, enhancing nutrient absorption, and acting as an antioxidant, which in turn fuels its adoption at a rapid pace.

The acetic acid segment is likely to exhibit a significant growth rate over the coming years because of its emerging use as an antioxidant in numerous products, including sauces, pickles, and condiments. Also, it consists of antimicrobial properties that help extend food items' shelf life by inhibiting the growth of bacteria and fungi.

By Function

Flavor Enhancers Segment is Expected to Witness the Highest Growth During the Forecast Period

The flavor enhancers segment is expected to grow at a healthy CAGR during the anticipated period, mainly driven by continuous changes in consumer preferences and consumption patterns, as they are becoming more and more adventurous with their food choices and are significantly looking for unique and exotic flavors. Besides this, the growing prevalence of the busy lifestyles of modern consumers that have led to a rise in the consumption of convenience and ready-to-eat foods, which often require flavor enhancement to improve their taste and quality, is further anticipated to drive the demand for flavor enhancers across the globe.

By Application

Bakery & Confectionery Segment Held a Significant Market Revenue Share in 2022

The bakery & confectionery segment held the maximum market share in revenue in 2022, mainly due to widespread product adoption and utilization in bakery & confectionery products to enhance their organoleptic qualities and extend their shelf life. In addition, the growing prevalence of several lifestyle diseases, including obesity, diabetes, and heart diseases across the globe, leads to increased demand for sugar-free and healthy confectionery, which is likely to influence the demand for acidulants over the coming years positively.

The beverages segment is anticipated to grow significantly over the study period, mainly due to its ability to provide a tart or acidic taste and possess antimicrobial properties that can inhibit the growth of bacteria and fungi in beverages. The growing global consumption of beverages globally because of changing consumer living styles and the availability of beverages in different varieties or flavors will likely boost the segment market.

Regional Insights

Asia Pacific Region Accounted for the Largest Market Share in 2022

In 2022, the Asia The Asia Pacific region accounted for the largest market share in 2022 and is expected to retain its market position over the projected period; that is largely attributable to significant product adoption by major food products manufacturers to improve the quality and flavor and boost the shelf life along with the surging demand and consumption of food & beverages as a result of a growing population and rapid rate of urbanization in countries like China, India, and Indonesia. Several governments across the region have implemented stricter regulations and quality standards related to food safety and additives, which fuels the demand for acidulants as they are considered safe for consumption when used within approved limits, and their compliance with regulatory requirements also encourages their use in the food and beverage industry.

The North American region is anticipated to be the fastest-growing region with a healthy CAGR over the coming years, owing to several advancements in food processing technologies and manufacturing processes, including encapsulation techniques, that enhance product stability and performance in various applications.

Key Market Players & Competitive Insights

The numerous players in the lighting industry have strategically shifted their focus away from the traditional lighting business. As a result, these market players are actively investing in research and development (R&D) for medical devices and exploring opportunities in the automotive industry and other sectors. This strategic realignment reflects the growing recognition of new market potentials and the need to adapt to evolving industry trends.

Some of the major players operating in the global market include:

- Anpario PLC

- Archer Daniels Midland Company

- BASF

- Batory Foods Inc.

- Brenntag

- Cargill Inc.

- Foodchem

- Hamburg Fructose GmbH

- Hawkins Watts Limited

- Kemin Industries

- Novus International Inc.

- Nutrex NV

- Oxiris Chemicals S.A.

- Perstorp Holding AB

- Peterlabs Holdings Berhad

- Trouw Nutrition

- Univar Solutions

- Vizag Chemicals International

Recent Developments

- In April 2022, Primient announced that the company has entered into the food and ingredients market with a wide range portfolio of proven products, including food, beverage, personal care, apparel, and animal nutrition industries. The company’s portfolio includes expertise and solutions in various applications, from acidulants to industrial starches, personal care additives, and animal nutrition.

- In May 2022, Kemin Industries expanded its market presence across the Mexico and Central American regions by opening new offices and distribution centers. The new location will allow the company to offer improved services and solutions to its customers.

Acidulants Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2487.35 million |

|

Revenue Forecast in 2032 |

USD 4,099.55 million |

|

CAGR |

6.40% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Function, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Anpario PLC, Archer Daniels Midland Company, BASF, Batory Foods Inc., Brenntag, Cargill Inc., Foodchem, Hamburg Fructose GmbH, Hawkins Watts Limited, Kemin Industries, Novus International Inc., Nutrex NV, Oxiris Chemicals S.A., Perstorp Holding AB, Peterlabs Holdings Berhad, Trouw Nutrition, Univar Solutions, Vizag Chemicals International. |

In today’s hyper-connected world, running a business around the clock is no longer an option. And at Polaris Market Research, we get that. Our sales and analyst team is available 24x5 to assist you. Get all your queries and questions answered about the Acidulants Market report with a phone call or email, as and when needed.

Browse Our Top Selling Reports

Australia Facial Injectables Market Size, Share 2024 Research Report

Fibrate Drugs Market Size, Share 2024 Research Report

Herpes Simplex Virus Treatment Market Size, Share 2024 Research Report

FAQ's

The acidulants market report covering key segments are type, function, application, and region.

Acidulants Market Size Worth $4,099.55 Million By 2032.

The global acidulants market is expected to grow at a CAGR of 6.4% during the forecast period.

Asia Pacific is leading the global market.

key driving factors in acidulants market are increasing demand for instant beverages and other drinks.