U.S. Garden Planter Market Share, Size, Trends, Industry Analysis Report

By Material (Terracotta, Plastic), By End-use (Residential, Commercial), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM4335

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

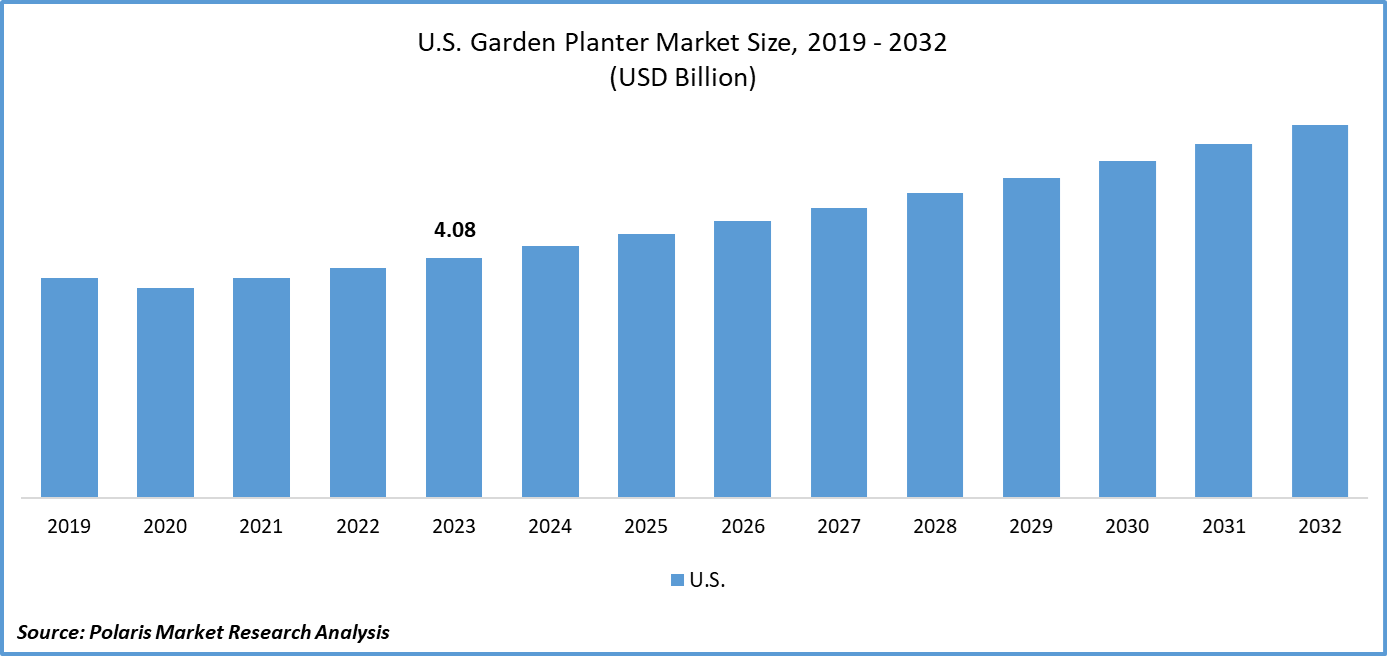

U.S. garden planter market size was valued at USD 4.08 billion in 2023. The market is anticipated to grow from USD 4.29 billion in 2024 to USD 6.65 by 2032, exhibiting the CAGR of 5.6% during the forecast period.

Market Overview

The rise in the establishment of eco-friendly cities in the U.S. is fueling the need for outdoor planters. With a growing emphasis on sustainability, environmental awareness, and the inclusion of green spaces in urban planning, garden planters play a vital role in promoting urban gardening and landscaping. As an example, the United States Environmental Protection Agency has launched the 'Greening America's Communities' program. This initiative aids cities and towns in developing and implementing realistic visions for environmentally friendly neighborhoods, incorporating innovative green infrastructure, and employing other sustainable design strategies.

Regulations within the garden planter market have the potential to shape product design and material choices, ensuring adherence to safety standards and environmental sustainability. Compliance with these regulations is driving the creation of eco-friendly planters while restricting the use of certain materials. Stringent guidelines pertaining to labeling and market practices not only foster market growth but also encourage increased consumer adoption. Consequently, regulations play a pivotal role in laying the groundwork for the expansion of the market.

To Understand More About this Research: Request a Free Sample Report

Growth Factors

- The surge in commercial construction is likely to boost the demand in the garden planters market

In the U.S., commercial construction is increasing, which is likely to foster the demand for garden planters aligning with contemporary landscaping and architectural inclinations. Garden planters provide practical solutions for introducing green elements into diverse commercial settings such as offices, restaurants, cafes, hotels, and retail spaces. This strategy is designed to craft inviting and aesthetically pleasing environments. Outdoor planters play a crucial role in these places by defining boundaries, ensuring privacy, and adding to a delightful ambiance. The integration of greenery elevates the overall experience for both visitors and occupants, turning outdoor areas into more welcoming and comfortable settings.

- Ecofriendly practices of sustainable garden planters contributing to the market growth

The shift towards sustainable and environmentally friendly living is impacting the acceptance of sustainable garden planters, potentially contributing to market growth in the U.S. Consumers are actively seeking outdoor planters crafted from eco-friendly materials or designed with features promoting water conservation and efficient drainage. This emphasis on green practices is evident in both commercial and residential settings, where the presence of greenery enhances the overall environmental image. The demand for sustainability catalyzes innovation in planter materials and design, aligning with the wider societal emphasis on eco-friendly solutions.

Restraining Factors

- Substitute products act as a barrier to market growth

While the market has a restricted number of direct substitutes, alternatives like do-it-yourself (DIY) options such as repurposed containers, hanging pots, & elevated garden beds can serve as viable substitutes. Additionally, some consumers choose alternative felt planters. The presence of such substitutes provides consumers with a range of options, allowing them to make choices based on their individual preferences, gardening requirements, & space limitations.

Report Segmentation

The market is primarily segmented based on material, end use, distribution channel, and region.

|

By Material |

By End Use |

Distribution Channel |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Material Insights

The plastic segment accounted for the largest market share in 2023

The plastic segment held the largest market share in 2023. This is attributed to the durability factor, which significantly contributes to the major market share of plastic garden planters in the U.S. It exhibits a robust resistance to cracking and chipping, ensuring an extended lifespan when compared to certain alternative materials. This wide range provides consumers with the flexibility to select planters that match their aesthetic preferences, though they still benefit from the inherent durability of plastic.

The fiberglass segment is expected to witness a lucrative growth rate. The increasing popularity of fiberglass garden planters is linked to current design trends in landscaping and outdoor decoration. The sleek and streamlined look of fiberglass matches modern design aesthetics, establishing it as a preferred option for both residential and commercial purposes, aiming to improve the aesthetic appeal of their outdoor areas. Furthermore, the range of finishes, including glossy and matte options, increases their adaptability to several design styles in the U.S.

By End-Use Insights

The residential segment is expected to witness significant growth in the coming years

The residential segment is expected to register the highest CAGR during the forecast timeframe. The growing market trend of consumers dedicating more time to their home gardens plays a significant role in the widespread adoption of visually appealing garden planters in residential settings. Consumers are inclined towards enhancing their outdoor spaces, including balconies, yards, and patios, transforming them into functional and inviting areas. Additionally, the surge in home improvement projects across the U.S. is encouraging homeowners to undertake lawn and garden remodeling, contributing to the anticipated growth of this segment.

The commercial segment held the largest market share. The increasing awareness of the positive effects of green spaces on staff well-being and the workplace atmosphere in the U.S. primarily propels it. For instance, a 2021 Gallup poll in the U.S. indicated that office plants have been shown to improve concentration levels and decrease stress. Plants have proven to decrease attention spans and physiological stress, contributing to overall well-being. As a result, businesses are increasingly investing in integrating greenery in both outdoor and indoor areas, strategically employing planters to craft appealing environments.

Regional Insights

The expansion of the garden planter market in the U.S. is attributed to changes in lifestyle trends, changing consumer preferences, and a rising interest in gardening. Additionally, the increasing inclination towards outdoor leisure and the desire to establish functional and visually appealing garden spaces have fueled heightened consumer interest in planters that elevate the overall ambiance of home gardens. This shift in consumer behavior aligns with the market's growth trajectory as individuals increasingly favor products that enhance and contribute to a more fulfilling outdoor experience. The convergence of these factors signifies a broader trend towards creating enjoyable and aesthetically pleasing outdoor environments, driving the demand for garden planters.

Key Market Players & Competitive Insights

The U.S. Garden planter market is marked by a notable level of innovation driven by rapid technological advancements. Innovations within this market encompass smart planters equipped with integrated sensors to monitor soil moisture, light levels, and nutritional levels. Furthermore, there is a burgeoning trend of innovation in self-watering planters. These planters feature containers that retain water through the wicking systems.

Some of the major players operating in the global market include:

- THE HC COMPANIES, INC.

- Bloem

- Crescent Garden Company

- Mayne

- Tusco Products

- Planters Unlimited

- Urban Pot

- NewPro Corp

- Novelty Manufacturing Co.

- Palmer Planter Company

Recent Developments in the Industry

- In July 2023, Crescent Garden Company joined forces with UBQ Materials to launch a novel series of planters known as Crescent Too O+, featuring UBQ. Crescent Garden is at the forefront of transforming sustainability in both home and garden settings.

- In July 2021, The HC Companies expanded its lineup of sustainable products by unveiling an innovative bio-based resin material. The introduction of HC's BioPax growing containers signifies a technological advancement within the industry and is in line with the company's commitment to environmental initiatives.

- In March 2021, The Forest Stewardship Council officially acknowledged The HC Companies for their array of fiber-growing & protective packaging solutions. Products have received the designation of "FSC Recycled 100%." This recognition underscores HC's continual commitment to delivering progressively sustainable offerings to the market.

Report Coverage

The U.S. Garden planter market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, material, end use, distribution channel, and market future opportunities.

U.S. Garden Planter Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 4.29 billion |

|

Revenue forecast in 2032 |

USD 6.65 billion |

|

CAGR |

5.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Explore the 2024 market share, size, and revenue growth rate statistics in the field of U.S. Garden Planter Market, meticulously compiled by Polaris Market Research Industry Reports. This comprehensive analysis encompasses a market forecast outlook extending to 2032, along with an insightful historical overview. Experience the depth of this industry analysis by obtaining a complimentary PDF download of the sample report.

Browse Our Bestselling Reports:

Plastic Processing Machinery Market Size, Share Research Report

Sex Reassignment Surgery Market Size, Share Research Report

Information Technology Service Management Market Size, Share Research Report

FAQ's

The U.S. Garden Planter Market report covering key segments are material, end use, distribution channel

U.S. Garden Planter Market Size Worth $6.65 Billion By 2032

U.S. garden planter market exhibiting the CAGR of 5.6% during the forecast period.

key driving factors in U.S. Garden Planter Market are The surge in commercial construction is likely to boost the demand in the market