Joint Pain Injections Market Share, Size, Trends, Industry Analysis Report

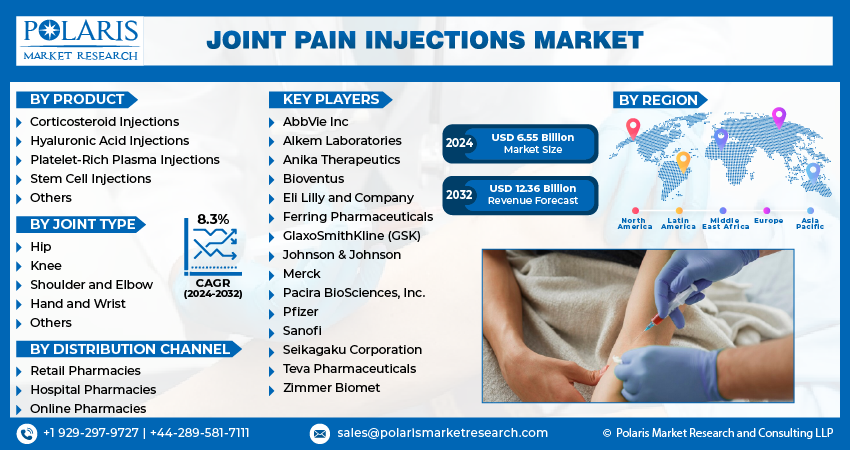

By Product (Corticosteroid Injections, Hyaluronic Acid Injections, Platelet-Rich Plasma Injections, Stem Cell Injections, Others); By Joint Type; By Distribution Channel; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM4129

- Base Year: 2023

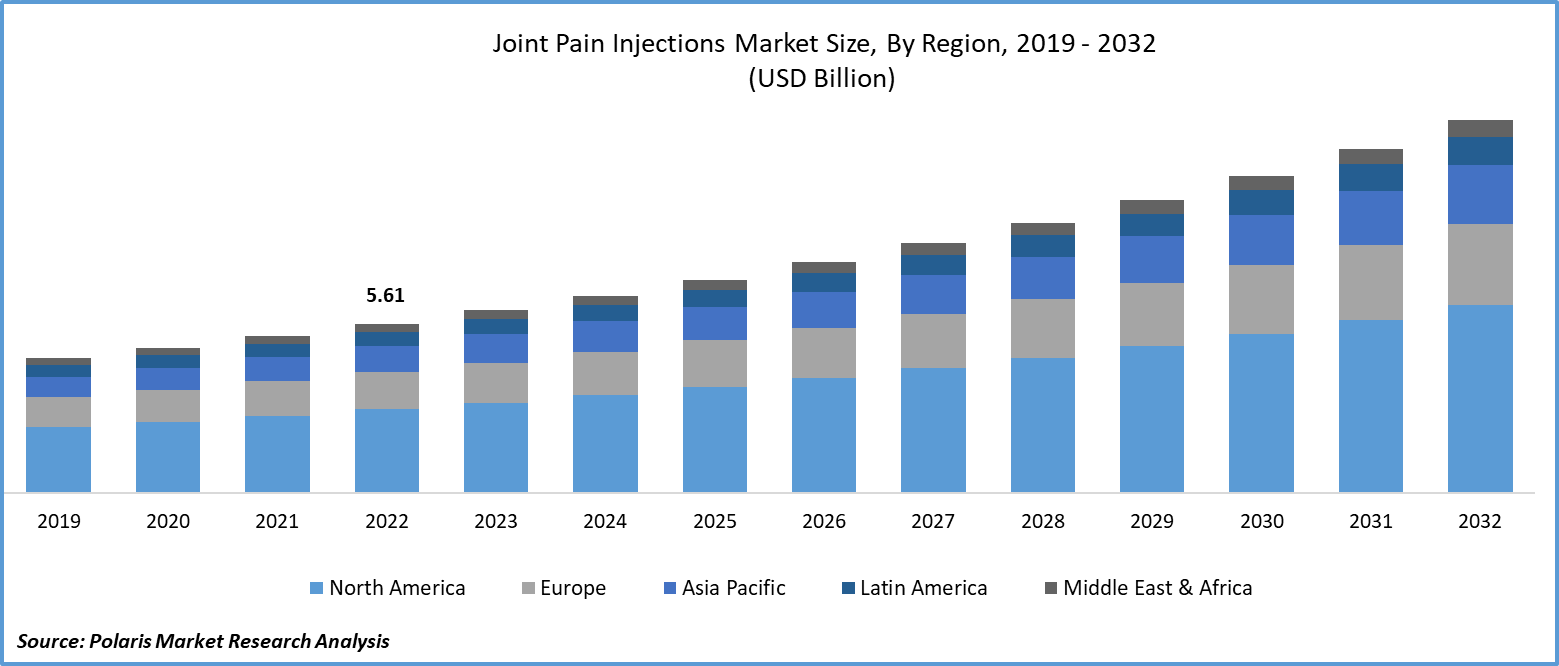

- Historical Data: 2019-2022

Report Outlook

The global joint pain injections market was valued at USD 6.06 billion in 2023 and is expected to grow at a CAGR of 8.3% during the forecast period.

A growing recognition of the merits associated with joint pain injections is evident among patients and healthcare professionals alike. Patients are progressively better informed about their treatment alternatives and are actively pursuing non-surgical options. Healthcare practitioners, encompassing orthopedic specialists, rheumatologists, and pain management physicians, are proactively advocating joint pain injections as a viable avenue for pain management. This heightened awareness and the endorsement of joint pain injections are acting as catalysts for the expansion of the market.

To Understand More About this Research: Request a Free Sample Report

In addition, companies operating in the market are introducing new products with enhanced capabilities to cater to the growing consumer demand.

- For instance, in May 2021, Ono Pharmaceutical Co., Ltd. and Seikagaku Corporation launched JOYCLU 30mg intra-articular injection for knee and hip joints.

Many patients prefer joint pain injections over systemic pain medications. Joint pain injections offer the advantage of localized pain relief, targeting the specific joint affected. This localized approach reduces the need for systemic pain medications, which may have side effects and affect the entire body. As patients become more involved in their treatment decisions, joint pain injections align with their preference for targeted, effective, and minimally invasive solutions.

Continuous advancements in injection techniques and formulations play a pivotal role in driving market growth. Innovative formulations and delivery methods have enhanced the efficacy of joint pain injections. Additionally, advanced imaging techniques, such as ultrasound guidance, have improved the precision and accuracy of injections, leading to better patient outcomes and increased confidence in this treatment modality.

Post-COVID-19, the joint pain injections market has evolved to meet changing healthcare dynamics. Telemedicine has become prevalent, offering remote consultations. Safety measures in healthcare facilities are stringent, ensuring patient well-being. Patients are more proactive about addressing joint pain reevaluating their health priorities. The supply chain is now more resilient, and research into innovative joint pain injections, including biologics, has intensified. Patient education is emphasized, empowering informed decision-making. Insurance and reimbursement policies have seen shifts, requiring adaptation. Additionally, there's a heightened focus on the patient experience with a patient-centered approach.

Growth Drivers

- Aging population, prevalence of joint disorders, and rise in demand for minimally invasive treatments

The global increase in the elderly population, especially in developed nations, serves as a significant catalyst. Joint pain and its related conditions, like osteoarthritis, tend to become more prevalent as individuals age. Consequently, the demand for joint pain injections increases with the growing elderly population. This demographic shift is characterized by an extended life expectancy, underscoring the pressing need for effective pain management within the senior age group.

Moreover, the surging incidence of joint disorders, encompassing osteoarthritis, rheumatoid arthritis, and musculoskeletal injuries, plays a substantial role in driving the demand for joint pain injections. As these conditions become increasingly widespread, healthcare providers are turning to injections as a non-invasive and efficient solution for pain relief. Joint pain injections offer precise pain management and contribute to an improved quality of life for individuals grappling with these conditions.

The demand of minimally invasive treatments is on the ascent. Patients are increasingly drawn to non-surgical alternatives for mitigating joint pain, thereby mitigating risks, shortening recovery periods, and reducing the potential for complications associated with surgical procedures. Joint pain injections are regarded as a minimally invasive approach that adeptly addresses pain while enhancing joint functionality. This shift towards non-surgical interventions is significantly bolstering the joint pain injection market.

Report Segmentation

The market is primarily segmented based on product, joint type, distribution channel, and region.

|

By Product |

By Joint Type |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

- Hyaluronic acid injections accounted for a significant share in 2022

Hyaluronic acid injections accounted for a significant share in 2022. Hyaluronic acid injections, commonly used for conditions like osteoarthritis, are increasingly prominent in the medical industry. These injections provide a non-surgical option for those seeking relief from joint pain and improved mobility. Hyaluronic acid functions as a lubricant and cushion within the joints. When administered directly into the affected joint, it alleviates pain and inflammation, enhancing joint functionality. With minimal invasiveness and a swift recovery period, these injections are favored by individuals aiming to address joint pain and restore their quality of life.

By Joint Type Analysis

- Knee emerged as the largest segment in 2022

The knee segment accounted for the largest market share in 2022. An aging population experiences a higher incidence of knee-related conditions, such as osteoarthritis. Knee pain injections offer a non-surgical alternative, catering to patients who prefer less invasive treatments. These injections enhance the quality of life by providing relief from discomfort and improving mobility. Advancements in medical technology have yielded more effective and longer-lasting injection options. Increased patient awareness of available treatments, coupled with personalized medicine, makes knee joint pain injections an attractive choice. The shorter recovery period compared to surgery minimizes downtime, while improved healthcare access and positive clinical evidence further drive demand. Patient preferences for non-opioid and non-surgical solutions play a pivotal role in the popularity of these injections.

By Distribution Channel Analysis

- Retail pharmacies accounted for a significant share in 2022

The retail pharmacies accounted for a significant share in 2022. Growing consumer awareness and demand for accessible treatments drive the growth of this segment. Additionally, many joint pain injections, often requiring prescriptions, are now available through retail pharmacies. Some pharmacies even offer in-house clinics with trained professionals who can administer these injections, providing a convenient one-stop solution. With an aging population experiencing more joint-related issues, the demand for these treatments is on the rise. Furthermore, retail pharmacies are increasingly integrating e-commerce platforms, making it easier for patients to access and order prescription medications, including joint pain injections. Educational initiatives by pharmacies also play a role in increasing awareness and sales.

Regional Insights

- North America region dominated the global market in 2022

The North American region dominated the global market in 2022. An aging population prevalent in the region, increases the incidence of joint-related ailments, particularly osteoarthritis, driving demand for non-surgical solutions like joint pain injections. North America's advanced healthcare infrastructure and extensive awareness of treatment options encourage the adoption of innovative injection therapies. The region's role as a center for pharmaceutical research and development leads to continuous advancements in these therapies. Strategic collaborations between pharmaceutical companies and healthcare institutions expand the market's reach, while patient preference for minimally invasive treatments further boosts the adoption of joint pain injections. Opportunities lie in personalized injection therapies, market expansion, and increased patient education.

The Asia Pacific region is anticipated to experience significant growth during the projected period. The region's growing health awareness and a shift towards proactive healthcare approaches have made joint pain injections a preferred choice among patients and healthcare providers. Moreover, Asia's popularity as a medical tourism destination has further boosted the market, as patients from around the world seek such treatments in the region. Government initiatives to enhance healthcare access and affordability, coupled with ongoing research and innovation, contribute to market growth.

Key Market Players & Competitive Insights

The joint pain injections market is fragmented and is anticipated to witness competition due to the presence of several players. Major market players are constantly introducing new products to strengthen their position in the market. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- AbbVie Inc

- Alkem Laboratories

- Anika Therapeutics

- Bioventus

- Eli Lilly and Company

- Ferring Pharmaceuticals

- GlaxoSmithKline (GSK)

- Johnson & Johnson

- Merck

- Pacira BioSciences, Inc.

- Pfizer

- Sanofi

- Seikagaku Corporation

- Teva Pharmaceuticals

- Zimmer Biomet

Recent Developments

- In October 2021, Pacira BioSciences, Inc. acquired Flexion Therapeutics, Inc. to strengthen its offerings and enable market expansion.

Joint Pain Injections Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 6.55 billion |

|

Revenue forecast in 2032 |

USD 12.36 billion |

|

CAGR |

8.3% from 2024 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019-2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Joint Type, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global joint pain injections market size is expected to reach USD 12.36 billion by 2032

Key players in the market are Anika Therapeutics, Bioventus, Eli Lilly and Company, Ferring Pharmaceuticals

North American contribute notably towards the global joint pain injections market

The global joint pain injections market is expected to grow at a CAGR of 8.2% during the forecast period.

The joint pain injections market report covering key segments are product, joint type, distribution channel, and region.