Alcopop Market Share, Size, Trends, Industry Analysis Report

By Base Type (Beer, Whiskey, Rum, Vodka, and Others); By Packaging Type; By Distribution Channel; By Region; Segment Forecast, 2023 – 2032

- Published Date:Jul-2023

- Pages: 117

- Format: PDF

- Report ID: PM3660

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

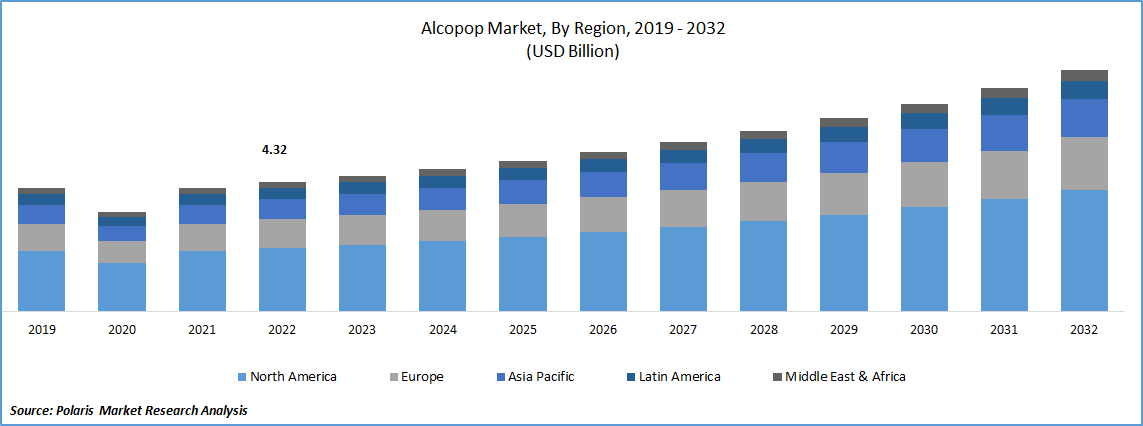

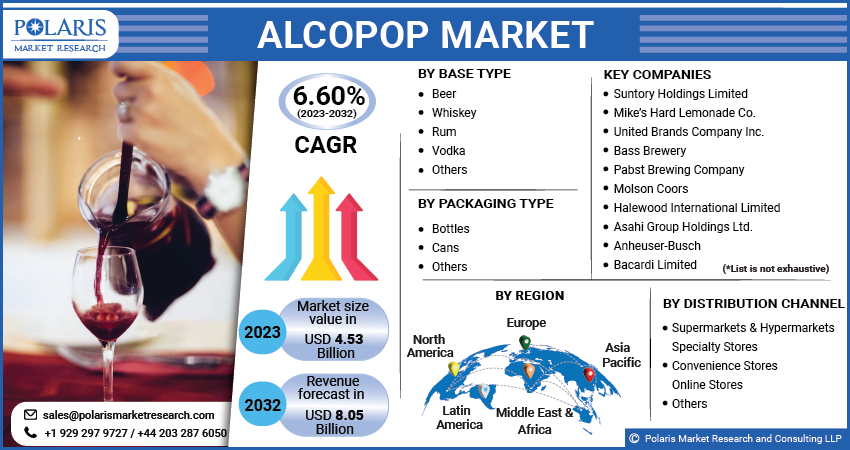

The global alcopop market size and share was valued at USD 4.32 billion in 2022 and is expected to grow at a CAGR of 6.60% during the forecast period.

The surging demand for flavored alcoholic beverages across the globe and the rising proliferation of alcopop among the Gen Z population along with the rising consumer disposable income and spending or purchasing power led to higher adoption and demand for several lifestyle products including food & beverages are key factors propelling the demand and growth of the market at a significant pace.

An alcopop is a term used to refer to certain sweetened alcoholic beverages. They are flavored to taste like pop, cola, or lemonade and have relatively low alcohol content. Alcopops are popular among young drinkers for two main reasons. They come in cool packaging with colorful and bright labels, making them attractive to young consumers. Also, alcopops have a fruity, sugary-sweet taste, making them more palatable to new and occasional drinkers.

The history of alcopops can be traced back to the 20th century. Alcopops first became popular in Europe and then spread to other parts of the world. Initially, alcopops were marketed as alternatives to traditional beer. However, they soon gained traction as their niche. Based on their base type, alcopops are classified as beer alcopops, whiskey alcopops, rum alcopops, and vodka alcopops. The convenience and ready-to-drink format of alcopops are the primary factors driving the alcopop market sales.

Product innovations, technological advancements, and the introduction of regulatory policies have been detailed in the report to enable businesses to make more informed decisions. Furthermore, the impact of the COVID-19 pandemic on the alcopop market demand has been examined in the study. The report is a must-read for anyone looking to develop effective strategies and stay ahead of the curve.

The market research report offers an in-depth analysis of the industry to support informed decision-making. It offers a meticulous breakdown of various market niches and keeps readers updated on the latest industry developments. Along with tracking the alcopop market on the basis of SWOT and Porter’s Five Forces models, the research report includes graphs, tables, charts, and other pictorial representations to help readers understand the key insights and important data easily.

To Understand More About this Research: Request a Free Sample Report

Additionally, increasing R&D investments and focusing on key companies on innovating products to cater to the growing demand for alcoholic beverages while keeping the positive and negative impacts on mind, is likely to contribute significantly towards the market growth.

- For instance, in March 2021, Brown-Forman Corporation, announced the expansion of its Woodford Reserve Distillery in Kentucky, Versailles, mainly to meet the rising demand for one of the finest and top-selling bourbon whiskey. The expansion product is expected to be started in the second quarter of 2021 with completion scheduled for the third quarter of 2022.

Moreover, growing advancements and innovations in technology have enabled the development of new formulations and ingredient combinations for alcopops including the use of natural sweeteners, flavor enhancers, and functional ingredients to create unique taste profiles and enhance the overall drinking experience which further allows for the production of low-calorie or sugar-free alcopop options to cater to health-conscious consumers, are likely to create significant growth opportunities.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the alcopop market. The rapid spread of the pandemic resulted in lockdowns, restrictions on social gatherings, and the closure of bars and restaurants in many countries, thereby, there was a significant shift in consumer behavior towards product consumption as various ready-to-drink beverages saw increased sales as people sought convenient and enjoyable options for in-home consumption during lockdowns.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Rising Prevalence of Alcopops is driving the market growth

The growing popularity and prevalence of alcopops as a convenience and ready-to-drink format, as they are pre-mixed alcoholic beverages that require no additional preparation or mixing, making them convenient for consumers who are looking for a hassle-free drinking experience along with the growing percentage of the younger population who are willing to try and taste new alcoholic products mainly in high income countries like US, Germany, Canada, and France, are among the primary factors driving the market growth.

Furthermore, the rising focus and implementation of research & development activities to develop and innovate fortified and innovative products in various different spirit assortments like malt liquor coupled with the surging rate of socializing and nightlife activities particularly among the youngsters across both developed and developing economies, are also likely to have positive impact on the market growth over the years.

Report Segmentation

The market is primarily segmented based on base type, packaging type, distribution channel, and region.

|

By Base Type |

By Packaging Type |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Base Type Analysis

Rum segment is expected to witness the highest growth rate during the forecast period

The run-based alcopop segment is expected to grow during the anticipated period, mainly due to the growing consumption of rum-based alcopop across various countries along with its availability in a wide range of flavors from spiced and dark rum to flavored variants like coconut, pineapple, and mango, which significantly attracts the consumers looking for different taste experiences and pleasure, enhancing the popularity of the rum segment at rapid pace.

The beer segment is also expected to hold a significant market share over the forecast period, which is largely accelerated by the easy availability and accessibility of beer products in various different types of channels including bars, restaurants, convenience stores, and online channels and rapidly changing consumer preferences towards the flavored beer. Besides this, beer consumption is also being significantly influenced by several cultural and social factors, as celebrations, social gatherings, sporting events, and festivals often involve the consumption of beer, which has paved the way for higher product demand and growth of the market.

By Packaging Type Analysis

Bottles segment held the maximum market share in 2022

The bottles segment held the maximum market share in terms of revenue in 2022, which is being driven by several factors like its higher convenience to customers, as they come ready-to-drink individual bottles which makes them easily accessible and portable for various social occasions and availability in variety of flavors to cater the need and demand of different taste of customers. In addition, major companies within the market are continuously focusing on innovating and developing new packaging designs and product extensions, to keep the product segment fresh and appealing to consumers, and maintain its demand globally.

The cans segment is projected to exhibit the fastest growth rate over the next coming years, on account of the growing prevalence and popularity of the canned segment as they provide a convenient and portable packaging option for alcopop beverages, as they are lightweight, easy to carry, and do not require any kind of additional tools like bottle openers, making them popular among consumers who want to enjoy alcopop on the go, at outdoor events, parties, or social gatherings.

By Distribution Channel Analysis

Supermarkets & hypermarkets segment accounted for the largest market share in 2022

The supermarkets segment garnered a substantial share in 2022, which is mainly attributable to their ability to offer higher convenience to consumers by providing a one-stop-shop for several products including alcopops, and allowing consumers to easily find and purchase alcopops alongside other groceries. Along with this, supermarkets often have extensive shelf space and prominent displays, which makes it easier for alcopop brands to gain visibility attract consumer attention, and boost their revenue opportunities.

The online stores segment is likely to emerge as the fastest growing segment with a healthy growth rate over the study period, because of the rising consumer inclination towards online shopping channels and an increasing number of brands focusing on making their products online available to broaden their market reach and customer base. Online platforms enable targeted marketing efforts for major alcopop brands and allow them to reach their desired audience effectively through social media campaigns, email marketing, and digital advertising, which create awareness and ultimately drive sales.

Regional Analysis

North America region dominated the global market in 2022

The North America region dominated the global market with a substantial market share in 2022 and is expected to maintain its market dominance throughout the forecast period. The regional market growth can be largely accelerated to widespread demand and consumption of different types of alcoholic beverages especially among the younger population along with the presence of a regulatory environment allowing the sales and consumption of low-alcoholic beverages including alcopops as an alternative for the drinkers.

The Asia Pacific region is anticipated to be the fastest growing region during the projected period, owing to growing urbanization and westernization trends in the APAC region, which has influenced consumer lifestyles and drinking habits and the rising appeal of ready-to-drink products especially among the busy urban dwellers who may not have the time or knowledge to mix their own cocktails. Additionally, the region has a large population of Gen Z or millennials, who are the major consumers of alcopops and have a desire to spend more on premium and convenient alcoholic beverages, which has been pushing the market growth forward.

Competitive Insight

The Alcopop market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Anheuser-Busch

- Asahi Group

- Bacardi Limited

- Bass Brewery

- Beverage Brands

- Brown-Forman Corporation

- Coors Brewing Company

- Diageo.

- Halewood International Limited

- Mike’s Hard Lemonade

- Miller Brewing Company

- Molson Coors

- Pabst Brewing Company

- SKYY Vodka

- Suntory Holdings Limited

- United Brands Company

Recent Developments

- In October 2022, Radico Khaitan, introduced new ready-to-drink variants with a vodka base with around 4.8 percent alcohol and is available in three variants including cola, mojito, and cosmopolitan. The new range of products will now be sold in Karnataka followed by Goa, Maharashtra, & Daman & Diu, this allows the company to fill the gap present in the low-alcoholic beverage category.

- In January 2021, Diageo, introduced its new range of ready-to-drink Gordon’s cans, which come with 0% alcohol-free spirit and are blended with the tonic that is good for on-the-go summer occasions. The new range of drinks will be easily accessible across the United Kingdom and has expanded the range of alcohol-free drinks.

Alcopop Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 4.53 billion |

|

Revenue Forecast in 2032 |

USD 8.05 billion |

|

CAGR |

6.60% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Base Type, By Packaging Type, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Suntory Holdings Limited, Mike’s Hard Lemonade Co., United Brands Company Inc., Bass Brewery, Pabst Brewing Company, Molson Coors, Halewood International Limited, Asahi Group Holdings Ltd., Anheuser-Busch, Bacardi Limited, Miller Brewing Company, Beverage Brands, Brown-Forman Corporation, SKYY Vodka, Coors Brewing Company, and Diageo. |

Uncover the dynamics of the alcopop sector in 2024 with detailed statistics on market share, size, and revenue growth rate meticulously curated by Polaris Market Research Industry Reports. This all-encompassing analysis extends to a forward-looking market forecast until 2032, complemented by a perceptive historical overview. Immerse yourself in the profound insights offered by this industry analysis through a complimentary PDF download of the sample report.

We provide our clients the option to personalize the alcopop market report to suit their needs. By customizing the report, you can get data as per your format and definition. Also, the customization option allows you to gain a deeper dive into a specific segment, region, customer, or market competitor.

FAQ's

The alcopop market report covering key segments are base type, packaging type, distribution channel, and region.

Alcopop Market Size Worth $8.05 Billion by 2032.

The global alcopop market is expected to grow at a CAGR of 6.60% during the forecast period.

North America is leading the global market.

key driving factors in alcopop market are Rising Prevalence of Alcopops are driving the market growth.