Alkenyl Succinic Anhydride (ASA) Market Size, Share, Trends, & Industry Analysis Report

By Type (HDSA, DDSA, ODSA), By Alkyl Chain Length, By Market Purity, By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM5865

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

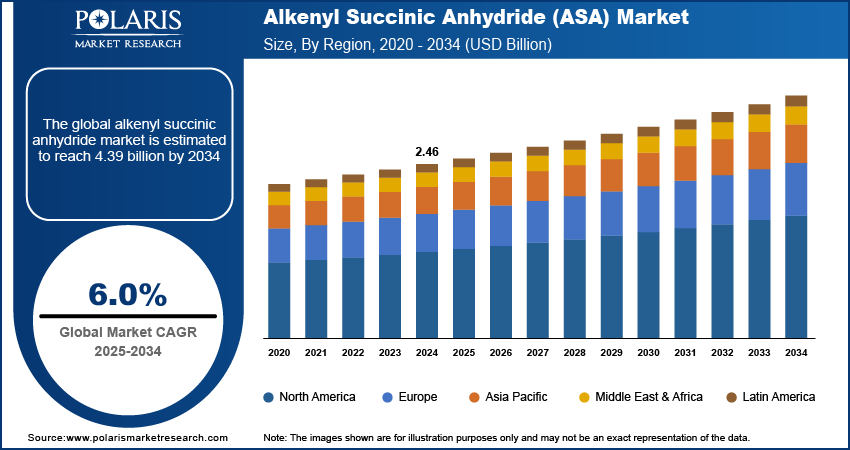

The global alkenyl succinic anhydride (ASA) market size was valued at USD 2.46 billion in 2024, growing at a CAGR of 6.0% during 2025–2034. Increasing use of alkenyl succinic anhydride in the paper and pulp industry to enhance water resistance and achieve better print quality is driving industry growth.

Alkenyl succinic anhydride (ASA) is a synthetic sizing agent extensively used in the paper and pulp industry to enhance internal sizing efficiency in high-speed production environments. Its compatibility with alkaline and neutral paper-making systems, combined with effective reactivity with cellulose fibers, offers a dependable alternative to traditional rosin-based sizes. ASA helps improve printability, reduce water absorption, and increase the durability of printing and writing papers. Its application also contributes to minimizing pitch-related issues and improving machine runnability, supporting higher operational stability.

The shift toward environmentally responsible chemical use in paper manufacturing further fueling ASA adoption, as it helps to reduce environmental impact and higher performance yield. ASA is also witnessing steady growth in tissue, coated paper, fine paper, and packaging board segments due to its flexible formulation and processing efficiency. Manufacturers are focusing on cost efficiency and modernizing production processes that rely on ASA to achieve consistent product quality while minimizing resource usage. Ongoing advancements in ASA emulsification, dosing, and retention systems are expected to strengthen its role across the industry.

To Understand More About this Research: Request a Free Sample Report

ASA usage is increasing in the textile industry for its use in fabric treatment and industrial coating applications. It helps improve fabric durability by enhancing resistance to moisture, wear, and chemicals. Textile manufacturers benefit from its ability to support strong bonding in finishing agents. It helps to produce technical fabrics used in industrial and protective wear. ASA blends well with polymer systems, making it suitable for textile coatings that require consistent performance in large-scale production.

Rising focus on sustainability certifications and eco-label compliance is shaping procurement strategies within the paper manufacturing sector. As an example, International Energy Agency (IEA) reported that the pulp and paper sector contributed to around 2% of total industrial emissions in 2022. Thus, the demand for the eco-label ASA products is expected to grow rapidly in the coming years. ASA-based systems help mills meet evolving buyer expectations related to environmental responsibility and chemical traceability. Companies are opting for green premium products to meet its sustainability goals, which is leading to wider ASA inclusion in approved chemical lists. These factors, combined with the growing importance of operational transparency and lifecycle performance, are creating a favorable environment for continued ASA demand across modern and legacy production assets.

Industry Dynamics

Rising Demand for Alkenyl Succinic Anhydride (ASA) in Paper and Pulp Industry

The use of alkenyl succinic anhydride (ASA) is increasing steadily across the paper and pulp industry as manufacturers seek to improve internal sizing efficiency and meet evolving production requirements. According to the World Wide Fund for Nature (WWF), approximately 405 million tonnes of paper and paperboard packaging are produced annually and is expected to double by 2050. ASA provides reliable performance in alkaline and neutral pH environments, making it suitable for modern paper-making systems that prioritize process stability and material compatibility. Its ability to react quickly with cellulose fibers enhances water resistance and supports better print quality across various paper grades. As production volumes rise and demand for high-quality paper continues across global markets, ASA offers the consistency and efficiency needed for continuous operations.

This growing preference is also driven by operational improvements such as reduced downtime, improved machine cleanliness, and minimized chemical waste. ASA helps paper producers maintain steady sizing performance even under variable processing conditions, which is important for facilities running multiple grades or operating under fluctuating raw material quality. Its integration into production lines aligns with long-term goals of optimizing output, reducing input variability, and enhancing product reliability. These benefits, combined with the ongoing shift away from traditional rosin-based sizing agents, are contributing to the broader adoption of ASA across the global paper and pulp segment.

Growing Demand for Bio-Based Alkenyl Succinic Anhydride Products

Increasing focus on sustainable sourcing and reduced reliance on fossil-derived chemicals is pushing the development and adoption of bio-based ASA products. Manufacturers are exploring renewable feedstocks to produce environmentally responsible ASA variants that meet the goals of lowering carbon footprints and meeting green certification requirements. Bio-based formulations support compliance with procurement criteria set by eco-label programs and sustainability-conscious end-users, particularly in markets such as premium packaging, stationery, and specialty paper.

This shift is also influenced by stricter environmental regulations and increased transparency in supply chains, prompting chemical producers to invest in alternative production pathways. For instance, the UN Net-Zero Coalition aims for global carbon neutrality by 2050, in line with the Paris Agreement. By 2023, over 140 countries, responsible for around 88% of global emissions committed to this goal. Bio-based ASA products offer comparable performance to conventional variants while helping customers meet internal ESG targets. Their growing availability is creating new business opportunities across paper-producing regions that are prioritizing cleaner input materials. As demand rises for traceable, low-impact raw materials, bio-based ASA is positioned to become an important component of the global paper chemicals portfolio.

-market-size-worth-usd-4.39-billion-by-2034.png)

Segmental Insights

Type Analysis

The global segmentation, based on type includes, HDSA, DDSA, ODSA, OSA, and others. The HDSA segment is projected to grow during the forecast period. This growth is attributed to its broad utility in paper sizing and lubricant formulations. Its strong hydrophobic nature allows for efficient binding with cellulose fibers, enhancing water resistance and print performance in alkaline paper-making systems. Additionally, HDSA’s chemical stability supports consistent quality in lubricant dispersants and corrosion inhibitors. Its compatibility with bulk manufacturing processes with its cost-efficiency and availability has cemented its place across high-demand sectors. The material's proven track record in delivering performance while simplifying processing continues to reinforce its dominance across industrial applications.

The ODSA segment is projected to grow at a robust pace in the coming years, fueled by its favorable properties for high-load and high-temperature environments. The extended alkyl chain length improves thermal and oxidative stability, making it well-suited for advanced lubricant systems, polymer additives, and engineered plastics. Manufacturers are increasingly adopting ODSA to address performance requirements in sectors such as automotive, aerospace, and high-performance coatings. With ongoing efforts to improve fuel efficiency and extend equipment life, the demand for high-functionality additives like ODSA is anticipated to grow consistently across diversified industrial domains.

Alkyl Chain Length Analysis

The global segmentation, based on alkyl chain length includes, C4, C6, C8, C10, C12, and C14. The C12 segment accounted for significant market share in 2024, by providing a balanced combination of hydrophobicity and chemical reactivity. This chain length is effective in applications such as internal paper sizing, where moderate hydrophobic interaction with cellulose fibers enhances moisture resistance. Additionally, C12 variants are widely utilized in coatings and lubricants due to their compatibility with various formulation systems. Their manageable viscosity and ease of dispersion make them a practical choice in high-throughput industrial processes. As industries prioritize formulation consistency, the C12 segment maintains a stronghold through reliability and well-established performance benchmarks.

The C14 segment is projected to grow at a significant pace during the assessment phase, owing to rising demand for enhanced thermal performance and surface protection in heavy-duty applications. Longer alkyl chains provide improved coverage, superior film formation, and higher resistance to chemical degradation. These characteristics are valuable in advanced lubricant systems, corrosion-resistant surface treatments, and moisture-barrier coatings. As end-use sectors such as industrial manufacturing and automotive continue to adopt next-generation performance chemicals, C14-based ASA compounds are gaining market attention for their durability and compatibility with newer material technologies.

Market Purity Analysis

The global segmentation, based on market purity includes, 99%, 99.5%, 99.9%, and 99.99%. The 99% segment held substantial value of the market in 2024, due to their suitability for general industrial applications where ultra-high purity is not essential. These variants are extensively used in paper manufacturing, surface coatings, and adhesive formulations. Their ease of integration into existing production lines and favorable cost-performance ratio make them a practical choice for volume-driven industries. Manufacturers favor 99% purity products for their stability, reliable reactivity, and ability to maintain consistent output quality in continuous processing environments, further supporting their dominant market positioning.

The 99.9% segment is estimated to hold a substantial market share in 2034, driven by rising demand for high-precision formulations in electronics, pharmaceuticals, and specialty coatings. Such applications require minimal contamination, consistent molecular structure, and tight specification compliance. ASA compounds with this level of purity are being used in formulations where even trace impurities can affect performance, shelf life, or safety. As regulatory standards become more stringent and product differentiation relies increasingly on purity and performance, 99.9% ASA variants are securing a growing share among quality-focused end-use segments.

Application Analysis

The global segmentation, based on application includes, lubricants, coatings, plastics, additives, and other applications. The lubricants segment held the largest share of the market in 2024, due to its effective use as a dispersant, emulsifier, and corrosion inhibitor. ASA helps stabilize lubricant formulations, enhance oxidative resistance, and reduce sludge formation in high-stress mechanical systems. These properties are critical in maintaining engine performance and reducing maintenance frequency across automotive and industrial settings. ASA’s compatibility with synthetic and semi-synthetic oils widened its adoption among lubricant formulators seeking to meet modern efficiency and emissions requirements. Its multifunctionality and adaptability continue to support its dominance within lubricant applications.

The coatings segment is estimated to hold a significant market share in 2034, due to increasing requirements for chemical resistance, moisture control, and adhesion management in industrial and architectural surfaces. ASA is being integrated into high-performance coatings for infrastructure, packaging, and marine applications, where its ability to improve barrier properties and surface bonding offers functional and economic advantages. Demand for advanced coating solutions in emerging economies and specialized construction projects is further accelerating ASA usage. As coating systems evolve to meet environmental and durability standards, ASA continues to find expanding roles in next-generation formulations.

End User Analysis

The global segmentation, based on application includes, automotive, pulp & paper, textile & apparel, construction, pharmaceuticals, personal care & cosmetics, and other end users. The pulp & paper segment captured substantial market share in 2024, due to its efficiency as an internal sizing agent in alkaline paper-making systems. ASA reacts quickly with cellulose fibers, imparting improved print performance, water resistance, and mechanical strength to finished paper products. These benefits are particularly valued in packaging boards, printing papers, and specialty tissue grades. ASA also enables consistent production with reduced chemical waste, supporting operational efficiency and environmental compliance. With steady demand across commercial, industrial, and consumer paper products, ASA continues to be a strategic component for mills worldwide.

The personal care and cosmetics segment is estimated to grow at a significant CAGR from 2025-2034, driven by increased adoption in emulsifiers, thickeners, and moisture-retention agents. ASA derivatives are valued for their mild reactivity, chemical stability, and compatibility with diverse formulation systems, including bio-based and synthetic products. Applications span across creams, lotions, cleansers, and hair conditioners, where they improve product texture and performance. With consumers seeking high-functionality personal care items that meet environmental and skin-safety standards, ASA’s role in enhancing formulation quality is becoming more integral to product innovation pipelines. This growth trend is supported by leading cosmetic-producing countries such as South Korea, France, and US. For example, according to South Korea's Ministry of Food and Drug Safety, the country exported cosmetics worth USD 10.28 billion in 2024, reflecting a 20.3% increase compared to 2023.

Regional Analysis

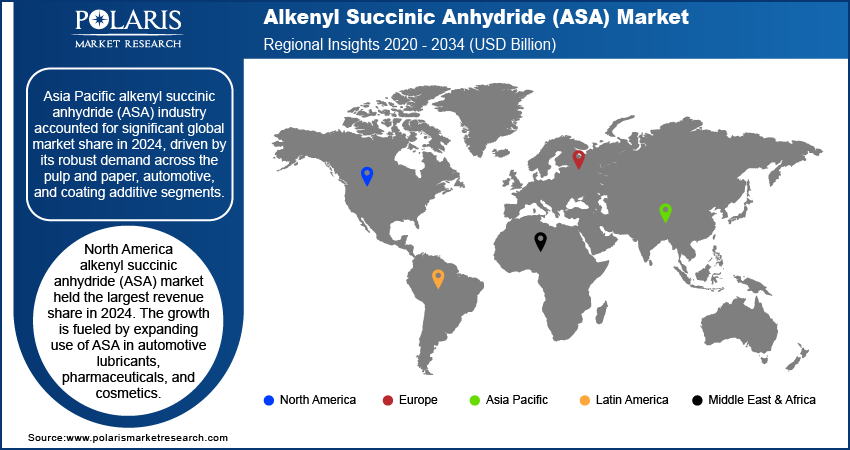

Asia Pacific alkenyl succinic anhydride (ASA) industry accounted for significant global market share in 2024, driven by its robust demand across the pulp and paper, automotive, and coating additive segments. The region benefits from high-volume manufacturing capacities in countries such as China, India, Japan, and South Korea, where cost-effective production models and expanding industrial infrastructure are central to sustained market growth.

China Alkenyl Succinic Anhydride (ASA) Market Insight

The China alkenyl succinic anhydride market, captured substantial regional share. This is attributed to the presence of well-established paper-making industry that significantly utilizes the use of ASA in alkaline sizing applications to meet higher standards in printability and water resistance. According to Sunsirs, China domestic paper production capacity grown by 1 million tons for double adhesive paper, 1.3 million tons for white cardboard, and 1.36 million tons for household paper by the third quarter of 2024. Additionally, regional automotive OEMs are incorporating ASA-based lubricant additives to improve engine cleanliness and operational efficiency. Favorable regulatory shifts aimed at encouraging cleaner manufacturing practices and reducing import dependency on specialty additives further boosted regional adoption. Growth is also supported by rising investments in R&D focused on bio-based ASA derivatives and advanced performance formulations for temperature-stable industrial applications.

North America Alkenyl Succinic Anhydride (ASA) Market Assessment

North America alkenyl succinic anhydride market held the largest revenue share in 2024. The growth is fueled by expanding use of ASA in automotive lubricants, pharmaceuticals, and cosmetics. According to the OICA, U.S. car production rose from 10.05 million units in 2022 to 10.56 million units in 2024, marking a growth of approximately 5.1% within the span of two years. This steady rise may bolster demand for ASA-based additives used in automotive coatings, lubricants, and sealants. Furthermore, the US dominates the ASA market in this region due to a well-established specialty chemicals sector and rising demand for performance-driven, compliant ingredients. Increasing focus on bio-derived ASA products aligns with corporate sustainability goals and evolving consumer expectations. Additionally, paper processors are adopting ASA to improve recyclability and alkaline sizing. Industry-academic partnerships and regulatory support continue to encourage innovation and long-term usage across applications.

Europe Alkenyl Succinic Anhydride (ASA) Market Overview

Europe is alkenyl succinic anhydride market is driven by the steady demand for ASA across coatings, plastics, and lubricant systems. For instance, in January 2025, AkzoNobel announced an investment of USD 25.52 million to expand and modernize its powder coatings facility in Como, Italy, enhancing production efficiency and capacity. This development impacts the demand for ASA-based additives used in coatings formulations, supporting innovation in surface treatment applications. Countries such as Germany, France, and Italy remain significantly contributes in ASA adoption for its stability and compliance with regional standards. This growth is further driven by REACH-compliant formulations and environmental labeling frameworks that support lower-emission additives. Moreover, rising interest in skin-safe and biodegradable ASA-based emulsifiers is expanding the product’s reach in personal care. Ongoing investments in high-purity production and tailored applications help maintain Europe's competitive position in the global ASA landscape.

Key Players & Competitive Analysis

The alkenyl succinic anhydride (ASA) industry is highly competition, driven by growing demand for performance additives and application-specific customization. Companies are expanding capacities and improving supply reliability to meet rising usage in paper sizing, lubricants, and coatings. Innovation in bio-based and high-purity variants is gaining traction in regulated sectors. R&D efforts aim to enhance stability and extend ASA’s application across industrial and consumer segments. Regional partnerships and regulatory alignment continue to influence market positioning and long-term competitiveness.

Key companies in the industry include Kemira Oyj, Mare Holding S.p.A., Vertellus Holdings LLC, Chevron Phillips Chemical Company LLC, Ineos Group Limited, AnHui Sinograce Chemical Co., Ltd., Tianyu Fine Chemical Co., Ltd., Zhejiang Huayang Technology Co., Ltd., Anqing Hongyu Chemical Co., Ltd., Shanghai Fortune Chemical Co., Ltd., Hangzhou Dayangchem Co., Ltd., and Tokyo Chemical Industry Co., Ltd. (TCI).

Key Players

- Kemira Oyj

- Mare Holding S.p.A.

- Vertellus Holdings LLC

- Chevron Phillips Chemical Company LLC

- Ineos Group Limited

- AnHui Sinograce Chemical Co., Ltd.

- Tianyu Fine Chemical Co., Ltd.

- Zhejiang Huayang Technology Co., Ltd.

- Anqing Hongyu Chemical Co., Ltd.

- Shanghai Fortune Chemical Co., Ltd.

- Hangzhou Dayangchem Co., Ltd.

- Tokyo Chemical Industry Co., Ltd. (TCI)

Industry Developments

June 2025: Ruqinba Chemical showcased its advanced alkenyl succinic anhydride-based metalworking additives and surfactants at the Lubricant Expo China 2025. The company emphasized ASA's multifunctional performance in enhancing lubrication, corrosion resistance, and emulsification in industrial fluid formulations.

November 2024: INEOS partnered with GNFC to build a large-scale acetic acid plant in India, aiming to boost local chemical manufacturing. This is expected to improve raw material availability for ASA production, supporting its use in paper sizing, textiles, and specialty chemicals.

September 2024: Kemira expanded its production capacity for alkenyl succinic anhydride sizing agents at its Nanjing site in China to meet the rising demand from the paper and board industry in the Asia-Pacific region. This strategic investment aims to strengthen Kemira's regional supply capabilities and support long-term customer growth.

Alkenyl Succinic Anhydride Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- HDSA

- DDSA

- ODSA

- OSA

- Others

By Alkyl Chain Length Outlook (Revenue, USD Billion, 2020–2034)

- C4

- C6

- C8

- C10

- C12

- C14

By Market Purity Outlook (Revenue, USD Billion, 2020–2034)

- 99%

- 99.5%

- 99.9%

- 99.99%

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Lubricants

- Coatings

- Plastics

- Additives

- Other Applications

By End User Type Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Pulp & Paper

- Textile & Apparel

- Construction

- Pharmaceuticals

- Personal Care & Cosmetics

- Other End Users

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Alkenyl Succinic Anhydride (ASA) Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.46 Billion |

|

Market Size in 2025 |

USD 2.61 Billion |

|

Revenue Forecast by 2034 |

USD 4.39 Billion |

|

CAGR |

6.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.46 billion in 2024 and is projected to grow to USD 4.39 billion by 2034.

The global market is projected to register a CAGR of 6.0% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Kemira Oyj, Mare Holding S.p.A., Vertellus Holdings LLC, Chevron Phillips Chemical Company LLC, Ineos Group Holdings S.A., AnHui Sinograce Chemical Co., Ltd., Tianyu Fine Chemical Co., Ltd., Zhejiang Huayang Technology Co., Ltd., Anqing Hongyu Chemical Co., Ltd., Shanghai Fortune Chemical Co., Ltd., Hangzhou Dayangchem Co., Ltd., and Tokyo Chemical Industry Co., Ltd. (TCI).

The lubricants segment held the largest share of the market in 2024.

The 99% segment held substantial value of the market in 2024.