Animal Ultrasound Market Size, Share, Trends, Industry Analysis Report

: By Animal (Small Animals and Large Animals), Solution, Type, End Use, Technology, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 115

- Format: PDF

- Report ID: PM3336

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

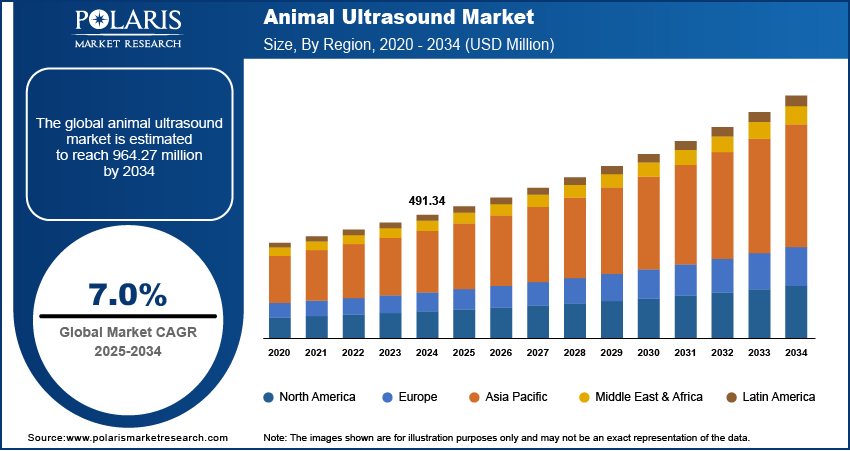

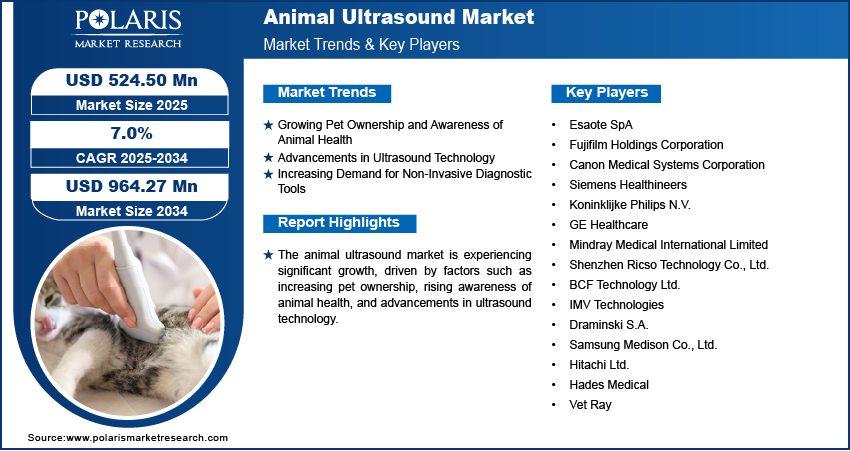

The animal ultrasound market size was valued at USD 491.34 million in 2024, exhibiting a CAGR of 7.0% during 2025–2034. The market is collectively driven by rising pet ownership, growing awareness of animal health, advancements in ultrasound technology, increasing demand for non-invasive diagnostics, and the expanding use of portable devices and telemedicine in veterinary care.

Key Insights

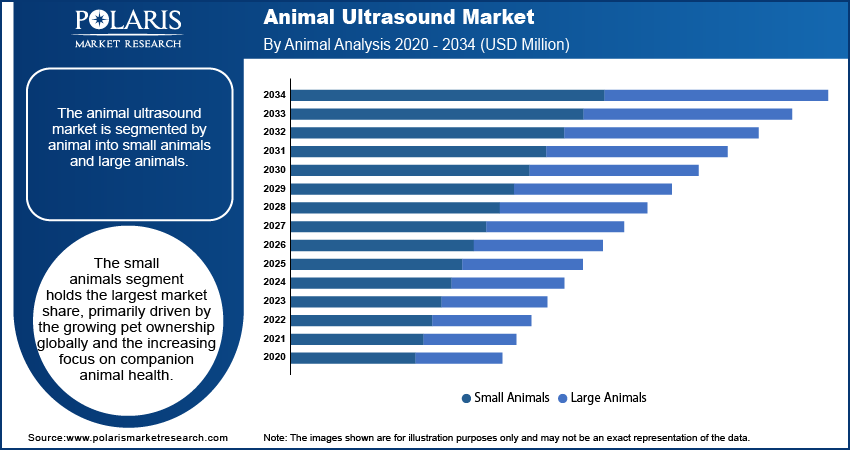

- The small animals segment holds the largest market share, driven by growing pet ownership, focus on companion animal health, and frequent use of advanced diagnostic tools in veterinary clinics.

- The equipment segment leads the market, supported by demand for portable, high-resolution ultrasound machines with advanced features such as Doppler imaging.

- Doppler imaging is expanding fastest, driven by its application in cardiology and vascular assessments, especially for diagnosing heart conditions in pets.

- Veterinary hospitals & clinics dominate the market, benefiting from advanced infrastructure and growing demand for comprehensive diagnostic services.

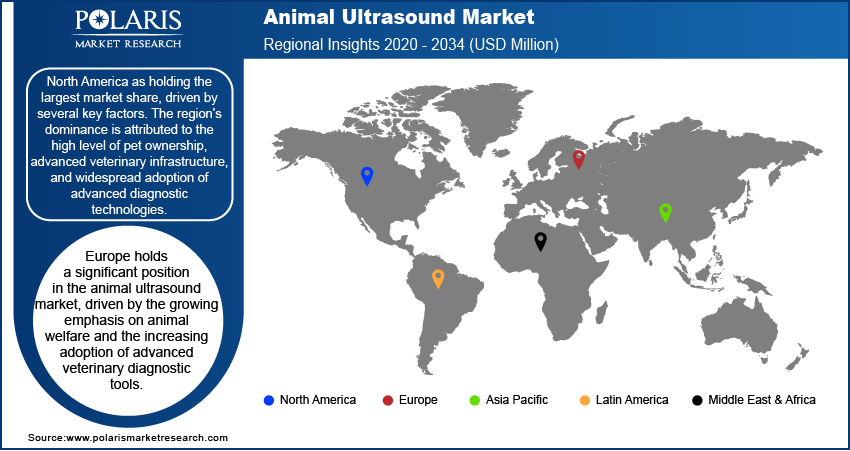

- North America holds the largest regional market share, supported by high pet ownership, advanced veterinary care infrastructure, and early adoption of diagnostic technologies.

- Europe maintains a strong market presence due to high pet ownership, focus on animal welfare, and widespread availability of modern veterinary services.

Industry Dynamics

- Rising pet ownership, growing livestock farming, and increasing demand for non-invasive diagnostics are driving overall market growth across segments and regions.

- Advancements in portable ultrasound technology and digitization, including PACS and telemedicine, enhance diagnostic efficiency and broaden accessibility.

- Expanding use of ultrasound in education, research, and rural livestock management is creating new adoption across non-traditional end users.

- High equipment costs, limited access in rural areas, and a lack of trained professionals are key restraints slowing broader market penetration.

Market Statistics

2024 Market Size: USD 491.34 million

2034 Projected Market Size: USD 964.27 million

CAGR (2025–2034): 7.0%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The animal ultrasound market encompasses the use of ultrasound imaging technology for diagnostic and monitoring purposes in veterinary medicine. This market is driven by increasing pet ownership, rising awareness of animal health, and advancements in ultrasound technology that improve diagnostic accuracy. The demand for non-invasive diagnostic tools and the growing adoption of ultrasound for preventive care in livestock are also contributing factors. The animal ultrasound market trends include the integration of portable and handheld ultrasound devices, the rise of telemedicine in veterinary practices, and the increasing application of ultrasound in specialized areas such as cardiology and reproduction. The market is further influenced by the need for early disease detection and the ongoing development of more user-friendly and cost-effective ultrasound systems.

Market Dynamics

Growing Pet Ownership and Awareness of Animal Health

The increasing number of pet owners worldwide has significantly contributed to the animal ultrasound market growth. According to the American Pet Products Association (APPA), approximately 67% of the US households owned a pet in 2023, indicating a rising trend in pet ownership. This growth is coupled with heightened awareness of the importance of regular veterinary care, including diagnostic imaging, to ensure the early detection and management of health issues in pets. As pet owners become more proactive about their animals' health, the demand for advanced diagnostic tools such as ultrasound is increasing, driving market expansion.

Advancements in Ultrasound Technology

Technological advancements in ultrasound devices are another major animal ultrasound market driver. Innovations such as the development of portable and handheld ultrasound machines have made it easier for veterinarians to perform diagnostics in various settings, including remote locations. These devices offer high-resolution imaging and user-friendly interfaces, which improve diagnostic accuracy and efficiency. Furthermore, the integration of features such as Doppler imaging and real-time data sharing enhances the utility of ultrasound in veterinary practices, contributing to its widespread adoption.

Increasing Demand for Non-Invasive Diagnostic Tools

The preference for non-invasive diagnostic methods is rising among both pet owners and veterinary professionals. Ultrasound technology, being a safe and non-invasive diagnostic tool, is gaining popularity for its ability to provide detailed internal imaging without the need for surgery or sedation. This demand is particularly strong in the livestock industry, where regular health monitoring is essential for disease prevention and management. The use of ultrasound in reproductive management and cardiovascular diagnostics in animals is becoming increasingly common, reflecting a broader trend towards non-invasive veterinary care solutions.

Segment Insights

Assessment by Animals

The animal ultrasound market is segmented by animals into small animals and large animals. The small animals segment holds the largest market share, primarily driven by the growing pet ownership globally and the increasing focus on companion animal health. The rising demand for advanced diagnostic tools in veterinary clinics for pets such as dogs and cats contribute significantly to the dominance of this segment. The availability of specialized ultrasound devices designed for small animals and the increased frequency of routine check-ups and diagnostic procedures are key factors supporting this growth.

The large animals segment is also registering the fastest growth, attributed to the expanding livestock industry and the need for efficient reproductive and health management. The use of ultrasound technology in large animals, including cattle and horses, is becoming more prevalent due to its effectiveness in early disease detection, pregnancy monitoring, and overall health assessment. The adoption of portable ultrasound devices for on-site diagnostics in farms and rural areas further drives growth in this segment, reflecting the broader application of veterinary ultrasound in large-scale animal management.

Evaluation by Solution

The animal ultrasound market is segmented by solution into equipment, accessories/consumables, and PACS (Picture Archiving and Communication Systems). The equipment segment holds the largest animal ultrasound market share, driven by the increasing demand for advanced ultrasound machines in veterinary practices. The continuous development of portable and handheld devices, along with the integration of innovative features such as Doppler imaging and enhanced image resolution, contributes significantly to the segment's dominance. The widespread adoption of these devices in both urban and rural veterinary settings underscore the growing reliance on sophisticated diagnostic equipment for accurate animal health assessments.

The PACS (Picture Archiving and Communication Systems) segment is also registering the fastest growth, fueled by the rising need for efficient data management and storage solutions in veterinary clinics and hospitals. The adoption of PACS enables seamless access, retrieval, and sharing of diagnostic images, enhancing the overall workflow and collaboration among veterinary professionals. As veterinary practices increasingly digitize their operations, the demand for robust and secure image archiving systems is accelerating, positioning the PACS segment as a key growth driver in the market.

Assessment by Type

The animal ultrasound market segmentation, based on type, includes 2-D ultrasound imaging, 3-D/4-D ultrasound imaging, and Doppler imaging. The 2-D ultrasound imaging segment holds the largest market share due to its widespread use in veterinary practices for routine diagnostic procedures. This imaging type is cost-effective and provides clear, real-time images, making it a preferred choice for general health assessments, pregnancy detection, and basic diagnostic needs in both small and large animals. Its ease of use and broad applicability contribute to its dominance in the market.

The Doppler imaging segment is also experiencing the fastest growth, driven by the increasing demand for advanced diagnostic capabilities in veterinary cardiology and vascular assessments. Doppler imaging allows for detailed evaluation of blood flow and heart function, which is critical for diagnosing cardiovascular conditions and monitoring reproductive health in animals. The rising awareness of the benefits of Doppler technology, along with the growing prevalence of heart-related conditions in pets, is fueling its rapid adoption, positioning it as a significant growth area within the animal ultrasound market.

Outlook by End Use

The animal ultrasound market is segmented by end use into veterinary hospitals & clinics and other end use. The veterinary hospitals & clinics segment holds the largest market share, driven by the increasing number of veterinary facilities equipped with advanced diagnostic tools. These establishments frequently utilize ultrasound technology for a wide range of diagnostic procedures, from routine check-ups to complex health assessments, due to its non-invasive nature and reliability. The growing pet population and rising expenditure on veterinary healthcare services further support the dominance of this segment, as more pet owners seek comprehensive diagnostic care for their animals.

The other end use segment, which includes research institutions, academic settings, and livestock management facilities, is also registering the fastest growth. This growth is fueled by the expanding application of ultrasound technology in animal research and agricultural settings. The need for efficient and non-invasive health monitoring in large-scale livestock operations, along with the increasing focus on veterinary research and education, drives the adoption of ultrasound solutions in these environments. The demand for specialized diagnostic tools in reproductive management and disease prevention within these sectors is contributing to the rapid expansion of this segment.

Regional Insights

By region, the study provides animal ultrasound market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, driven by several key factors. The region's dominance is attributed to the high level of pet ownership, advanced veterinary infrastructure, and widespread adoption of advanced diagnostic technologies. The US, in particular, leads the market due to significant investments in veterinary healthcare and a strong focus on companion animal health. Additionally, the presence of major market players and continuous technological advancements further boosts the animal ultrasound market in North America. Other regions, such as Europe and Asia Pacific, are also witnessing growth due to increasing awareness of animal health and rising investments in veterinary services, but North America remains at the forefront due to its mature market and robust veterinary ecosystem.

Europe holds a significant position in the animal ultrasound market, driven by the growing emphasis on animal welfare and the increasing adoption of advanced veterinary diagnostic tools. Countries such as Germany, the UK, and France are key contributors due to their well-established veterinary healthcare systems and high pet ownership rates. The European market is also supported by stringent regulations promoting animal health and the presence of numerous veterinary clinics equipped with modern diagnostic equipment. The rising awareness of preventive care and the demand for efficient livestock management solutions further boost the market in this region.

Asia Pacific is experiencing rapid animal ultrasound market growth, fueled by increasing pet adoption rates and expanding livestock industries in countries such as China, India, and Japan. The growing middle-class population and rising disposable incomes are leading to higher spending on pet healthcare and veterinary services. Additionally, the region's focus on improving agricultural productivity and livestock health is driving the adoption of advanced diagnostic tools, including ultrasound technology. The presence of emerging economies and ongoing developments in veterinary infrastructure are expected to continue propelling market growth in Asia Pacific.

Key Players and Competitive Insights

The animal ultrasound market features several key players actively contributing to its growth. Companies such as Esaote SpA, Fujifilm Holdings Corporation, and Canon Medical Systems Corporation are prominent in the development and distribution of veterinary ultrasound equipment. Other notable players include Siemens Healthineers, Koninklijke Philips N.V., and GE Healthcare, all of which offer a range of ultrasound solutions tailored for veterinary applications. Mindray Medical International Limited and Shenzhen Ricso Technology Co., Ltd. are also actively engaged in providing innovative ultrasound products for both small and large animals. Additional participants such as BCF Technology Ltd., IMV Technologies, and Draminski S.A. focus on specialized veterinary imaging solutions. These companies compete based on factors such as technological advancements, product portfolio, and service offerings. The market is characterized by continuous innovation, with many players investing in research and development to enhance the functionality and efficiency of their ultrasound devices. Companies are also focusing on developing portable and user-friendly solutions to cater to the growing demand for mobile veterinary services. Price competitiveness and the availability of after-sales support are other critical factors influencing competition in the market.

Strategic collaborations, partnerships, and mergers also shape the competitive landscape, expanding animal ultrasound market presence and enhancing product offerings. For instance, partnerships between veterinary clinics and ultrasound equipment manufacturers are common to provide customized solutions and improve diagnostic accuracy. Additionally, the increasing adoption of telemedicine and digital imaging solutions has prompted several companies to integrate advanced features such as cloud connectivity and data analytics into their ultrasound systems, further intensifying competition in the market.

Esaote SpA is a significant animal ultrasound market player. It is known for its range of veterinary imaging solutions and specializes in developing ultrasound systems for both small and large animals.

Fujifilm Holdings Corporation is another major player. It offers a variety of diagnostic imaging systems, including veterinary ultrasound. The company continues to expand its presence in the veterinary market with innovative technologies.

List of Key Companies

- Esaote SpA

- Fujifilm Holdings Corporation

- Canon Medical Systems Corporation

- Siemens Healthineers

- Koninklijke Philips N.V.

- GE Healthcare

- Mindray Medical International Limited

- Shenzhen Ricso Technology Co., Ltd.

- BCF Technology Ltd.

- IMV Technologies

- Draminski S.A.

- Samsung Medison Co., Ltd.

- Hitachi Ltd.

- Hades Medical

- Vet Ray

Animal Ultrasound Industry Developments

- October 2024: Fujifilm introduced an advanced ultrasound system with improved Doppler imaging capabilities, focusing on delivering more precise diagnostics for cardiovascular and abdominal conditions in animals.

- September 2024: Esaote announced the launch of a new portable ultrasound system designed to offer enhanced image quality and user-friendly features, aimed at improving diagnostic efficiency in veterinary practices.

Animal Ultrasound Market Segmentation

By Animal Outlook

- Small Animals

- Large Animals

By Solution Outlook

- Equipment

- Accessories/Consumables

- PACS (Picture Archiving and Communication Systems)

By Type Outlook

- 2-D Ultrasound Imaging

- 3-D/4-D Ultrasound Imaging

- Doppler Imaging

By End Use Outlook

- Veterinary Hospitals & Clinics

- Other End Use

By Technology Outlook

- Digital Imaging

- Contrast Imaging

By Application

- Orthopedics

- Cardiology

- Oncology

- Urology & Obstetrics/ Gynecology

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Animal Ultrasound Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 491.34 million |

|

Market Size Value in 2025 |

USD 524.50 million |

|

Revenue Forecast by 2034 |

USD 964.27 million |

|

CAGR |

7.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The animal ultrasound market has been segmented into detailed segments of animal, solution, type, and end use, technology, and application. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The growth and marketing strategies in the animal ultrasound market focus on expanding product offerings through technological advancements, particularly in portable and user-friendly ultrasound systems. Companies are increasing their investment in research and development to improve diagnostic capabilities and enhance user experience. Strategic partnerships with veterinary clinics and hospitals, along with collaborations with educational institutions, are common to expand market reach. Additionally, players are leveraging digital marketing, trade shows, and online platforms to raise awareness and capture a broader customer base, while offering training and support services to drive adoption among veterinarians.

FAQ's

The animal ultrasound market size was valued at USD 491.34 million in 2024 and is projected to grow to USD 964.27 million by 2034.

The market is projected to register a CAGR of 7.0% during the forecast period, 2025-2034.

North America had the largest share of the market.

The animal ultrasound market features several key players actively contributing to its growth. Companies such as Esaote SpA, Fujifilm Holdings Corporation, and Canon Medical Systems Corporation are prominent in the development and distribution of veterinary ultrasound equipment. Other notable players include Siemens Healthineers, Koninklijke Philips N.V., and GE Healthcare, all of which offer a range of ultrasound solutions tailored for veterinary applications.

The small animals segment accounted for the larger share of the market in 2024.

The equipment segment accounted for the larger share of the market in 2024.

Animal ultrasound is a non-invasive imaging technique used to visualize internal organs and structures in animals. It utilizes high-frequency sound waves to produce real-time images, helping veterinarians diagnose various health conditions in both small and large animals. This technology is commonly used for routine check-ups, pregnancy detection, and identifying abnormalities in organs such as the heart, liver, kidneys, and reproductive organs. Animal ultrasound is valued for its safety, as it does not involve radiation, and its ability to provide detailed, clear images that assist in accurate diagnosis and treatment planning.

A few key trends in the market are described below: Rising Adoption of Portable Ultrasound Devices: Increased demand for mobile, handheld ultrasound systems to provide on-site diagnostic services, especially in rural or remote areas. Integration of Advanced Imaging Features: Incorporation of Doppler imaging, 3D/4D imaging, and real-time data sharing to improve diagnostic capabilities. Telemedicine and Remote Diagnostics: Growing use of ultrasound technology for remote consultations and diagnostics, particularly in rural and underserved areas. Shift Toward Non-Invasive Diagnostic Methods: Increased preference for ultrasound over traditional invasive diagnostic techniques due to its safety and effectiveness.

A new company entering the animal ultrasound market could focus on developing portable and user-friendly ultrasound devices, addressing the increasing demand for mobile veterinary services. By integrating advanced features such as real-time data sharing, AI-driven image analysis, and cloud-based solutions, the company could differentiate itself from competitors. Additionally, offering cost-effective and scalable ultrasound systems for both small and large animals could attract a broader customer base. Focusing on providing excellent customer support, training, and maintenance services, along with creating partnerships with veterinary clinics and agricultural facilities, would also help establish a strong market presence.

Companies manufacturing, distributing, or purchasing animal ultrasound and related products, and other consulting firms must buy the report.