Antibiotic Resistance Market Share, Size, Trends, Industry Analysis Report

By Disease (cUTI, CDI, ABSSSI, HABP, CABP, cIAI, and BSI); By Drug Class; By Distribution Channel; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 116

- Format: PDF

- Report ID: PM4434

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

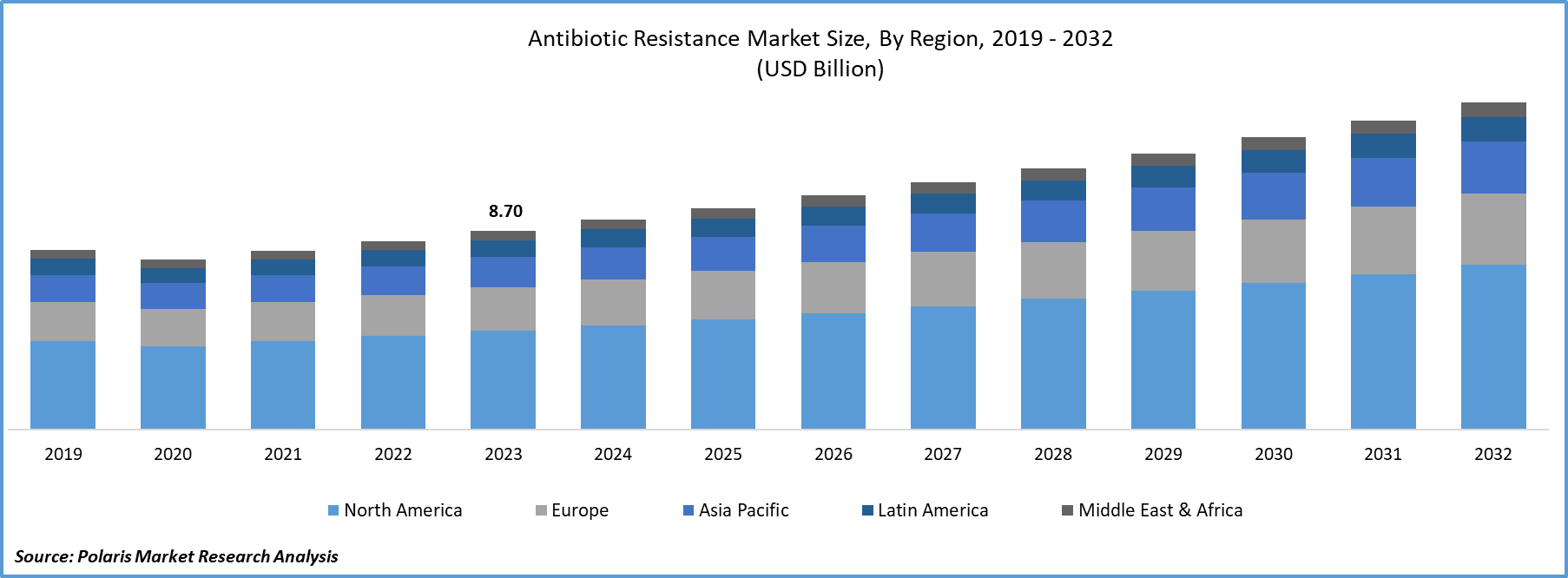

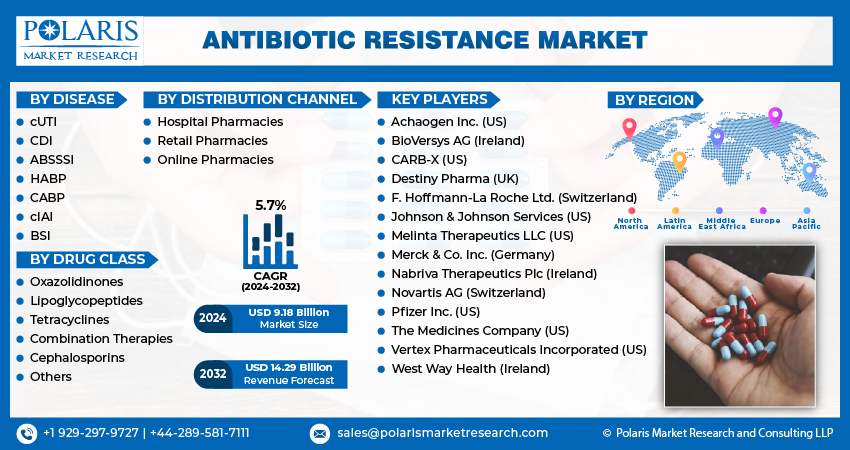

Antibiotic resistance market size was valued at USD 8.70 billion in 2023. The market is anticipated to grow from USD 9.18 billion in 2024 to USD 14.29 billion by 2032, exhibiting the CAGR of 5.7% during the forecast period.

Market Overview

The rapid increase in the burden of antibiotic-resistant infections across the globe and the growing need for effective therapies for effectively addressing antibiotic resistance are major factors driving market growth. Also, the growing cases of overuse or misuse of antibiotics among humans, animals, and agriculture that led to the development of antibiotic resistance is further propelling the market’s growth. For instance, as per a report by the Centers for Disease Control and Prevention, each year, around 2.8 Mn antimicrobial infections are found in the U.S., and over 35,000 people die due to these infections. Globally, more than 1.27 Mn people die because of these infections.

Furthermore, the rising consumption of antibiotics worldwide as a result of drastic population growth, rising incidences of various infectious diseases, and greater access to healthcare facilities also contribute to antibiotic resistance. Thereby, numerous companies are focusing on the development and discovery of new solutions with the ability to combat antibiotic or antimicrobial resistance.

To Understand More About this Research: Request a Free Sample Report

Growth Factors

Rising prevalence of antibiotic-resistant and hospital-acquired infections to drive antibiotic resistance market growth

The rising incidence of antibiotic, as well as hospital-acquired infections around the world, creates substantial demand for effective antibiotics and innovative infection control measures to combat these types of resistant pathogens, a key factor propelling the market’s growth. For instance, according to the Clinical Excellence Commission, there are about 165,000 healthcare-associated infections in Australia every year, which makes them the most common complication affecting patients in hospitals.

Growing development of new novel antibiotics boosting market’s growth

With companies increasingly focusing on the development of new antibiotics that could overcome various resistance mechanisms and treat infections more effectively, there is an emerging growth opportunity in the market. Researchers across the globe are exploring new drug classes, targeting novel bacterial targets, and employing innovative approaches like combination therapies and adjuvants.

Restraining Factors

Stringent government regulations and requirements to hamper market growth

As the development process of new antibiotics and drugs is very complex, lengthy, and expensive, and most of the antibiotics are developed for short durations that result in low profit margins, the market growth is negatively impacted over the years.

Report Segmentation

The market is primarily segmented based on disease, drug class, distribution channel, and region.

|

By Disease |

By Drug Class |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Diseases Insights

Complicated urinary tract infections segment captured largest share in 2023

The complicated urinary tract infections segment accounted for the largest share. Segment’s dominance is attributed to the rising prevalence of these infections globally and the emergence of UTI (urinary tract infections) as a public health concern. For instance, as per a recent study, more than 404.6 million people worldwide were diagnosed with UTIs, and approx. 236,786 people died due to UTIs.

By Drug Class Insights

Oxazolidinones segment held the majority share in 2023

The oxazolidinones segment held the majority share. This dominance is attributable to widespread utilization because of its higher effectiveness against several certain drug-resistant bacteria coupled with its greater efficacy against multidrug-resistant pathogens, including methicillin-resistant staphylococcus aureus and vancomycin-resistant Enterococcus.

The combination therapies segment will grow at the highest pace. This growth is due to its growing adoption and popularity worldwide, as it involves the use of several antibiotics to target infections. In addition, combining antibiotics with different mechanisms also allows for a broader spectrum of activity against several bacterial species.

By Distribution Channel Insights

Online pharmacies segment is expected to witness highest growth during the forecast period

The retail pharmacies segment will grow at the highest pace during the forecast period. Segment’s growth is attributable to the rising emergence of digital pharmacies and telemedicine and a growing number of healthcare companies focusing on establishing their online presence to allow their patients for remote consultation and easy access to antibiotics. Also, advancements in technology, such as digital health records and e-prescribing systems, resulted in enhanced tracking of patient health and monitoring their progress, which, in turn, fostered the segment’s growth.

The hospital pharmacies segment led the market. This dominance is accelerated by a larger patient pool opting for hospital pharmacies for their healthcare needs and a continuous increase in hospital infrastructure in emerging economies worldwide. Moreover, these pharmacies play a vital role in the management of antibiotics for several infections as they enable seamless coordination between healthcare professionals and ensure timely access to antibiotics for patients.

Regional Insights

North America dominated the global antibiotic resistance market industry in 2023

The North America region dominated the global market in 2023. Region’s dominance is attributed to growing funding or investments for scientific research of new drug classes, technological advancements, and rising adoption of innovative antibiotic therapies. In addition, growing awareness among the general public and healthcare professionals regarding the consequences of antibiotics and the creation of educational campaigns focused on addressing such issues are further anticipated to propel the region’s growth. For instance, the National Microbiology Laboratory, Canada, announced that they understand the extent of antimicrobial resistance in the country. It aims to identify new threats and also properly assess the potential burden of AMR worldwide.

APAC is expected to grow at the fastest rate during the forecast period. This growth is accelerated by the region’sa greater prevalence of infectious diseases as a result of the vast population in the region and inefficient regulation or control over the use of antibiotics that led to overuse or misuse, contributing to the development of antibiotic resistance.

Key Market Players & Competitive Insights

Getting regulatory approvals and implementing on strategic partnerships to drive competition

The antibiotic resistance market size is highly competitive in nature with the robust presence of global and regional companies in the market. Major companies are competing on various factors such as new drug development, growing R&D activities or efforts, focusing on regulatory approvals, creating awareness programs, and implementation of strategic partnerships & collaborations.

Some of the major players operating in the global market include:

- Achaogen Inc. (US)

- BioVersys AG (Ireland)

- CARB-X (US)

- Destiny Pharma (UK)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Johnson & Johnson Services (US)

- Melinta Therapeutics LLC (US)

- Merck & Co. Inc. (Germany)

- Nabriva Therapeutics Plc (Ireland)

- Novartis AG (Switzerland)

- Pfizer Inc. (US)

- The Medicines Company (US)

- Vertex Pharmaceuticals Incorporated (US)

- West Way Health (Ireland)

Recent Developments in the Industry

- In November 2022, LumiraDx Healthcare Private Limited announced the launch of its new highly sensitive C-Reactive Protein point-of-care antigen test in India. This test can be used in several clinical settings to reduce unnecessary antibiotic prescribing, which leads to antimicrobial resistance.

Report Coverage

The antibiotic resistance market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, disease, drug class, distribution channel, and their futuristic growth opportunities.

Antibiotic Resistance Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 9.18 billion |

|

Revenue forecast in 2032 |

USD 14.29 billion |

|

CAGR |

5.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

We strive to offer our clients the finest in market research with the most reliable and accurate research findings. We use industry-standard methodologies to offer a comprehensive and authentic analysis of the Antibiotic Resistance Market. Besides, we have stringent data-quality checks in place to enable data-driven decision-making for you.

Browse Our Top Selling Reports

Asia Pacific Immunohistochemistry Market Size, Share 2024 Research Report

Complementary and Alternative Medicine for Anti-Aging & Longevity Market Size, Share 2024 Research Report

Corn Market Size, Share 2024 Research Report

gRNA Market Size, Share 2024 Research Report

Flexible Electronics Market Size, Share 2024 Research Report

FAQ's

The global antibiotic resistance market size is expected to reach USD 14.29 billion by 2032

Key players in the market are Johnson & Johnson Services, Merck & Co. Inc, Pfizer Inc

North America contribute notably towards the global Antibiotic Resistance Market

Antibiotic resistance market exhibiting the CAGR of 5.7% during the forecast period.

The Antibiotic Resistance Market report covering key segments are disease, drug class, distribution channel, and region.