Automated Liquid Handling Technologies Market Size, Share, Trends, Industry Analysis Report

: By Product (Automated Workstations and Reagents & Consumables), Application, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 119

- Format: PDF

- Report ID: PM3029

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

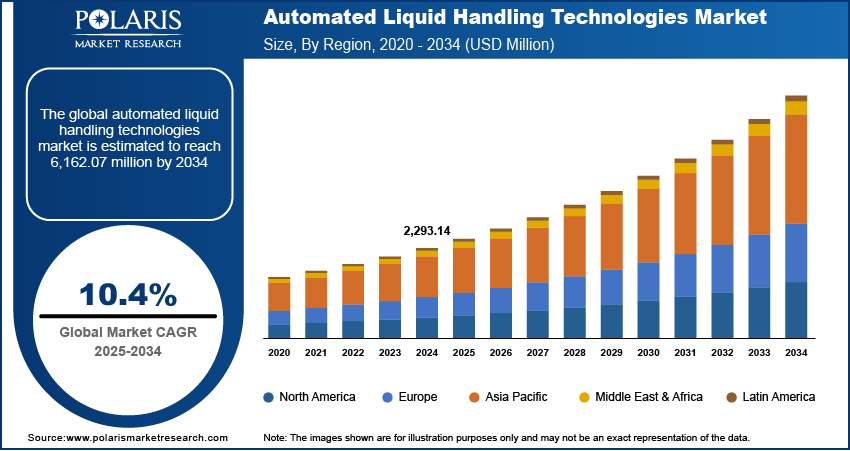

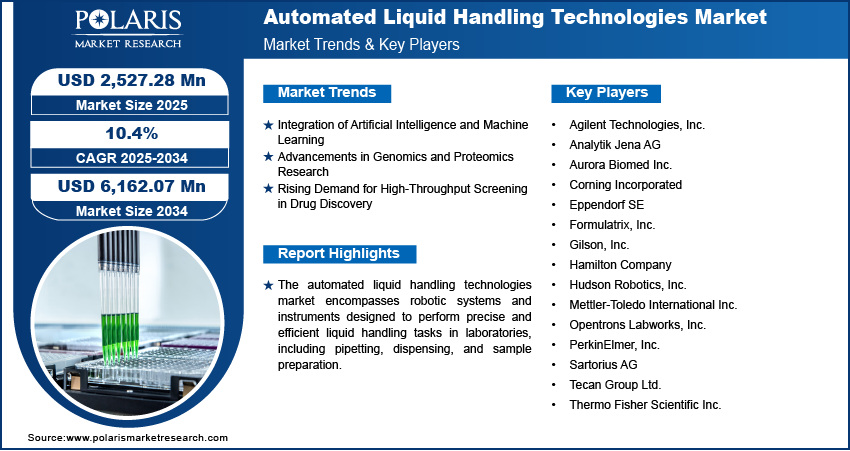

The automated liquid handling technologies market size was valued at USD 2,293.14 million in 2024, growing at a CAGR of 10.4% during 2025–2034. The market growth is primarily fueled by the growing adoption of automation in biotechnology and pharmaceutical research and the expansion of genomics and proteomics research.

Key Insights

- The automated workstations segment led the market in 2024, owing to their crucial role in pharmaceutical and biotechnology research.

- The cancer & genomic research segment is witnessing the fastest growth, as automated liquid handling systems help reduce human error and streamline complex protocols.

- North America led the market in 2024. The presence of a well-established life sciences sector and significant investments in R&D contribute to the region’s leading market share.

- Asia Pacific is witnessing rapid growth. Rising investments in research and development, especially in emerging economies such as Japan and China, contribute to the regional market growth.

Industry Dynamics

- The rising integration of artificial intelligence (AI) and machine learning (ML), which enables advanced error control and remote interaction, fuels market growth.

- The expansion of genomics and proteomics research, which needs precise and reproducible handling of minute liquid volumes, drives the adoption of automated liquid handling technologies.

- The growing emphasis on the development of open-source and low-cost automated liquid handling systems is expected to create several market opportunities.

- The high cost of technologies may hinder market growth.

Market Statistics

2024 Market Size: USD 2,293.14 million

2034 Projected Market Size: USD 6,162.07 million

CAGR (2025-2034): 10.4%

North America: Largest Market in 2024

AI Impact on Automated Liquid Handling Technologies Market

- The ability of AI to adjust for liquid viscosity, temperature, and other variables in real time helps optimize pipetting accuracy.

- Machine learning algorithms streamline assay setup. That way, they reduce human error and improve reproducibility in high-throughput labs.

- AI-driven scheduling coordinates multiple instruments, improving productivity and minimizing workflow bottlenecks.

- Intelligent data analysis from AI-enabled systems helps researchers refine experimental design and improve overall laboratory efficiency.

To Understand More About this Research: Request a Free Sample Report

The automated liquid handling technologies market refers to the industry focused on robotic systems and instruments designed to improve the accuracy, efficiency, and reproducibility of liquid sample transfers in laboratories. Key drivers of market growth include the increasing adoption of automation in pharmaceutical and biotechnology research, the rising demand for high-throughput screening in drug discovery, and the need for minimizing human errors in laboratory workflows.

Technological advancements, such as the integration of artificial intelligence and cloud-based solutions, are shaping market trends. Additionally, the expansion of genomics and proteomics research, along with growing investments in laboratory automation, is further driving the demand for automated liquid handling systems.

Market Dynamics

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) into automated liquid handling systems is a significant automated liquid handling technologies market driver. These technologies enable advanced error control, remote interaction, and adaptive responses to unforeseen issues, such as nozzle blockages during sample handling. The incorporation of AI and ML enhances the efficiency and reliability of laboratory workflows, making automated systems more intelligent and capable of handling complex tasks. This advancement is crucial for laboratories aiming to increase throughput and maintain high precision in their processes.

Advancements in Genomics and Proteomics Research

The expansion of genomics and proteomics research significantly drives the automated liquid handling technologies market expansion. These fields require precise and reproducible handling of minute liquid volumes for applications such as DNA/RNA sequencing and protein assays. Automated systems facilitate high-throughput processing, essential for large-scale studies. The increasing complexity of biological research necessitates advanced liquid handling solutions to ensure accuracy and efficiency in experimental procedures.

Rising Demand for High-Throughput Screening in Drug Discovery

The pharmaceutical industry's growing need for high-throughput screening (HTS) in drug discovery is fueling the automated liquid handling technologies market. HTS allows rapid testing of thousands of compounds for potential therapeutic effects. Automated liquid handling systems enable precise and efficient sample preparation and compound management, which are critical for the success of HTS. The demand for faster drug development timelines and the need to screen extensive compound libraries have made automated liquid handling technologies crucial in modern pharmaceutical research.

Segment Insights

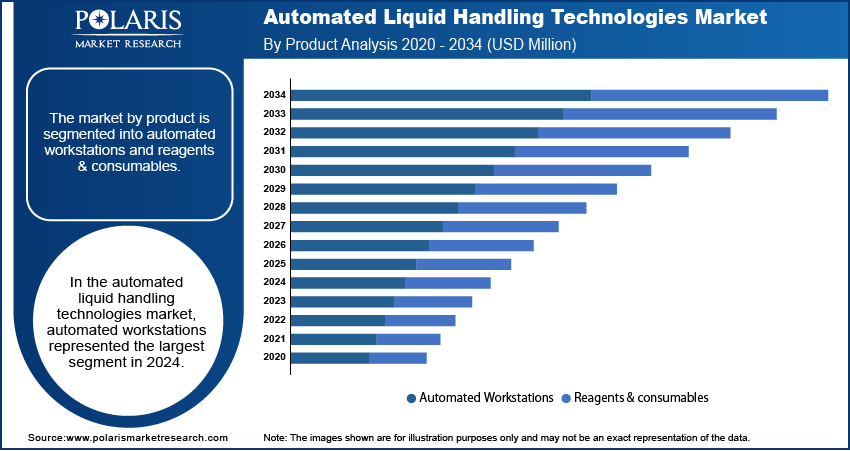

Assessment by Product

The automated liquid handling technologies market segmentation, based on product, includes automated workstations and reagents & consumables. The automated workstations segment dominated the automated liquid handling technologies market share in 2024. These workstations are essential in pharmaceutical and biotechnology research, offering precision and efficiency in tasks such as high-throughput screening and genomic analysis. The ability of automated workstations to handle complex protocols and integrate with various laboratory instruments makes them crucial in modern laboratories, contributing to their dominance.

The reagents & consumables segment is also experiencing significant growth, driven by the increasing adoption of automated systems across various research and clinical settings. Consumables such as specialized pipette tips, reagent reservoirs, and microplates are in high demand, as they are crucial for maintaining the accuracy and reliability of automated processes. The continuous need for these consumables ensures a steady expansion in the segment.

Evaluation by Application

The automated liquid handling technologies market is segmented by application into drug discovery & ADME-Tox research, cancer & genomic research, bioprocessing/biotechnology, and others. The drug discovery and ADME-Tox research segment dominated the market share in 2024. This prominence is attributed to the extensive screening processes in drug discovery, where over a million compounds are often evaluated in a single experiment. Automated liquid handling systems facilitate high-throughput, low-volume, and precise operations essential for such large-scale screenings. Applications within this segment include serial dilutions, compound selection for retesting, and confirmatory analyses, all of which benefit from the integration of automated platforms to enhance throughput and accuracy.

The cancer & genomic research segment is also experiencing the fastest growth in the market. The precision required in dispensing protein or DNA solutions onto substrates or microwells makes manual techniques impractical, leading to increased adoption of automated liquid handling systems. These systems streamline complex protocols, reduce human error, and improve reproducibility, thereby accelerating advancements in cancer studies and genomic analyses.

Outlook by End User

The automated liquid handling technologies market segmentation, based on end user, includes academic & research institutes, pharmaceutical & biotechnology companies, and contract research organizations. The pharmaceutical & biotechnology companies accounted for a major market share in 2024. This is attributed to the consistent need for dispensing samples onto various substrates and transferring them to containers of different sizes, which has led to the rapid adoption of automated liquid handling systems in drug development and manufacturing processes. The increasing reliance on automation for drug screening and development highlights the prominence of the segment.

The academic & research institutes segment is anticipated to exhibit significant growth during the forecast period. Institutions engaged in life science experiments, particularly those involving genetics, antibody testing, protein crystallization, and drug screening, often handle minimal sample volumes. The demand for automated approaches, including sensor-integrated robotic systems, is expected to rise, boosting revenue in the sector.

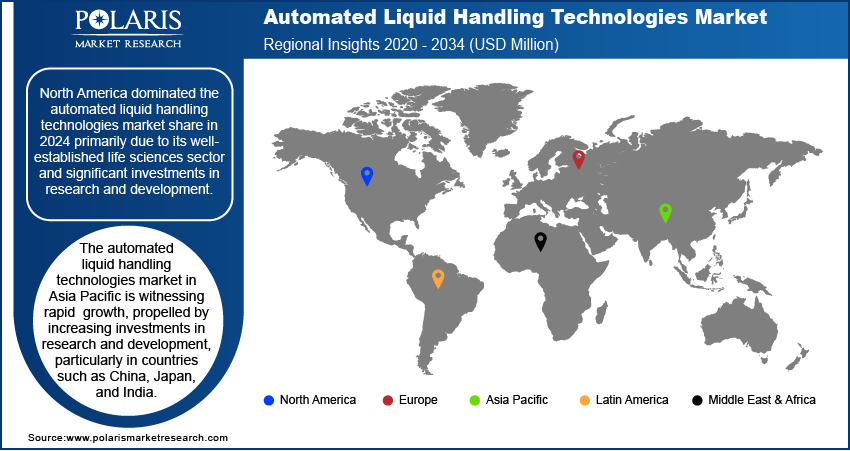

Regional Outlook

By region, the study provides automated liquid handling technologies market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market share in 2024 primarily due to its well-established life sciences sector and significant investments in research and development. The presence of major pharmaceutical and biotechnology companies, along with advanced laboratory infrastructure, has facilitated the widespread adoption of automated liquid handling systems in the region. Additionally, the increasing demand for high-throughput screening and precision in laboratory processes has further propelled automated liquid handling technologies market growth in North America.

The automated liquid handling technologies market in Europe is experiencing substantial growth, driven by the increasing adoption of automation in research and development laboratories and pharmaceutical companies. The demand for advanced liquid handling systems is rising due to the need for high-throughput screening and precise sample handling in drug discovery and genomic research. The presence of key industry players, such as Tecan Group Ltd., Hamilton Company, and Eppendorf AG, further strengthens the market in the region. Additionally, supportive government initiatives and funding for research activities contribute to the market expansion.

The automated liquid handling technologies market in Asia Pacific is witnessing rapid growth, propelled by increasing investments in research and development, particularly in countries such as China, Japan, and India. The expanding pharmaceutical and biotechnology sectors in these countries drive the demand for automated solutions to enhance laboratory efficiency and accuracy. Moreover, the rising awareness of the benefits of automation in laboratory processes and the growing focus on personalized medicine contribute to the market's development in this region. The establishment of new research facilities and the adoption of advanced technologies further support the market growth.

Key Players and Competitive Analysis Report

In the automated liquid handling technologies market, several companies remain active and independent, contributing significantly to advancements in laboratory automation. Thermo Fisher Scientific Inc. offers a comprehensive range of automated liquid handling solutions, including robotic systems, pipetting tools, workstations, and software for precise and efficient laboratory tasks. Agilent Technologies Inc. provides space-saving and flexible automated liquid handling platforms that enable simplified sample preparation with consistently high accuracy. Hamilton Company specializes in precision liquid handling instruments and robotic workstations, catering to various laboratory automation needs.

These companies are actively engaged in developing innovative solutions to meet the evolving demands of laboratory automation. Their product offerings range from standalone pipetting systems to fully integrated robotic workstations, catering to various applications in genomics, drug discovery, clinical diagnostics, and more. By focusing on precision, efficiency, and user-friendly designs, these companies contribute to advancements in laboratory workflows, enabling researchers to achieve higher throughput and reproducibility in their experiments.

The competitive landscape in the automated liquid handling technologies market is characterized by continuous innovation and strategic initiatives. Companies are investing in research and development to introduce advanced features such as non-contact dispensing, integration with artificial intelligence for error control, and modular designs for customizable workflows. Collaborations and partnerships are also prevalent, allowing companies to combine expertise and expand their product portfolios. For instance, in May 2023, Hamilton Company and Biosero, Inc. announced a strategic co-marketing alliance to streamline and improve automated liquid handling processes in laboratories. Such initiatives enhance the capabilities of automated liquid handling systems, providing comprehensive solutions to meet the diverse needs of the scientific community.

Thermo Fisher Scientific Inc. is a major provider of automated liquid handling technologies, offering a range of innovative solutions to enhance laboratory efficiency and productivity. Their portfolio includes systems such as the Thermo Scientific CV2000, which is designed for automated aliquoting and can process up to 1000 samples per hour, ensuring zero cross-contamination and compatibility with various sample management software. Another key product is the Thermo Scientific Versette, a compact automated liquid handler that supports 96- and 384-channel pipetting with interchangeable heads, providing versatility for a broad range of applications. It is designed to reduce hands-on time and improve reproducibility, making it ideal for tasks such as plate replication and serial dilutions. Thermo Fisher's automated liquid handling systems are engineered to deliver accuracy, precision, and reproducibility, allowing laboratories to streamline workflows and focus on high-value tasks.

Agilent Technologies Inc. is a prominent player in the automated liquid handling technologies market, offering advanced solutions that streamline laboratory workflows and enhance productivity. The company's flagship products, such as the Encore Multispan Liquid Handling System and the Bravo Automated Liquid Handling Platform, showcase its innovative approach to automation. The Encore Multispan System integrates multispan pipetting technology with a robotic arm and intelligent software control, enabling researchers to automate complex workflows efficiently. Its dual multispan pipetting system delivers high throughput and versatility, accommodating various sample formats, while its built-in robotic arm facilitates seamless workflow integration. Additionally, advanced software features like 3D simulation allow researchers to optimize protocols remotely, enhancing reliability and reducing experimental errors.

List of Key Companies

- Agilent Technologies, Inc.

- Analytik Jena AG

- Aurora Biomed Inc.

- Corning Incorporated

- Eppendorf SE

- Formulatrix, Inc.

- Gilson, Inc.

- Hamilton Company

- Hudson Robotics, Inc.

- Mettler-Toledo International Inc.

- Opentrons Labworks, Inc.

- PerkinElmer, Inc.

- Sartorius AG

- Tecan Group Ltd.

- Thermo Fisher Scientific Inc.

Automated Liquid Handling Technologies Industry Developments

- July 2023: Revvity announced the launch of the Fontus Automated Liquid Handling Workstation, a next-generation liquid handler incorporating the best technologies from Revvity’s existing platforms, designed to deliver easier and faster workflows.

- September 2023: SLS announced the launch of the Eppendorf epMotion range for Automated Liquid Handling Systems.

- February 2023: Agilent introduced an on-deck thermal cycler accessory for its Bravo NGS automated liquid handling platform. This integration enables seamless thermal cycling within automated workflows, improving efficiency in next-generation sequencing (NGS) sample preparation and other genomic applications.

Automated Liquid Handling Technologies Market Segmentation

By Product Outlook (Revenue-USD Million, 2020–2034)

- Automated Workstations

- Reagents & Consumables

By Application Outlook (Revenue-USD Million, 2020–2034)

- Drug Discovery & ADME-Tox Research

- Cancer & Genomic Research

- Bioprocessing/Biotechnology

- Others

By End User Outlook (Revenue-USD Million, 2020–2034)

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2,293.14 million |

|

Market Value in 2025 |

USD 2,527.28 million |

|

Revenue Forecast by 2034 |

USD 6,162.07 million |

|

CAGR |

10.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The automated liquid handling technologies market has been segmented into detailed segments of product, application, and end user. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

Companies in the automated liquid handling technologies market focus on expanding their product portfolios through technological advancements, including AI-driven automation and non-contact dispensing. Strategic collaborations, acquisitions, and partnerships with research institutions help strengthen market presence and enhance product capabilities. Investments in research and development support innovation, addressing the demand for high-throughput and precision-based laboratory workflows. Companies also adopt targeted marketing strategies, including digital outreach, scientific conferences, and direct engagement with pharmaceutical and biotechnology firms. Additionally, expanding into emerging markets and customizing solutions for specific laboratory needs contribute to market growth.

FAQ's

The automated liquid handling technologies market size was valued at USD 2,293.14 million in 2024 and is projected to grow to USD 6,162.07 million by 2034.

The market is projected to register a CAGR of 10.4% during the forecast period, 2024-2034.

North America had the largest share of the market.

Key players in the automated liquid handling technologies market include Agilent Technologies, Inc.; Analytik Jena AG; Aurora Biomed Inc.; Corning Incorporated; Eppendorf SE; Formulatrix, Inc.; Gilson, Inc.; Hamilton Company; Hudson Robotics, Inc.; Mettler-Toledo International Inc.; Opentrons Labworks, Inc.; PerkinElmer, Inc.; Sartorius AG; Tecan Group Ltd.; and Thermo Fisher Scientific Inc.

The automated workstations segment accounted for the largest market share in 2024.

The drug discovery & ADME-Tox research segment accounted for the largest market share in 2024.

Automated liquid handling technologies refer to robotic systems and instruments designed to perform precise and efficient liquid handling tasks in laboratories. These systems automate processes such as pipetting, dispensing, and sample preparation, reducing human error and improving workflow efficiency. They are widely used in applications like drug discovery, genomic research, clinical diagnostics, and bioprocessing. Automated liquid handling technologies enhance reproducibility, increase throughput, and minimize contamination risks, making them essential tools in modern laboratory settings.

A few key trends in the market are described below: Integration of Artificial Intelligence (AI) and Machine Learning (ML): AI-driven liquid handling systems enhance precision, error detection, and workflow optimization. Adoption of Non-Contact Dispensing Technologies: Non-contact liquid handling minimizes contamination risks and improves accuracy in sample processing. Miniaturization and Microfluidics Advancements: Increasing use of microfluidic-based liquid handling systems supports high-throughput screening and cost efficiency. Growing Demand for High-Throughput Screening (HTS): Automated systems are increasingly used in drug discovery and genomic research to process large sample volumes efficiently.

A new company entering the automated liquid handling technologies market can focus on developing AI-driven and IoT-enabled automation solutions to enhance precision and real-time monitoring. Investing in non-contact dispensing and microfluidic-based systems can help cater to the growing demand for high-throughput and miniaturized applications. Providing modular and customizable solutions tailored to specific laboratory needs can offer a competitive advantage. Expanding into emerging markets with cost-effective yet high-performance systems can help gain market traction. Additionally, integrating sustainable and eco-friendly designs, such as reducing plastic consumables, can align with industry trends and regulatory requirements.

Companies manufacturing, distributing, or purchasing automated liquid handling technologies and related products, and other consulting firms must buy the report.