Automotive Aftermarket Market Size, Share, Trends, Industry Analysis Report: By Product Type (Replacement Parts and Accessories), Vehicle Type, Service Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 129

- Format: PDF

- Report ID: PM1028

- Base Year: 2024

- Historical Data: 2020-2023

Automotive Aftermarket Market Overview

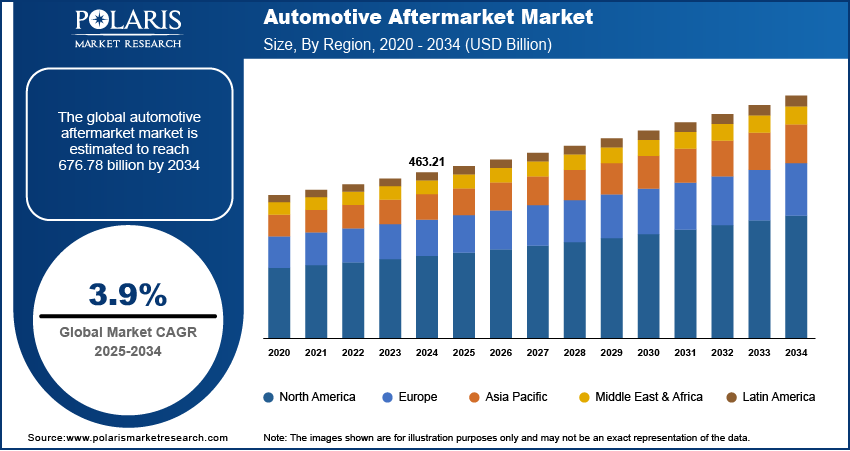

The global automotive aftermarket market size was valued at USD 463.21 billion in 2024. The market is projected to grow from USD 480.72 billion in 2025 to USD 676.78 billion by 2034, exhibiting a CAGR of 3.9% from 2025 to 2034.

The automotive aftermarket market encompasses the manufacturing, distribution, and sale of vehicle parts, accessories, and services after the original equipment manufacturer (OEM) sale. The market caters to vehicle maintenance, repair, and customization demands, which include parts replacement, performance-improving accessories, and others for passenger and commercial vehicles.

The evolving consumer preferences for personalized vehicles and advanced features have fueled the automotive aftermarket market growth. The market is expanding rapidly owing to technological innovations, including e-commerce platforms and predictive maintenance solutions, which have improved product accessibility and enhanced service precision.

To Understand More About this Research: Request a Free Sample Report

Automotive Aftermarket Market Dynamics

Rising Automotive Customization

The rising vehicle customization culture, especially among younger drivers, is driving the automotive aftermarket market growth. According to the US Bureau of Labor Statistics, in the US alone, employment in vehicle customization shops increased by 12% from 2019 to 2023, showcasing the growth of the vehicle customization culture. Social media and automotive influencers have transformed cars from simple transportation into expressions of personal identity, creating viral trends in vehicle modifications and inspiring widespread customization, thereby propelling market demand.

Expansion of E-Commerce Channels

The surge in e-commerce platforms is reshaping the automotive aftermarket market, providing consumers with improved accessibility and convenience for the purchase of automotive equipment. Online marketplaces have enabled users to compare prices, review products, and access a wide array of parts from global vendors, contributing to market growth. Furthermore, companies adopting omnichannel strategies, which integrate online and offline sales channels, are capturing significant market share as consumers increasingly favor digital-first purchasing channels.

Automotive Aftermarket Market Segment Insights

Automotive Aftermarket Market Assessment by Product Type Insights

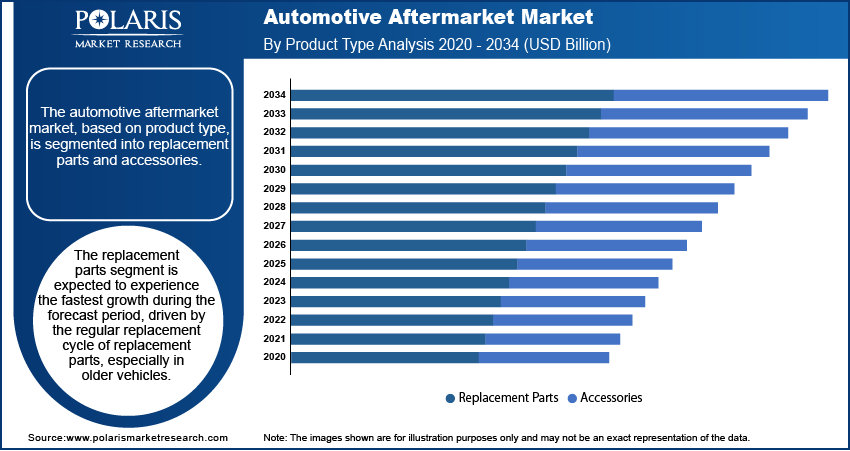

The automotive aftermarket market, based on product type, is segmented into replacement parts and accessories. The replacement parts segment is expected to experience the fastest growth during the forecast period, driven by the regular replacement cycle of replacement parts, especially in older vehicles. Additionally, environmental regulations are prompting the replacement of parts to meet emissions standards, while growing concerns over fuel efficiency are leading to the replacement of components that optimize vehicle performance and reduce fuel consumption, thereby driving segmental growth in the global market.

Automotive Aftermarket Market Evaluation by Vehicle Type Insights

The automotive aftermarket market, based on vehicle type, is segmented into passenger cars, commercial vehicles, and electric vehicles (EVs). The passenger cars segment dominated the market in 2024 due to the larger global fleet of passenger cars and a higher frequency of maintenance as compared to other vehicle types. Additionally, growing interest in vehicle customization and increasing disposable income worldwide contribute to the dominance of the segment.

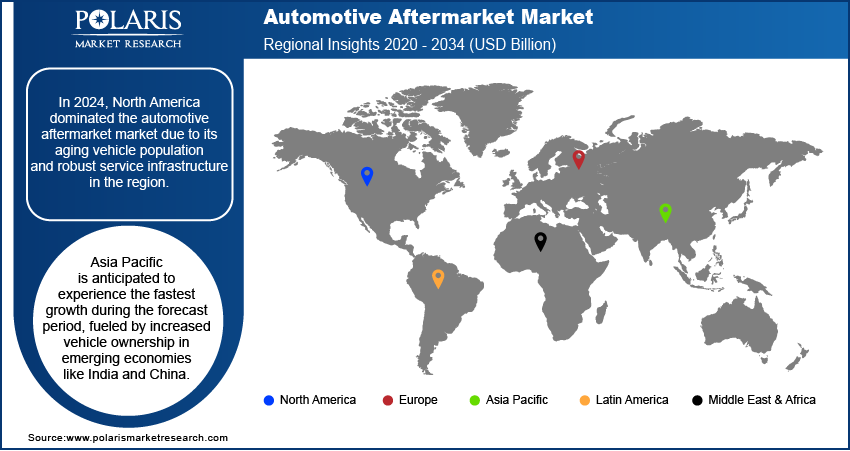

Automotive Aftermarket Market Regional Analysis

By region, the report offers automotive aftermarket market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the global market in 2024 due to its aging vehicle population and robust service infrastructure. Aging vehicles require more frequent maintenance and replacement parts, which increases the demand for aftermarket products and services. The average age of vehicles in North America is now over 12 years, leading to a greater need for repairs and upgrades. Additionally, technological advancements in automotive design and engineering have contributed to the evolution of the automotive aftermarket market in the region. The rise of e-commerce platforms has further expanded the market, as these platforms have transformed how consumers purchase automotive aftermarket parts and accessories, making it easier for them to find and order products online.

The Asia Pacific automotive aftermarket market is anticipated to experience the fastest growth during the forecast period, fueled by increased vehicle ownership in emerging economies like India and China. For instance, according to the Society of Indian Automobile Manufacturers, India has 380 million vehicles, while China boasts 420 million passenger vehicles, showcasing a large volume of vehicle ownership in the region. Additionally, these countries are witnessing rapid urbanization and growing consumer spending on vehicle maintenance, further fueling regional market growth.

List of Key Companies in Automotive Aftermarket Market

- Robert Bosch GmbH

- Denso Corporation

- ZF Friedrichshafen AG

- Continental AG

- 3M Company

- Valeo SA

- BorgWarner Inc.

- Tenneco Inc.

- Aisin Seiki Co., Ltd.

- Delphi Technologies

- Federal-Mogul Corporation

- Goodyear Tire & Rubber Company

- Bridgestone Corporation

- Magneti Marelli

- Cooper Tire & Rubber Company

Automotive Aftermarket Market – Key Players and Competitive Insights

The leading companies dominate the automotive aftermarket market through global networks, innovative technologies, and diverse portfolios. Bosch and Denso focus on advanced diagnostic tools, while Bridgestone and Goodyear specialize in tires, commanding significant automotive aftermarket market share. These players employ strategies such as mergers and acquisitions, partnerships, and digitalization to maintain a competitive edge.

Continental AG, is a technology company with a global presence, providing innovative solutions for vehicles, machinery, traffic, and transportation. The company specializes in tires, automotive components, software development, driver assistance systems, automated driving, connectivity, vehicle networking, and autonomous mobility. Continental AG has evolved into a multifaceted entity operating through four key segments: Automotive, ContiTech, Tires, and Contract Manufacturing. The Automotive segment is focused on enhancing vehicle safety and performance through advanced technologies, including safety, chassis, brake, motion, and motion control systems. It also develops solutions for assisted and automated driving, as well as innovative display, operating, and interior systems encompassing audio and camera technologies. Additionally, the segment provides intelligent information and communication technology solutions, integrating the latest advancements in vehicle connectivity and automation. Continental's Tires sector supplies a wide range of tires for cars, busesv, trucks, electric two-wheelers, and specialty vehicles, alongside offering digital tire monitoring and management systems. The ContiTech division specializes in producing high-performance products and systems from rubber, metal, plastic, and textiles, catering to industries such as energy, construction, agriculture, automotive, and transportation. Continental leverages its extensive expertise in material science and engineering to support various industrial applications globally through its contract manufacturing services.

3M Company, originally founded in 1902 as Minnesota Mining and Manufacturing Company, is a diversified technology and science corporation headquartered in St. Paul, Minnesota. With operations in over 70 countries and sales in approximately 200 countries, 3M serves a wide range of industries, including industrial, safety, healthcare, and consumer markets. The company’s portfolio features more than 60,000 products categorized into key business segments. The Safety & Industrial segment offers personal protective equipment, adhesives, abrasives, and tapes for industries such as automotive and construction. In the Transportation & Electronics segment, 3M provides solutions for automotive OEMs and electronic components. 3M operates manufacturing facilities across various regions, including North America, and significant operations in Asia Pacific, particularly in India and China. The company also maintains a robust presence throughout Europe.

Automotive Aftermarket Industry Developments

September 2024: Continental, a technology company that develops solutions for vehicles, machines, traffic, and transportation, announced the launch of a major product range expansion initiative for the aftermarket.

January 2024: ZF Aftermarket, one of the world’s major aftermarket providers, released a press document stating that they introduced over 770 new parts for passenger cars in North America in 2023 to cover an additional 158.2 million vehicles in operation.

March 2021: SKF India’s Automotive Aftermarket division announced the launch of three new products, which include chains and sprockets for 2-wheelers, timing belts, and steering and suspension systems for 4-wheelers. The company stated that the new products aim to address customer needs for improved durability and performance.

Automotive Aftermarket Market Segmentation

By Product Type Outlook (Revenue – USD Billion, 2020–2034)

- Replacement Parts

- Batteries

- Filters

- Brake Components

- Accessories

- Interior Accessories

- Exterior Accessories

By Vehicle Type Outlook (Revenue – USD Billion, 2020–2034)

- Passenger Cars

- Commercial Vehicles

- Electric Vehicles (EVs)

By Service Channel Outlook (Revenue – USD Billion, 2020–2034)

- OEM-Authorized Dealers

- Independent Service Providers

- Online Platforms

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automotive Aftermarket Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 463.21 billion |

|

Market Size Value in 2025 |

USD 480.72 billion |

|

Revenue Forecast by 2034 |

USD 676.78 billion |

|

CAGR |

3.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global automotive aftermarket market size was valued at USD 463.21 billion in 2024 and is projected to grow to USD 676.78 billion by 2034.

The global market is projected to register a CAGR of 3.9% from 2025 to 2034.

North America had the largest share of the global market in 2024.

Some of the key players in the market are Bosch Automotive Aftermarket; Denso Corporation; ZF Friedrichshafen AG; Continental AG; 3M Company; Valeo SA; BorgWarner Inc.; Tenneco Inc.; Aisin Seiki Co., Ltd.; Delphi Technologies; Federal-Mogul Corporation; Goodyear Tire & Rubber Company; Bridgestone Corporation; Magneti Marelli; and Cooper Tire & Rubber Company

The passenger cars segment dominated the market in 2024 due to the presence of a larger global passenger car fleet and a higher frequency of maintenance as compared to other vehicle types.