Automotive Circuit Tester Market Size, Share, Trends, & Industry Analysis Report

By Type of Circuit Tester (Digital Circuit Testers, Analog Circuit Testers), By Power Source, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5998

- Base Year: 2024

- Historical Data: 2020-2023

Overview

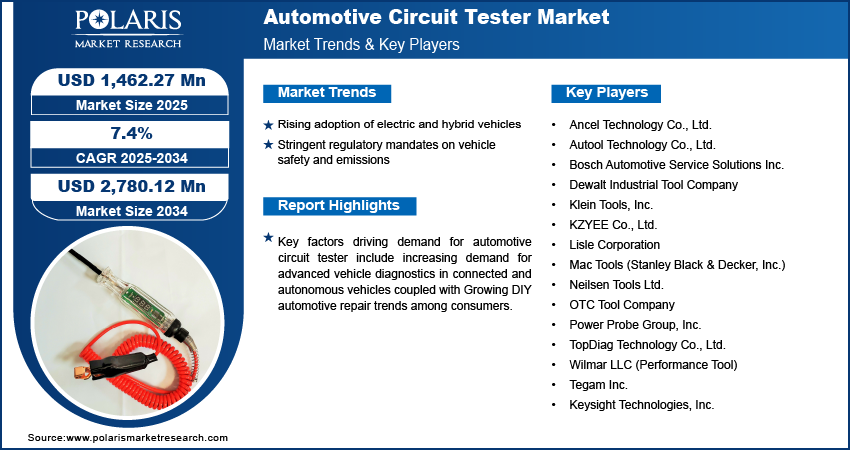

The global automotive circuit tester market size was valued at USD 1,362.78 million in 2024, growing at a CAGR of 7.4% from 2025–2034. Key factors driving demand for automotive circuit tester include rising adoption of electric and hybrid vehicles coupled with stringent regulatory mandates on vehicle safety and emissions.

Key Insights

- The digital circuit testers segment accounted for largest market share in 2024.

- The solar-powered circuit testers segment is projected to grow at a rapid pace in the coming years, due to the rising emphasis on energy-efficient and sustainable workshop tools.

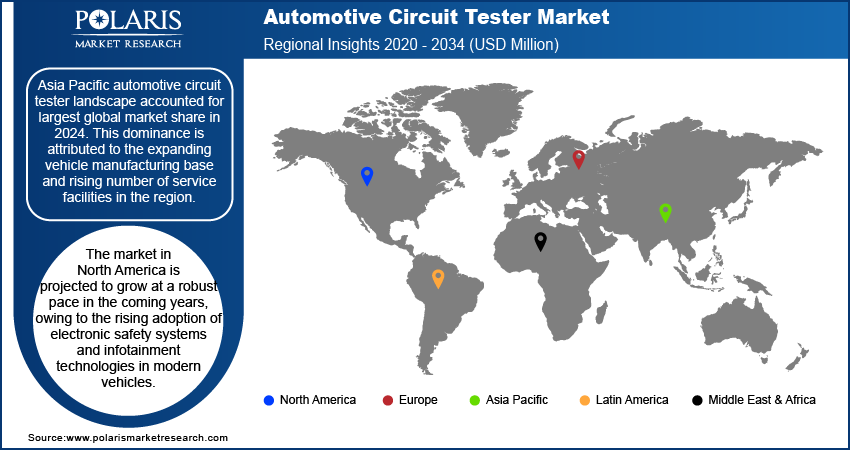

- The Asia Pacific automotive circuit tester market accounted for largest global market share in 2024.

- The China automotive circuit tester market held largest regional share of the Asia Pacific market in 2024, due to rapid rise in electric vehicle production and the shift toward digital vehicle diagnostics.

- The market in North America is projected to grow with a fastest CAGR from 2025-2034, owing to the rising adoption of electronic safety systems and infotainment technologies in modern vehicles.

- The US automotive circuit tester market is growing rapidly, due to increasing integration of ADAS and EV diagnostic platforms in aftermarket services.

.webp)

Automotive circuit testers are essential tools used by technicians and maintenance professionals to identify faults, verify wiring connections, and check the continuity and voltage levels of circuits in vehicles. These tools contribute significantly to preventive maintenance and diagnostics, helping reduce downtime, improve repair accuracy, and ensure overall vehicle safety. Increasing integration of sensors, infotainment systems, and autonomous driving features in modern vehicles is accelerating the need for accurate circuit diagnostic tools across passenger and commercial segments.

Increasing demand for advanced vehicle diagnostics in connected and autonomous vehicles is fueling the adoption of automotive circuit testers. Integration of advanced features such as adaptive cruise control, lane departure warning, and V2X communication systems led to a substantial increase in electronic control units (ECUs) and sensor-based circuits in modern vehicles. For instance, in June 2025, Verizon Business launched its Edge Transportation Exchange, a commercial Vehicle‑to‑Everything (V2X) communication platform. The system leverages 5G, LTE, edge computing, and precise geolocation to enable near real-time data exchange among vehicles, pedestrians, and roadway infrastructure. These systems require consistent electrical monitoring to avoid faults that compromise vehicle functionality and passenger safety. Automotive circuit testers are widely used in diagnostic routines to ensure system reliability in semi-autonomous and connected vehicle platforms.

Growing DIY automotive repair trends among consumers are accelerating the demand for compact and user-friendly circuit testers for personal use. These testers help users identify wiring problems, blown fuses, and voltage irregularities without professional assistance, reducing reliance on repair shops. Therefore, manufacturers are expanding product lines to include affordable, battery-operated testers that cater to hobbyists and DIY enthusiasts, fueling growth of the circuit testing tools market.

Industry Dynamics

- Rising adoption of electric and hybrid vehicles is driving demand for automotive circuit testers, as EV platforms rely on intricate electrical architectures that require precise diagnostics.

- Stringent regulatory mandates on vehicle safety and emissions are pushing automakers and service providers to enhance diagnostic accuracy, leading to increased use of circuit testers.

- Limited standardization across vehicle models and diagnostic interfaces is restraining market growth, as technicians face compatibility issues and require model-specific tools.

- Growing integration of digital technologies, such as wireless communication and real-time data analytics, is creating future opportunities for the market.

Rising Adoption of Electric and Hybrid Vehicles: Rising adoption of electric and hybrid vehicles is boosting the need for circuit testing solutions, thus fueling the market growth. According to the International Energy Agency, global electric vehicle sales surpassed 17 million units in 2024, accounting for over 20% of total vehicle sales worldwide. These vehicles are equipped with complex power electronics systems, battery management units, and regenerative braking circuits, which require regular inspection to ensure optimal performance and safety. Automotive circuit testers are increasingly utilized to verify connectivity, identify faults, and monitor voltage fluctuations across these systems.

Stringent Regulatory Mandates on Vehicle Safety and Emissions: Stringent regulatory mandates on vehicle safety and emissions are accelerating the adoption of precision diagnostic tools. Regulatory frameworks across key automotive markets now require OEMs and service providers to comply with enhanced diagnostic procedures aimed at reducing environmental impact and ensuring road safety. For instance, in April 2024, the US Environmental Protection Agency (EPA) finalized new emission standards aimed at significantly cutting air pollutants from light-duty and medium-duty vehicles, effective from model year 2027. This regulatory shift is driving demand for circuit testers capable of conducting accurate inspections across various electrical subsystems. Additionally, rising consumer expectations for efficient aftersales services and shorter vehicle repair times are pushing service centers to invest in high-performance testers to streamline diagnostics and improve customer satisfaction.

Segmental Insights

Type of Circuit Tester Analysis

Based on type, the segmentation includes digital circuit testers, analog circuit testers, multi-meter circuit testers, and advanced diagnostic circuit testers. The digital circuit testers segment accounted for largest revenue share in 2024, driven by features such as precision, ease of use, and compatibility with modern vehicle electronic systems. These testers offer clear digital readouts, reducing the risk of human error during diagnostics. It is widely adopted in professional service centers and industrial workshops due to the ability to measure voltage, continuity, and resistance with high accuracy.

The advanced diagnostic circuit testers segment is projected to grow at the fastest CAGR during the forecast period. The increasing complexity of automotive electronics in EVs and autonomous vehicles, is increasing the demand for circuit testers that offer integrated diagnostic functions. These devices feature built-in memory, wireless connectivity, and compatibility with software platforms, making them suitable for in-depth fault analysis across multiple vehicle models and architectures.

Power Source Analysis

In terms of power source, the segmentation includes battery-powered circuit testers, AC powered circuit testers, and solar powered circuit testers. The battery-powered circuit testers segment dominated the revenue share in 2024, attributed to its high mobility, flexibility, and ease of use in field and garage settings. Technicians prefer battery-operated devices as it eliminate the need for a fixed power supply, making it suitable for on-site diagnostics, roadside assistance, and mobile repair units. The compact design and independence from external power sources boosts the dominance across independent and authorized service centers.

The solar-powered circuit testers segment is anticipated to expand at the fastest pace from 2025 to 2034, supported by rising emphasis on energy-efficient and sustainable workshop tools. These testers are adopted in regions with reliable sunlight exposure, by eco-conscious service providers aiming to reduce carbon emissions and operational costs. The growing adoption of solar-powered automotive repair tools is steadily increasing the demand for automotive circuit testers.

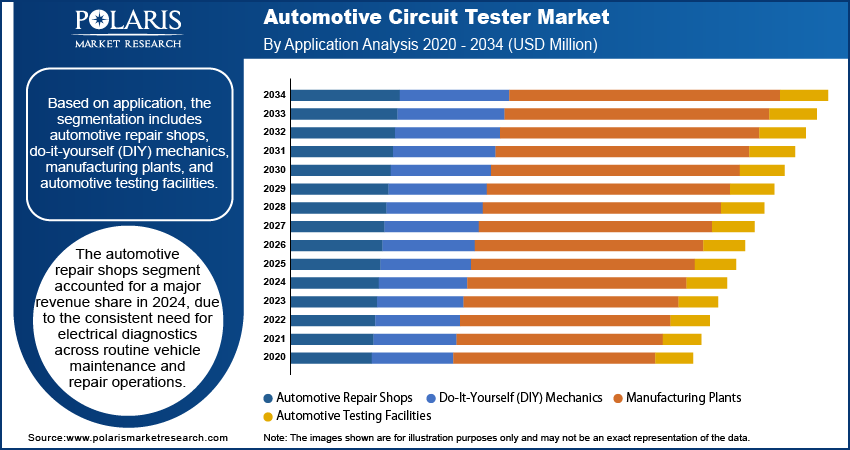

Application Analysis

Based on application, automotive repair shops, do-it-yourself (DIY) mechanics, manufacturing plants, and automotive testing facilities. The automotive repair shops segment dominated the market in 2024 due to the consistent need for electrical diagnostics across routine vehicle maintenance and repair operations. These shops require reliable circuit testers to quickly identify faults in lighting systems, ignition modules, battery terminals, and other electrical subsystems. The increasing vehicle parc and growing emphasis on fast, accurate repairs is contributing to sustained demand from this segment.

The DIY mechanics segment is expected to register the fastest growth during the forecast period. Enthusiasts and hobbyists are investing in circuit testers for personal use to troubleshoot and repair vehicle electrical systems at home. Rising availability of affordable, user-friendly testers through online platforms further boosting the segment expansion. The growing trend of self-servicing in North America and parts of Europe, is propelling the market growth.

Regional Analysis

Asia Pacific automotive circuit tester market accounted for largest share of global market in 2024. This dominance is attributed to the expanding vehicle manufacturing base and rising number of service facilities in the region. Automotive OEMs and suppliers in countries such as Japan, South Korea, and India are increasing their focus on incorporating electronics-intensive systems in passenger and commercial vehicles. Moreover, governments in the region are investing in automotive electrification and component localization during assembly and maintenance procedures, fueling the growth of the market.

China Automotive Circuit Tester Market Insight

China held largest regional market share in Asia Pacific automotive circuit tester landscape in 2024 due to the rapid rise in electric vehicle production and the shift toward digital vehicle diagnostics. According to the latest data from EV Volumes, total of 4.86 million electric vehicles were delivered to customers in China in 2024, up from 2.7 million in 2023. Battery electric vehicle (BEV) registrations increased by 17.3%, with 6.34 million new units added to the country's roads. The country is witnessing rapid growth in the installation of high-voltage systems, powertrain control modules, and complex sensor networks. This growth is increasing the need for advanced circuit testers that perform precise voltage and continuity checks across EV platforms.

North America Automotive Circuit Tester Market

The market in North America is projected to grow with a fastest CAGR from 2025-2034, owing to the rising adoption of electronic safety systems and infotainment technologies in modern vehicles. Also, the rising compliance requirements for vehicle safety and emissions are driving the adoption of digital circuit testers across service centers. These tools are used to verify the functionality of components such as airbag modules, lighting circuits, and engine control units (ECUs), ensuring adherence to federal inspection protocols. Additionally, the growth of independent repair networks and growing emphasis on standardized diagnostics are contributing to the rising demand for circuit testing tools across urban and semi-urban areas.

US Automotive Circuit Tester Market Overview

The market in US is expanding due to strong government support and incentives aimed at accelerating electric vehicle (EV) adoption. Rising federal policies such as the Inflation Reduction Act of 2022 significantly boosting EV demand by offering substantial tax benefits to consumers. For instance, under Internal Revenue Code Section 30D, buyers of new qualified plug-in electric vehicles (EVs) or fuel cell electric vehicles (FCVs) are eligible for a tax credit of up to USD 7,500 for purchases made between 2023 and 2032. This incentive structure is driving higher EV sales, which in turn increasing the demand for advanced circuit testing tools required for maintenance, diagnostics, and service of complex electric powertrains. In addition, growing expansion of EV infrastructure across the US is pushing repair shops and service centers to adopt digital diagnostic tools that deliver real-time fault detection and support advanced vehicle electrical systems.

Europe Automotive Circuit Tester Market

The automotive circuit tester landscape in Europe is projected to hold a substantial share in 2034, due to strong emphasis on automotive safety compliance and advanced engineering standards. Also, the European automotive manufacturers are integrating electronics-heavy systems to support driver assistance features and smart mobility platforms. This shift is increasing demand for circuit testers capable of assessing complex control modules, adaptive lighting systems, and integrated sensor circuits. Moreover, stringent EU directives on vehicle diagnostics and emissions testing are compelling workshops and inspection agencies to deploy precision circuit testing devices further propelling the regional market growth.

Key Players & Competitive Analysis Report

The automotive circuit tester market is moderately fragmented, with competition centered on technological features, ease of use, compatibility with evolving vehicle architectures, and brand reliability. Leading manufacturers are focusing on enhancing product functionality through digital integration, real-time diagnostics, and multi-vehicle compatibility to support modern automotive electrical systems. Companies are investing in rugged, portable designs suitable for workshop and field environments, along with smart calibration tools to improve testing accuracy. Key strategies include partnerships with OEMs, expansion of distribution networks through e-commerce platforms, and product bundling with other diagnostic tools for service centers. Moreover, growing demand for hybrid and electric vehicles is pushing firms to develop specialized testers for high-voltage components, battery systems, and EV-specific circuits. Growing complexity in vehicle electronics is propelling manufacturers to emphasize training programs, reliable after-sales support, and adherence to evolving regulatory standards to boost customer confidence and expand into emerging automotive markets.

Major companies operating in the automotive circuit tester market include Ancel Technology Co., Ltd., Autool Technology Co., Ltd., Bosch Automotive Service Solutions Inc., Dewalt Industrial Tool Company, Keysight Technologies, Inc., Klein Tools, Inc., KZYEE Co., Ltd., Lisle Corporation, Mac Tools (Stanley Black & Decker, Inc.), Neilsen Tools Ltd., OTC Tool Company, Power Probe Group, Inc., Tegam Inc., TopDiag Technology Co., Ltd., and Wilmar LLC (Performance Tool).

Key Players

- Ancel Technology Co., Ltd.

- Autool Technology Co., Ltd.

- Bosch Automotive Service Solutions Inc.

- Dewalt Industrial Tool Company

- Klein Tools, Inc.

- KZYEE Co., Ltd.

- Lisle Corporation

- Mac Tools (Stanley Black & Decker, Inc.)

- Neilsen Tools Ltd.

- OTC Tool Company

- Power Probe Group, Inc.

- TopDiag Technology Co., Ltd.

- Wilmar LLC (Performance Tool)

- Tegam Inc.

- Keysight Technologies, Inc.

Industry Developments

- November 2024: AUTOOL launched the BT960 Automotive Battery Tester, a powerful diagnostic tool featuring advanced conductance technology, seven testing functions, a 0–80 V range, real-time temperature monitoring, and a built-in thermal printer. Its support for lithium battery testing and real-time leakage detection met modern vehicle needs, driving adoption across professional repair and DIY markets.

Automotive Circuit Tester Market Segmentation

By Type of Circuit Tester Outlook (Revenue, USD Million, 2020–2034)

- Digital Circuit Testers

- Analog Circuit Testers

- Multimeter Circuit Testers

- Advanced Diagnostic Circuit Testers

By Power Source Outlook (Revenue, USD Million, 2020–2034)

- Battery-Powered Circuit Testers

- AC Powered Circuit Testers

- Solar Powered Circuit Testers

By Application Outlook (Revenue, USD Million, 2020–2034)

- Automotive Repair Shops

- Do-It-Yourself (DIY) Mechanics

- Manufacturing Plants

- Automotive Testing Facilities

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automotive Circuit Tester Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1,362.78 Million |

|

Market Size in 2025 |

USD 1,462.27 Million |

|

Revenue Forecast by 2034 |

USD 2,780.12 Million |

|

CAGR |

7.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1,362.78 million in 2024 and is projected to grow to USD 2,780.12 million by 2034.

The global market is projected to register a CAGR of 7.4% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are Ancel Technology Co., Ltd., Autool Technology Co., Ltd., Bosch Automotive Service Solutions Inc., Dewalt Industrial Tool Company, Keysight Technologies, Inc., Klein Tools, Inc., KZYEE Co., Ltd., Lisle Corporation, Mac Tools (Stanley Black & Decker, Inc.), Neilsen Tools Ltd., OTC Tools (Bosch Automotive Service Solutions Inc.), Power Probe Group, Inc., Tegam Inc., TopDiag Technology Co., Ltd., and Wilmar LLC (Performance Tool).

The digital circuit testers segment dominated the market in 2024.

The solar-powered circuit testers segment is expected to witness the fastest growth during the forecast period.