Automotive ECU Market Share, Size, Trends & Industry Analysis Report

By Capacity Type (16-Bit, 32-Bit, 64-Bit); By Propulsion; By Vehicle Type; By Application; By Region; Segment Forecast, 2025- 2034

- Published Date:May-2025

- Pages: 145

- Format: PDF

- Report ID: PM1426

- Base Year: 2024

- Historical Data: 2020-2023

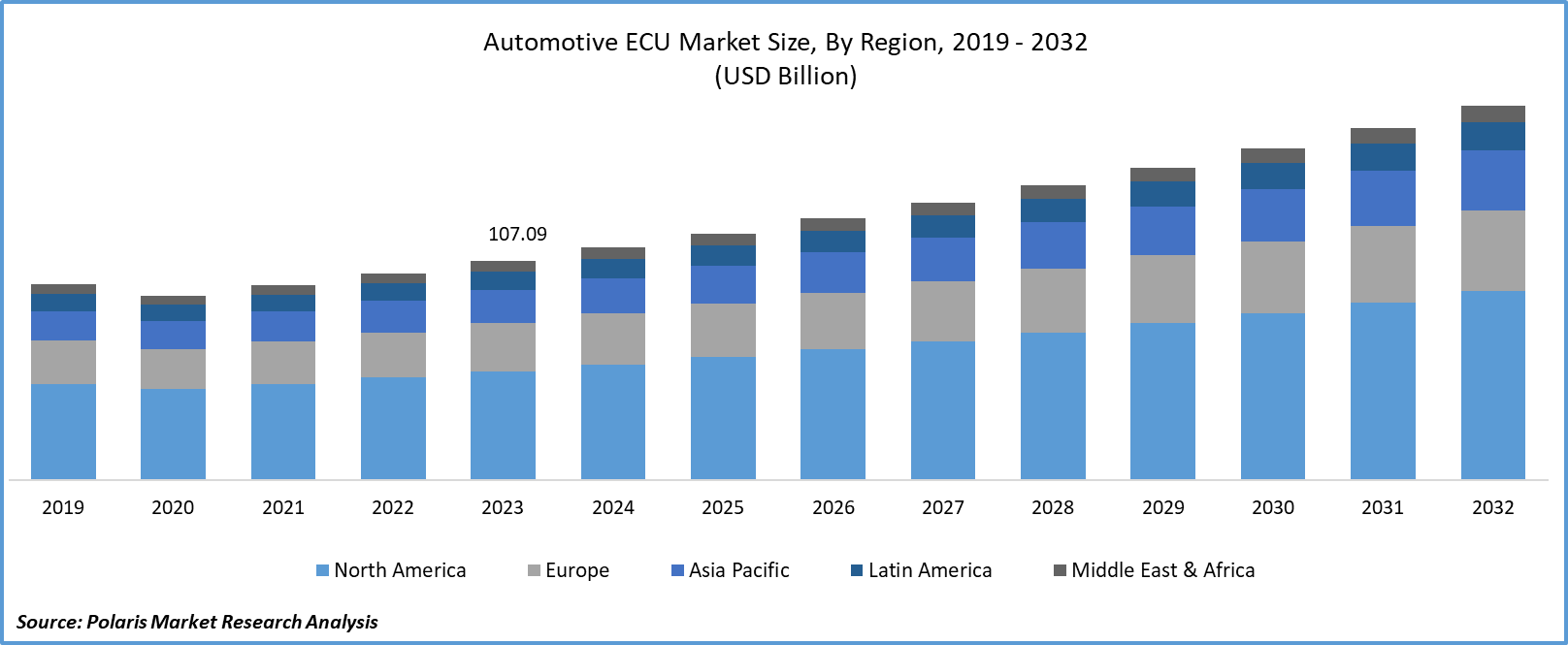

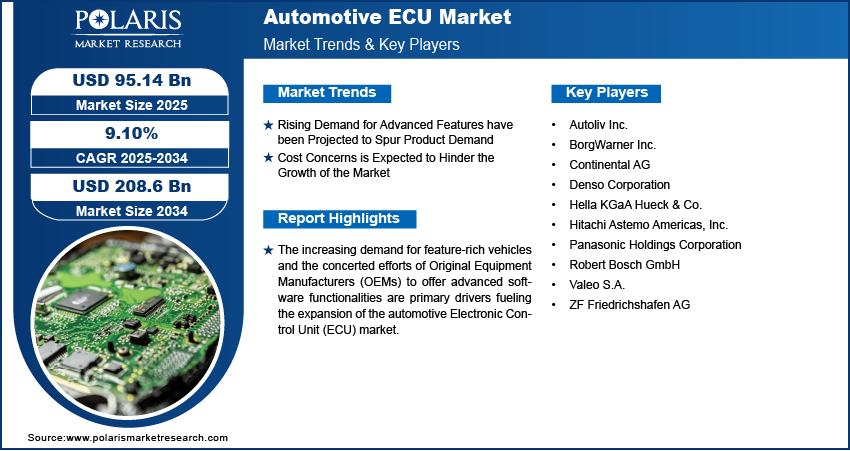

The global automotive ECU market was valued at USD 87.2 billion in 2024 and is expected to grow at a CAGR of 9.10% from 2025 to 2034. The market is expanding due to the growing demand for advanced driver-assistance systems (ADAS) and in-vehicle infotainment features.

Industry Trend

In contemporary vehicles, the automotive electronic control unit (ECU) plays a pivotal role by overseeing diverse electrical and electronic systems. Functioning as the vehicle's central command center, it oversees and fine-tunes a multitude of operations to uphold peak performance, safety, and efficiency standards.

The increasing demand for feature-rich vehicles and the concerted efforts of Original Equipment Manufacturers (OEMs) to offer advanced software functionalities are primary drivers fueling the expansion of the automotive Electronic Control Unit (ECU) market. This growth is further propelled by increasing requirements for vehicle safety systems and the imperative to curtail fuel consumption and emissions.

The escalating adoption of Automotive Driver-Assisted System (ADAS) technologies, encompassing features like parking assistance, adaptive cruise control (ACC), and automatic emergency braking (AEB), is significantly bolstering the automotive ECU market. Moreover, the pandemic-induced disruptions in assembly operations within U.S. and European production facilities led to substantial delays in delivery schedules and diminished revenue forecasts. However, the lifting of lockdown measures spurred a rapid resurgence in sales of both commercial and passenger vehicles across various segments, reinvigorating global automotive industry and consequently propelling demand for automotive ECU market.

To Understand More About this Research: Request a Free Sample Report

The quest for semiconductors essential for vehicle electrification is on a sharp rise, mirroring the surge in the development and adoption of electric vehicles amid heightened global initiatives to mitigate carbon emissions. Integral to power modules, Insulated Gate Bipolar Transistors (IGBTs) serve as potent power switches in inverters, facilitating the conversion of D.C. and A.C. currents to regulate and operate electric vehicle motors.

The partnership landscape for Automotive Electronic Control Units (ECUs) involves collaborations between technology providers, automotive manufacturers, and component suppliers to develop advanced ECUs. These partnerships aim to integrate cutting-edge hardware and software solutions, enhance vehicle performance, safety, and efficiency, and address evolving industry demands such as connectivity, autonomy, and electrification.

For instance, in January 2023, NVIDIA Corporation forged a partnership with Foxconn, a prominent manufacturing entity, to develop platforms tailored for autonomous vehicles. Under this collaboration, Foxconn will produce automotive electronic control units designed for vehicles utilizing NVIDIA's DRIVE Orin chip and DRIVE Hyperion sensors dedicated to autonomous driving.

The rising use of autonomous driving features like AEB, ACC, park assist, blind-spot detection, and LDW systems is driving automotive ECU market growth. Additionally, the growing demand for fuel-efficient autonomous vehicles, EVs, and vehicle-to-vehicle communication technology is expected to boost the electronic control units' market further.

Key Takeaway

- Asia Pacific dominated with more than 35% of the share in 2024.

- The North America is expected to witness the fastest-growing CAGR during the forecast period.

- By vehicle type category, the passenger cars segment accounted for the largest share in 2024.

- By propulsion category, the battery powered segment is projected to grow at fastest CAGR during the projected period.

What are the Drivers Driving the Demand for the Automotive ECU Market?

Rising Demand for Advanced Features have been Projected to Spur Product Demand

Consumers today are no longer satisfied with basic transportation; they seek vehicles that offer a seamless, connected experience, advanced safety features, and potential autonomous driving capabilities. This desire stems from technological advancements, evolving lifestyles, and societal needs.

As smartphones and digital lifestyles become ubiquitous, consumers expect their vehicles to integrate with their digital world seamlessly. They desire features like in-car Wi-Fi, Bluetooth connectivity for hands-free calling and music streaming, and smartphone integration for navigation and app access. Automotive ECUs play a crucial role in managing these connectivity features, ensuring reliable communication while maintaining data security and privacy.

The idea of autonomous vehicles, where cars can navigate and operate without human intervention, captures consumer interest. While fully autonomous vehicles are still in development, there's a growing demand for vehicles with advanced driver assistance systems (ADAS). These systems offer features like adaptive cruise control, lane-keeping assistance, and automated parking. ECUs serve as the brains behind ADAS, processing sensor data, making real-time decisions, and enhancing safety and driving convenience.

Which Factor is Restraining the Demand for Automotive ECU?

Cost Concerns is Expected to Hinder the Growth of the Market

Designing, developing, and manufacturing advanced ECUs involves substantial investment in research, engineering, and production facilities. These ECUs incorporate sophisticated hardware components, such as microprocessors, memory modules, and sensors, as well as intricate software algorithms for controlling various vehicle functions. The complexity of these systems contributes to higher development and production costs for both automakers and suppliers.

Integrating advanced ECUs with existing vehicle systems requires careful coordination and testing to ensure seamless operation and compatibility. This integration process involves additional engineering efforts, validation testing, and quality assurance measures, all of which incur additional costs for automakers and suppliers. Hence, this high cost of installation and maintenance can hinder the growth of the automotive ECU market.

Report Segmentation

The market is primarily segmented based on capacity type, propulsion, vehicle type, application, and region.

|

By Capacity Type |

By Propulsion |

By Vehicle Type |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Vehicle Type Insights

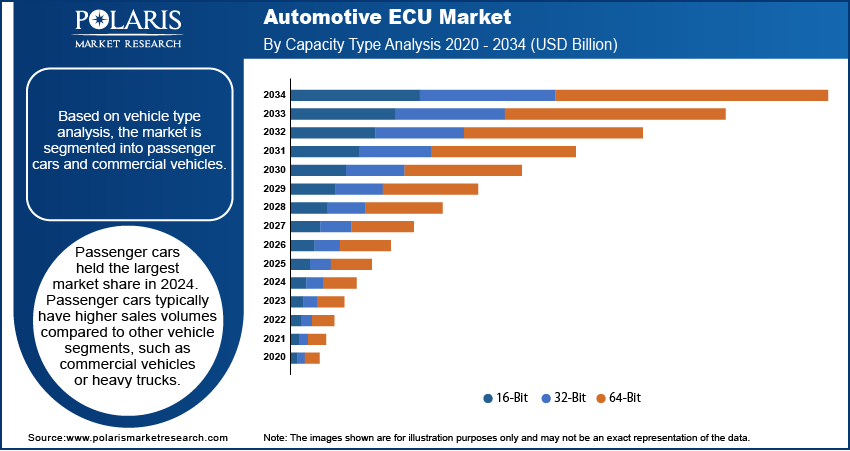

Based on vehicle type analysis, the market is segmented into passenger cars and commercial vehicles. Passenger cars held the largest market share in 2024. Passenger cars typically have higher sales volumes compared to other vehicle segments, such as commercial vehicles or heavy trucks. The sheer number of passenger cars sold globally contributes to the significant demand for automotive ECUs in this segment. Consumers increasingly demand passenger cars equipped with advanced electronic features such as infotainment systems, driver assistance technologies, and connectivity features. These features rely on sophisticated ECUs to operate effectively, further driving the demand for ECUs in passenger cars.

Features such as adaptive cruise control, lane departure warning systems, automated parking, and advanced infotainment systems require robust ECUs for control and management. Moreover, the growing popularity of electric and hybrid passenger cars also contributes to the demand for automotive ECUs. These vehicles require specialized ECUs to manage battery systems, electric motors, regenerative braking, and other components unique to electrified powertrains.

By Propulsion Insights

Based on propulsion analysis, the market has been segmented on the basis of battery-powered, hybrid, and internal combustion engines. The battery-powered segment is expected to be the fastest-growing CAGR during the forecast period. The increasing adoption of electric vehicles, including battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), is a significant driver of growth in the battery-powered segment. EVs rely entirely or partially on battery power for propulsion, requiring specialized ECUs to manage battery charging, energy consumption, thermal management, and other electric drivetrain components. These advancements necessitate more sophisticated ECUs capable of effectively managing and optimizing battery performance for improved efficiency and range.

Regional Insights

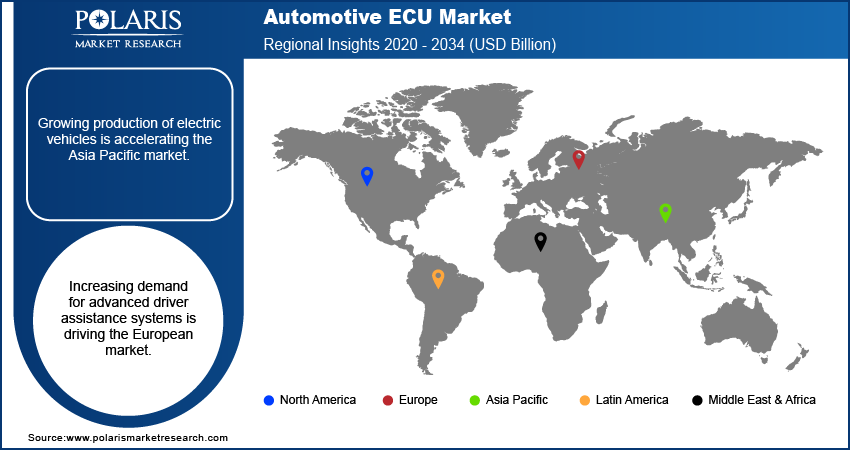

Asia Pacific

Asia Pacific automotive ECU market accounted for the largest share in 2024. Asia Pacific has become a major hub for automotive manufacturing, with several major automakers establishing production facilities in countries like China, Japan, South Korea, and India. The region's robust automotive industry generates substantial demand for Automotive ECUs to support the integration of advanced electronic systems and features in vehicles. Asia Pacific accounts for a significant portion of global vehicle production, with China being the world's largest automotive market. The region's burgeoning automotive production drives the demand for ECUs, which are essential components for controlling and managing various vehicle functions, including engine management, transmission control, and safety systems. This infrastructure development creates opportunities for the adoption of advanced vehicle technologies and fuels the demand for Automotive ECUs to support these technologies.

North America

North America automotive ECU market is expected to witness the fastest CAGR during the forecast period. Stringent regulatory standards related to vehicle safety, emissions, and cybersecurity are driving the demand for advanced ECUs in North America. Automakers are required to comply with regulations such as the Federal Motor Vehicle Safety Standards (FMVSS) and Corporate Average Fuel Economy (CAFE) standards, which mandate the integration of advanced electronic systems in vehicles. This regulatory environment creates opportunities for ECU manufacturers to supply compliant solutions to automakers. North America is at the forefront of research and development in connected and autonomous vehicle technologies. Automakers and technology companies in the region are investing heavily in the development of advanced driver assistance systems (ADAS), vehicle-to-everything (V2X) communication, and autonomous driving capabilities. These technologies rely on sophisticated ECUs to process sensor data, make real-time decisions, and control vehicle functions, driving the demand for ECUs in the region. As the adoption of EVs accelerates, there is a corresponding need for specialized ECUs to manage the unique requirements of electric drivetrains, battery systems, and charging infrastructure.

Competitive Landscape

The competitive market landscape for the Automotive Electronic Control Unit (ECU) market is characterized by intense competition among key players vying for market share. The market features a significant presence of emerging players, and startups focused on niche segments or innovative solutions within the Automotive ECU market. The companies often offer specialized ECUs tailored for specific applications, such as electric vehicles, autonomous driving systems, or vehicle connectivity.

Some of the major players operating in the global market include:

- Autoliv Inc.

- BorgWarner Inc.

- Continental AG

- Denso Corporation

- Hella KGaA Hueck & Co.

- Hitachi Astemo Americas, Inc.

- Panasonic Holdings Corporation

- Robert Bosch GmbH

- Valeo S.A.

- ZF Friedrichshafen AG

Recent Developments

- In November, 2024, Marelli unveiled its AI-based Electronic Control Unit, VEC_480, at the Professional MotorSport World Expo in Cologne, delivering enhanced real-time computing, connectivity, and neural algorithm processing for all propulsion types in motorsport applications.

- In August 2023, Continental expanded its automotive software product toolkit with the introduction of Virtual ECU Creator software. This innovative tool enables innovators to configure and utilize virtual cloud-based electronic control units, facilitating the creation of code for hardware that may not be currently available and streamlining the expansion process.

- In March 2023, Marelli Motorsport launched its cutting-edge Electronic Control Unit, the BAZ-340 ECU. This revamped unit marks a comprehensive redesign crafted to prevent the inherent obsolescence of its predecessor's electronics while also facilitating the advancement of its core features.

Report Coverage

The automotive ECU Market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, capacity type, propulsion, vehicle type, application, and their futuristic growth opportunities.

Automotive ECU Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 95.14 Billion |

|

Revenue forecast in 2034 |

USD 208.60 billion |

|

CAGR |

9.10% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Capacity Type, By Propulsion, By Vehicle Type, By Application And By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The Automotive ECU Market report covering key segments are capacity type, propulsion, vehicle type, application, and region.

Automotive ECU Market Size Worth USD 208.6 Billion by 2034

The automotive ECU market exhibiting a CAGR of 9.10 % during the forecast period

North America is leading the global market

key driving factors in Automotive ECU Market are Rising Demand for Advanced Features