Batter & Breader Premixes Market Share, Size, Trends, Industry Analysis Report

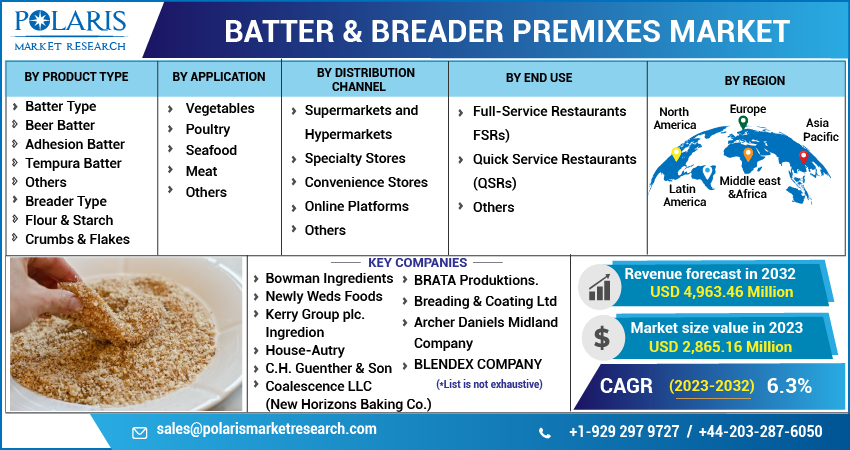

By Product Type; By Application (Vegetables, Poultry, Seafood, Meat, Others); By Distribution Channel; By End-Use; By Region; Segment Forecast, 2023 - 2032

- Published Date:May-2023

- Pages: 116

- Format: PDF

- Report ID: PM1976

- Base Year: 2022

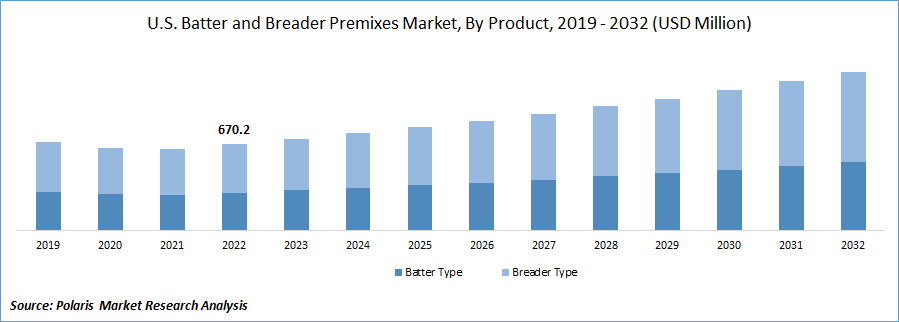

- Historical Data: 2019-2021

Report Outlook

The global batter & breader premixes market was valued at USD 2,657.13 million in 2022 and is expected to grow at a CAGR of 6.3% during the forecast period. The batter and breader premixes market is primarily driven by increased premium meat product consumption. The major factor driving the market is expanding interest in frozen and prepared food items, which has prompted the production and consumption of batter and breader premixes. Additionally, rising R&D spending associated with batter & breader premixes and their application in many end-use industries spurs the market demand.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces batter & breader premixes market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

Know more about this report: Request for sample pages

A growing consumer preference towards processed meat and seafood has resulted in an increasing demand for ready-to-cook (RTC) food, which has, in turn, boosted the need for batter and breader premixes. The market is being driven by several growth factors. One of the key drivers is the convenience factor offered by RTC food products. Busy lifestyles and increasing time constraints have led consumers to prefer RTC food products, which are easy to prepare and require less cooking time. Batter and breader premixes are key ingredients in many RTC food products, such as chicken nuggets, fish sticks, and onion rings.

Another factor driving the growth of the market is the increasing popularity of fried foods. Fried foods such as French fries, chicken wings, and fish and chips have always been popular in North America, and this trend is expected to continue during the forecast period. Batter and breader premixes are essential ingredients in preparing these fried foods. As the demand for these foods grows, the market is also anticipated to increase.

The COVID-19 pandemic significantly impacted the market due to fluctuations in demand and disruptions in the supply chain. Initially, there was a surge in demand for packaged and convenience foods as consumers shifted towards home-cooked meals. However, transportation and logistics restrictions led to a shortage of raw materials, increased transportation costs, and production slowdowns. As the pandemic continues, the market is expected to recover gradually with a shift towards healthier and more nutritional premixes and an increased focus on locally-sourced and sustainable ingredients due to changing consumer preferences.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The rising demand for high-quality food products is also driving the growth of the batter and breader premixes market. Consumers are increasingly concerned about the quality and safety of their food and are willing to pay a premium for high-quality products. Batter and breader premixes can help manufacturers meet these expectations by ensuring consistent product quality and safety.

In addition, the increasing popularity of ethnic foods is also driving the growth of the market. Consumers are becoming more adventurous with their food choices and seeking new and exotic flavors. Batter and breader premixes can help manufacturers create authentic ethnic flavors and textures in their food products, appealing to consumers seeking new and exciting taste experiences.

The growing trend towards healthy eating also drives the growth of the market. Consumers are increasingly concerned about the health impact of their food and are looking for healthier alternatives. Batter and breader premixes low in fat, sodium, and calories can help manufacturers meet this demand and create more nutritious food products.

Furthermore, the breader premixes have grown significantly recently, especially in the chicken application. Breader premixes are used in various applications, including chicken, seafood, vegetables, and other processed foods, to provide a crispy and crunchy texture while preserving the food's flavor. The chicken application segment accounts for a significant share of the breader premixes market, driven by the rising demand for processed and convenience foods.

Report Segmentation

The market is primarily segmented based on product type, application, distribution channel, end-use, and region.

|

By Product Type |

By Application |

By Distribution Channel |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Breader segment dominated the market in 2022

Breader segment dominated the market in 2022, and will continue its dominance over the forecast period. Breader-type premixes are widely used in the food industry as a convenient and efficient way to coat and bread a variety of food products. These premixes are typically made from a combination of dry ingredients, such as flour, breadcrumbs, spices, and other flavorings, which are mixed to create a uniform coating mixture. Breader-type premixes are available in various formulations, including regular, seasoned, and gluten-free options, to cater to different dietary preferences and requirements.

The main advantage of using breader-type premixes is their ease and consistency in the breading process. These premixes are pre-mixed and ready to use, eliminating the need for individual measurement and mixing dry ingredients. This saves time and labor in commercial food production, ensuring a consistent and uniform coating on each food product, which is crucial for achieving consistent quality and taste.

Breader-type premixes are versatile and can be used for various food products, including poultry, seafood, meat, vegetables, and desserts. They can be used for fried and baked products, offering flexibility in cooking methods and end-product options. Breader-type premixes are commonly used to produce popular food items such as fried chicken, fish fillets, onion rings, nuggets, and breaded cheese sticks.

Meat segment holds the largest revenue share of the market in 2022

The meat segment holds the largest market revenue share in 2022, and likely to continue its dominance during forecast period. The rising population's increasing need for proteins and essential nutrients has increased the consumption of various types of meat, such as pork, beef, and others. For instance, the OECD-FAO Agriculture Outlook has estimated the increase of global meat consumption by 14% by 2030. Rapid urbanization and Income growth have shifted the source of calories and proteins to meat in various emerging and low-income countries. As the demand for meat-based dishes continues to rise, food service operators and consumers are looking for convenient and easy-to-use products to enhance their meat dishes' flavor and texture.

Batter and breader premixes provide a simple and efficient way to bread and batter meat, saving time and effort for home cooks and food service operators. These premixes are available in various flavors and textures, allowing for customization based on personal and local tastes. Additionally, many batter and breader premixes for meat are formulated to be low in fat, calories, and sodium, which makes them a healthier option for health-conscious consumers.

Supermarkets and Hypermarkets segment anticipated to hold highest CAGR during forecast period

The Supermarkets and Hypermarkets segment expected to hold highest CAGR over the forecast period. The supermarkets and hypermarkets for the batter and breader premixes are highly preferred by consumers due to their convenience, availability of a wide range of products, and attractive pricing. Supermarkets and hypermarkets offer a one-stop shopping experience for customers, allowing them to purchase their groceries and household items in one place.

In the market, these retail formats play a significant role in increasing the visibility and availability of products. As a result, manufacturers of batter and breader premixes often partner with supermarkets and hypermarkets to ensure their products are widely available to consumers.

Moreover, supermarkets and hypermarkets are increasingly investing in product placement and marketing activities to promote the sales of batter and breader premixes. It includes activities such as in-store promotions, discounts, and product demonstrations. Additionally, the rise of e-commerce platforms and online grocery shopping has further expanded the reach of supermarkets and hypermarkets, making it easier for consumers to purchase batter and breader premixes from the comfort of their homes.

Quick service restaurants (QSRs) segment dominated the market in 2022

Quick service restaurants segment dominated the global market in 2022. Quick Service Restaurants (QSRs) worldwide have recognized the value of incorporating batter and breader mixes into their operations. Leading companies in the food industry have emerged as key providers of these essential ingredients and services. Batter and breader mixes offer QSRs a convenient and efficient way to create crispy and flavorful coated foods in their fast-paced environments, such as chicken, fish, onion rings, and more.

In North America, where QSRs are a staple of the fast-food industry, leading companies such as Tyson Foods, Inc. and Archer Daniels Midland Company (ADM) are prominent providers of batter and breader mixes. These companies offer a wide range of batter and breader mix options, including traditional flour-based combinations, specialty blends for specific food items, and customizable mixes that allow QSRs to create unique flavors and textures. These companies also provide technical support, training, and menu development assistance to help QSRs optimize their batter and breader mixes in their operations.

North America dominated the global market in 2022

North America dominated the global market in 2022. North America has a thriving food industry, with a particular emphasis on baked goods. Batter and breader premixes are a crucial component of this industry, as they provide an easy and convenient way to prepare and coat various food products. These premixes create different bread and batter types, including fried chicken, fish, and onion rings.

The North American market is dominated by several key players, including Kerry Group, McCormick & Company, Newly Weds Foods, and Archer Daniels Midland. These companies offer various premixes for different food products and cooking methods. They also invest heavily in research and development, creating new technologies to improve the quality and consistency of their premixes.

New batter and breader premix market technologies focus on improving the final product's texture and flavor. For instance, some companies are developing premixes that use enzymes to improve the crispiness and browning of fried foods. Others use natural ingredients to enhance the flavor of their premixes, including herbs, spices, and even vegetables. Baking units play a critical role in the batter and breader premixes market. These units coat food products with the premix before cooking, ensuring the batter or breading adheres properly and evenly. Baking units can be customized to meet the specific needs of different food products, such as temperature, humidity, and cooking time.

Competitive Insight

Some of the major players operating in the global batter & breader premixes market include Bowman Ingredients, Newly Weds Foods, Kerry Group plc., Ingredion, House-Autry, C.H. Guenther & Son, Coalescence LLC (New Horizons Baking Co.), BRATA Produktions., Breading & Coating Ltd, Archer Daniels Midland Company, BLENDEX COMPANY, McCormick & Company, Inc, Louisiana Fish Fry Products Ltd, PGP International (ABFI), and Showa Sangyo Co., Ltd.

Recent Developments

- In June 2022, Guenther Bakeries UK Limited expanded its UK operations by signing a lease with Goodman Group, which helped the company to fulfill the contract of supplying baked goods to global brands.

- In July 2021, Kerry Group announced the opening a new coatings manufacturing facility in Rome, GA. that specializes in creating innovative solutions for coated poultry, seafood, appetizers, and alternative meat categories. Its impressive production capabilities include Japanese breadcrumb (panko style), cracker meal, and breader blends.

Batter & Breader Premixes Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 2,865.16 million |

|

Revenue forecast in 2032 |

USD 4,963.46 million |

|

CAGR |

6.3% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Product Type, By Application, By Distribution Channel, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Bowman Ingredients, Newly Weds Foods, Kerry Group plc., Ingredion, House-Autry, C.H. Guenther & Son, Coalescence LLC (New Horizons Baking Co.), BRATA Produktions., Breading & Coating Ltd, Archer Daniels Midland Company, BLENDEX COMPANY, McCormick & Company, Inc, Louisiana Fish Fry Products Ltd, PGP International (ABFI), and Showa Sangyo Co., Ltd. |

In today’s hyper-connected world, running a business around the clock is no longer an option. And at Polaris Market Research, we get that. Our sales & analyst team is available 24x5 to assist you. Get all your queries and questions answered about the batter & breader premixes market report with a phone call or email, as and when needed.

FAQ's

The global batter & breader premixes market size is expected to reach USD 4,963.46 million by 2032.

Key players in the Bowman Ingredients, Newly Weds Foods, Kerry Group plc., Ingredion, House-Autry, C.H. Guenther & Son, Coalescence LLC (New Horizons Baking Co.), BRATA Produktions.

North America contribute notably towards the global batter & breader premixes market.

The global batter & breader premixes market expected to grow at a CAGR of 6.3% during the forecast period.

The batter & breader premixes market report covering key segments are product type, application, distribution channel, end-use, and region.