Battery Separators Market Share, Size, Trends, Industry Analysis Report

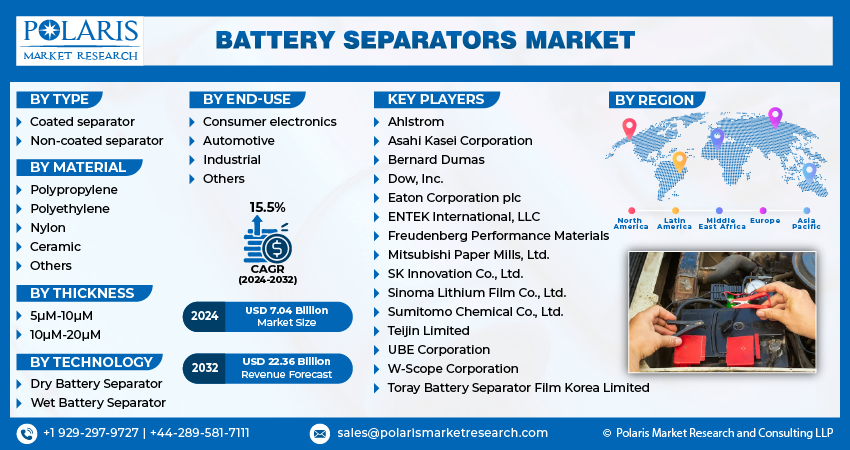

By Type (Coated separator, Non-coated separator); By Material; By Thickness; By Technology; By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 118

- Format: PDF

- Report ID: PM4498

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

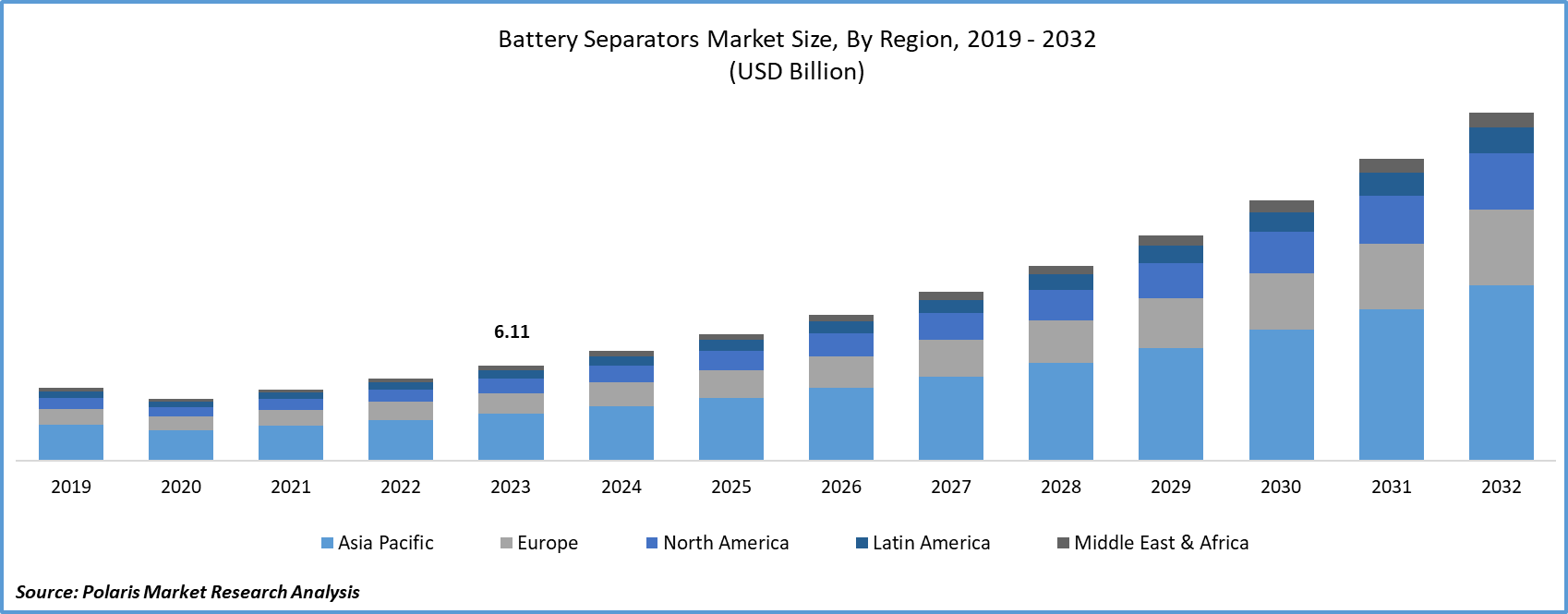

Battery separators market size was valued at USD 6.11 billion in 2023. The market is anticipated to grow from USD 7.04 billion in 2024 to USD 22.36 billion by 2032, exhibiting the CAGR of 15.5% during the forecast period

Battery Separators Market Overview

The industrial, automotive, and consumer electronics sectors are driving battery separators market growth. These separators play an important role in industrial applications by ensuring reliable energy storage for continuous operations and streamlining the integration of renewable energy sources. The automotive industry experiences advantages through the utilization of high-performance separators in electric and hybrid vehicles, contributing to improved battery efficiency and safety. Furthermore, in the field of consumer electronics, battery separators play an important role in promoting the development of compact and powerful devices, thereby supporting the proliferation of smartphones, tablets, and wearable technology.

Battery separators separate the anode (positive electrode) and cathode (negative electrode) materials within a cell. These barriers prevent short circuits between the battery's internal components, ensuring optimal ionic conductivity during charging and discharging. Separators, which have a porous structure, are chemically and electrochemically stable for the battery's electrolyte and electrode materials. Furthermore, the separator is designed to automatically turn off the battery in the event of overheating or a short circuit.

For instance, in October 2023, Asahi Kasei plans to expand its production capacity for lithium-ion battery (LIB) separators in response to rising demand for electric vehicles, particularly in North America. This expansion will increase the company's coating capacity to approximately 1.2 billion square meters per year, allowing for the production of coated separators for batteries capable of powering approximately 1.7 million electric vehicles.

The battery separators market is anticipated to grow owing to advancements in lithium-ion batteries and battery technology. Furthermore, ongoing R&D efforts to develop new materials for battery separators contribute to the growth of the market during the forecast period. Also, rapid technological advancements in the electronics and electrical sectors are facilitating the market growth.

To Understand More About this Research: Request a Free Sample Report

The increasing adoption of electric vehicles, which rely on advanced battery technologies, has a significant impact on the battery separator market. With the growing electric vehicle market, there is an increased demand for battery separators that provide high performance and safety. Energy storage technologies are becoming increasingly popular, especially for grid stability and renewable energy integration. These technologies frequently rely on large batteries, emphasizing the need for dependable and efficient battery separators. The growth of renewable energy sources such as solar and wind power has increased the demand for energy storage systems. Battery separators are critical components of these systems because they allow surplus renewable energy to be stored for later use.

The COVID-19 pandemic has had a significant impact on the battery separators market development. Although the initial lockdowns and restrictions on manufacturing and supply chain operations caused significant market disruptions, the rising demand for rechargeable batteries and electric vehicles during the pandemic has created opportunities for the growth of the market. However, issues such as supply chain disruptions and raw material shortages have resulted in price fluctuations, hindering the growth of the market. Furthermore, the economic downturn caused by the pandemic has reduced consumer demand for high-end consumer electronics, reducing the need for battery separators in these applications.

Battery Separators Market Dynamics

Market Drivers

Rising Adoption of Lithium-Ion-Batteries Driving the Growth of the Market

The rising adoption of lithium-ion batteries is driving the growth of the market. Deep-cycle lithium-ion and lead-acid batteries are becoming indispensable choices for storing renewable energy. Although lithium batteries are relatively new in this area, they are addressing some of the limitations associated with lead-acid alternatives. Additionally, lithium batteries are increasingly supplanting lead-acid batteries in various applications, such as residential, commercial, and recreational vehicle use.

Furthermore, the surge in sustainable power, driven by advances in lithium batteries, opens up battery separators market opportunities for energy storage, which benefits both the environment and the economy. Another important factor driving the battery separators market is the growing need for energy storage solutions in the telecommunications industry. With increased global connectivity and reliance on smartphones, telecom infrastructure requires more reliable and long-lasting batteries. The preference for lithium-ion batteries in various industries is expected to have a significant impact on the battery separators market development.

Increasing Electrification of Vehicle, and Elevated Sales of Smart Electronic Equipments and Improvements in LI-Ion Batteries Facilitating the Growth of the Market

Automakers are devoting significant financial resources to the development of electric vehicles in response to government incentives and regulations in various countries mandating the gradual elimination of traditional internal combustion engine vehicles. The added benefits of noiseless engines and zero local emissions make electricity a viable alternative to conventional fuel, especially given rising crude oil prices. This shift to electric power is not limited to automobiles; it is also evident in the widespread use of wireless electrical and electronic devices such as laptop computers, mobile phones, digital cameras, and other similar devices. Batteries continue to be the preferred energy source for devices such as mobile phones and portable consumer electronics, fueling growth in the industry.

Market Restraints

Absence of Appropriate Storage and Transportation of Batteries Hampering on the Growth of the Market

Managing batteries of various kinds carries inherent risks. Without proper safeguards, batteries can pose hazards to nearby individuals, whether in use, charging or in storage. Potential problems include overheating, burning, or exploding battery chargers, leading to electrical shocks and burns. These risks associated with batteries can result in accidents, fatalities, and property damage. For example, improper handling of lithium-ion batteries causes numerous workplace injuries. Not only lithium-ion batteries but also commonly used lead-acid batteries and standard 9-volt dry cell batteries found in supermarkets can pose serious risks to people in close proximity. As a result of the lack of proper battery storage and transportation practices, legislatures are compelled to impose stringent regulations on battery manufacturers. This may impede the growth of the battery separators market.

Report Segmentation

The market is primarily segmented based on type, material, thickness, technology, end-use, and region.

|

By Type |

By Material |

By Thickness |

By Technology |

By End-Use |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Battery Separators Market Segmental Analysis

By Type Analysis

The coated separator segment held the largest market share in 2023. Coated separators improve safety by adding an extra layer of protection between electrodes. These protective coatings can help to prevent dendrite growth, which can lead to short circuits and battery failure. Electric vehicles, renewable energy storage, and high-performance electronics are driving the demand for batteries with higher energy density, cycle life, and safety ratings. Coated separators emerge as a solution for meeting these stringent requirements, providing a new perspective on improving battery performance.

The non-coated separator segment witnessed the fastest growth in the market. Non-coated separators are typically less expensive to produce than coated separators. This financial advantage makes them demanding in procedures where cost-effectiveness is important, such as conventional lead-acid batteries and certain consumer electronics applications.

By Material Analysis

The polyethylene segment dominated the market in 2023. Manufacturing polyethylene separators with consistently uniform pore sizes allow for efficient ion transport, preventing dendrite growth and short circuits. These low-cost separators are in line with the industry's cost-cutting efforts. The increasing popularity of electric vehicles, which rely heavily on advanced battery technologies, is driving battery separators market demand for polyethylene battery separators. As the electric vehicle demand grows, there is a greater need for dependable batteries to power consumer devices such as smartphones, computers, wearables, and other gadgets.

The polypropylene segment witnessed the fastest growth in the market. Polypropylene (PP) is a highly versatile polymer that is used as both a fiber and a plastic in a wide range of industries, including automotive and medical devices. In particular, polypropylene separators play an important role in electric vehicle (EV) batteries, improving their performance and safety. These separators are designed to withstand high temperatures and have excellent chemical stability, making them ideal for integration into lithium-ion batteries.

By End-Use Analysis

Based on end-use analysis, the market has been segmented on the basis of consumer electronics, automotive, industrial, and others. The automotive segment dominated the market with the largest revenue share in 2023. The shift to electric vehicles represents a significant advancement in the automotive industry. Electric vehicles (EVs) rely on cutting-edge battery technology, such as lithium-ion batteries, for safety, efficiency, and durability. This reliance on advanced batteries highlights the importance of high-performance separators. Many countries and regions are putting regulations in place to promote cleaner transportation in response to concerns about greenhouse gas emissions. These regulatory measures are contributing to increased demand for electric and hybrid vehicles, necessitating the development of advanced battery technologies.

Battery Separators Market Regional Insights

Asia-Pacific Dominated the Market with the Largest Share in 2023

Asia-Pacific dominated the battery separators market. The resilient battery manufacturing industries in China, Japan, and India, combined with government commitments to infrastructure development, are expected to be key drivers of regional market growth. Furthermore, the growing presence of fast-moving consumer goods (FMCG) companies in India, China, and Singapore is expected to increase demand for batteries, contributing to market growth in the near future. Furthermore, the acceleration of industrialization, rising government infrastructure investments, and an increase in Foreign Direct Investments (FDIs) are expected to drive battery separators market growth.

North America is expected to grow at the fastest rate in the market. Electric vehicles are gaining popularity across North America, particularly in the United States. Governments have implemented various incentives, and consumers are increasingly aware of the benefits of EVs. The expansion of the electric vehicle demand is driving up growth for cutting-edge battery technology, particularly premium separators. Batteries and separators are critical components of energy storage systems, helping to stabilize the grid by storing surplus renewable energy.

Competitive Landscape

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Ahlstrom

- Asahi Kasei Corporation

- Bernard Dumas

- Dow, Inc.

- Eaton Corporation plc

- ENTEK International, LLC

- Freudenberg Performance Materials

- Mitsubishi Paper Mills, Ltd.

- SK Innovation Co., Ltd.

- Sinoma Lithium Film Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Teijin Limited

- Toray Battery Separator Film Korea Limited

- UBE Corporation

- W-Scope Corporation

Recent Developments

- In January 2022, Entek Manufacturing acquired a manufacturer of material handling equipment, Adaptive Engineering, and Fabrication. Adaptive is in charge of overseeing the development, installation, and sales of material handling equipment, with support from Entek's project management and engineering teams.

Report Coverage

The Battery Separators Market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, material, thickness, technology, end-use and their futuristic growth opportunities.

Battery Separators Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7.04 billion |

|

Revenue forecast in 2032 |

USD 22.36 billion |

|

CAGR |

15.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Material, By Thickness, By Technology, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation |

Delve into the intricacies of Battery Separators in 2024 through the meticulously compiled market share, size, and revenue growth rate statistics by Polaris Market Research Industry Reports. Uncover a comprehensive analysis that not only projects market trends up to 2032 but also provides valuable insights into the historical landscape. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Data Mesh Market Size, Share 2024 Research Report

Hydrogen Hubs Market Size, Share 2024 Research Report

Therapeutic Hypothermia Systems Market Size, Share 2024 Research Report

Digestive Health Supplements Market Size, Share 2024 Research Report

Europe Digestive Health Supplements Market Size, Share 2024 Research Report