Bioceramics Market Share, Size, Trends, Industry Analysis Report

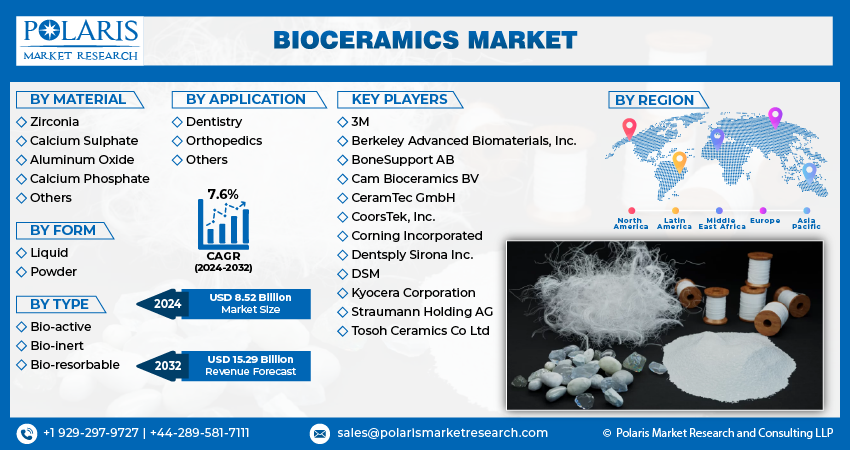

By Material (Zirconia, Calcium Sulphate, Aluminum Oxide, Calcium Phosphate, Others); By Form; By Type; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Apr-2024

- Pages: 119

- Format: PDF

- Report ID: PM4831

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

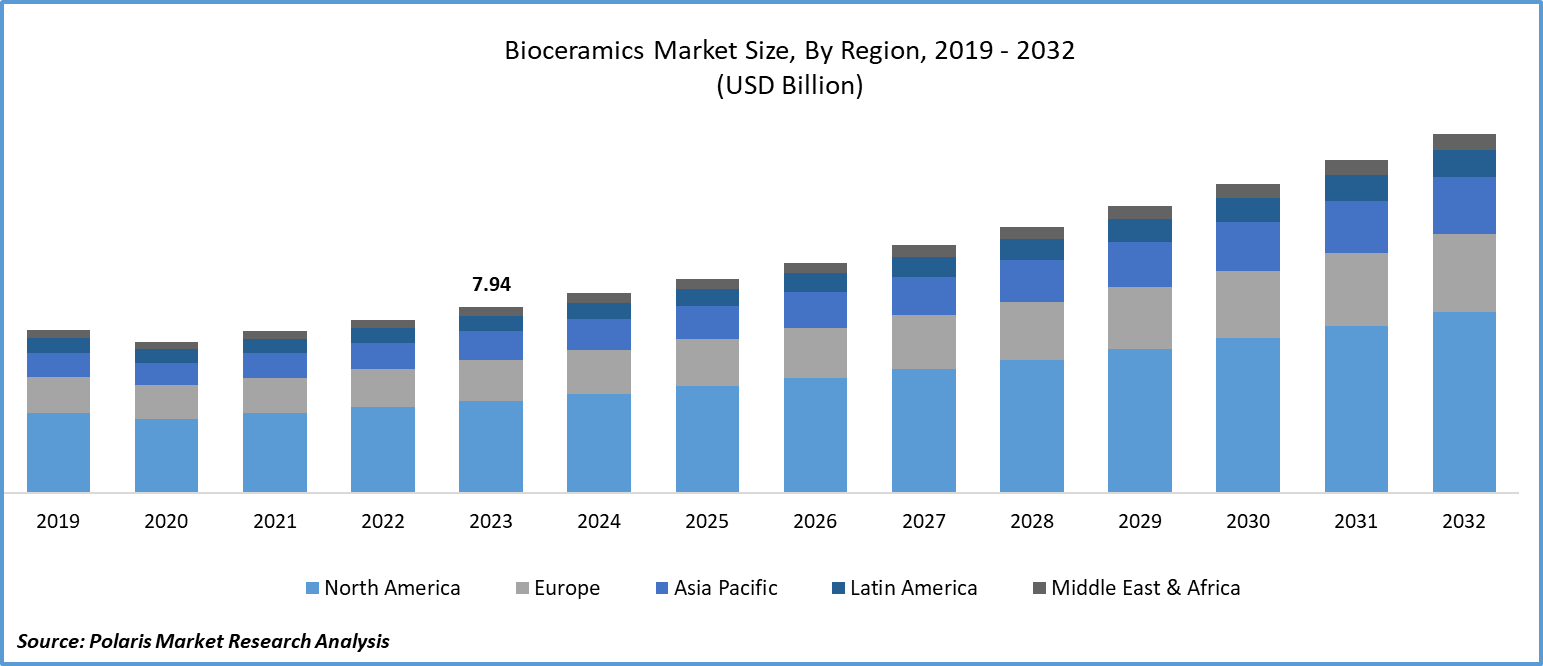

- Global bioceramics market size was valued at USD 7.94 billion in 2023.

- The market is anticipated to grow from USD 8.52 billion in 2024 to USD 15.29 billion by 2032, exhibiting the CAGR of 7.6% during the forecast period.

Market Introduction

Rising global healthcare expenditures are propelling the market. With advancing economies and aging populations, healthcare costs surge due to technological advancements and higher chronic disease rates. Bioceramics are used in orthopedic and dental surgeries, favored for their durability, biocompatibility, and bioactivity. Additionally, their compatibility with minimally invasive surgeries boosts adoption. As healthcare spending continues to rise, investment in bioceramics and innovative medical technologies is expected to increase, driving further advancements in treatments and procedures.

In addition, companies operating in the market are entering partnerships to enhance their offerings and strengthen their market presence.

To Understand More About this Research: Request a Free Sample Report

- For instance, in July 2023, Lithoz GmbH and Himed entered into a strategic research collaboration to expedite the advancement of medical-grade bioceramics. Their partnership aims to create implants utilizing biocompatible calcium phosphates, addressing the rapidly growing need for cutting-edge bioceramic materials for additive manufacturing.

Technological advancements drive the market, transforming medical applications. Bioceramics like alumina, zirconia, and hydroxyapatite are pivotal in orthopedic, dental, and tissue engineering. Additive manufacturing, particularly 3D printing, enables precise customization of bioceramic structures for individual patients. Nanotechnology enhances the mechanical properties and bioactivity of bioceramics, improving tissue integration and durability. Bioactive coatings and surface modifications further promote faster healing. Advanced bioceramic composites offer multifunctional materials, expanding application potential and fostering innovation in personalized medical solutions.

Industry Growth Drivers

The increasing aging population is projected to spur product demand.

The growing elderly population globally is a key driver of the market. Bioceramics, including alumina and hydroxyapatite, are increasingly used in medical applications due to their biocompatibility and durability. With aging individuals facing prevalent bone and dental health issues, demand for orthopedic and dental implants is rising. The resilience and compatibility offered by bioceramics make them suitable for long-term implantation, which is vital for aging patients requiring sustainable medical interventions. Advanced manufacturing techniques like nanoparticle integration and 3D printing further enhance the properties of bioceramics, catering to the specific needs of older people.

The growing incidence of chronic diseases is expected to drive bioceramics market growth.

The surge in chronic diseases like osteoporosis and osteoarthritis is fueling the bioceramics market growth. Aging populations and sedentary lifestyles contribute to this, necessitating effective medical interventions. In orthopedics and dentistry, bioceramics such as calcium phosphates and alumina-based ceramics find wide application for bone grafting, joint replacements, and dental implants, owing to their seamless integration with the body and excellent mechanical properties. Their corrosion resistance and stability under physiological conditions make them suitable for long-term implantation, reducing the need for frequent replacements. Additionally, their compatibility with minimally invasive surgeries further drives demand.

Industry Challenges

The high cost of bioceramic implants is likely to impede bioceramics market growth.

The high expense associated with bioceramic implants constrains the bioceramics market. Despite their benefits, such as biocompatibility and durability, the intricate manufacturing processes and quality materials involved contribute to elevated costs. Additionally, customization requirements further drive up prices. This expense limits access to bioceramic implants, particularly in regions with limited healthcare resources or for patients lacking comprehensive insurance coverage. Furthermore, healthcare providers and patients may opt for alternative materials due to cost considerations, impacting bioceramics market growth.

Report Segmentation

The bioceramics market analysis is primarily segmented by material, form, type, application, and region.

|

By Material |

By Form |

By Type |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Material Analysis

The Zirconia segment held a significant bioceramics market share in 2023

The zirconia segment held a significant bioceramics market share in 2023. Zirconia implants, favored for dental applications, offer a natural appearance similar to real teeth, enhancing patient satisfaction. Their excellent biocompatibility reduces the risk of rejection, making them ideal for dental and orthopedic implants. Zirconia's exceptional mechanical properties ensure durability. Corrosion resistance further enhances stability, especially in oral environments. Hypoallergenic properties make zirconia suitable for patients with metal allergies, broadening its application scope. Continuous technological advancements improve precision and aesthetics, driving adoption.

By Form Analysis

The powder segment held a significant bioceramics market share in 2023

The powder segment held a significant bioceramics market share in 2023 due to its versatility, manufacturing flexibility, and cost-effectiveness. Powdered bioceramics are widely used in orthopedic implants, dental restorations, and tissue engineering scaffolds, meeting diverse medical needs. Their adaptable manufacturing processes enable the creation of intricate structures, enhancing functionality and scalability. Moreover, powdered bioceramics can be engineered for enhanced bioactivity, ensuring tissue integration and implant success. Compliance with regulatory standards further ensures safety and efficacy.

By Type Analysis

Bio-inert segment held a significant bioceramics market share in 2023

The bio-inert segment held a significant bioceramics market share in 2023 due to their superior biocompatibility, minimal reactivity with tissues, and stability in physiological conditions. Their biocompatibility ensures minimal adverse reactions upon implantation, making them preferred for medical applications. With low reactivity, they mitigate inflammation or rejection risks, ensuring long-term implant success. Additionally, their structural integrity and chemical stability contribute to sustained functionality in medical devices. Versatile across medical procedures, particularly in orthopedics and dental implants, they seamlessly integrate with tissues. Their durability and resistance to degradation translate to reduced replacement needs and healthcare costs. Established clinical efficacy and safety drive widespread adoption among healthcare professionals.

By Application Analysis

The dentistry segment held a significant bioceramics market share in 2023

The dentistry segment held a significant bioceramics market share in 2023. Bioceramic materials meet the high demand for natural-looking dental solutions. They offer superior aesthetics, ensuring compatibility with oral tissues and reducing the risk of adverse reactions due to excellent biocompatibility. Moreover, their durability and strength, similar to natural teeth, ensure long-term functionality in dental restorations and implants. Bioceramic dental materials also facilitate minimally invasive procedures, preserving natural tooth structure and enhancing patient comfort.

Regional Insights

North America dominated the global bioceramics market in 2023

North America dominated the global bioceramics market in 2023. Its advanced technological infrastructure and research facilities drive the development of cutting-edge bioceramic materials and technologies. The region's robust healthcare system, high healthcare expenditure per capita, and stringent regulatory environment ensure widespread adoption and trust in bioceramic products. Additionally, North America's aging population fuels demand for orthopedic implants, dental restorations, and other medical devices, contributing to market growth. Strong collaborations between academia, industry, and research institutions further promote innovation.

The demand from the Asia-Pacific region is expected to increase during the bioceramics market forecast period. Its expanding population and robust economic growth drive increased healthcare needs, necessitating bioceramics utilization in medical procedures. Improved healthcare infrastructure, particularly in countries like China and India, fosters the adoption of advanced medical technologies such as bioceramics. Additionally, rising chronic disease rates, including osteoporosis and dental ailments, necessitate bioceramic applications for treatments like bone grafting and dental implants. Ongoing technological advancements and government initiatives aimed at enhancing healthcare access further fuel market growth. Moreover, the region's growing prominence in medical tourism attracts international patients, leading to increased bioceramics utilization in procedures catering to these individuals.

Key Market Players & Competitive Insights

The bioceramics market involves diverse players, and the expected surge of newcomers will intensify rivalry. Key players continually enhance their technologies to maintain a competitive advantage, emphasizing effectiveness, reliability, and security. These firms prioritize strategic actions like forming alliances, improving product ranges, and participating in collaborations. They aim to outperform competitors within the industry and secure a significant market share.

Some of the major players operating in the global bioceramics market include:

- 3M

- Berkeley Advanced Biomaterials, Inc.

- BoneSupport AB

- Cam Bioceramics BV

- CeramTec GmbH

- CoorsTek, Inc.

- Corning Incorporated

- Dentsply Sirona Inc.

- DSM

- Kyocera Corporation

- Straumann Holding AG

- Tosoh Ceramics Co Ltd

Recent Developments

- In July 2023, SHS Capital, a healthcare expert based in Germany, along with ING Corporate Investments and additional Co-Investors, invested funds in CAM Bioceramics. CAM Bioceramics is a contract development and manufacturing organization (CDMO) specializing in cutting-edge orthobiological calcium phosphate solutions.

- In August 2023, 3DCERAM Sinto, Inc. and SINTX Technologies, Inc. unveiled a partnership aimed at creating numerous innovative resins and techniques for additive manufacturing of ceramic items. The collaboration primarily targets the biomedical and investment casting sectors.

- In May 2023, CeramTec introduced Rubalit ZTA, a high-quality ceramic substrate offering exceptional flexural strength, impressive thermal conductivity, electrical insulation, and elevated dielectric strength, ensuring superior performance.

Report Coverage

The bioceramics market report emphasizes key regions worldwide to help users better understand the product. It also provides market insights into recent developments and trends and analyzes the technologies gaining traction worldwide. Furthermore, the report covers an in-depth qualitative analysis of various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, materials, forms, types, and applications, and their futuristic growth opportunities.

Bioceramics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 8.52 billion |

|

Revenue Forecast in 2032 |

USD 15.29 billion |

|

CAGR |

7.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The Bioceramics Market report covering key segments are material, form, type, application, and region.

Bioceramics Market Size Worth $15.29 Billion By 2032

Bioceramics Market exhibiting the CAGR of 7.6% during the forecast period.

North America is leading the global market

key driving factors in Bioceramics Market are increasing aging population