Biohacking Wearables Market Size, Share, Trends, Industry Analysis Report

: By Product Type (Smart Watches, Fitness Trackers, Smart Clothing, Sleep Trackers, and Others), Distribution Channel, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 119

- Format: PDF

- Report ID: PM5588

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

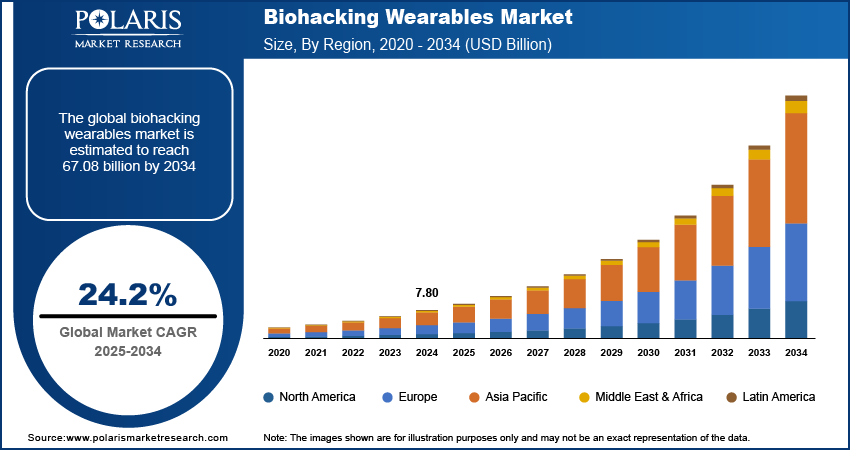

The global biohacking wearables market size was valued at USD 7.80 billion in 2024, exhibiting a CAGR of 24.2% during 2025–2034. The market is growing due to rising health awareness, smart device adoption, advanced sensor integration, and personalized direct-to-consumer solutions.

Key Insights

- The smartwatches segment led the product type category in 2024 due to ongoing innovation in sensors, IoT integration, and the ability to deliver real-time health analytics.

- The online retailers segment is growing rapidly due to rising smartphone usage, internet access, and the shift toward convenient, contactless shopping.

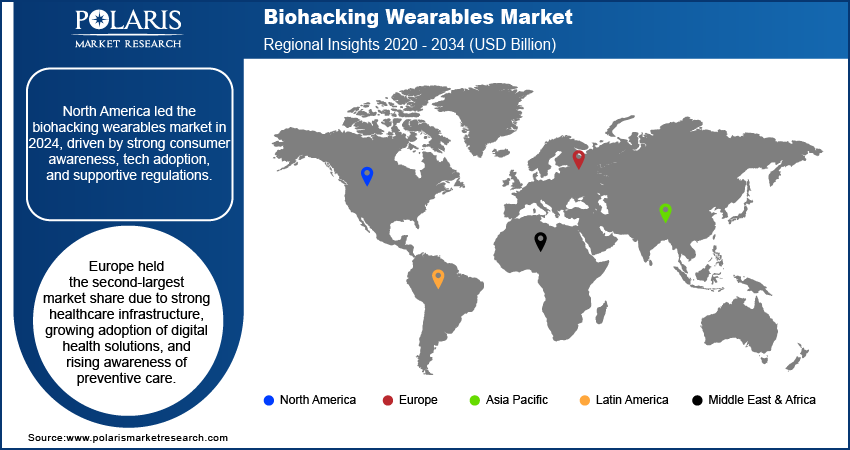

- North America led the regional market in 2024, driven by high consumer health awareness, early adoption of wearable technologies, and strong healthcare infrastructure.

- Europe held the second-largest market share, with strong demand in countries such as Germany, the UK, and France, supported by healthcare digitization and chronic disease monitoring initiatives.

Industry Dynamics

- Growing health consciousness among urban populations is encouraging proactive tracking of wellness and fitness, increasing demand for biohacking wearables globally.

- Integration of AI-powered sensors enables real-time disease detection, driving adoption of smart wearables for preventive and continuous health monitoring.

- Smartwatches now offer noninvasive monitoring for ECG, blood oxygen, stress, and sleep, appealing to a wider health-conscious audience.

- Growing workplace stress and sleep disorders are pushing more users toward sleep trackers for better rest and performance improvement.

- Increasing consumer interest in tailored health solutions creates room for wearable brands to build deeper customer relationships directly.

- Concerns about personal data security in direct sales channels may discourage users from adopting personalized wearable health platforms.

Market Statistics

2024 Market Size: USD 7.80 billion

2034 Projected Market Size: USD 67.08 billion

CAGR (2025–2034): 24.2%

North America: Largest market in 2024

AI Impact on Biohacking Wearables Market

- AI enhances real-time health monitoring by analyzing biometric data for early detection of anomalies such as arrhythmias, sleep disorders, or stress.

- Machine learning algorithms personalize health insights and recommendations, improving user engagement and the effectiveness of wearable devices.

- AI integration enables predictive analytics, helping users and healthcare providers proactively manage chronic conditions and optimize performance.

- Natural language processing (NLP) powers intelligent voice assistants in wearables, making health data more accessible and user-friendly.

- AI-driven automation supports adaptive device behavior, such as adjusting activity goals or sleep tracking sensitivity based on user patterns.

To Understand More About this Research: Request a Free Sample Report

The biohacking wearables market is growing due to rising consumer interest in proactive health monitoring and human performance optimization. The market demand is fueled by increasing health consciousness, particularly among urban populations, and the growing adoption of fitness-oriented technology. Moreover, the healthcare-based digital wearable products, such as smart watches, are gaining importance among consumers, thus boosting the market revenue. The smart watches offer multifunctionality, including heart rate monitoring, sleep tracking, and glucose sensing, which is further fueling the biohacking wearables market growth.

A major factor driving the biohacking wearables market demand is the integration of advanced wearable sensor devices, which are capable of detecting anomalies in real-time, enabling early detection of diseases. For instance, in 2023, Apple introduced enhanced health tracking features in its Apple Watch Series 9 with the new S9 SiP, including Artificial Intelligence (AI) based heart health analytics. Thus, such innovations are expanding demand for biohacking wearables in both the consumer and medical sectors.

Factors such as increasing workplace stress and rising sleep-related disorders are driving the growing adoption of sleep trackers, thus fueling the demand for biohacking wearables. Moreover, initiatives taken by the US Centers for Disease Control and Prevention (CDC) to promote better sleep health awareness are leading to increased consumer spending on sleep-enhancing wearables. Therefore, the convergence of health awareness initiatives and advanced wearable technology is creating a strong market demand for sleep trackers, which is playing an important role in expanding the biohacking wearables market development.

Market Dynamics

Rising Adoption of Smart Watches for Chronic Disease Management

The rising prevalence of chronic conditions, such as diabetes and cardiovascular disorders, is driving consumers to adopt smartwatches that are equipped with advanced health monitoring features. Smartwatches deliver real-time data on electrocardiogram (ECG), blood oxygen levels, and glucose, enabling users and healthcare providers to manage health conditions proactively. Moreover, with the rising cases of chronic diseases across all age groups, smart wearables provide a noninvasive, convenient solution for continuous tracking. For instance, the Fitbit Sense 2 Smartwatch, launched by Fitbit in September 2022, is designed to offer functions such as stress management, sleep improvement, heart health tracking, and Google integration, thus benefiting its users to prevent or manage chronic disease. Thus, increasing adoption of smart watches for chronic disease management drives the biohacking wearables market expansion.

Expansion of Direct Sales Channels for Customized Biohacking Solutions

Direct sales channels are offering personalized device solutions and seamless customer engagement. Major brands are building stronger customer relationships by skipping traditional retail formats, directly engaging consumers, and using digital platforms to deliver personalized products and subscription-based health insights. This approach allows companies to capture precise user data, optimize product offerings, and enhance brand loyalty. The strategy is particularly effective in catering to the individual segment, which seeks customized health solutions. Therefore, by analyzing the purchasing patterns of the consumers, the companies can create tailored products and offer better sales services. Thus, such an approach toward a direct engagement model supports cross-selling and long-term user retention. Therefore, the growth of direct sales channels has emerged as a key biohacking wearables market trend.

Segment Analysis

Market Assessment by Product Type

The biohacking wearables market segmentation, based on product type, includes smart watches, fitness trackers, smart clothing, sleep trackers, and others. The smart watches segment dominated the market share in 2024 due to continuous innovation in sensor and the integration of advanced features powered by the Internet of Things (IoT) technology. These multifunctional devices track health and fitness parameters and offer real-time data relating to heart rate monitoring, stress levels, ECG, blood oxygen saturation, and others. Moreover, the ease of use, combined with increasing healthcare awareness and demand for personal health analytics, is generating demand for smartwatches as a form of comprehensive wellness tools.

Growing partnerships between wearable tech companies and healthcare providers have expanded the clinical relevance of smartwatches. In January 2024, Fitbit and Quest Diagnostics initiated the Wearables for Metabolic Health (WEAR-ME) pilot study to explore how data from wearable devices, combined with laboratory tests, can enhance the assessment and management of metabolic health. This collaboration aims to provide individuals with actionable insights to prevent diseases such as diabetes and heart disease. As a result, the growing convergence of digital health innovation and clinical collaboration continues to strengthen the position of smartwatches within the biohacking wearables market.

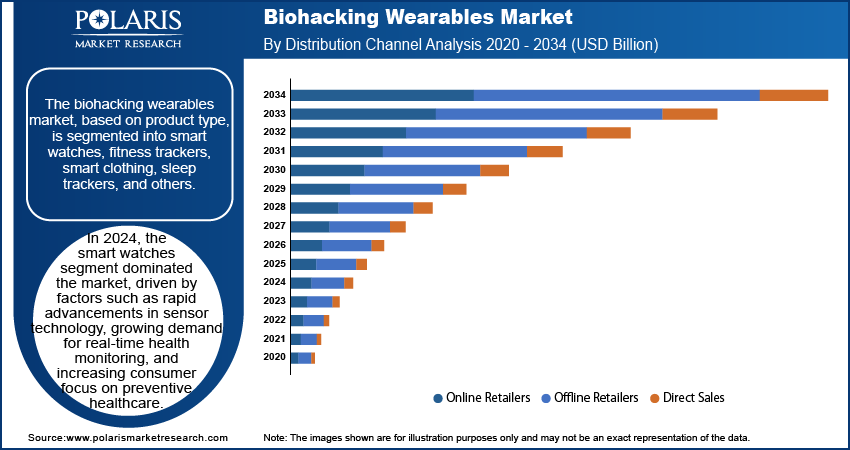

Market Evaluation by Distribution Channel

In terms of distribution channel, the biohacking wearables market is divided into online retailers, offline retailers, and direct sales. The online retailers segment is expected to experience the fastest growth rate during the forecast period due to increasing internet penetration, rising smartphone usage, and the growing preference for convenient, contactless shopping experiences. Consumers are actively purchasing wearables through C2C (Consumer-To-Consumer) e-commerce platforms that offer competitive pricing, detailed product insights, and user reviews. Additionally, companies are enhancing their digital presence and launching exclusive online offers to drive sales. The growing influence of health-focused social media marketing and influencer endorsements also contributes to the surge in online demand, accelerating market share and expanding market opportunities for e-commerce platforms.

Regional Analysis

By region, the study provides biohacking wearables market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest share of the global biohacking wearables market revenue in 2024, driven by high consumer awareness, advanced healthcare infrastructure, and early adoption of wearable technologies. The presence of key market players, including Apple, Fitbit (Google), and WHOOP, is focusing on personal wellness and preventive healthcare solutions, thus accelerating the development across the region. Additionally, supportive regulatory frameworks and the growing integration of wearable devices in clinical and remote patient monitoring programs contribute to market growth in North America.

The US biohacking wearables market is experiencing significant growth, driven by a tech-savvy population and an efficient ecosystem for health-focused startups. Innovations in neurostimulation devices and implantable technologies are gaining traction in the country, supported by substantial venture capital investments. For instance, in 2023, the US Food and Drug Administration (FDA) qualified the Apple Watch's atrial fibrillation (AFib) history feature for use in clinical studies, marking the first digital health technology to receive such recognition. This milestone highlights the increasing integration of wearable medical devices system, enhancing their credibility and adoption in medical applications.

Canada is witnessing a rising trend in biohacking communities and wellness-focused startups that are driving demand for personalized wearables. Universities and research institutions are performing research and development on wearable technology, particularly in neurostimulation and sleep enhancement devices. Therefore, the country’s tech-forward consumer base and strong emphasis on mental well-being are fostering a favorable environment for market expansion, especially within the smart clothing and implantable device segments.

According to the biohacking wearables market stats, Europe held the second-largest market share due to strong healthcare infrastructure, growing adoption of digital health solutions, and rising awareness of preventive care. Consumers across countries such as Germany, the UK, and France are actively using smartwatches and fitness trackers to monitor chronic conditions and enhance lifestyle. Government initiatives supporting remote monitoring and personal wellness, along with favorable regulations for wearable medical devices, continue to boost market demand and create growth opportunities for regional manufacturers.

Key Players & Competitive Analysis Report

Major players in the biohacking wearables market are actively investing in research and development to introduce advanced, personalized health monitoring features, which will further accelerate market growth during the forecast period. These companies are also engaging in strategic partnerships, global expansions, and cross-sector collaborations to strengthen their international footprint. Notable developments, including the implementation of AI to wearable devices, are improving product offerings, thus providing market growth opportunities.

The biohacking wearables market is consolidated, with the presence of limited numbers of key global and regional market players. A few major players in the market include Apple Inc., Biostrap, Dexcom, Eight Sleep, Fitbit (Google), Garmin Ltd., Muse (InteraXon), NeuroSky, Oura Health, and WHOOP.

Apple Inc. is a global technology company actively engaged in the biohacking wearables market through its advanced health-focused ecosystem. Operating under its wearables and health business segment, Apple offers the Apple Watch, which features capabilities such as ECG, blood oxygen monitoring, heart rate tracking, and sleep analysis. Integrated with HealthKit and ResearchKit, it supports both consumer wellness and clinical research. Apple continues to innovate by conducting AI and seamless device integration for personalized health optimization.

Biostrap is a health-focused wearable technology company specializing in health-centric wearable technology. The company has a strong focus on the development of clinical-grade biometric monitoring devices. Biostrap operates solely within the biohacking wearables market, providing devices that track sleep patterns, oxygen saturation, heart rate variability (HRV), and respiratory rate. The company serves individual biohackers and healthcare providers by delivering data-driven insights through its proprietary platform.

List of Key Companies

- Apple Inc.

- Biostrap

- Dexcom

- Eight Sleep

- Fitbit (Google)

- Garmin Ltd.

- Muse (InteraXon)

- NeuroSky

- Oura Health

- WHOOP

Biohacking Wearables Industry Developments

November 2024: Dexcom collaborated with Oura Health to integrate its glucose monitoring technology with Oura's smart rings. This partnership aims to provide users with comprehensive health data by combining glucose readings with metrics such as heart rate, activity levels, sleep, and stress.

May 2023: Oura Health acquired Proxy Inc., a tech startup specializing in digital identification tools. This acquisition is expected to enhance Oura's capabilities in health tracking and user authentication, potentially expanding the applications of its smart rings in personalized health monitoring and secure digital interactions.

Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Smart Watches

- Fitness Trackers

- Smart Clothing

- Sleep Trackers

- Others

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Online Retailers

- Offline Retailers

- Direct Sales

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Individuals

- Healthcare Providers

- Corporate Wellness Programs

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 7.80 billion |

|

Market Size Value in 2025 |

USD 9.53 billion |

|

Revenue Forecast by 2034 |

USD 67.08 billion |

|

CAGR |

24.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 7.80 billion in 2024 and is projected to grow to USD 67.08 billion by 2034.

The global market is projected to register a CAGR of 24.2% during the forecast period.

North America held the largest share of the global market in 2024.

A few of the key players in the market are Apple Inc., Biostrap, Dexcom, Eight Sleep, Fitbit (Google), Garmin Ltd., Muse (InteraXon), NeuroSky, Oura Health, and WHOOP.

The smart watches segment dominated the market share in 2024.