BOPET Films Market Size, Share, Trends, Industry Analysis Report

: By Thickness (Thin and Thick), Application, End-Use Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Sep-2025

- Pages: 129

- Format: PDF

- Report ID: PM5664

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

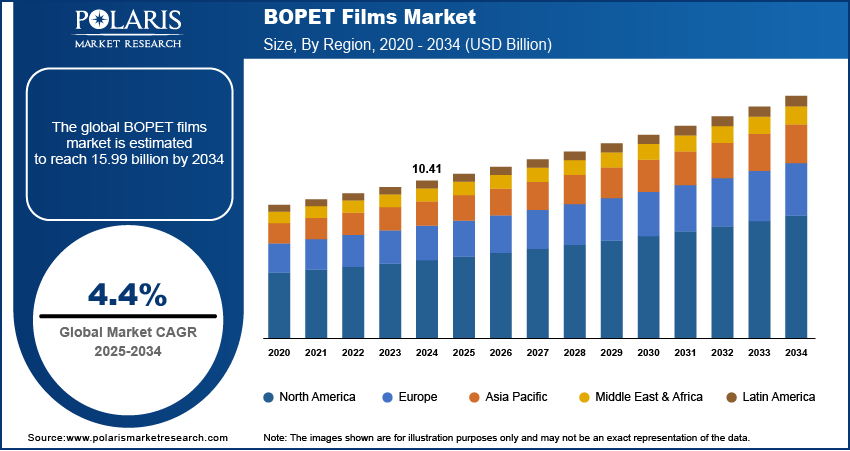

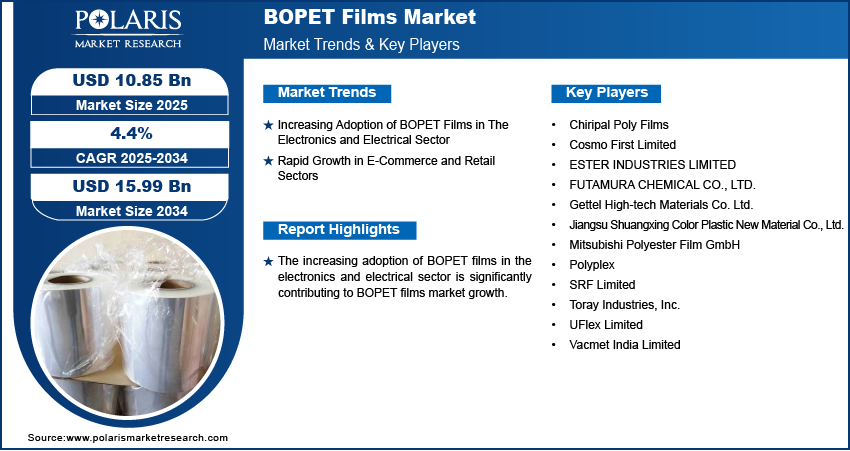

BOPET films market size was valued at USD 10.41 billion in 2024, exhibiting a CAGR of 4.4% during the forecast period. Rising demand for durable, high-barrier packaging in food and electronics, combined with advances in coating technologies and regulatory pushes for sustainable, recyclable films, is driving robust growth in the market.

Key Insights

Thin BOPET films dominate due to their lightweight, high strength, excellent barrier properties, and suitability for flexible packaging in food and pharmaceuticals.

Packaging leads applications thanks to BOPET’s superior oxygen and moisture barriers, tensile strength, and ability to extend shelf life.

Asia Pacific holds the largest market share due to a strong manufacturing base, growing packaging demand, and expanding automotive and electronics industries.

North America is growing rapidly because of rising demand for sustainable packaging, strict environmental regulations, and the use of advanced materials in electronics and industry.

Industry Dynamics

Rising demand for high-performance packaging materials with excellent moisture and oxygen barrier properties boosts market growth globally.

Advancements in coating and processing technologies enable multifunctional BOPET films, expanding applications and improving product performance.

Increasing adoption in electronics and electrical sectors due to superior dielectric strength, dimensional stability, and temperature insulation enhances market demand.

Approval of recycled PET for food packaging promotes sustainable BOPET film solutions, aligning with global environmental and safety standards.

High production costs and complex manufacturing processes can limit widespread adoption and profitability for BOPET film manufacturers.

Market Statistics

2024 Market Size: USD 10.41 billion

2034 Projected Market Size: USD 15.99 billion

CAGR (2025–2034): 4.4%

Asia Pacific: Largest market in 2024

To Understand More About this Research:Request a Free Sample Report

The biaxially oriented polyethylene terephthalate (BOPET) films market encompasses the production and distribution of BOPET-engineered polyester films created by stretching polyethylene terephthalate (PET) in two directions. This process enhances properties such as transparency, tensile strength, reflectivity, chemical and dimensional stability, gas and aroma barrier capabilities, and technical insulation. BOPET films are utilized across various industries, including packaging, electronics, and industrial applications, due to their durability and versatility. The rising demand for high-performance packaging materials that offer excellent moisture and oxygen barrier properties, which are critical in extending shelf life and maintaining product integrity, especially in the food and beverage industry is fueling market growth.

Advancements in coating technologies and film processing techniques are enabling the development of multifunctional BOPET films. Moreover, the shift toward sustainable packaging solutions is pushing manufacturers to innovate in recyclable and biodegradable plastics, creating new BOPET films market opportunities. For instance, the Food Safety and Standards Authority of India approved the use of recycled amorphous polyethylene terephthalate for food packaging, storage, and distribution. This regulation aims to promote sustainable packaging solutions among domestic and global manufacturers while ensuring compliance with food safety standards. Regulatory emphasis on reducing plastic waste and carbon emissions is also accelerating the transition to high-performance alternatives like BOPET, supporting long-term BOPET films market dynamics.

Market Dynamics

Increasing Adoption of BOPET Films in The Electronics and Electrical Sector

The increasing adoption of BOPET films in the electronics and electrical sector is significantly contributing to BOPET films market growth. These films offer excellent dielectric strength, superior dimensional stability, and high temperature insulation, making them indispensable in applications where precision, reliability, and durability are critical. Manufacturers are integrating BOPET films into products such as flexible printed circuit boards, insulation tapes, and capacitor dielectrics, where the ability to withstand high voltage and temperature variations is essential. Technological advancements in electronic miniaturization and flexible electronics are further accelerating the shift toward high-performance materials like BOPET. The demand for compact, lightweight, and efficient components continues to rise, positioning BOPET films as a preferred choice across next-generation electronics manufacturing.

Rapid Growth in E-Commerce and Retail Sectors

Rapid growth in e-commerce and retail sectors is driving strong demand for BOPET films, particularly for their role in flexible, transparent, and robust packaging. For instance, according to the US Census Bureau, in the fourth quarter of 2024, U.S. retail e-commerce sales were estimated at USD 352.9 billion, reflecting a 22.1 percent increase compared to the third quarter of the same year. BOPET’s clarity, tensile strength, and barrier properties make it ideal for protecting goods during shipping while maintaining visual appeal and product integrity. Consumer expectations for secure, tamper-evident, and aesthetically pleasing packaging in online retail environments have prompted manufacturers to adopt high-performance films that can endure transportation and handling stress. The need for extended shelf life and freshness, especially in food and personal care products, is also pushing retailers and brands to opt for BOPET-based laminates and pouches. The shift toward lightweight, efficient packaging solutions in response to sustainability and cost-efficiency goals continues to support the expansion of the BOPET films market in the retail and e-commerce ecosystem.

Segment Insights

Market Assessment by Thickness Outlook

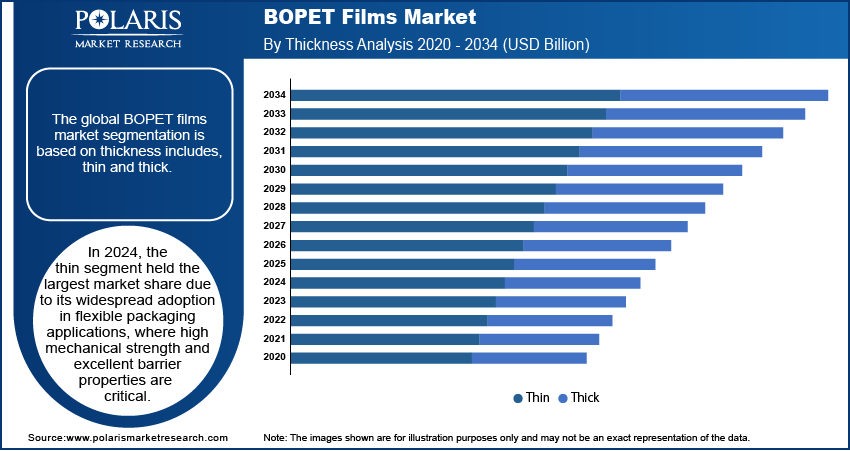

The global BOPET films market segmentation is based on thickness includes, thin and thick. In 2024, the thin segment held the largest market share due to its widespread adoption in flexible packaging applications, where high mechanical strength and excellent barrier properties are critical. Thin BOPET films offer a balance of lightweight construction and durability, making them ideal for multilayer laminates used in food, personal care, and pharmaceutical packaging. Their high transparency and printability enhance product presentation, while their resistance to moisture and gases supports extended shelf life. Manufacturers continue to prefer thin-gauge films for cost-efficient large-volume production, and their compatibility with high-speed processing equipment further strengthens their dominance in the BOPET films market.

The thick segment is expected to record the fastest CAGR over the forecast period, due to the increasing use of high-thickness BOPET films in industrial and technical applications. These films provide enhanced tensile strength, dimensional stability, and thermal endurance, making them suitable for uses such as insulation, photovoltaic modules, release liners, and protective coverings. Demand from high-growth industries such as electronics, solar energy, and automotive is accelerating the need for thick-gauge variants that can perform reliably in harsh environments. Enhanced customization, such as surface treatments and specialty coatings, is also expanding the application potential of thick BOPET films, supporting segmental growth.

Market Evaluation by Application Outlook

The global BOPET films market segmentation is based on application includes, packaging, electrical and electronics, imaging, and others. The packaging segment accounted for the largest market share in 2024 due to the material’s outstanding performance in preserving product quality, especially in perishable and sensitive goods. BOPET films offer superior oxygen and moisture barrier properties, maintaining freshness and extending shelf life in food, beverages, and medical packaging. Their high tensile strength enables thinner packaging structures, reducing material use without compromising functionality. Moreover, BOPET’s excellent thermal stability allows for high-speed heat sealing and retort processing. Consumer demand for visually appealing, sustainable, and lightweight packaging solutions continues to encourage manufacturers to integrate BOPET-based laminates into their supply chains, securing the segment's leadership in the market.

The electrical and electronics segment is poised to grow at the fastest CAGR over the forecast period, due to the rapid expansion of applications requiring high-performance insulation, thermal management, and dimensional stability. BOPET films are increasingly used in flexible printed circuits, transformer insulation, motor windings, and capacitor films due to their high dielectric strength and heat resistance. Ongoing advancements in electric vehicles, 5G infrastructure, and miniaturized electronics are pushing the demand for reliable and high-performance substrates. The segment’s momentum is further supported by the need for efficient and durable materials that meet the stringent specifications of modern electronics manufacturing and next-generation technologies.

Regional Analysis

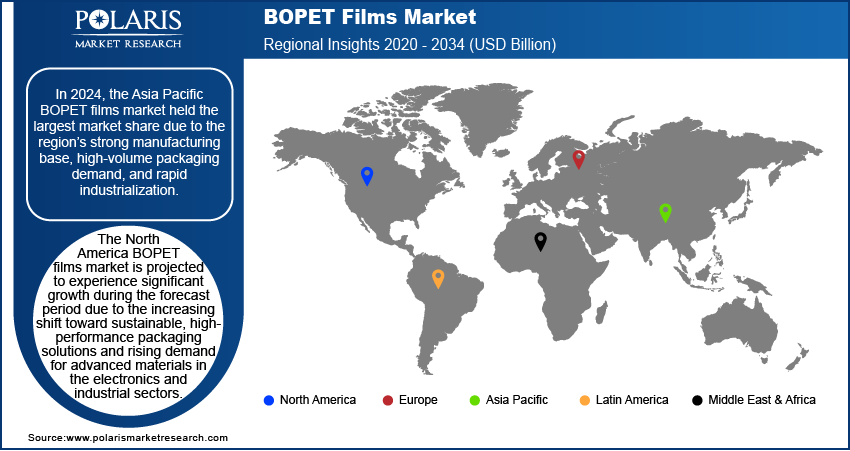

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the Asia Pacific BOPET films market held the largest market share due to the region’s strong manufacturing base, high-volume packaging demand, and rapid industrialization. The presence of cost-competitive production facilities, coupled with robust supply chain networks, enables large-scale BOPET film output to serve domestic and international markets efficiently. Surging demand for flexible packaging from industries such as food and beverage, pharmaceuticals, and personal care is a key driver, supported further by the region's expanding middle-class population and urban consumption trends. The growing demand in the electronics and automotive sectors is driving the integration of BOPET films across key global economies. For instance, according to the Ministry of Industry and Information Technology, China the largest automotive market globally, with domestic production projected to hit 35 million vehicles by 2025. In 2021, over 26 million vehicles were sold, including 21.48 million passenger cars, marking a 7.1% increase from 2020. This trend is further solidifying the region's leading position in the growth and volume consumption of BOPET films in the market.

The North America BOPET Films market is projected to experience significant growth during the forecast period due to the increasing shift toward sustainable, high-performance packaging solutions and rising demand for advanced materials in the electronics and industrial sectors. Heightened regulatory emphasis on environmental compliance and recyclable packaging is accelerating the adoption of BOPET films as an eco-efficient alternative. For instance, in November 2024, the Biden-Harris administration has unveiled a comprehensive national framework aimed at mitigating plastic pollution. This strategy encompasses a multifaceted approach to tackle the environmental and health impacts associated with plastic waste. Key components include implementing regulatory measures, enhancing waste management systems, promoting the circular economy, and fostering innovation in alternative materials. Technological innovations and investments in high-barrier film development are enhancing market penetration across medical, food processing, and high-value manufacturing industries. Moreover, the presence of major end-use sectors such as aerospace, automotive, and high-end electronics is creating consistent demand for thick-gauge and specialty BOPET films, contributing to sustained market expansion in the region.

BOPET Films Key Market Players & Competitive Analysis Report

The competitive landscape of the BOPET films market is defined by strategic initiatives aimed at capturing value across high-demand verticals through innovation, scale, and global reach. Industry analysis highlights an increased focus on market expansion strategies, particularly targeting end-use segments such as flexible packaging, electronics, and specialty industrial applications. Key players are leveraging technology advancements to develop high-barrier, recyclable, and heat-resistant film variants tailored to next-generation consumer and industrial needs. Mergers and acquisitions are reshaping the supply chain dynamics, enabling companies to broaden their geographic footprint and strengthen product portfolios. Post-merger integration efforts are increasingly centered around operational efficiency, enhanced distribution networks, and shared R&D capabilities. Joint ventures and strategic alliances, particularly with raw material providers and downstream converters, are streamlining innovation cycles and reducing time-to-market for advanced film solutions. Product launches reflecting tailored application performance, such as UV resistance, anti-fog coatings, or improved printability, are becoming a central pillar of differentiation. Companies are also prioritizing sustainability-driven initiatives, including the introduction of mono-material laminates and circular economy models.

UFlex Limited is engaged in the manufacturing and distribution of flexible packaging solutions, including BOPET films, BOPP films, CPP films, and high-barrier metalized films. The company specializes in packaging laminates, pre-fabricated pouches, holography products, and engineering solutions such as packaging machines. The company's product portfolio extends to pharmaceutical packaging, liquid packs, inks, adhesives, and coatings. UFlex operates globally with manufacturing facilities in India, UAE, Mexico, Egypt, Poland, the US, Russia, Hungary, and Nigeria. Headquartered in Noida, India, it serves diverse industries like FMCG, pharmaceuticals, automotive, and food & beverages across more than 150 countries.

Toray Industries, Inc. is engaged in producing advanced materials and products for various industries, including BOPET films used in flexible packaging applications. The company specializes in polymer chemistry and offers a wide range of products such as polyester films for imaging and electronics, carbon fiber composites for aerospace and automotive sectors, and textiles for industrial use. Toray provides services in research and development to innovate sustainable solutions. Headquartered in Tokyo, Japan, Toray has a significant presence across Asia-Pacific, Europe, North America, and other regions through its subsidiaries and production facilities.

Key Companies

- Chiripal Poly Films

- Cosmo First Limited

- ESTER INDUSTRIES LIMITED

- FUTAMURA CHEMICAL CO., LTD.

- Gettel High-tech Materials Co. Ltd.

- Jiangsu Shuangxing Color Plastic New Material Co., Ltd.

- Mitsubishi Polyester Film GmbH

- Polyplex

- SRF Limited

- Toray Industries, Inc.

- UFlex Limited

- Vacmet India Limited

BOPET Films Industry Developments

In January 2025, Polyplex Corporation announced to invest USD 69.75 million to set up a new BOPET film manufacturing plant in India, increasing production capacity by 52400 MTPA.

In February 2024, Mitsubishi Polyester Film GmbH initiated the construction of a new polyester film production line in the Kalle Albert industrial area of Wiesbaden, designed to deliver an annual capacity of 27,000 tons of HOSTAPHAN PET films.

BOPET Films Market Segmentation

By Thickness Outlook (Revenue USD Billion 2020 - 2034)

- Thin

- Thick

By Application Outlook (Revenue USD Billion 2020 - 2034)

- Packaging

- Electrical and Electronics

- Imaging

- Others

By End-Use Industry Outlook (Revenue USD Billion 2020 - 2034)

- Food and Beverages

- Personal Care and cosmetics

- Pharmaceuticals and Medical

- Others

By Regional Outlook (Revenue USD Billion 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 10.41 billion |

|

Market Size Value in 2025 |

USD 10.85 billion |

|

Revenue Forecast in 2034 |

USD 15.99 billion |

|

CAGR |

4.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global BOPET films market size was valued at USD 10.41 billion in 2024 and is projected to grow to USD 15.99 billion by 2034.

The global market is projected to grow at a CAGR of 4.4% during the forecast period.

In 2024, the Asia Pacific BOPET films market held the largest market share due to the region’s strong manufacturing base, high-volume packaging demand, and rapid industrialization.

Some of the key players in the market are Chiripal Poly Films; Cosmo First Limited; ESTER INDUSTRIES LIMITED; FUTAMURA CHEMICAL CO., LTD.; Gettel High-tech Materials Co. Ltd.; Jiangsu Shuangxing Color Plastic New Material Co., Ltd.; Mitsubishi Polyester Film GmbH; Polyplex; SRF Limited; Toray Industries, Inc.; UFlex Limited; Vacmet India Limited

In 2024, the thin segment held the largest market share due to its widespread adoption in flexible packaging applications, where high mechanical strength and excellent barrier properties are critical.

The packaging segment accounted for the largest market share in 2024 due to the material’s outstanding performance in preserving product quality, especially in perishable and sensitive goods.