Braided Packing Market Size, Share, Industry Analysis Report

By Type (Square Braided, Braid Over Braid), By Material Type, By Temperature, By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM5866

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

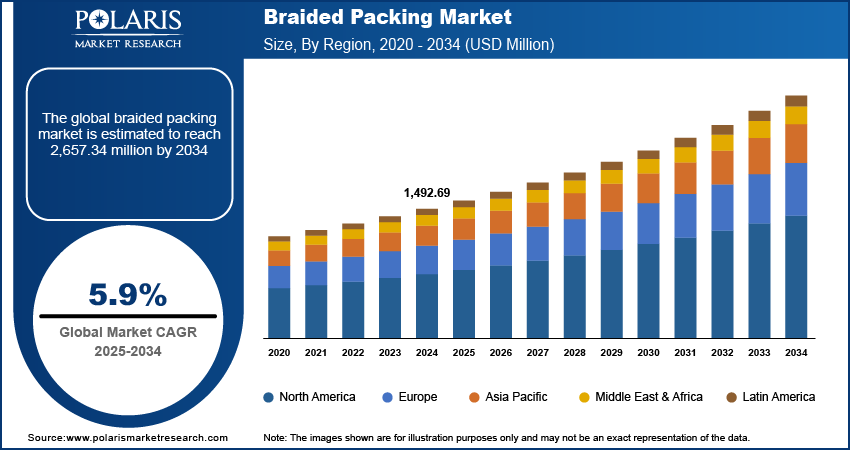

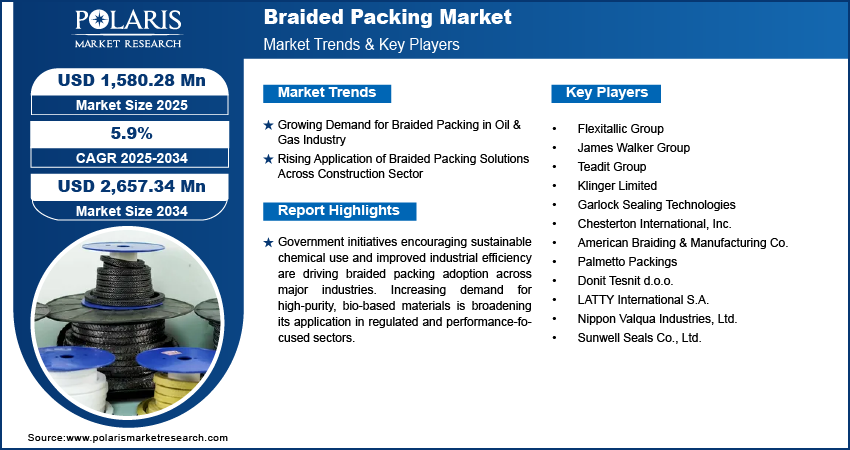

The global braided packing market size was valued at USD 1,492.69 million in 2024, growing at a CAGR of 5.9% during 2025–2034. Rising demand for braided packing is fueled by its adoption in oil & gas and construction industries for reliable sealing performance under high-pressure and abrasive operating conditions.

Braided packing is a mechanical sealing solution widely used across industries such as petrochemicals, oil & gas, construction, power generation, marine, and wastewater treatment. It is designed to contain fluids and prevent leakage around shafts and valve stems, braided packing combines various yarns such as graphite, PTFE, aramid, carbon, and fiberglass woven into flexible and durable configurations. Braided packing helps to operate under high temperatures, varying pressures, and chemically aggressive environments makes it a practical choice for rotary and reciprocating equipment in dynamic and static sealing applications.

Growing focus on process reliability, equipment efficiency, and workplace safety is strengthening the demand for advanced braided packing systems. Industries are increasingly preferring low-emission, low-maintenance sealing solutions that help extend asset lifecycle and reduce unplanned downtime. Innovations in lubricant impregnation, corner reinforcement, and hybrid material compositions are helping users meet stricter regulatory expectations while optimizing sealing performance. End users continue to upgrade legacy infrastructure to meet maintenance operations with sustainability goals, braided packing remains a reliable and cost-effective sealing option that supports operational continuity across a wide range of mechanical systems.

To Understand More About this Research: Request a Free Sample Report

Braided packing are increasingly adopted in the textile and apparel sector for equipment maintenance and fluid sealing applications that demand heat resistance and material integrity. Its integration in dyeing machines, steam valves, and chemical tanks supports smoother operations by minimizing leakage, wear, and frequent downtime. In industrial laundry and textile finishing units, braided packing supports high-pressure sealing in pump systems and rotary equipment, contributing to consistent throughput and energy efficiency.

Rising shift toward regulatory compliance and clean manufacturing due to increase in carbon emissions is pushing industries such as chemicals, food processing, and power generation to adopt stricter procurement practices, thus driving the demand for the braided packing growth. According to the International Energy Agency (IEA), energy-related CO₂ emissions grew by 1.1% in 2023, reaching a record 37.4 gigatonnes. This is pushing companies to re-evaluate input materials and sealing systems. Braided packing made with low-emission fibers and process-safe lubricants is gaining preference as companies work toward ISO 14001 certifications and sustainable operational standards. Companies are choosing sealing solutions that meet regulations, last longer, and need less maintenance, helping improve reliability and reduce overall costs.

Industry Dynamics

Growing Demand for Braided Packing in Oil & Gas Industry

The rapid growth in the oil and gas production fuels the demand for high-performance sealing solutions such as braided packing to ensure safety and efficiency across all operations. According to the IEA, global oil supply grew by 1.8 million barrels per day in 2025, reaching 104.9 million barrels per day, expected to further increase of 1.1 million barrels per day in 2026. Non-OPEC+ countries are contributing most of this growth, contributing 1.4 million barrels per day in 2025 and are expected to add a further 840,000 barrels per day in 2026. Braided packing offers strong resistance to extreme temperatures, high pressures, and chemically aggressive media, making it suitable for industrial valve and pump applications in offshore rigs, refineries, and pipeline systems. Its ability to minimize leakage, support equipment longevity, and meet regulatory emission standards is driving its selection in both exploration and refining operations.

Additionally, ongoing investments in unconventional extraction techniques and deepwater exploration are strengthening the demand for braided packing in mission-critical applications. Industry participants are seeking sealing materials that combine durability with low maintenance cycles to reduce downtime. Braided packing aligns well with these operational priorities, offering reliable sealing solutions in dynamic environments. This trend is further supported by the push toward equipment standardization and safety compliance across global oilfield operations.

Rising Application of Braided Packing Solutions Across Construction Sector

Growing construction activities in both developed and developing countries drives the demand for braided packing, as it provides strong sealing in HVAC systems, pipes, and joints to improve durability and performance. According to Oxford Economics, global construction activity is projected to rise from USD 9.7 trillion in 2022 to USD 13.9 trillion by 2037, largely driven by major construction sector such as China, the US, and India. Its ability to provide effective thermal insulation, vibration dampening, and chemical resistance enhances the durability of mechanical installations in both residential and commercial projects. As construction projects increasingly specify sustainable and cost-effective materials, braided packing provides an optimal balance of performance, longevity, and ease of maintenance.

Urban development, infrastructure upgrades, and building modernization initiatives across regions are increasing the requirement for robust mechanical seals in pumps, compressors, and heat exchangers. Braided packing meets these specifications, helping construction contractors and system engineers maintain operational safety and system efficiency. Its adaptability to diverse operating conditions, including fluctuating temperatures and corrosive environments, supports broader application across plumbing, sealing, and air conditioning systems in modern construction ecosystems.

Segmental Insights

Material Type Analysis

The global segmentation, based on material type includes, graphite, PTFE, carbon fiber, aramid, and others. The graphite segment is projected to witness substantial growth during the forecast period. This growth is attributed to its high compatibility with extreme pressure and temperature conditions in critical sealing operations. The growing deployment of graphite-based packing in refineries, power plants, and chemical processing units reflects end-user preference for materials that deliver durability and thermal stability under corrosive media. This material resists wear and chemical degradation while offering excellent lubricity, making it ideal for valves and pumps operating under dynamic loads. Its low coefficient of friction and ability to handle thermal cycling have positioned graphite packing as a first-choice solution in severe industrial environments.

The PTFE segment is projected to grow at a robust pace in the coming years, due to increasing demand from sectors requiring low-friction, non-reactive sealing solutions. Industries such as pharmaceuticals, water treatment, and food processing are adopting PTFE materials for their inert chemical properties and superior performance in clean, non-contaminating environments. PTFE's non-stick behavior and excellent resistance to aggressive acids and solvents make it suitable for use in mixers, agitators, and pump glands. Its role in minimizing leakage and enhancing equipment lifespan in precision applications contributed to its accelerated adoption, where hygiene and safety standards are critical.

Type Analysis

The global segmentation, based on type includes, square braided, braid over braid, braid over core, interbraid, and die form. The square braided segment accounted for largest market value in 2024, due to its structural robustness and widespread utility across standard sealing applications. It offers balanced density and symmetrical construction, providing consistent sealing pressure and minimal product extrusion. The configuration supports long-term usage in pumps and valves in utilities and chemical plants. Its adaptability to different fluid types and pressures makes it a staple solution for operational teams looking for cost-effective and durable performance. The segment’s demand is reinforced by its ease of installation and ability to perform in moderate-speed rotary and reciprocating equipment.

The interbraid segment is projected to grow at a significant pace during the assessment phase, due to its enhanced load-bearing and sealing capability in high-pressure operations. The core design delivers added structural integrity, helping reduce compression set and ensuring consistent dimensional recovery. This configuration is growing in dynamic sealing environments such as high-speed pumps, reactors, and turbines. End users prefer it for applications requiring extended service life and low maintenance. The layered braiding construction helps distribute forces evenly, enhancing sealing under fluctuating loads and pressures, thereby supporting its expanding presence in advanced manufacturing and power generation plants.

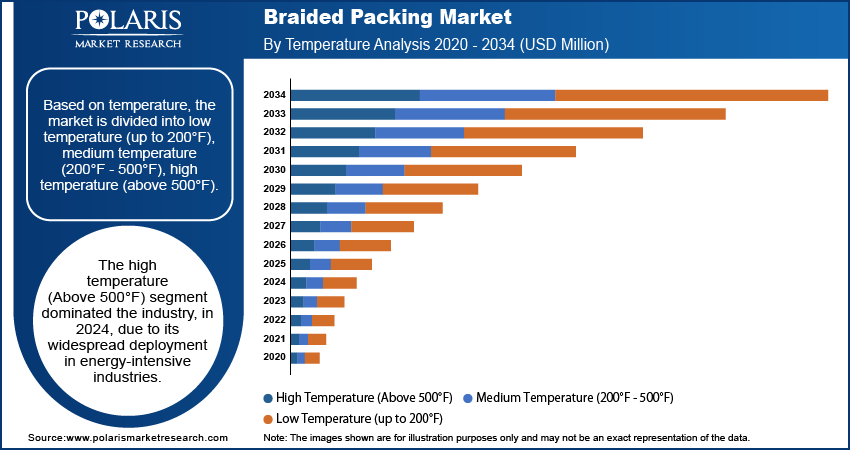

Temperature Analysis

The global segmentation, based on temperature includes, low temperature (up to 200°F), medium temperature (200°F - 500°F), high temperature (above 500°F). The high temperature (Above 500°F) segment dominated the industry, in 2024, due to its widespread deployment in energy-intensive industries. Applications involving steam turbines, reactors, and incinerators rely on these products for consistent sealing under extreme thermal stress. The demand is concentrated in sectors such as power generation, oil refining, and metallurgy where thermal degradation poses operational risks. These packings are typically made of graphite, carbon fiber, or hybrid materials capable of retaining integrity at elevated temperatures. End users prioritize thermal endurance, oxidation resistance, and long-term dimensional stability, driving strong market preference toward this segment.

The medium temperature (200°F - 500°F) segment is estimated to hold a substantial market share by 2034, due to increasing usage in moderate industrial processes in food, pulp, and water management sectors. These applications typically operate under controlled heat levels where a balance between performance and cost-efficiency is essential. Materials such as aramid and PTFE dominate this range for their chemical resistance and moderate thermal tolerance. The versatility of medium-temperature packing in handling varied media, including slurry, acid, and alkaline substances, is accelerating its adoption. Industries aiming to optimize plant reliability without over-engineering are increasingly selecting solutions within this segment.

Application Analysis

The global segmentation, based on application includes, pumps, valves, mixers & agitators, reactors, and compressors. The pumps segment is projected to grow with a substantial CAGR during the forecast period, due to their omnipresence across sectors including oil & gas, water treatment, and power. Braided packing provides effective sealing for both centrifugal and reciprocating pumps, helping contain fluid leakage and maintain pressure consistency. Its ease of adjustment and re-packing capabilities make it a preferred solution in high-wear environments. The durability of braided packing in handling abrasive media, chemicals, and thermal variations supports its continued dominance. Its role in minimizing equipment downtime and reducing total maintenance costs further strengthens this segment’s leadership.

The valves segment is estimated to hold a significant market share in 2034, due to rising investments in flow regulation infrastructure across municipal utilities and industrial processing. Sealing systems in valves demand materials that offer low creep and chemical resistance under varying pressures. Braided packing meets these needs by providing effective stem sealing in throttling and shut-off valve assemblies. Industries such as petrochemicals and pharmaceuticals are integrating braided valve packing to ensure compliance with leakage control standards. The segment is benefiting from improvements in material density and cross-sectional integrity that extend lifecycle under cyclic loads.

End User Analysis

The global segmentation, based on end user includes, oil & gas, chemical, power generation, construction, paper and pulp, water treatment, and other end users. The oil & gas segment captured substantial share of the market in 2024, due to its dependence on fluid control and leak prevention in exploration and refining processes. As per the U.S. Energy Information Administration, global liquid fuel production grew by 1.6 million barrels per day in 2025, which is 0.2 million more than last month’s forecast. In 2026, it is expected to rise by another 0.8 million barrels per day. Braided packing is integral in maintaining equipment efficiency in valves, compressors, and pipeline pumps that operate under harsh conditions. The sector’s focus on safety and operational reliability continues to fuel demand for thermally resilient and chemically stable sealing solutions. Adoption is driven by the need to reduce unplanned maintenance and extend equipment life in offshore rigs, refineries, and LNG facilities operating in aggressive environments.

The chemical and cosmetics segment is estimated to grow at a significant CAGR from 2025-2034, as it ensures reliable performance in pumps, valves, and agitators used for fluid movement and filtration. This growth is attributed to rising global investment in wastewater infrastructure, desalination, and municipal treatment systems. Braided packing solutions offer effective sealing against process media variability and help mitigate leakage in critical applications. The segment benefits from regulatory push toward clean water access and equipment reliability in corrosive environments. Materials such as PTFE and aramid are preferred for their chemical neutrality and endurance in continuous-flow systems.

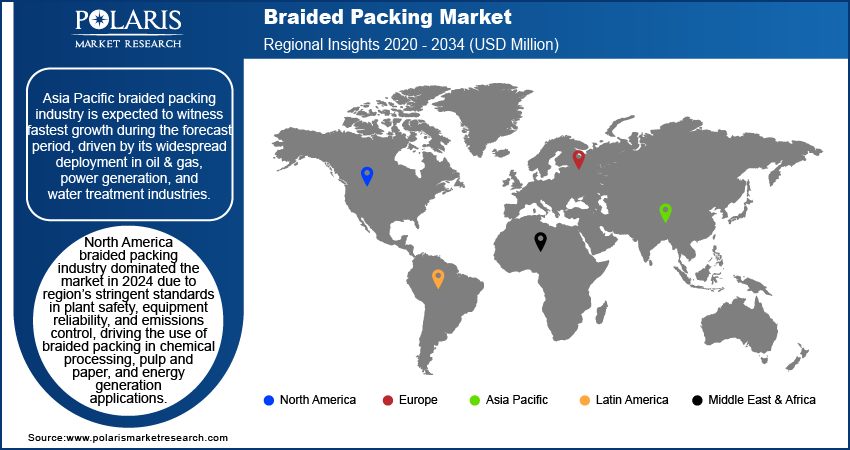

Regional Analysis

Asia Pacific braided packing industry is expected to witness fastest growth during the forecast period, driven by its widespread deployment in oil & gas, power generation, and water treatment industries. Countries including China, India, Japan, and South Korea operate large-scale industrial infrastructures, which increases demand for high-performance sealing solutions used in valves, pumps, and agitators. The region’s manufacturing cost advantages and continued emphasis on industrial equipment modernization strengthen its leadership in global braided packing demand. Furthermore, energy security initiatives and the growth of the petrochemical and chemical sectors are fueling consistent consumption of temperature- and pressure-resistant sealing materials across plant maintenance cycles.

China Braided Packing Market Insight

The China braided packing industry market is driven by the expansion of oil refining capacity, chemical plant construction, and increasing investment in water treatment facilities. According to the National Bureau of Statistics of China, the chemical raw materials and chemical product manufacturing industry in the country grew by 9.5% during the first eleven months of 2024. In addition, China’s construction sector continues to grow, reinforcing the use of braided packing in pumps and agitators deployed in concrete and structural material processing. The availability of local manufacturers and government incentives for industrial productivity improvement are supporting volume growth across end-use segments.

North America Braided Packing Market Analysis

The North America braided packing industry dominated the market in 2024 due to region’s stringent standards in plant safety, equipment reliability, and emissions control, driving the use of braided packing in chemical processing, pulp and paper, and energy generation applications. The US maintains its dominant position due to its strong OEM presence, retrofitting programs in the oil & gas sector, and focus on extending operational life of rotating equipment. According to the US Energy Information Administration (EIA), in 2023, the US produced an average of 12.9 million barrels of crude oil per day, breaking the previous record of 12.3 million barrels per day set in 2019. Rising preference for durable and thermally stable graphite- and aramid-based packing variants contributes to steady market expansion. Industry adoption of EPA-compliant sealing materials and new investments in sealing system modernization are reinforcing product demand.

Europe Braided Packing Market Assessment

The Europe braided packing industry accounted for significant market share in 2024, fueled by its stringent environmental norms, industrial maintenance standards, and technological upgrades in process equipment. Rising focus on government-led energy efficiency programs is driving the demand for braided packing in various industries that requires reliable and efficient sealing solutions. For instance, under the Energy Efficiency Act, Germany aims to reduce its energy consumption by approximately 500 TWh by 2030, which represents about one-fifth of its total energy use in 2022. European manufacturers are emphasizing precision-engineered packing for high-temperature and high-pressure conditions, complying with REACH and local emissions standards. The shift toward advanced material engineering and adoption of aramid and PTFE-based products continues to support regional growth and product innovation.

Key Players & Competitive Analysis Report

The braided packing industry is moderately fragmented, featuring a mix of multinational manufacturers and regionally active suppliers competing on product quality, material compatibility, thermal resistance, and application versatility. Demand spans sectors such as oil & gas, power generation, chemicals, and water treatment, driving companies to innovate in composite materials, high-temperature sealing solutions, and automation-integrated designs to meet evolving end-user needs. Market participants prioritize developing low-emission, asbestos-free packing solutions aligned with regulatory standards. Strategic alliances, distribution partnerships, and product customization influence brand positioning in emerging industrial economies. Focus on supply chain resilience, product traceability, and localized manufacturing is expected to enhance competitive advantage across key regions.

Key companies in the industry include Flexitallic Group, James Walker Group, Teadit Group, Klinger Limited, Garlock Sealing Technologies, Chesterton International, Inc., American Braiding & Manufacturing Co., Palmetto Packings, Donit Tesnit d.o.o., LATTY International S.A., Nippon Valqua Industries, Ltd., Sunwell Seals Co., Ltd.

Key Players

- Flexitallic Group

- James Walker Group

- Teadit Group

- Klinger Limited

- Garlock Sealing Technologies

- Chesterton International, Inc.

- American Braiding & Manufacturing Co.

- Palmetto Packings

- Donit Tesnit d.o.o.

- LATTY International S.A.

- Nippon Valqua Industries, Ltd.

- Sunwell Seals Co., Ltd.

Industry Developments

August 2021: EGC Holding Company acquired Slade Inc., to expand its product range and strengthen its presence in the sealing and packing market. This acquisition is expected to enhance EGC’s capabilities in providing high-quality braided packing products to various industrial sectors.

Braided Packing Market Segmentation

By Material Type Outlook (Revenue, USD Million, 2020–2034)

- Graphite

- PTFE

- Carbon Fiber

- Aramid

- Others

By Type Outlook (Revenue, USD Million, 2020–2034)

- Square Braided

- Braid Over Braid

- Braid Over Core

- Interbraid

- Die Form

By Temperature Outlook (Revenue, USD Million, 2020–2034)

- Low Temperature (up to 200°F)

- Medium Temperature (200°F - 500°F)

- High Temperature (Above 500°F)

By Application Outlook (Revenue, USD Million, 2020–2034)

- Pumps

- Valves

- Mixers & Agitators

- Reactors

- Compressors

By End User Type Outlook (Revenue, USD Million, 2020–2034)

- Oil & Gas

- Chemical

- Power Generation

- Construction

- Paper and Pulp

- Water Treatment

- Other End Users

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Braided Packing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1,492.69 Million |

|

Market Size in 2025 |

USD 1,580.28 Million |

|

Revenue Forecast by 2034 |

USD 2,657.34 Million |

|

CAGR |

5.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1,492.69 million in 2024 and is projected to grow to USD 2,657.34 million by 2034.

The global market is projected to register a CAGR of 5.9% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Flexitallic Group, James Walker Group, Teadit Group, Klinger Limited, Garlock Sealing Technologies, Chesterton International, Inc., American Braiding & Manufacturing Co., Palmetto Packings, Donit Tesnit d.o.o., LATTY International S.A., Nippon Valqua Industries, Ltd., Sunwell Seals Co., Ltd.

The high temperature (Above 500°F) segment dominated the market share in 2024.

The valves segment is estimated to hold a significant market share during the forecast period.