Brain Implants Market Size, Share, Trends, Industry Analysis Report

: By Product (Deep Brain Stimulators, Spinal Cord Stimulators, and Vagus Nerve Stimulators), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 120

- Format: PDF

- Report ID: PM1897

- Base Year: 2024

- Historical Data: 2020-2023

Brain Implants Market Overview

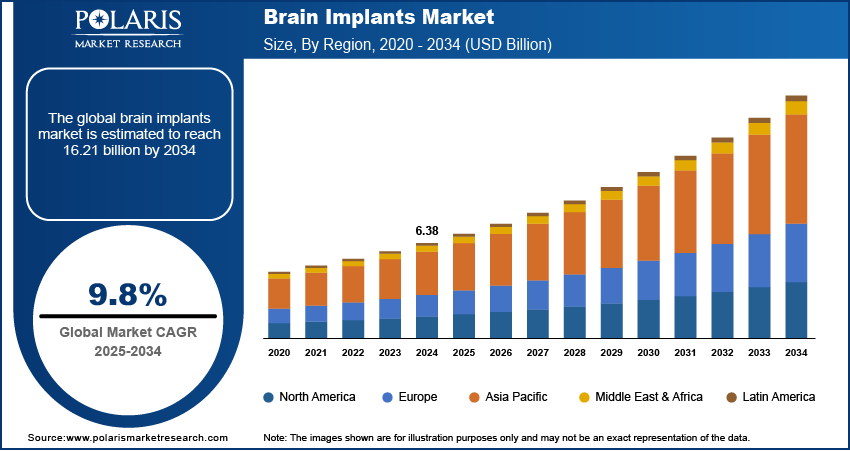

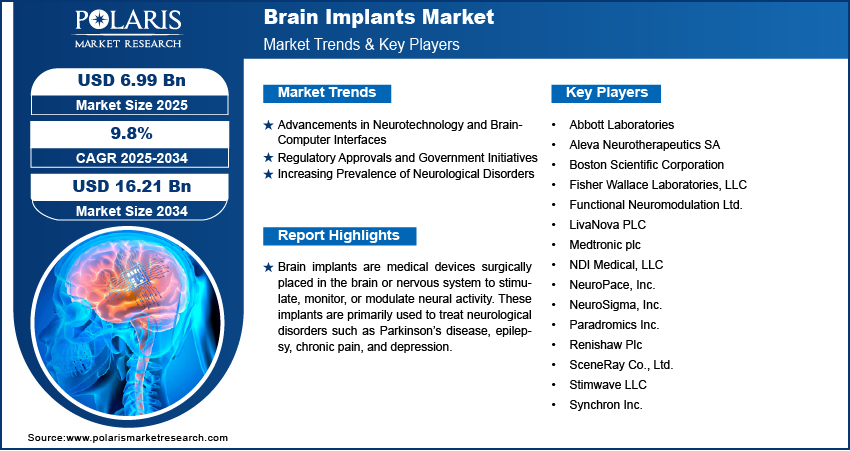

The brain implants market size was valued at USD 6.38 billion in 2024. The market is projected to grow from USD 6.99 billion in 2025 to USD 16.21 billion by 2034, exhibiting a CAGR of 9.8% during 2025–2034.

The brain implants market is experiencing significant growth due to increasing neurological disorders, advancements in neurotechnology, and rising demand for minimally invasive treatments. Brain implants, also known as neural implants, are medical devices placed directly in the brain to restore lost functions, improve cognitive abilities, and assist in neurological rehabilitation. These implants are widely used in treating conditions such as Parkinson’s disease, epilepsy, depression, and paralysis. Technological advancements, including artificial intelligence (AI) integration, wireless communication, and biocompatible materials, are driving market expansion. Additionally, increasing investments in neuroscience research and the rising prevalence of neurodegenerative diseases further contribute to market growth.

Key drivers of the brain implants market include the growing elderly population, which is more susceptible to neurological conditions, and the rising demand for deep brain stimulation (DBS) devices for movement disorders. Government initiatives supporting neurological research and favorable regulatory policies also enhance market development. Moreover, the expanding adoption of brain-computer interface (BCI) technology in healthcare and military applications fuels market innovation. The continued research and development, coupled with increasing awareness and acceptance of brain implant technologies, are expected to drive further growth in the coming years.

To Understand More About this Research: Request a Free Sample Report

Brain Implants Market Dynamics

Advancements in Neurotechnology and Brain-Computer Interfaces

The brain implants market is experiencing significant growth due to rapid advancements in neurotechnology and brain-computer interface (BCI) systems. Recent studies have demonstrated the potential of BCIs in restoring sensory functions. For instance, a February 2025 study published in Science showcased how individuals with spinal cord injuries could experience realistic touch sensations through a robotic hand controlled by brain signals, marking a substantial leap in neurotechnology research. These technological advancements are expanding the therapeutic applications of brain implants, thereby driving market growth.

Regulatory Approvals and Government Initiatives

The market is also propelled by supportive regulatory approvals and government initiatives aimed at fostering innovation in neurotechnology. In February 2025, the US Food and Drug Administration (FDA) approved an adaptive brain pacemaker developed by Medtronic for treating Parkinson's disease symptoms. This device represents a significant advancement in brain-computer interface technology, offering personalized treatment by adjusting stimulation based on real-time patient needs. Such regulatory endorsements not only validate the safety and efficacy of advanced brain implant technologies but also encourage further research and development in the field, thereby driving brain implants market expansion.

Increasing Prevalence of Neurological Disorders

The rising incidence of neurological disorders, particularly among the aging population, is a significant brain implants market driver. As the global population ages, the prevalence of conditions such as Parkinson's disease, Alzheimer's disease, and epilepsy has increased, leading to a higher demand for effective treatment options. For example, the Parkinson's Foundation reported that nearly one million people in the US were living with Parkinson's disease in 2020, with the number expected to rise to 1.2 million by 2030. This growing patient population necessitates advanced therapeutic interventions, thereby fueling the demand for brain implants.

Brain Implants Market Segment Insights

Brain Implants Market Assessment by Product

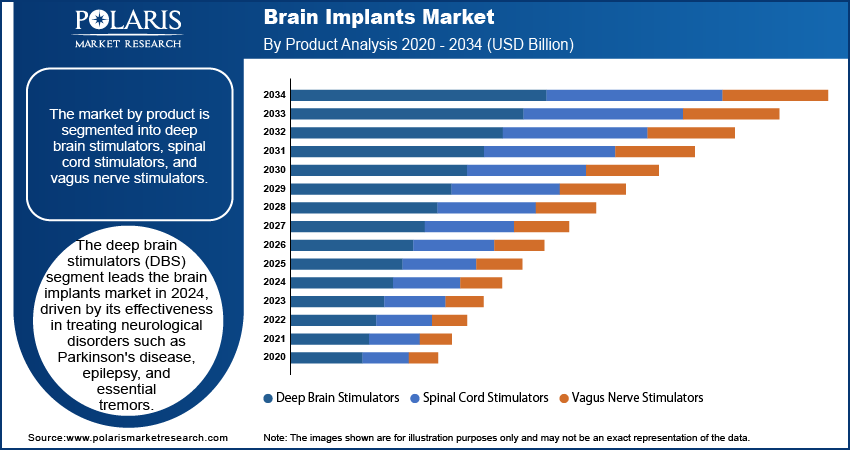

The brain implants market segmentation, based on product, includes deep brain stimulators, spinal cord stimulators, and vagus nerve stimulators. The deep brain stimulators segment leads the market, driven by its effectiveness in treating neurological disorders such as Parkinson's disease, epilepsy, and essential tremors. DBS devices deliver electrical impulses to targeted brain regions, alleviating symptoms and enhancing patients' quality of life. Technological advancements, including the development of smaller, rechargeable devices and wireless programming capabilities, have further increased the appeal of DBS systems. The growing acceptance of DBS as a standard therapy underscores its market-leading position.

Brain Implants Market Evaluation by Application

The brain implants market is segmented by application into chronic pain, epilepsy, Parkinson’s disease, depression, essential tremor, Alzheimer’s disease, and others. The chronic pain segment holds the largest brain implants market share. This dominance is driven by the increasing prevalence of chronic pain conditions, such as back pain, neuropathic pain, and fibromyalgia, affecting millions globally. Brain implants, particularly spinal cord stimulators (SCS) and deep brain stimulators (DBS) have proven effective in providing relief to patients unresponsive to conventional treatments such as medication or physical therapy. These devices modulate pain signals in the brain or spinal cord, offering sustained pain relief and improving patients' quality of life.

Parkinson’s disease is expected to witness the fastest brain implants market growth due to the rising prevalence of the disease and the increasing adoption of deep brain stimulation (DBS) as an effective treatment option. Patients often experience severe motor complications that become resistant to conventional medication, making brain implants a viable therapeutic alternative as Parkinson’s progresses. DBS implants help regulate abnormal brain activity, especially improving motor function, reducing tremors, and improving the quality of life for patients with advanced Parkinson’s. The growing preference for minimally invasive neuromodulation techniques and continuous advancements in implantable device technology is further driving the adoption of brain implants for Parkinson’s disease.

Brain Implants Market Regional Insights

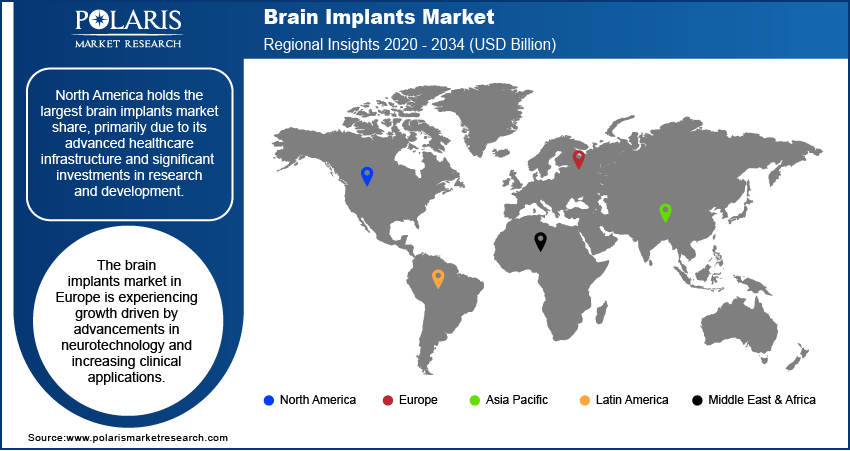

By region, the study provides brain implants market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, primarily due to its advanced healthcare infrastructure and significant investments in research and development. The region's high prevalence of neurological disorders, such as Alzheimer's and Parkinson's diseases, has heightened the demand for innovative treatment options. For instance, according to NCBI, in 2023, an estimated 6.7 million Americans aged 65 and older were living with Alzheimer's dementia, with projections to reach 13.8 million by 2060. Additionally, North America's supportive regulatory environment facilitates the rapid adoption of advanced neurotechnologies, further boosting the brain implants market growth in this region.

The brain implants market in Asia Pacific is growing quickly due to high demand for implant procedures. Companies like Straumann have seen big revenue jumps, with the region seeing nearly 20% growth in this area. This growth is driven by more cases of neurological disorders and higher healthcare spending in countries like Thailand, India, and Malaysia. A growing middle class and better healthcare access are also helping the market expand in this region.

Brain Implants Market – Key Players and Competitive Insights

The competitive landscape of the brain implants market features global and regional players competing through innovation and strategic alliances. Global players leverage R&D capabilities and technological advancements to deliver advanced solutions, meeting the demand for disruptive technologies. Brain implants market trends highlight rising technological adoption driven by economic growth and geopolitical shifts. Companies focus on strategic investments, mergers, and joint ventures to strengthen market positions. Regional players offer cost-effective solutions tailored to local needs. The market experiences ongoing technological transformation, with companies investing in supply chain management and sustainability strategies.

Competitive intelligence and pricing insights are critical for identifying growth opportunities. The industry's growth is driven by technological innovation, market adaptability, and strategic regional investments, ensuring sustained competitiveness in a dynamic global market. The brain implants market features several active companies contributing to advancements in neurotechnology. Notable players include Abbott Laboratories; Aleva Neurotherapeutics SA; Boston Scientific Corporation; Fisher Wallace Laboratories, LLC; Functional Neuromodulation Ltd.; LivaNova PLC; Medtronic plc; NDI Medical, LLC; NeuroPace, Inc.; NeuroSigma, Inc.; Paradromics Inc.; Renishaw Plc; SceneRay Co., Ltd.; Stimwave LLC; and Synchron Inc.

Abbott Laboratories is a global healthcare company headquartered in Abbott Park, Illinois, specializing in medical devices, diagnostics, pharmaceuticals, and nutritional products. Founded in 1888, the company has grown into a multinational corporation with operations in over 160 countries. Abbott is renowned for its innovative medical technologies, particularly in cardiovascular care, diabetes management, and neuromodulation. The neuromodulation segment includes advanced brain implants designed to address neurological disorders. Abbott’s deep brain stimulation (DBS) systems are used for conditions such as Parkinson’s disease and essential tremor, offering targeted electrical stimulation to specific brain regions to improve motor function and reduce symptoms. These systems feature advanced technology, such as directional leads for precise stimulation and user-friendly programming interfaces. Abbott continues to expand its neuromodulation portfolio to improve patient outcomes with its commitment to research and development. Acquisitions such as St. Jude Medical have boosted its capabilities in this area, enabling the company to remain a leader in brain implant technologies.

Boston Scientific Corporation is a global medical technology company headquartered in Marlborough, Massachusetts, specializing in the development, manufacturing, and commercialization of innovative medical devices. Founded in 1979, the company operates across multiple interventional specialties, such as cardiovascular, neuromodulation, neurovascular intervention, and pain management. In the realm of brain implants, Boston Scientific focuses on neuromodulation technologies designed to treat neurological disorders such as Parkinson’s disease, essential tremor, and dystonia. Its deep brain stimulation (DBS) systems offer precise electrical stimulation to targeted areas of the brain to alleviate motor symptoms and improve patient quality of life. These systems feature advanced programming capabilities and directional leads for customized therapy. Boston Scientific’s commitment to innovation extends to its partnerships with clinicians and research institutions worldwide, ensuring continuous improvement in device efficacy and safety.

List of Key Companies in Brain Implants Market

- Abbott Laboratories

- Aleva Neurotherapeutics SA

- Boston Scientific Corporation

- Fisher Wallace Laboratories, LLC

- Functional Neuromodulation Ltd.

- LivaNova PLC

- Medtronic plc

- NDI Medical, LLC

- NeuroPace, Inc.

- NeuroSigma, Inc.

- Paradromics Inc.

- Renishaw Plc

- SceneRay Co., Ltd.

- Stimwave LLC

- Synchron Inc.

Brain Implants Market Developments

- January 2025: Boston Scientific announced the acquisition of Bolt Medical, a company specializing in intravascular lithotripsy technology, for up to USD 900 million. This acquisition aims to enhance Boston Scientific's coronary artery disease treatment portfolio.

- August 2024: Medtronic obtained FDA approval for Asleep DBS surgery, making it the first approved procedure of its kind. This approval offers new treatment options for Parkinson’s and essential tremor patients in the United States, improving both patient comfort and surgical efficiency.

Brain Implants Market Segmentation

By Product Outlook (Revenue-USD Billion, 2020–2034)

- Deep Brain Stimulators

- Spinal Cord Stimulators

- Vagus Nerve Stimulators

By Application Outlook (Revenue-USD Billion, 2020–2034)

- Chronic Pain

- Epilepsy

- Parkinson’s Disease

- Depression

- Essential Tremor

- Alzheimer’s Disease

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Brain Implants Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.38 billion |

|

Market Size Value in 2025 |

USD 6.99 billion |

|

Revenue Forecast by 2034 |

USD 16.21 billion |

|

CAGR |

9.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The brain implants market size was valued at USD 6.38 billion in 2024 and is projected to grow to USD 16.21 billion by 2034.

The market is projected to register a CAGR of 9.8% during the forecast period, 2025-2034.

North America had the largest share of the market in 2024.

The brain implants market key players include Abbott Laboratories; Aleva Neurotherapeutics SA; Boston Scientific Corporation; Fisher Wallace Laboratories, LLC; Functional Neuromodulation Ltd.; LivaNova PLC; Medtronic plc; NDI Medical, LLC; NeuroPace, Inc.; NeuroSigma, Inc.; Paradromics Inc.; Renishaw Plc; SceneRay Co., Ltd.; Stimwave LLC; and Synchron Inc.

The deep brain stimulators segment accounted for the largest share of the market in 2024.

Brain implants are medical devices surgically placed in the brain to monitor, stimulate, or modulate neural activity. These implants are used for treating neurological disorders such as Parkinson’s disease, epilepsy, chronic pain, and depression. They work by delivering electrical impulses to specific brain regions to restore or enhance neural function. Brain implants include deep brain stimulators, spinal cord stimulators, and vagus nerve stimulators, each designed for different therapeutic applications. Advancements in neurotechnology, including brain-computer interfaces and wireless stimulation, continue to expand their potential in both medical and research fields.