Breast Tissue Markers Market Size, Share, & Industry Analysis Report

: By Product, By Material (Bio-absorbable and Non-absorbable), By Usage Type, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5696

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

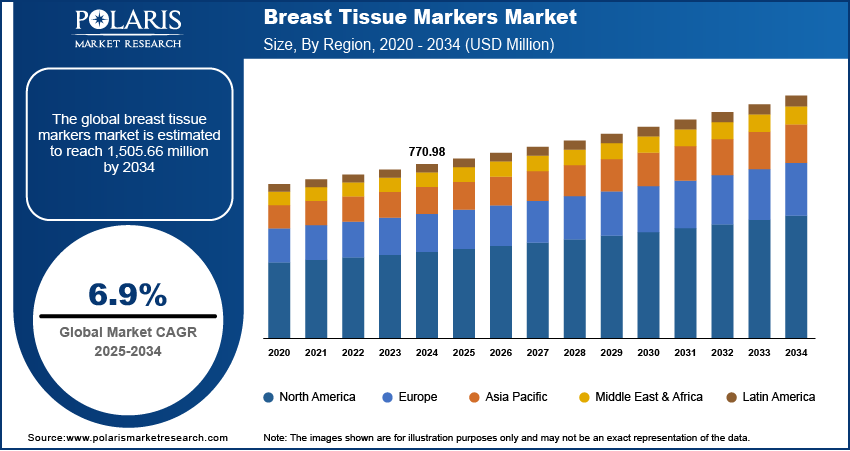

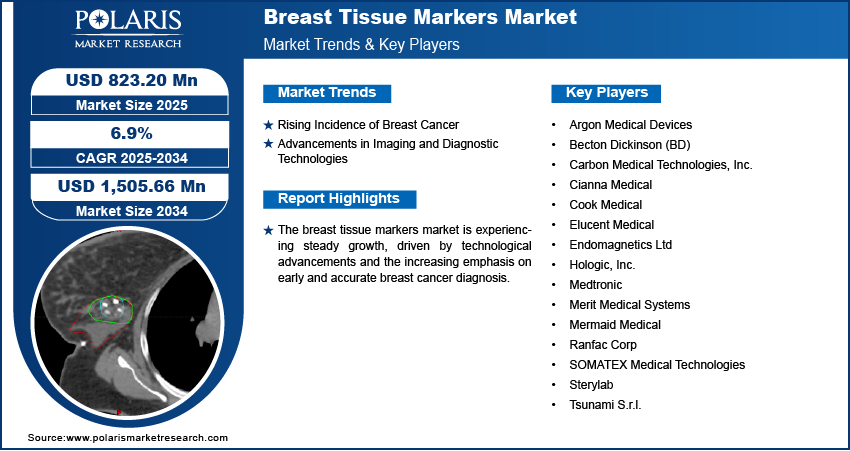

The global breast tissue markers market was valued at USD 770.98 million in 2024 and is expected to register a CAGR of 6.9% from 2025 to 2034. The breast tissue markers market is driven by the rising incidence of breast cancer, increased awareness of early detection, advancements in imaging technologies, and growing preference for minimally invasive procedures to improve accuracy in diagnosis, surgery, and treatment planning.

Breast tissue markers are small, biocompatible medical devices implanted at the site of a breast abnormality to aid in its precise localization during cancer biopsy or surgical procedures. The market is witnessing steady growth, driven by the increasing preference for minimally invasive procedures. According to a June 2023 report by the University of Chicago Medical Center, the American Cancer Society estimated that there were approximately 300,000 new breast cancer cases and over 43,500 deaths in 2023, highlighting the importance of early detection methods and minimally invasive procedures. These markers play an essential role in improving the accuracy of image-guided biopsies and reducing the need for more invasive surgeries. The growing demand for minimally invasive approaches arises from their advantages, such as reduced patient discomfort, shorter recovery times, and fewer post-operative complications. Therefore, as healthcare systems continue to highlight patient-centered care, the use of breast tissue markers has become integral to modern breast cancer diagnostics and treatment planning.

To Understand More About this Research: Request a Free Sample Report

The global market is benefitting from the expansion of breast cancer screening programs and heightened awareness initiatives. Early detection remains critical in improving breast cancer prognosis, and screening programs are being reinforced across both developed and emerging economies. The WHO launched the global breast cancer initiative (GBCI) in 2021 with the aim to reduce breast cancer mortality by 2.5% annually through three strategies such as early detection, timely diagnosis, and comprehensive management. The program guides governments worldwide in strengthening detection and treatment systems to save lives. The detection rate of breast abnormalities has increased, necessitating the use of precise localization tools such as breast tissue markers as more women undergo routine screenings. Additionally, awareness campaigns and government-led initiatives are encouraging women to participate in early screening, indirectly boosting the demand for markers as part of the standard diagnostic services workflow. This collaboration between preventive healthcare and diagnostic innovation drives the market's ongoing growth.

Market Dynamics

Rising Incidence of Breast Cancer

The growing prevalence of breast cancer directly increases the demand for accurate diagnostic and treatment tools. According to a March 2024 WHO report, breast cancer accounted for 2.3 million diagnoses and 670,000 deaths worldwide in 2022. There is a heightened need for effective methods to localize and track lesions within the breast tissue, particularly during biopsy and surgical interventions as more cases are diagnosed annually. Breast tissue markers support clinicians in precisely identifying the site of abnormalities, allowing timely and targeted treatment. This growing clinical necessity, driven by the increasing burden of breast cancer worldwide, reinforces the adoption of tissue markers as a standard component in patient care pathways. Therefore, the rising incidence of breast cancer is propelling the breast tissue markers market growth.

Advancements in Imaging and Diagnostic Technologies

Advancements in imaging and diagnostic technologies are recreating a crucial role in accelerating the adoption of breast tissue markers. The integration of high-resolution modalities such as ultrasound, MRI, and digital mammography has improved the visibility of breast abnormalities, making earlier and more accurate detection possible. In September 2023, Hologic and Bayer collaborated to provide contrast-enhanced mammography (CEM) solutions in Europe, Canada, and Asia Pacific. The collaboration combines Hologic’s mammography systems with Bayer’s contrast agents to improve breast cancer detection and includes training for clinical implementation. These technologies require complementary tools that aid in consistent lesion tracking and localization, especially during follow-up procedures or surgeries. Breast tissue markers serve as reliable reference points that align with AI in medical imaging systems, improving procedural outcomes and diagnostic confidence. This technological synergy continues to support the growth and refinement of breast cancer diagnostic protocols.

Segment Insights

Market Assessment by Product

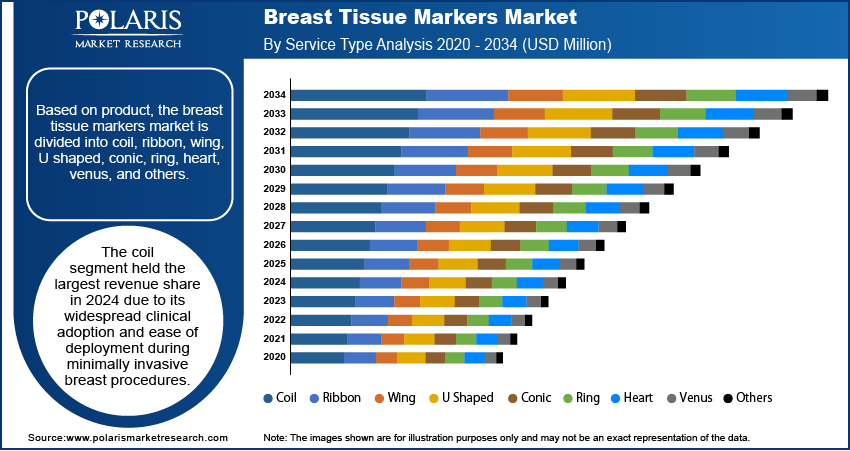

The global breast tissue markers market segmentation, based on product, includes coil, ribbon, wing, U shaped, conic, ring, heart, venus, and others. The coil segment held the largest revenue share in 2024 due to its widespread clinical adoption and ease of deployment during minimally invasive breast procedures. Coil-shaped markers are highly compatible with various imaging modalities, such as 3D ultrasound, mammography, and MRI, allowing accurate lesion localization throughout diagnostic and treatment workflows. Their flexibility, biocompatibility, and visibility post-implantation make them a preferred choice among radiologists and surgeons. Additionally, the coil design allows for secure placement within dense or fatty breast tissues, minimizing migration and improving procedural reliability, thereby driving its dominance in the global market.

Market Evaluation by Usage Type

The global breast tissue markers market segmentation, based on usage type, includes biopsy, surgical planning, and others. The surgical planning segment is expected to witness fastest growth during the forecast period owing to the increasing need for precision in breast-conserving surgeries and tumor excisions. Accurate localization becomes critical for effective surgical outcomes as early detection rates improve and more patients are diagnosed at operable stages. Breast tissue markers are increasingly used to guide surgeons in identifying lesion margins, ensuring complete removal while preserving healthy tissue. This growing clinical focus on personalized and conservative surgical approaches supports the accelerated adoption of tissue markers in surgical planning workflows across healthcare systems.

Regional Analysis

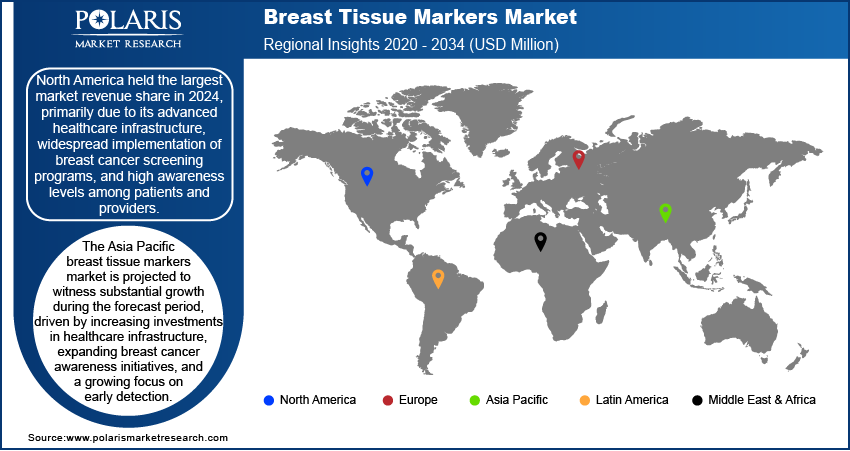

By region, the report provides the breast tissue markers market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest market revenue share in 2024 primarily due to its advanced healthcare infrastructure, widespread implementation of breast cancer screening programs, and high awareness levels among patients and providers. For instance, in October 2023, the American Cancer Society updated its screening guidelines for women at average breast cancer risk. Women should start annual mammograms at age 45, with an option to begin at 40. Those 55 and above may transition to biennial screenings if they are in good health. The region also benefits from a strong presence of key medical device manufacturers and the early adoption of technologically advanced diagnostic tools. Regulatory support and well-established reimbursement frameworks further facilitate the integration of breast tissue markers in routine diagnostic and surgical practices. These factors collectively contribute to the robust demand and large-scale utilization of breast tissue markers across the US and Canada.

The Asia Pacific breast tissue markers market is projected to witness substantial growth during the forecast period driven by increasing investments in healthcare infrastructure, expanding breast cancer awareness initiatives, and a growing focus on early detection. Rapid urbanization, coupled with rising disposable incomes, is improving access to advanced medical technologies in countries such as China, India, and Japan. Furthermore, government-led cancer control programs and the emergence of private diagnostic centers are fueling the demand for breast cancer diagnostic solutions, including tissue markers. This evolving landscape positions the region as a growth frontier for market participants aiming to expand their global footprint.

Key Players and Competitive Analysis

The breast tissue markers sector is witnessing transformation, driven by technological advancements in bioresorbable markers and AI-enhanced localization systems. Industry trends reveal a growing preference for precise, patient-friendly solutions, particularly in developed markets where oncoplastic surgery adoption rises. Competitive analysis indicates leaders such as Hologic and Becton Dickinson are making strategic investments in smart markers with RFID tracking, addressing latent demand for reduced re-excision rates. Meanwhile, emerging markets present expansion opportunities as breast cancer screening programs expand, though economic and geopolitical shifts require careful navigation of local reimbursement policies. Disruptions and trends, such as 3D-printed biodegradable markers, are reshaping revenue growth potential. Small and medium-sized businesses are innovating in niche business segments such as ultrasound-visible markers, while larger players focus on sustainable value chains through hospital partnerships. Expert insights highlight that competitive positioning now relies on combining real-time imaging compatibility with EHR integration capabilities. Persistent challenges include supply chain disruptions for rare-earth materials used in radiographic markers. The sector's future will be defined by how well companies balance the technological assessment of new composites with regional footprint optimization in high-growth areas. A few of the key players in the market are AlterG, Inc.; Biodex Medical Systems, Inc.; Caremax Breast Tissue Markers Ltd.; DJO Global; Drive DeVilbiss Healthcare; Ekso Bionics; GF Health Products, Inc.; Hocoma AG; Hospital Equipment Mfg. Co; Invacare Corporation; Maddak, Inc.; Ottobock; Patterson Medical (now Ability Dynamics); Rifton Equipment; and TheraBand (Performance Health).

Hologic, Inc. specializes in women’s health and medical technology, with a strong focus on breast health solutions, including an extensive portfolio of breast tissue markers. The company’s breast biopsy markers are designed to improve the accuracy and efficiency of breast cancer diagnosis, surgical planning, and long-term monitoring. Hologic offers a variety of marker families, such as Tumark, SecurMark, TriMark, and CeleroMark, each engineered for optimal visibility under multiple imaging modalities, such as ultrasound, mammography, stereotactic, and MRI. These markers are constructed from biocompatible materials such as titanium, stainless steel, and nitinol, often combined with bio-absorbable suture-like netting to ensure precise tissue fixation and minimal migration after placement. The smart/advanced design of Hologic’s markers allows for single-handed, ergonomic deployment, supporting accurate and efficient marker placement even during complex procedures. Distinct geometric shapes such as cork, hourglass, buckle, infinity, and stoplight enable clinicians to mark multiple biopsy sites within the same breast for easy identification and follow-up. Hologic’s breast tissue markers are compatible with their advanced biopsy systems, such as ATEC, Eviva, Celero, and Sertera, ensuring seamless integration into clinical workflows. Hologic empowers physicians to deliver personalized, compassionate care throughout the continuum of breast cancer screening, diagnosis, and treatment by providing reliable, visible, and easy-to-use marking solutions.

Becton Dickinson (BD) is a global medical technology company with a robust portfolio of breast tissue markers designed to support clinicians in the accurate localization and long-term identification of breast lesions. BD’s breast tissue marker range includes products such as the SenoMark, SenoMark Ultra, UltraClip II, UltraCor Twirl, Gel Mark Ultra, and SenoMark UltraCor, each engineered for optimal visibility and stability across imaging modalities such as ultrasound, mammography, and MRI. These markers utilize innovative materials such as polyglycolic acid pads, polylactic acid pellets, and radiopaque metals, providing enhanced ultrasound visibility for weeks and permanent marking for future procedures. Unique marker shapes such as heart, Venus, ring, ribbon, coil, and clover enable easy differentiation of multiple biopsy sites within the same breast and celebrate and honor breast cancer patients, with BD contributing to the American Cancer Society for each special marker sold. The design focus on accurate placement and minimal migration ensures that the markers reliably remain at the intended site, aiding in follow-up imaging, surgical planning, and patient management. BD’s breast tissue markers are compatible with a broad range of biopsy systems. They are recognized for their ease of use, ergonomic applicators, and support of clinical excellence, reflecting the company’s commitment to advancing breast cancer care and improving patient outcomes.

List of Key Companies in Breast Tissue Markers Market

- Argon Medical Devices

- Becton Dickinson (BD)

- Carbon Medical Technologies, Inc.

- Cianna Medical

- Cook Medical

- Elucent Medical

- Endomagnetics Ltd

- Hologic, Inc.

- Medtronic

- Merit Medical Systems

- Mermaid Medical

- Ranfac Corp

- SOMATEX Medical Technologies

- Sterylab

- Tsunami S.r.l.

Breast Tissue Markers Industry Developments

April 2025: Carbon Medical Technologies' BiomarC Tissue Marker System, which is designed to mark biopsy sites within breast tissue, received EU MDR 2017/745 certification, authorizing CE marking for European markets. The pyrolytic carbon-coated markers provide multi-modality imaging visibility and come preloaded in biopsy-compatible delivery systems.

July 2024: Stryker acquired MOLLI Surgical Inc., adding its wire-free localization technology for breast cancer surgery to Stryker's portfolio. The MOLLI 2 system provides real-time surgical guidance with a 3.2mm detectable marker.

March 2024: Mammotome received FDA 510(k) clearance for its LumiMARK Biopsy Site Markers, featuring three distinct 3D shapes (5-10mm) with multi-modality imaging visibility. The self-expanding markers are cleared for breast tissue and lymph node localization.

Breast Tissue Markers Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Coil

- Ribbon

- Wing

- U Shaped

- Conic

- Ring

- Heart

- Venus

- Others

By Material Outlook (Revenue, USD Million, 2020–2034)

- Bio-absorbable

- Non-absorbable

By Usage Type Outlook (Revenue, USD Million, 2020–2034)

- Biopsy

- Stereotactic

- Ultrasound

- MRI-guided

- Surgical Planning

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Centers

- Specialty Clinics

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Breast Tissue Markers Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 770.98 million |

|

Market Size Value in 2025 |

USD 823.20 million |

|

Revenue Forecast by 2034 |

USD 1,505.66 million |

|

CAGR |

6.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 770.98 million in 2024 and is projected to grow to USD 1,505.66 million by 2034.

The global market is projected to register a CAGR of 6.9% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are AlterG, Inc.; Biodex Medical Systems, Inc.; Caremax Breast Tissue Markers Ltd.; DJO Global; Drive DeVilbiss Healthcare; Ekso Bionics; GF Health Products, Inc.; Hocoma AG; Hospital Equipment Mfg. Co; Invacare Corporation; Maddak, Inc.; Ottobock; Patterson Medical (now Ability Dynamics); Rifton Equipment; TheraBand (Performance Health).

The coil segment held the largest revenue share in 2024.

The surgical planning segment is expected to witness fastest growth during the forecast period.