Brewer’s Yeast Market Share, Size, Trends, Industry Analysis Report

By Type (Liquid, Dry); By Application; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 118

- Format: PDF

- Report ID: PM4613

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

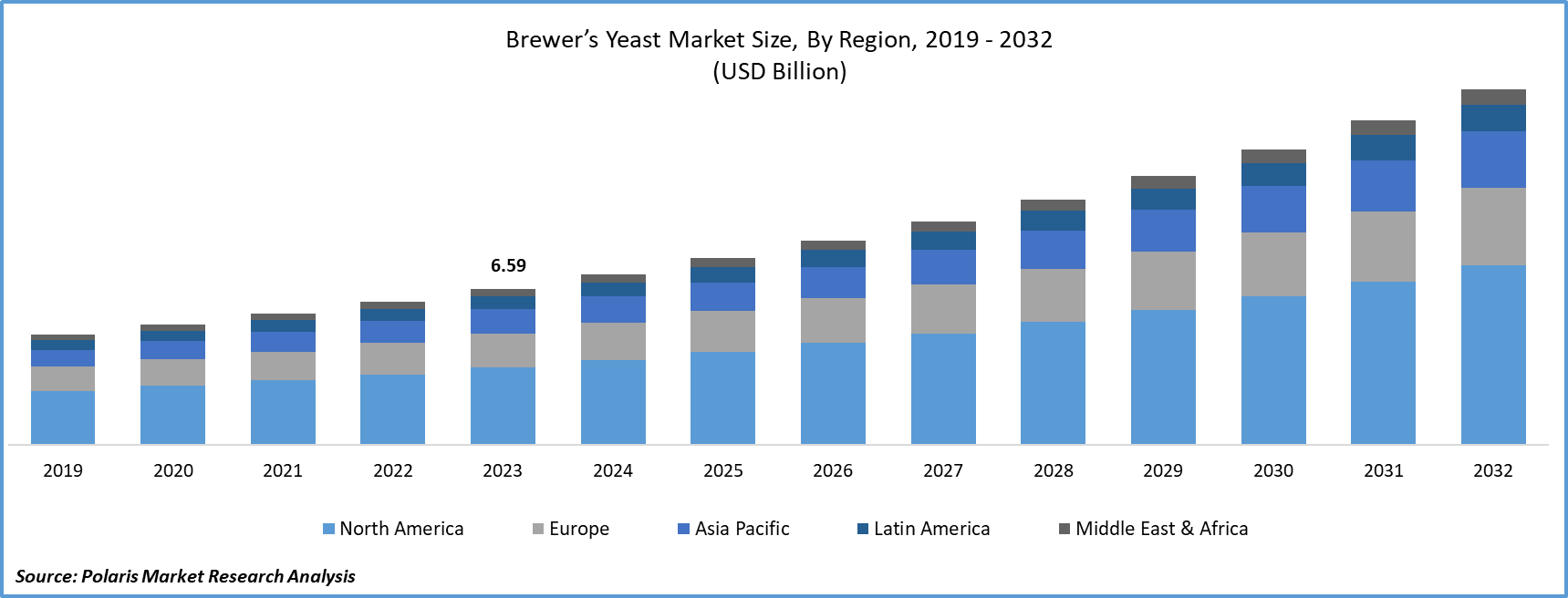

- Brewer’s Yeast Market size was valued at USD 6.59 billion in 2023.

- The market is anticipated to grow from USD 7.20 billion in 2024 to USD 15.01 billion by 2032, exhibiting the CAGR of 9.6% during the forecast period.

Market Introduction

Increased applications in the food and beverage industry drive the brewer's yeast market trends. Beyond traditional brewing uses, Brewer's Yeast is now a versatile ingredient, enhancing the flavors of snacks, soups, sauces, and condiments. Its nutty and savory profile contributes to the demand for natural and nutritious additives. Rich in B vitamins, proteins, and minerals, Brewer's yeast aligns with health-conscious consumer preferences, becoming a key component in functional foods, protein bars, and plant-based formulations.

In addition, companies operating in the market are introducing new products to expand market reach and strengthen their presence.

To Understand More About this Research: Request a Free Sample Report

- For instance, in September 2022, Lallemand Brewing introduced LalBrew NovaLager, a Saccharomyces pastorianus hybrid (non-GMO) designed specifically for crafting lager-style beers. This yeast strain combines the optimal fermentation performance of ale yeast, offering a robust profile with desirable brewing characteristics such as rapid fermentations, high attenuation, and strong flocculation.

Technological advancements in brewing are driving substantial growth in the brewer's yeast market forecast. Innovations in extraction processes, automation, and biotechnology have significantly increased the yield and quality of brewer's yeast. Optimized fermentation, aided by advanced analytical techniques and genetic engineering, enhances yeast characteristics and nutritional profiles. This progress has expanded the applications of brewer's yeast in the food and beverage industry, including nutritional supplements and animal feed.

Industry Growth Drivers

Increasing health and wellness trends are projected to spur the product demand

The brewer's yeast market growth is on the rise, propelled by the increasing health and wellness trends. In response to heightened consumer focus on nutrition and well-being, brewer's yeast, packed with essential nutrients, gains prominence. Recognized for potential health benefits, including immune system support and enhanced digestion, it aligns with the demand for natural and functional ingredients. Brewer's yeast is valued for its contributions to skin health, metabolism, and energy levels. Its incorporation into dietary supplements and functional foods caters to the preferences of health-conscious consumers, driving innovation and expanding its role in the broader health and wellness landscape.

Rising demand for plant-based proteins is expected to drive brewer’s yeast market growth

The brewer's yeast market report is surging, propelled by the growing demand for plant-based proteins. With consumers favoring plant-centric diets, brewer's yeast, a byproduct of beer production, stands out as a rich source of protein and essential nutrients. Its versatility in supplements, snacks, and plant-based protein formulations aligns with health-conscious preferences. Boasting vitamins, minerals, and amino acids, brewer's yeast caters to those seeking alternative protein sources. Moreover, its adoption aligns with sustainability trends, contributing to its expanding market. As the shift toward plant-based lifestyles persists, driven by health and environmental considerations, brewer's yeast is poised for continued growth, meeting the evolving demands of health-conscious consumers.

Industry Challenges

Price volatility is likely to impede the market growth

Price volatility presents a constraint on the brewer's yeast market growth, hindering consistent growth. Fluctuations in raw material costs, influenced by climate conditions and market dynamics, impact production. Unpredictable price variations, driven by factors such as demand-supply imbalances and global economic shifts, disrupt supply chains and hinder planning for manufacturers. This volatility can also influence consumer purchasing behavior, impacting product affordability and availability. To navigate these challenges, proactive risk management, resilient supply chain practices, and potential innovations in production processes are essential for mitigating the impact of price fluctuations, fostering stability, and ensuring the sustainability of the market.

Report Segmentation

The brewer’s yeast market industry analysis is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Dry segment held significant market revenue share in 2023

The dry segment held a significant revenue share in 2023. Dry brewer's yeast undergoes a moisture removal process, resulting in a granular or powdered form. The yeast offers convenience and stability compared to its fresh counterpart. Recognized for its extended shelf life and packed with B vitamins, proteins, and essential minerals, dry brewer's yeast is a favored ingredient in brewing for its impact on beer flavor and alcohol content. Its versatility extends to baking, where it serves as a leavening agent, enhancing the texture of bread. Moreover, it finds application in dietary supplements, providing concentrated plant-based nutrients. Valued for its nutritional richness and adaptability, dry brewer's yeast plays a pivotal role in brewing, baking, and health-oriented industries.

By Application Analysis

The demand for dietary supplements is expected to increase during the forecast period

The demand for dietary supplements is expected to increase during the forecast period. Brewer's yeast is integral to dietary supplements for its rich B-vitamin complex, offering thiamine and folic acid, among others. As a plant-based protein source, it delivers essential amino acids crucial for muscle health. Abundant in selenium, chromium, zinc, and iron, it provides a comprehensive mineral spectrum with immune-boosting and antioxidant benefits. The yeast's probiotic properties support digestive health, while B vitamins contribute to sustained energy levels and vitality. Recognized for promoting skin, hair, and nail health, it plays a role in cholesterol management and blood sugar control. Brewer's yeast is a versatile inclusion, appealing to diverse dietary preferences, including vegetarian and vegan lifestyles.

Regional Insights

Asia-Pacific region is expected to experience significant growth during the forecast period

In 2023, the North American region accounted for a significant brewer's yeast market share. The North American market is propelled by health-conscious trends, notably the demand for natural supplements rich in B vitamins. Brewer's yeast caters to the thriving brewing industry, particularly the dynamic craft beer sector, where diverse yeast strains are integral for distinct flavor profiles. A surge in home brewing enthusiasts has further driven demand for quality yeast strains. Brewer's yeast finds expanding applications in the food industry, acting as a flavor enhancer and nutritional supplement. Ongoing technological advancements enhance production efficiency while sustainability practices gain traction. The market, characterized by competition and consolidation, adheres to stringent regulatory standards, emphasizing quality control.

Asia-Pacific is expected to experience significant growth during the forecast period. Changing consumer preferences in Asia-Pacific, influenced by global trends, contribute to the demand for health-focused and nutritional products. Brewer's yeast, known for its nutritional content, aligns with this trend, driving its use as a dietary supplement. The region has also witnessed advancements in yeast production technologies. Improved fermentation and propagation methods have enhanced the efficiency of yeast production, ensuring a stable supply for both commercial breweries and other industries.

Key Market Players & Competitive Insights

The brewer’s yeast market involves a diverse array of contributors, and the expected entry of new players is poised to intensify competition. Established market leaders continuously enhance their technologies to maintain a competitive advantage, emphasizing efficiency, reliability, and safety. These entities prioritize strategic endeavors, including forging alliances, improving product offerings, and participating in collaborative projects, with the goal of outperforming others in the industry. Their ultimate aim is to secure a significant brewer’s yeast market share.

Some of the major players operating in the global brewer’s yeast market include:

- Alltech Inc.

- Angel Yeast Co., Ltd.

- Archer Daniels Midland Company

- Associated British Foods plc

- Chr. Hansen Holding A/S

- Inland Island Yeast Laboratories

- Kerry Group plc

- Lallemand Inc.

- Leiber GmbH

- Lesaffre Group

- Omega Yeast Labs

- Oriental Yeast Co. Ltd

- Shandong Bio Sunkeen Co., Ltd.

- Synergy Flavors

- White Labs

Recent Developments

- In September 2023, Leiber declared the establishment of its inaugural facility in the United States. The construction of the U.S. manufacturing facility will occur in stages, progressively enhancing its processing capacities and expanding the array of products offered.

- In February 2023, White Labs introduced WLP001- California Ale Yeast in an active dry format, broadening its product range within the market.

- In April 2021, Omega Yeast relocated to larger production facilities spanning 13,800 square feet, aiming to extend its operational capacity and meet the increasing demand in the market.

Report Coverage

The brewer’s yeast market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, types, applications, and their futuristic growth opportunities.

Brewer’s Yeast Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7.20 billion |

|

Revenue forecast in 2032 |

USD 15.01 billion |

|

CAGR |

9.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Brewer’s Yeast Market Size Worth $15.01 Billion By 2032

Key players in the market are Alltech Inc., Angel Yeast Co., Ltd., Associated British Foods plc, Kerry Group plc

Asia-Pacific contribute notably towards the global Brewer’s Yeast Market

Brewer’s Yeast Market exhibiting the CAGR of 9.6% during the forecast period.

The Brewer’s Yeast Market report covering key segments are type, application, and region.