Cabin Management System Market Size, Share, Trends & Industry Analysis Report

: By Aircraft Type (Commercial Aircraft, Business Jets, and Military Aircraft), By Component, By System Type, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 129

- Format: PDF

- Report ID: PM5678

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

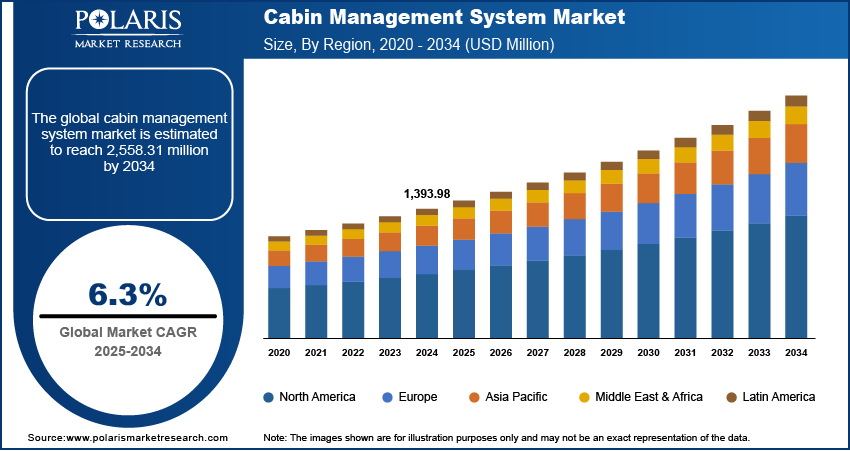

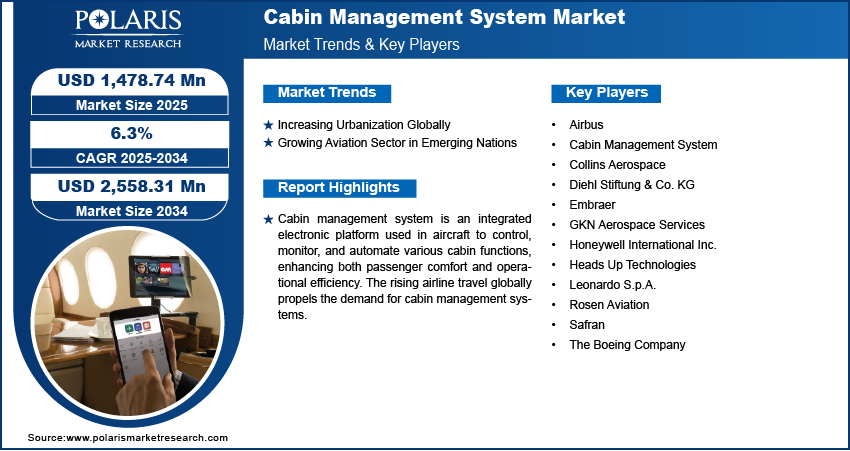

The global cabin management system (CMS) market size was valued at USD 1,393.98 million in 2024, at a CAGR of 6.3% during 2025–2034. The market is driven by rising demand for luxury experiences, more aircraft deliveries, tech advances, increased air travel, military upgrades, urbanization, and emerging market expansion.

Key Insights

- Commercial aircraft dominate due to rising global air traffic and airline fleet modernization, which includes investments in comfort, entertainment, and connectivity.

- OEM segment leads as new aircraft increasingly include integrated cabin management systems for efficiency and enhanced passenger experience.

- North America holds the largest market share, driven by a strong commercial fleet, OEM presence, and rapid technology adoption.

- Asia Pacific market expands due to increasing air travel, rising incomes, and airline fleet modernization.

Industry Dynamics

- Growing global air travel and increasing aircraft deliveries drive demand for advanced cabin management systems, enhancing passenger comfort.

- Rising military modernization boosts the need for advanced, integrated cabin systems in fighter and attack aircraft.

- Urbanization and expanding aviation sectors in emerging markets fuel investments in personalized and efficient cabin technologies.

- Advancements in wireless technologies and AI improve inflight entertainment, lighting, climate control, and operational efficiency.

- High integration costs, regulatory complexities, and dependence on legacy fleets restrain faster adoption of cabin management systems.

Market Statistics

2024 Market Size: USD 1,393.98 million

2034 Projected Market Size: USD 2,558.31 million

CAGR (2025–2034): 6.3%

North America: Largest market in 2024

AI Impact on Cabin Management System Market

- AI enables predictive maintenance in cabin systems, reducing downtime and improving operational efficiency for airlines.

- Smart AI algorithms personalize in-flight entertainment, lighting, and temperature based on passenger preferences, enhancing customer experience.

- AI-powered voice and gesture controls simplify cabin management, making system interaction more intuitive for crew and passengers.

- Real-time data analysis by AI helps optimize cabin resource usage, such as energy and connectivity, improving sustainability.

- Integration of AI in CMS supports advanced security and diagnostics, allowing proactive issue detection and system performance monitoring.

To Understand More About this Research:Request a Free Sample Report

The market is growing due to rising demand for luxury and personalized in-flight experiences, increasing aircraft deliveries, and advancements in wireless technologies, which enhance entertainment, lighting, and climate control functionalities within aircraft cabins.

Cabin management system (CMS) is an integrated electronic platform used in aircraft to control, monitor, and automate various cabin functions, enhancing both passenger comfort and operational efficiency. CMSs serve as the central interface for both crew and passengers, allowing seamless management of features such as ambient lighting, temperature, window shades, audio-visual entertainment, passenger signs, galley and lavatory controls, and even in-flight connectivity. Modern CMSs are designed to be user-friendly, often featuring intuitive touchscreens or wireless controls that consolidate all cabin functions into a single, accessible interface.

The architecture of a cabin management system is typically modular and scalable, using distributed nodes-such as Input/Output Distribution Nodes (IODNs), to ensure high reliability and easy adaptation to different aircraft sizes and configurations. This modularity reduces maintenance costs and simplifies upgrades as new technologies emerge. In business and private jets, CMSs are especially valued for their ability to deliver a luxury, home-like experience in the air, with high-definition displays, customizable controls, and integration with the latest consumer devices.

The rising airline travel globally is propelling the cabin management system market growth. India Brand Equity Foundation, in its report, stated that from January to September 2023, local airlines in India carried 112.86 million passengers, up 29.10% from the 87.42 million passengers transported during the same period in 2022. This increase in airline travel is driving airlines to invest in systems that improve the in-flight experience, such as personalized lighting, climate control, entertainment, and connectivity solutions. These features require sophisticated, integrated cabin management systems that allow crew members and passengers to control various cabin elements seamlessly. Additionally, increasing airline travel is fueling commercial fleet operators to purchase new aircraft, which ultimately boosts demand for cabin management systems as these systems are deployed in new aircraft to improve operational efficiency. Therefore, the surge in air travel is accelerating the adoption of cabin management systems to maintain high service standards and optimize cabin operations.

The demand for cabin management systems is driven by the rising military investments in modernizing and recapitalizing their fixed-wing fighter and attack planes. Armed forces require more sophisticated avionics and mission systems, including an enhanced cabin management system, as they invest in upgrading older aircraft or introduce next-generation platforms to improve pilot situational awareness and operational efficiency. Modern fighter jets integrate advanced displays, sensor fusion, and AI-driven decision aids, all of which rely on robust cabin management systems to process and present critical data seamlessly. Additionally, growing emphasis on network-centric warfare pushes militaries to invest in CMS that can integrate with battlefield communication systems, enabling real-time data sharing between pilots and command centers. The Department of Defense, a branch of the US federal government that manages the country's military forces, invested over USD 20 billion in fiscal year 2022 to modernize and recapitalize its fixed-wing fighter and attack planes. Thus, as defense investment increases in modernizing aircraft fleets, the need for reliable, high-performance cabin management systems continues to grow.

Market Dynamics

Increasing Urbanization Globally

Urbanization propels the need for efficient and comfortable air travel, driving airlines to invest in modern aircraft with an advanced cabin management system. This system enhances passenger experience by offering better connectivity, entertainment options, and personalized comfort controls. Additionally, urbanization leads to a rise in business and luxury travel, creating a demand for premium cabin experiences that cabin management system provides. United Nations Population Fund, in its report, stated that the number of urban people is estimated to increase to about 5 billion by 2030. Hence, the rising urbanization globally fuels the demand for commercial fleets and their systems, including cabin management systems.

Growing Aviation Sector in Emerging Nations

Airlines in emerging regions are rapidly increasing their fleets and launching new routes to meet the escalating travel demand, creating a strong need for modern, efficient aircraft equipped with an advanced cabin management system. Aircraft manufacturers and airlines in emerging nations are also prioritizing energy efficiency and streamlined maintenance to tackle rising airline travelers, which further increases the appeal and adoption of integrated cabin management systems. As competition intensifies, driven by the growing aviation sector in emerging regions such as India and Brazil, airlines differentiate their services by offering superior onboard experiences, making cabin management system an essential investment to capture market share and improve customer satisfaction.

Segment Insights

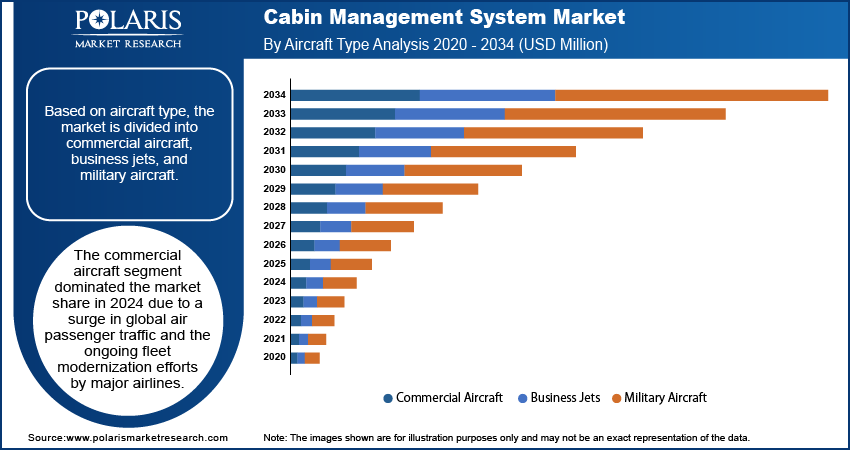

Market Assessment by Aircraft Type

Based on aircraft type, the cabin management system market is divided into commercial aircraft, business jets, and military aircraft. The commercial aircraft segment dominated the industry share in 2024 due to a surge in global air passenger traffic and the ongoing fleet modernization efforts by major airlines. Commercial airlines are aggressively investing in advanced cabin technologies to enhance the passenger experience, focusing on comfort, entertainment, and connectivity. The rise of long-haul and ultra-long-haul flights drove demand for sophisticated in-flight entertainment and connectivity systems that cater to both business and leisure travelers. Additionally, regulatory pressures to improve fuel efficiency and reduce operational costs are motivating commercial airlines to upgrade older fleets with lighter, more efficient cabin components, further boosting demand for cabin management systems.

The business jets segment is expected to grow at a robust pace in the coming years, owing to the surging demand for private air travel among high-net-worth individuals and corporations. Business jet owners prioritize features such as high-speed internet connectivity, advanced audio-visual entertainment, dynamic lighting controls, and seamless integration with personal electronic devices, which cabin management systems offer, leading to their high adoption. Furthermore, the rise of fractional ownership and charter services is expanding accessibility of business jets, boosting demand for sophisticated cabin management systems.

Market Evaluation by End User

In terms of end user, the cabin management system market is segregated into OEM (original equipment manufacturer) and aftermarket. The OEM (original equipment manufacturer) segment accounted for a major share due to increasing demand for new-generation aircraft equipped with an advanced cabin management system. Airlines and private jet operators are prioritizing modern fleets featuring integrated in-flight entertainment, connectivity solutions, and smart cabin controls, compelling manufacturers such as Airbus and Boeing to embed these systems during production. The rise in aircraft orders, particularly for fuel-efficient models such as the Airbus A320neo and Boeing 737 MAX, further boosted OEM dominance, as these aircraft incorporate next-gen cabin control features to enhance passenger experience and operational efficiency. Additionally, stringent aviation regulations and the push for lightweight, energy-efficient components encouraged OEMs to adopt advanced cabin management systems early in the manufacturing process.

Regional Analysis

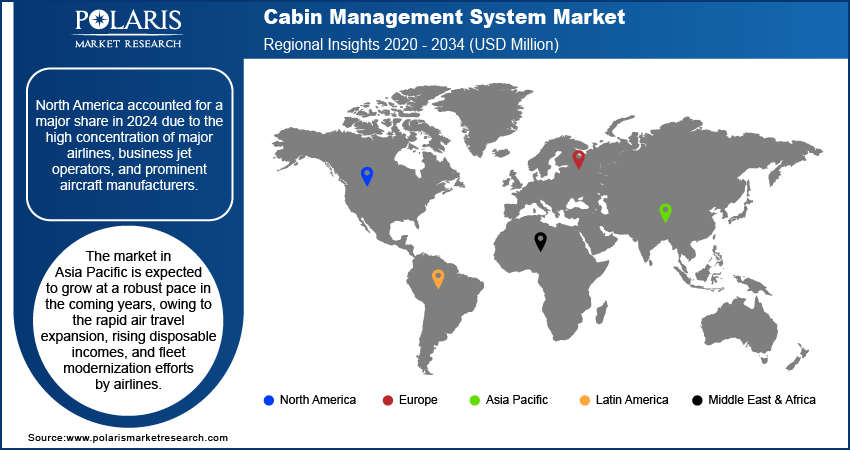

By region, the cabin management system market report provides insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for a major share in 2024 due to the high concentration of major airlines, business jet operators, and prominent aircraft manufacturers. The US accounted for a major share in the North America cabin management system market owing to its extensive commercial aviation fleet, strong presence of OEMs such as Boeing and Gulfstream, and rapid adoption of advanced cabin technologies. Airlines in the region invested heavily in next-generation inflight connectivity, touchscreen entertainment systems, and premium seating to enhance passenger experience and stay competitive. Additionally, the booming private aviation sector, supported by increasing corporate and business travel and demand for luxury cabin features, further solidified North America’s dominance in the industry. For instance, the Global Business Travel Association (GBTA) unveiled a new study in June 2024, stating the US was the nation that spent the most on business travel in 2022, with expenditures totaling USD 421.1 billion.

The Asia Pacific cabin management system market is expected to grow at a robust pace in the coming years, owing to the rapid air travel expansion, rising disposable incomes, and fleet modernization efforts by airlines. China and India are estimated to lead this growth, driven by massive orders for new aircraft, government investments in aviation infrastructure, and the emergence of low-cost carriers. Airlines of China, in particular, are prioritizing advanced cabin technologies to attract premium travelers, while Indian carriers are focusing on cost-effective yet advanced cabin management solutions to cater to the growing aviation sector. The increasing demand for business jets in the region, along with rising tourism and urbanization, is further projected to drive the adoption of cabin management system. Additionally, Asia Pacific’s focus on sustainable aviation and the introduction of next-gen aircraft such as the COMAC C919 is expected to create new opportunities for the industry.

Key Players and Competitive Analysis

The cabin management system market is highly competitive, driven by technological advancements and increasing demand for enhanced in-flight experiences. Key players are strategically leveraging mergers and acquisitions, partnerships, and collaborations to strengthen their positions and expand their product portfolios. These strategic moves enhance their technological capabilities and broaden their customer base by providing more integrated and customizable systems. Partnerships play a crucial role as well; companies often collaborate with software developers and hardware manufacturers to create seamless, end-to-end solutions. Moreover, startups are increasingly being acquired by established firms seeking to innovate rapidly and capture emerging segments. This dynamic landscape is further characterized by rigorous R&D investments aimed at developing next-generation cabin management systems that offer improved user interfaces, energy efficiency, and integration with IoT devices.

The cabin management system market is fragmented, with the presence of numerous global and regional market players. A few major players are Airbus, Collins Aerospace, Diehl Stiftung & Co. KG, Embraer, GKN Aerospace Services, Honeywell International Inc., Heads Up Technologies, Leonardo S.p.A., Safran, Rosen Aviation, and The Boeing Company.

Collins Aerospace is a global company in aviation technology, renowned for delivering innovative solutions that enhance the passenger experience in business and private aviation. In the field of cabin management systems, the company offers Venue Cabin Management System (CMS), a highly advanced and widely adopted platform designed to transform the in-flight environment into a seamless extension of the passenger’s lifestyle and preferences. Venue CMS provides passengers with intuitive control over all aspects of the cabin, from lighting and temperature to entertainment and connectivity, all accessible through elegantly designed touchscreens, seat controls, and mobile device applications.

Diehl Stiftung & Co. KG is a prominent global company in the aviation industry, recognized for its innovative approach to cabin systems and comprehensive solutions for aircraft manufacturers. Diehl Aviation’s portfolio encompasses a wide range of cabin equipment and systems, including advanced Cabin Management Systems (CMS), lighting, avionics, on-board lavatories, monuments, electronics, fire protection, water supply, and air-conditioning systems. The company’s CMS solutions are designed to enhance passenger comfort, safety, and convenience, integrating digital and networked functionalities that allow airlines and operators to tailor the in-flight experience to evolving customer expectations. Diehl’s CMS offerings typically feature intuitive interfaces for controlling lighting, temperature, entertainment, and other cabin functions, supporting both original equipment installations and retrofit upgrades for the aftersales sector.

List of Key Companies

- Airbus

- Collins Aerospace

- Diehl Stiftung & Co. KG

- Embraer

- GKN Aerospace Services

- Honeywell International Inc.

- Heads Up Technologies

- Leonardo S.p.A.

- Rosen Aviation

- Safran

- The Boeing Company

Cabin Management System Industry Developments

In April 2024, ALTO Aviation (US), a Heads Up Technologies subsidiary, introduced a Cadence Cabin Management System (CMS) retrofit for Gulfstream G200 aircraft. The retrofit offers fit-compatible replacement switch panels across the cabin, with minor adjustments at VIP seat and galley areas to support upgraded functionalities.

April 2025: Rosen Aviation announced the launch of Celestia, the first operator-designed Cabin Management System (CMS) for VIP, business, and commercial aviation cabins.

October 2024: Collins Aerospace announced the first deliveries of its new Venue cabin management system (CMS), which is equipped with Collins' all-new smart monitors and upgraded graphical user interface (GUI).

October 2023: Embraer Executive Jets and Lufthansa Technik expanded their existing cooperation in the field of cabin management systems.

Cabin Management System Market Segmentation

By Aircraft Type Outlook (Revenue, USD Million, 2020–2034)

- Commercial Aircraft

- Business Jets

- Military Aircraft

By Component Outlook (Revenue, USD Million, 2020–2034)

-

Hardware

- Control Panels

- Displays

- Sensors

- Connectivity Devices

- Software

- Cabin Control Software

- Connectivity Solutions

By System Type Outlook (Revenue, USD Million, 2020–2034)

- In-flight Entertainment (IFE) Systems

- Lighting Systems

- Passenger Comfort Systems

- Communication Systems

- Monitoring & Control Systems

By End User Outlook (Revenue, USD Million, 2020–2034)

- OEM (Original Equipment Manufacturer)

- Aftermarket

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cabin Management System Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,393.98 million |

|

Market Size Value in 2025 |

USD 1,478.74 million |

|

Revenue Forecast by 2034 |

USD 2,558.31 million |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1,393.98 million in 2024 and is projected to grow to USD 2,558.31 million by 2034.

The global market is projected to register a CAGR of 6.3% during the forecast period.

North America had the largest share of the global market in 2024.

A few of the key players in the market are Airbus, Collins Aerospace, Diehl Stiftung & Co. KG, Embraer, GKN Aerospace Services, Honeywell International Inc., Heads Up Technologies, Leonardo S.p.A., Safran, Rosen Aviation, and The Boeing Company.

The OEM (original equipment manufacturer) segment dominated market revenue in 2024.

The business jets segment is expected to grow at the fastest pace in the coming years.