In-flight Entertainment and Connectivity (IFEC) Market Share, Size, Trends, Industry Analysis Report

By Product (Hardware, Connectivity, Content); By Aircraft Type; By End Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:May-2025

- Pages: 155

- Format: PDF

- Report ID: PM1456

- Base Year: 2024

- Historical Data: 2020-2023

The global in-flight entertainment and connectivity market was valued at USD 7.46 billion in 2024 and is projected to grow at a CAGR of 9.60% from 2025 to 2034. The market is supported by growing air travel and passenger expectations for onboard digital services.

In-flight entertainment (IFE) market refers to the various forms of media available to passengers during air travel, such as movies, TV shows, music, games, and books. This content is typically accessed through personal screens located on the seatback or mobile devices and can be enjoyed throughout the flight. Connectivity, on the other hand, refers to the ability of passengers to access the internet and stay connected with their devices while in the air. Some airlines offer Wi-Fi connectivity, allowing passengers to browse the web, check emails, and communicate with others via messaging apps or social media.

Several factors, including the increasing demand for personalized experiences, the need for enhanced passenger engagement, and the desire for seamless connectivity onboard aircraft, drive the IFEC market. One of the key drivers of the IFEC market is the rising trend of personalization. Passengers are no longer satisfied with generic inflight entertainment options and instead seek customized content tailored to their individual preferences. Airlines are responding to this demand by offering personalized recommendations based on passenger data, such as viewing history and preferences.

To Understand More About this Research: Request a Free Sample Report

Also, airlines are incorporating more diverse content options, including TV shows, movies, music, and games, to cater to different tastes and interests. The desire for seamless connectivity on board aircraft is another significant factor driving the growth of the IFEC market. Passengers want to remain connected to friends, family, and colleagues even when they are flying at 30,000 feet. To meet this demand, airlines are adopting advanced connectivity technologies like Ka-band satellite connectivity, which offers faster speeds and greater reliability than traditional Wi-Fi connections.

Despite these drivers, there are some challenges facing the IFEC market such as the high cost associated with implementing advanced IFEC systems. Installing and maintaining these systems can be expensive, which may deter some airlines from investing in them. Another challenge is ensuring consistent connectivity across different regions and altitudes, which requires significant infrastructure investments.

Market New.png)

Growth Drivers

- Increased technological developments drive the market growth.

The in-flight entertainment and connectivity (IFEC) market has experienced significant growth in recent years, driven by advancements in technology. Advancements in satellite communication, wireless networking, and digital media have enabled airlines to offer a wide range of entertainment and connectivity options to passengers.

Also, advanced display systems and noise-canceling headphones provide an immersive experience for passengers, making long-route flights more enjoyable. Mobile apps and inflight portals allow passengers to access flight information, book meals, and purchase duty-free products, further enhancing the overall travel experience. The increasing demand for these advanced IFEC systems is driving market growth as airlines seek to differentiate themselves from competitors and provide a premium experience for their customers.

Report Segmentation

The market is primarily segmented based on product, aircraft type, end use, and region.

|

By Product |

By Aircraft Type |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

- The hardware segment held the largest market share in 2024.

The hardware segment accounted for the largest market share in 2024 because of the increasing demand for advanced IFEC systems that provide passengers with a seamless and personalized experience during their flights. Hardware components such as seatback screens, head up displays, and wireless access points are essential for delivering high-quality inflight entertainment and connectivity services. With the rise of streaming services and online content, passengers expect to have access to a wide range of entertainment options during their flights, which has driven the demand for advanced IFEC systems.

Also, advancements in display technology have led to the development of lightweight and high-resolution screens that offer an enhanced viewing experience for passengers. The integration of satellite connectivity and wireless communication technologies has enabled airlines to offer internet access, live television, and real-time updates on flight information, weather, and news.

By Aircraft Type Analysis

- The narrow-body aircraft dominated the market in 2024.

The narrow-body aircraft segment accounted for a significant share of the market in 2024, driven by the increasing demand for air travel, particularly in emerging markets, which has led to a rise in the number of narrow-body aircraft being delivered each year. As these aircraft are typically used for short-to medium-haul flights, passengers expect to have access to modern IFEC systems that can enhance their inflight experience. Also, advancements in technology have made it possible to install lightweight materials and compact IFEC solutions on narrow-body aircraft without compromising on functionality or performance. This has further fueled the adoption of IFEC systems in this segment.

Market Seg.png)

Regional Insights

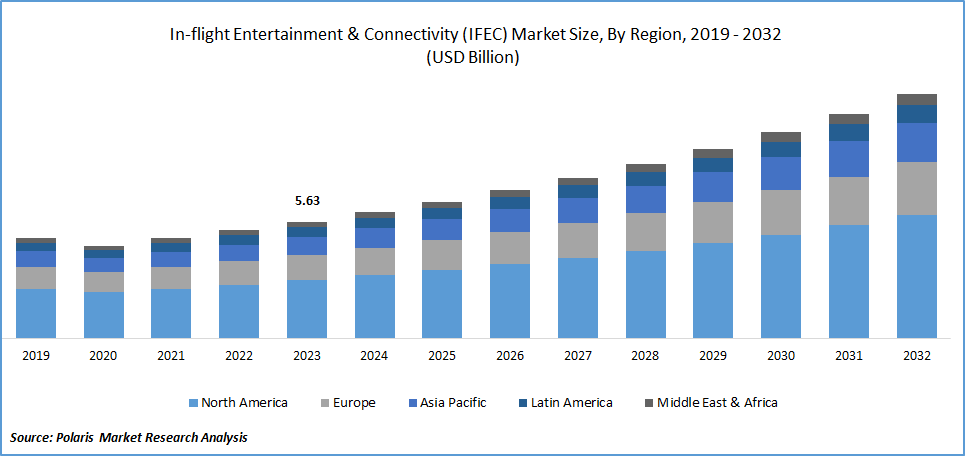

The North American IFEC market is accounted for the largest share, with the United States leading the way. This is due to the availability of advanced high-speed internet infrastructure, increased data usage in both air and ground applications, and user customization features. Many airlines in North America have invested heavily in developing their own proprietary IFE platforms, which provide passengers with a wide range of content options, including movies, TV shows, music, and games. Owing to these factors, North America showcased its dominance in the market.

The Asia Pacific IFEC market is expected to experience substantial growth in the market due to a surge in air travel demand, with countries such as India, China, and Indonesia experiencing rapid economic growth and an increasing number of middle-class passengers who are willing to pay for premium services like in-flight entertainment and connectivity. Also, governments in the region have been investing heavily in aviation infrastructure, leading to an increase in flight frequencies and routes, which creates more opportunities for in-flight entertainment and connectivity providers.

Market Reg.png)

Key Market Players & Competitive Insights.

The manufacturers in the in-flight entertainment and connectivity market have been actively developing and offering a range of solutions to cater to the growing demand for enhanced passenger experience. They are investing heavily in research and development to design and deliver unique IFE systems that provide an engaging and personalized experience for passengers. To enhance the passenger experience, some manufacturers are exploring emerging technologies like virtual reality (VR) and augmented reality (AR) to offer immersive experiences. Moreover, they are partnering with airlines and content providers to offer tailored content and services that meet the specific needs and preferences of different airlines and their passengers.

Some of the major players operating in the global market include:

- Anuvu

- BAE Systems

- Collins Aerospace

- Eutelsat Communications

- Gogo LLC

- Honeywell International Inc.

- Inmarsat Global Limited

- Iridium Communications Inc.

- Panasonic Avionics

- SAFRAN Group

- SITA

- Thales Group

- ViaSat, Inc.

- moment.tech

Recent Developments

- In January 2024, Air India launched a new inflight entertainment system, offering over 2,200 hours of content. The upgrade included movies, TV shows, and audio, enhancing the passenger experience on long-haul flights, particularly aboard the A350 and B777-200LR.

- In June 2023, Hughes Network Systems and OneWeb announced an exclusive distributor agreement to provide global airline markets with LEO connectivity services.

- In November 2022, moment.tech, a company that offers e-commerce, entertainment, and connectivity services to the travel sector, has launched In-Flight entertainment and connectivity platforms for jet operators.

- In December 2022, Viasat Inc., a global communications company, announced that Federal Aviation Administration (FAA) has approved the company's Ka-band In-flight Connectivity (IFC) solution for Gulfstream G450 aircraft.

In-flight Entertainment and Connectivity (IFEC) Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 8.03 Billion |

|

Revenue Forecast in 2034 |

USD 18.32 Billion |

|

CAGR |

9.60% from 2024 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Product, By Aircraft Type, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements concerning countries, regions, and segmentation. |

FAQ's

In-flight Entertainment and Connectivity Market report covering key segments are product, aircraft type, end use, and region.

In-flight Entertainment and Connectivity (IFEC) Market Size Worth USD 18.32 Billion By 2034

The global in-flight entertainment and connectivity market is expected to grow at a CAGR of 9.60% during the forecast period.

North America is leading the global market.

The Key driving factors in In-flight Entertainment and Connectivity Market is rising trend of personalization benefits market growth.