Calcium Carbonate Market Size, Share, Trends, Industry Analysis Report

: By Product Type (Ground Calcium Carbonate and Precipitated Calcium Carbonate), By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM3305

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

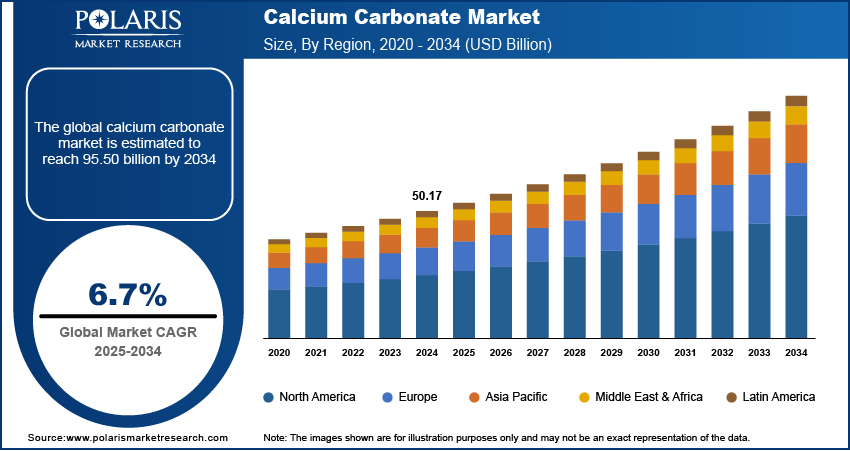

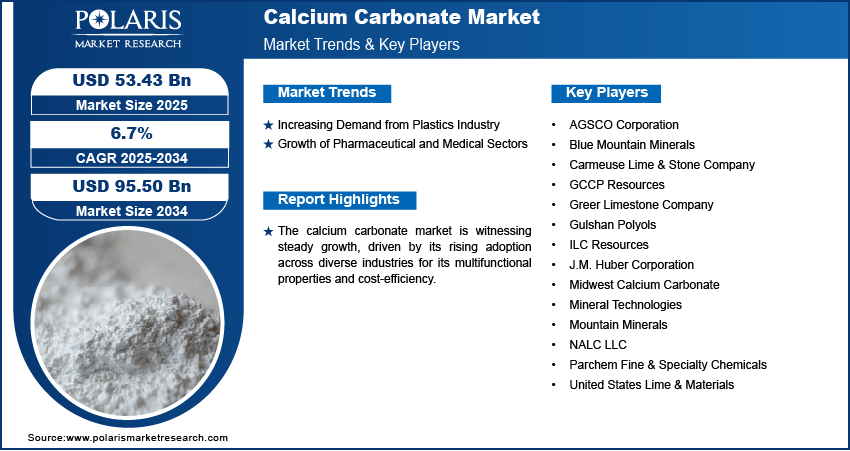

The global calcium carbonate market size was valued at USD 50.17 billion in 2024, growing at a CAGR of 6.7% during 2025–2034. Expanding construction activities, rising urbanization, and the desirable properties of calcium carbonate are the key factors driving market growth.

Key Insights

- The paper segment led the market in 2024. The segment’s dominance is primarily attributed to the crucial role of calcium carbonate as a coating agent and filler in paper production.

- The precipitated calcium carbonate segment is projected to register the fastest growth, owing to its tailored functionalities and excellent properties.

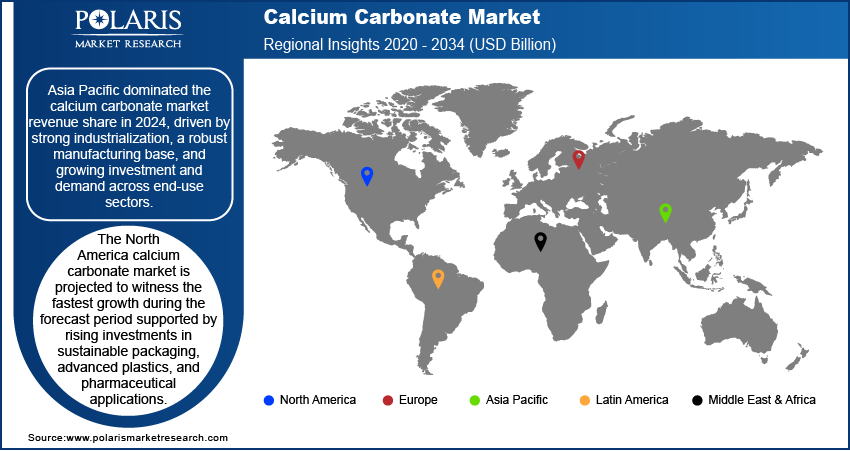

- Asia Pacific accounted for the largest market share in 2024. Rapid industrialization and the presence of a robust manufacturing base drive the region’s leading market share.

- North America is projected to register the fastest growth during the projection period, owing to growing investments in pharmaceuticals and sustainable packaging.

Industry Dynamics

- The ability of calcium carbonate to improve the processing efficiency and mechanical properties of plastic products is fueling its increased adoption in the plastics industry, driving market growth.

- The well-established role of calcium carbonate in the medical and pharmaceutical sectors is another factor contributing to market expansion.

- The shift towards sustainable and eco-friendly packaging options is anticipated to provide several market opportunities.

- Increasing cost due to high transportation charges may hinder market growth.

Market Statistics

2024 Market Size: USD 50.17 billion

2034 Projected Market Size: USD 95.50 billion

CAGR (2025-2034): 6.7%

Asia Pacific: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

Calcium carbonate, a naturally occurring compound composed of calcium, carbon, and oxygen, is widely used as a functional additive across multiple industries due to its versatile chemical and physical properties. The calcium carbonate demand is on the rise due to the expansion of construction activities across both developed and emerging economies. According to a joint April 2025 report from the US Census Bureau and the Department of Housing and Urban Development, in March 2025, 1.549 million new residential housing units were completed. In the construction sector, calcium carbonate is extensively utilized as a major ingredient in cement, concrete, and building materials, offering durability, strength, and improved surface finish.

The ongoing demand for infrastructure development, urbanization, and residential and commercial construction continues to increase the consumption of calcium carbonate. Additionally, its cost-effectiveness and compatibility with various construction composites make it a material of choice for manufacturers seeking both quality and economic efficiency.

The use of calcium carbonate is increasing due to the steady expansion of the paper industry. Calcium carbonate serves as a critical filler and high performance pigment in paper manufacturing, enhancing paper brightness, opacity, and surface smoothness while also reducing production costs. The global demand for high-quality paper products, such as flexible packaging, printing paper, and cleaning & hygiene products, continues to rise, and the need for effective and economical raw materials such as calcium carbonate grows accordingly. As per the CAPEXIL's April 2025 report, India reported 12.5% year-on-year growth in paper production (i.e., 604,300 tons) in January 2023. Cumulative output for April 2022–January 2023 reached 5.55 million tons, marking a 6.7% increase compared to the same period in the previous year.

Calcium carbonate contributes to improved printing performance and sustainability in paper production, aligning with industry trends focused on resource efficiency and environmental considerations. Together, these industry demands highlight calcium carbonate’s strong market outlook and reinforce its indispensable role in modern manufacturing processes.

Market Dynamics

Increasing Demand from Plastics Industry

The increasing demand from the plastics industry is driving the calcium carbonate market growth due to the compound's ability to enhance the mechanical properties and processing efficiency of plastic products. When used as a filler in thermoplastics such as polyethylene, polypropylene, and polyvinyl chloride (PVC), calcium carbonate improves rigidity, dimensional stability, and impact resistance while also reducing overall production costs. Its fine particle size and compatibility with polymer matrices make it particularly suitable for a range of applications, such as packaging, automotive components, and consumer goods. In April 2025, USC biomedical engineers developed a marine-safe plastic alternative by blending calcium carbonate from seashells with FDA-approved biodegradable polymer POC. The material aims to reduce microplastic pollution while maintaining biocompatibility, leveraging the researcher’s expertise in biomaterials. This innovation aligns with growing environmental concerns, as plastic waste remains a critical issue. According to a May 2022 Ocean Literacy report, plastics constitute approximately 80% of marine pollution, with an estimated 8 to 10 million metric tons entering the world's oceans annually. The incorporation of calcium carbonate in plastic formulations has become a strategic choice as manufacturers increasingly prioritize cost-effective solutions without compromising product performance, thereby reinforcing its growing significance within the sector.

Growth of Pharmaceutical and Medical Sectors

The growth of the pharmaceutical and medical sectors drives the demand for calcium carbonate, owing to its well-established role as an active pharmaceutical ingredient and excipient. According to a December 2024 report by the Ministry of Chemicals and Fertilizers, India's pharmaceutical market reached USD 50 billion in FY 2023-24. Domestic consumption accounted for USD 23.5 billion, while exports contributed USD 26.5 billion, reflecting the sector's significant domestic and international growth. In the pharmaceutical industry, calcium carbonate is widely utilized in the formulation of antacids, calcium supplements, and tablets due to its high calcium content and biocompatibility. It also functions as a stabilizer and bulking agent, supporting controlled drug delivery and uniform dosage. In the medical field, calcium carbonate finds applications in oral care products and certain medical devices, where safety, purity, and regulatory compliance are essential. This rising demand, aligned with advancements in healthcare and an aging global population, positions calcium carbonate as a vital component in the development and delivery of medical and therapeutic products.

Segment Insights

Market Assessment by Application

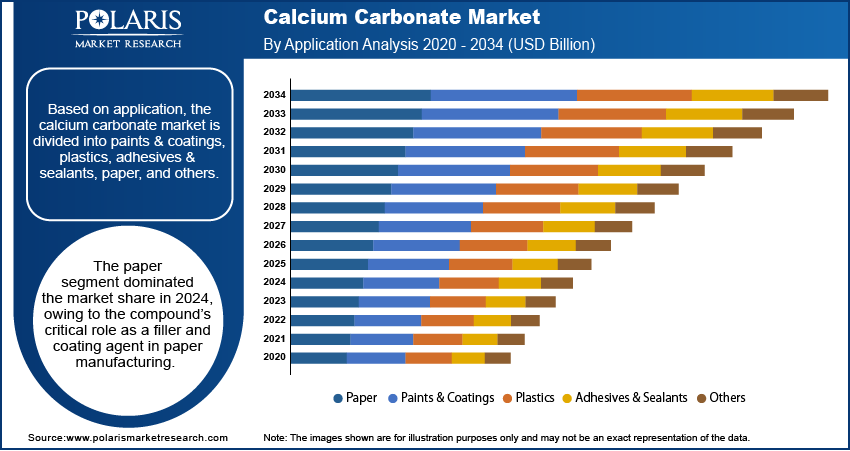

The global market segmentation, based on application, includes paints & coatings, plastics, adhesives & sealants, paper, and others. The paper segment dominated the calcium carbonate market share in 2024 owing to the compound’s critical role as a filler and coating agent in paper manufacturing. Calcium carbonate enhances paper brightness, opacity, and smoothness while also offering cost advantages by partially replacing expensive pulp content. Its widespread usage in producing printing, writing, and packaging papers makes it indispensable to the industry. The ongoing demand for high-quality and lightweight paper products, especially in the packaging sector, further strengthens this segment's leadership. Additionally, its contribution to improved printability and reduced ink absorption reinforces calcium carbonate’s relevance in modern paper production processes.

Market Evaluation by Product Type

The global market segmentation, based on product type, includes ground calcium carbonate and precipitated calcium carbonate. The precipitated calcium carbonate segment is expected to witness the fastest growth during the forecast period due to its superior properties and tailored functionalities. Unlike ground calcium carbonate, precipitated calcium carbonate (PCC) is synthetically processed, allowing for control over particle size, shape, and purity. Making it especially valuable in high-end applications such as pharmaceuticals, plastics, and specialty papers. PCC offers enhanced brightness, dispersion, and surface area, which contribute to improved product performance across diverse industries. Its adaptability to specific end-use requirements and value-added characteristics positions it as a preferred choice, driving its accelerated adoption and market expansion.

Regional Analysis

By region, the report provides the calcium carbonate market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the calcium carbonate market revenue share in 2024, driven by strong industrialization, a robust manufacturing base, and growing investments and demand across end-use sectors. In April 2023, Omya invested in seven calcium carbonate plants, six in China and one in Indonesia, boosting capacity by 1 million tonnes annually for paper and board manufacturers. The region's expanding construction, paper, plastic, and automotive industries create sustained demand for calcium carbonate as a key raw material. In addition, the presence of large limestone reserves, cost-effective labor, and favorable government policies support large-scale production and consumption. Countries such as China and India continue to lead in consumption and export, reinforcing Asia Pacific’s strategic position as the central hub of calcium carbonate demand and production.

The North America market is projected to witness the fastest growth during the forecast period supported by rising investments in sustainable packaging, advanced plastics, and pharmaceutical applications. The region’s focus on innovation and adoption of high-performance materials has increased the demand for both ground and precipitated calcium carbonate. In April 2022, Imerys expanded its production capacity of calcium carbonate at the Sylacauga plant in North America. This investment is a part of the company's three-year plan to support the increasing need and demand for ground calcium carbonate products, and the investment is mainly designed to expand the manufacturing capacity and enhance the current operational reliability. Moreover, increased infrastructure development and the resurgence of domestic manufacturing have contributed to heightened consumption across the construction and industrial sectors. The shift toward eco-friendly and efficient materials also supports the adoption of calcium carbonate, particularly as industries seek alternatives that align with regulatory and environmental standards.

Key Players and Competitive Analysis Report

The global calcium carbonate market landscape exhibits increasing consolidation among top-tier players such as Omya AG, Imerys, and Mississippi Lime Company, who collectively command market share through robust regional footprints and vertical integration strategies. Industry analysis indicates precipitated calcium carbonate (PCC) continues outpacing ground calcium carbonate (GCC) in revenue growth, driven by technological advancement in ultra-fine particle processing and surface treatment capabilities. Asia Pacific maintains its position as the dominant consumption hub, with particular expansion opportunities emerging in India and Southeast Asian countries where infrastructure development is accelerating. Paper and packaging applications remain the primary revenue driver, though construction and plastic segments demonstrate the strongest growth trajectories. Economic and geopolitical shifts, particularly carbon neutrality initiatives and logistics disruptions, are reshaping competitive positioning among suppliers. Small and medium-sized businesses increasingly focus on specialized grade development to capture premium pricing opportunities. Sustainability strategy and transformation have become a critical competitive differentiator, with firms investing in carbon capture technologies and developing circular economy approaches. A few key major players are Blue Mountain Minerals, GCCP Resources, Greer Limestone Company, ILC Resources, J.M. Huber Corporation, Midwest Calcium Carbonate, Mineral Technologies, Mountain Minerals, Parchem Fine & Specialty Chemicals, United States Lime & Materials, NALC LLC, Gulshan Polyols, AGSCO Corporation, and Carmeuse Lime & Stone Company.

Blue Mountain Minerals, headquartered in Columbia, California, is a long-established company specializing in the mining and processing of limestone and dolomitic limestone. The company is a leading supplier of finely ground limestone (calcium carbonate) and dolomitic limestone (calcium magnesium carbonate) for a diverse range of agricultural, industrial, and environmental applications across Northern and Central California. Blue Mountain Mineral's calcium carbonate products play a crucial role in improving soil health for agriculture by raising soil pH, enhancing water penetration, and supplying essential calcium for crop and livestock nutrition, benefiting the state’s vast agricultural sector that produces hundreds of crops and a significant share of the world’s almonds. The company’s products are also integral to the manufacture of glass, animal feed, and construction materials and serve as reagents for neutralizing acid emissions in energy production. Blue Mountain Minerals distinguishes itself through its commitment to sustainability, employing water recycling in its operations, and avoiding calcination processes that generate greenhouse gases.

J.M. Huber Corporation is a family-owned American company with a diverse portfolio across engineered materials, natural resources, and specialty chemicals. Through its division Huber Engineered Materials (HEM), the company specializes in the production of high-purity calcium carbonate products, serving a wide range of industries such as health and nutrition, pharmaceuticals, food, construction, and industrial applications. Huber’s flagship calcium carbonate product, HuberCal, is manufactured from natural limestone sources and is available in both powder and granulated forms, making it suitable for dietary supplementation, food fortification, antacids, and various pharmaceutical uses. The company operates state-of-the-art, ISO-certified facilities in Quincy, Illinois, and Modesto, California, ensuring rigorous quality control and adherence to cGMP guidelines throughout the production process. HuberCal calcium carbonate is recognized for its purity, consistency, and versatility, offering formulators an economical alternative to precipitated calcium carbonate without compromising on quality. Huber’s ongoing investments in capacity expansion and technology, such as the recent increase in granulation capabilities at its Quincy site, reflect its commitment to meeting the growing global demand for calcium carbonate in health and nutrition markets.

List of Key Companies

- AGSCO Corporation

- Blue Mountain Minerals

- Carmeuse Lime & Stone Company

- GCCP Resources

- Greer Limestone Company

- Gulshan Polyols

- ILC Resources

- J.M. Huber Corporation

- Midwest Calcium Carbonate

- Mineral Technologies

- Mountain Minerals

- NALC LLC

- Parchem Fine & Specialty Chemicals

- United States Lime & Materials

Calcium Carbonate Industry Developments

September 2025: Carmeuse Group announced the successful acquisition of a controlling interest in Cementos Bío Bío S.A. The company stated that the acquisition will significantly enhance its footprint in the lime and cement industry.

October 2024: Taiheiyo Cement Corporation advanced calcium carbonate concrete technology, utilizing CO2, water, and waste concrete. Developed with the University of Tokyo under NEDO's Moonshot Program, it aims for practical use in construction and civil engineering structures.

January 2024: TBM and Greenore collaborated to develop low-carbon "next-gen LIMEX" using CCU calcium carbonate derived from recycled CO2. The alliance combines TBM’s calcium carbonate material tech with Greenore’s carbon capture to promote carbon-negative products for sustainable applications.

September 2022, Omya and IFG collaborated to develop calcium carbonate-enhanced Omyafiber. Their joint R&D at IFG’s Linz facility focused on testing polypropylene (PP) and polylactic acid (PLA) fibers to expand nonwoven applications and optimize performance for industry adoption.

Calcium Carbonate Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Ground Calcium Carbonate

- Precipitated Calcium Carbonate

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Paper

- Paints & Coatings

- Plastics

- Adhesives & Sealants

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Calcium Carbonate Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 50.17 billion |

|

Market Size Value in 2025 |

USD 53.43 billion |

|

Revenue Forecast by 2034 |

USD 95.50 billion |

|

CAGR |

6.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 50.17 billion in 2024 and is projected to grow to USD 95.50 billion by 2034.

The global market is projected to register a CAGR of 6.7% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Blue Mountain Minerals, GCCP Resources, Greer Limestone Company, ILC Resources, J.M. Huber Corporation, Midwest Calcium Carbonate, Mineral Technologies, Mountain Minerals, Parchem Fine & Specialty Chemicals, United States Lime & Materials, NALC LLC, Gulshan Polyols, AGSCO Corporation, and Carmeuse Lime & Stone Company.

The paper segment dominated the market share in 2024.

The precipitated calcium carbonate segment is expected to witness the fastest growth during the forecast period.