Calcium Sulfate Market Size, Share, & Industry Analysis Report

: By Product Type (Gypsum and Anhydrite), By Grade, By End-Use Industries, and By Region, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5941

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

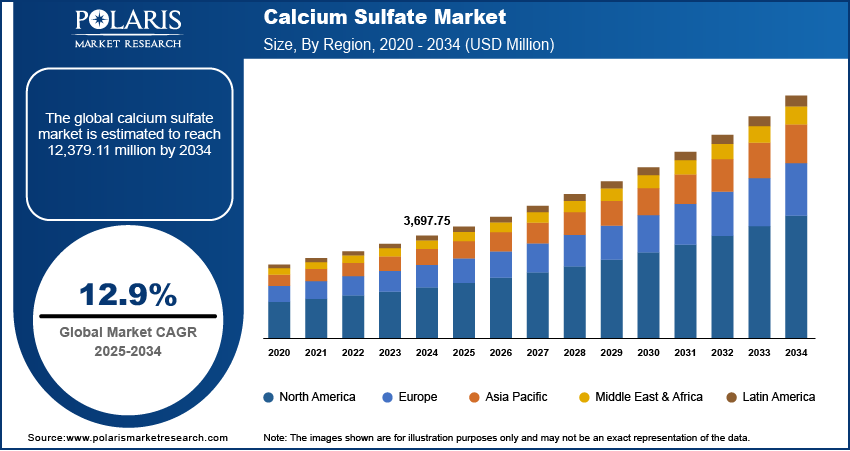

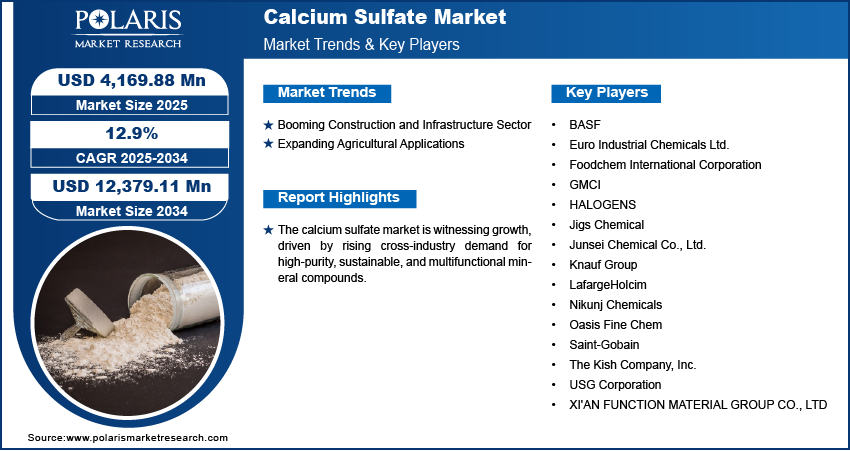

The global calcium sulfate market size was valued at USD 3,697.75 million in 2024, growing at a CAGR of 12.9% during 2025–2034. Growth is fueled by industrial byproduct recycling mandates and sustainable material requirements.

Calcium sulfate, an inorganic compound commonly found in its dehydrate form as gypsum, has a vital role across a range of industrial and consumer applications due to its chemical stability and nontoxic nature. The rising demand in the food and pharmaceutical industries is boosting the growth of calcium sulfate. According to a December 2024 report from IFPMA, the global pharmaceutical industry contributed a total of USD 2.295 trillion to global GDP in 2022. In May 2025, FAO reported that its food price index averaged 128.3 points in April 2025, marking a 1% increase. This reflects a slight rise in global food and pharmaceutical growth. In the food industry, it is extensively used as a firming agent, dough conditioner, and dietary supplement, particularly in baked goods and canned vegetables. Its ability to regulate acidity and improve texture in food products makes it highly desirable among manufacturers seeking to improve quality while meeting regulatory compliance. The growing preference for safe food additives and the expansion of processed food production globally are reinforcing its demand.

To Understand More About this Research: Request a Free Sample Report

The increasing availability of both natural and synthetic sulfate sources further drives market growth. According to a 2024 report from Mineral Commodity Summaries, in 2023, synthetic gypsum production reached ∼15 million tons, representing roughly one-third (33%) of the total US gypsum supply. Gypsum-based natural deposits and chemically synthesized variants assure a steady and scalable supply chain, allowing manufacturers to meet growing industrial demand with flexibility and consistency. The dual sourcing strategy improves supply reliability while allowing for tailored purity levels and physical properties suited to specific applications. This trend supports downstream industries by minimizing supply risks and stabilizing production costs. The balanced availability from natural and synthetic sources emerges as a driver of sustained market growth as industries seek dependable raw material inputs to maintain product quality and operational efficiency.

Industry Dynamics

Booming Construction and Infrastructure Sector

Calcium sulfate plays an integral role in modern building materials. According to a June 2024 RICS report quoting Oxford Economics, global construction output is projected to grow by USD 4.2 trillion over the next 15 years, reflecting steady expansion in worldwide building activity. Calcium sulfate, especially in its hemihydrate form (commonly referred to as plaster of Paris), is widely utilized in drywall, flooring compounds, and decorative plasters. Its excellent fire resistance, workability, and setting time make it a preferred choice for architectural applications and large-scale infrastructure projects. The construction industry increasingly turns to calcium sulfate for both structural and aesthetic purposes as urbanization accelerates and the demand for sustainable and cost-effective building materials grows. Therefore, the booming construction and infrastructure sector is driving the demand for calcium sulfate.

Expanding Agricultural Applications

Expanding agricultural applications boost the demand for calcium sulfate, especially as a soil conditioner and source of essential nutrients such as calcium and sulfur. Its application improves soil structure, reduces compaction, improves water infiltration, and supports root development, making it valuable for sustainable farming practices. Unlike other modifications, this does not alter soil pH, allowing precise nutrient management in diverse soil types. A March 2025 SMS Foundation report highlighted severe soil salinity in Haryana's Kheda Khalilpur village due to industrial water pollution, affecting 4,000 acres. A 2023 initiative promoted the use of gypsum, which reduced salinity and lowered farming costs by USD 18 to USD 24 per acre. The agricultural sector continues to adopt calcium sulfate as a reliable input for improved productivity and environmental stewardship with increasing focus on improving crop yield and soil health amid rising global food demand.

Segmental Insights

By Product Type Analysis

The global calcium sulfate market segmentation, based on product type, includes gypsum (natural and synthetic) and anhydrite (natural and synthetic). The gypsum segment is expected to witness the fastest growth during the forecast period, owing to its broad application base and increasing demand across multiple industries. Gypsum, the dehydrate form of calcium sulfate, is a major component in construction materials such as drywall, plasters, and cement board, offering advantages such as ease of application and fire resistance. Its utility in agriculture as a soil amendment and in the medical sector for orthopedic casts further improves its growth potential. The ongoing shift toward lightweight and energy-efficient building materials and sustainable farming inputs continues to drive the uptake of gypsum board globally.

By Application Analysis

The global segmentation, based on type, includes food, technical, and pharmaceutical. The food segment is expected to witness substantial growth during the forecast period due to the rising demand for food-grade calcium sulfate as a safe and multifunctional additive. It is commonly used as a firming agent, dough conditioner, and calcium supplement in various food products, such as bakery items, canned vegetables, and tofu. The shift toward clean-label and nutritionally improved food products supports its growing adoption. Additionally, regulatory approvals across global markets for its use in food processing provide a strong foundation for consistent demand from food manufacturers.

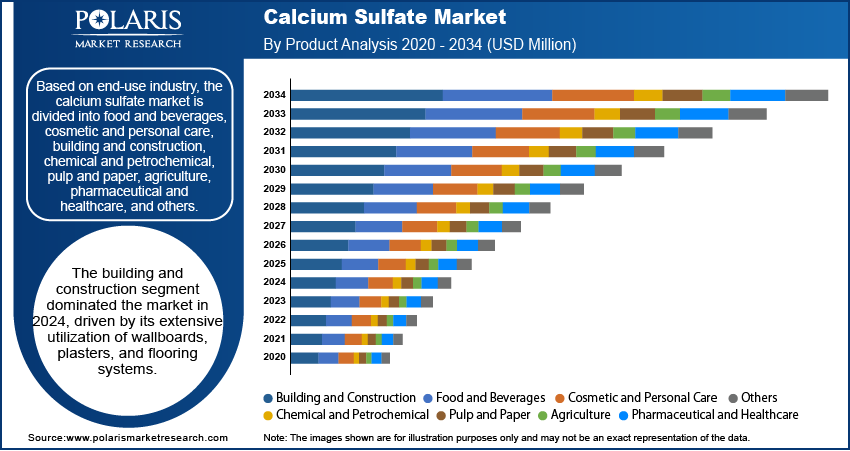

By End-Use Industry Analysis

The global segmentation, based on end-use industry, includes food and beverages, cosmetic and personal care, building and construction, chemical and petrochemical, pulp and paper, agriculture, pharmaceutical and healthcare, and others. The building and construction segment dominated the market in 2024, driven by its extensive utilization of wallboards, plasters, and flooring systems. The material’s fire-resistant, insulating, and aesthetic properties make it essential in both residential and commercial construction. Particularly in developing economies, the demand for durable and cost-effective building materials remains high as infrastructure development and urbanization continue to accelerate globally. Calcium sulfate’s compatibility with modern green building standards also contributed to its dominance in the construction sector in 2024.

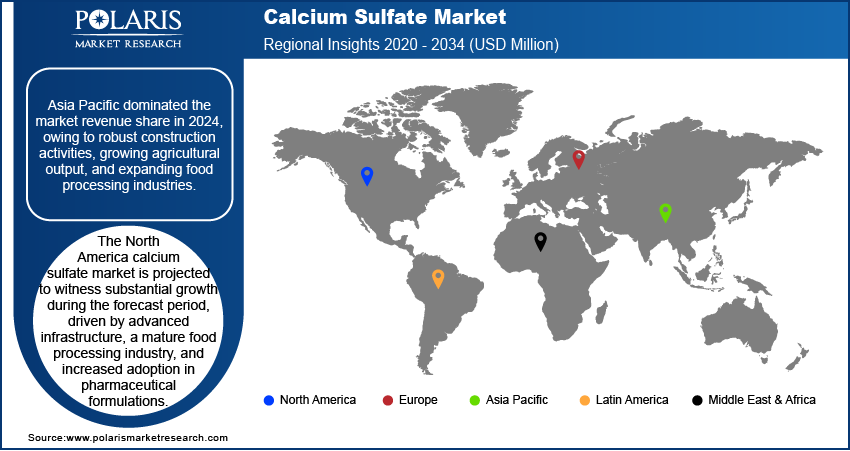

Regional Analysis

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the market revenue share in 2024, attributed to robust construction activities, growing agricultural output, and expanding food processing industries. The region’s strong demand for gypsum-based products in housing and infrastructure projects, especially in countries such as China and India, greatly fueled market growth. Furthermore, agricultural economies such as Vietnam and Indonesia are increasingly adopting calcium sulfate for soil treatment and crop enhancement. For instance, an April 2025 Vietnam government report revealed the country's fertilizer use averages three times the global rate, driven by staple crops such as rice, coffee, and fruits. The market consists of 75% chemical and 25% organic fertilizers. These countries contribute to the region's dynamic demand profile and drive the Asia Pacific calcium sulfate market.

The North America calcium sulfate market is projected to witness substantial growth during the forecast period, driven by advanced infrastructure, a mature food processing industry, and increased adoption in pharmaceutical formulations. The region’s focus on environmentally friendly construction materials and precision agriculture further accelerates the use of calcium sulfate across sectors. For instance, a December 2024 USDA report found that the adoption of precision agriculture is rising, with auto steering systems used by 52% of midsize and 70% of large US farms in 2023. These technologies enable more efficient applications such as calcium sulfate in soil management. Regulatory support and high product standards encourage steady demand. The US, Canada, and Mexico are among the major contributing countries, with the US calcium sulfate market leading in construction innovation and agro-tech applications.

The Europe calcium sulfate market is projected to witness significant growth during the forecast period, supported by its commitment to sustainable construction practices and clean-label food additives. Strict environmental regulations have encouraged the use of eco-friendly materials like gypsum in renovation and energy-efficient building projects. Additionally, the food and pharmaceutical industries in the region are adopting high-purity calcium sulfate for specialized applications. Major contributors are Germany, France, Italy, and the UK, where strong industrial frameworks and advanced regulatory environments are enabling consistent market development.

Key Players & Competitive Analysis Report

The market is witnessing competition driven by emerging markets, technological advancements, and sustainable value chains. Major players are leveraging strategic investments to capitalize on revenue opportunities, particularly in Asia Pacific, where robust construction and agricultural sectors fuel demand. Developed markets such as North America remain strong due to advanced infrastructure and pharmaceutical applications. Disruptions and trends, such as precision agriculture and eco-friendly manufacturing, are reshaping industry ecosystems, while economic and geopolitical shifts influence supply chains. Competitive intelligence highlights a focus on expansion opportunities, with companies exploring latent demand in untapped regions. Vendor strategies highlight product offerings and regional footprint optimization, while small and medium-sized businesses adopt innovative applications to stay relevant. Expert insights suggest long-term growth hinges on sustainability strategies and supply chain resilience, positioning calcium sulfate as a critical material across multiple sectors. A few key players are BASF; Euro Industrial Chemicals Ltd.; Foodchem International Corporation; GMCI; HALOGENS; Jigs Chemical; Junsei Chemical Co., Ltd.; Knauf Group; LafargeHolcim; Nikunj Chemicals; Oasis Fine Chem; Saint-Gobain; The Kish Company, Inc.; USG Corporation; and XI'AN FUNCTION MATERIAL GROUP CO., LTD.

GMCI (Global Minerals & Chemicals India), established in 2019 and headquartered in Ahmedabad, Gujarat, India, is a manufacturer and supplier of industrial minerals, including calcium sulfate. The company offers calcium sulfate in various forms, such as powder and granules, serving diverse needs with flexible packaging options. GMCI’s calcium sulfate is widely used across sectors such as agriculture, pharmaceuticals, construction, ceramics, and food processing due to its high purity and consistent quality. The company highlights sustainable manufacturing processes, assuring products are free from adulterants and impurities, which improves their performance in applications requiring heat resistance, tensile strength, and chemical stability. In the pharmaceutical sector, GMCI supplies calcium sulfate as a raw material for producing regulated products, sticking to strict hygiene and quality standards under ISO 9001 certification. The company’s minerals play crucial roles in improving soil quality in agriculture, acting as additives in construction materials, and serving as coagulants or fillers in food and industrial applications.

BASF SE, a global chemical company headquartered in Ludwigshafen, Germany, is also active in the field of calcium sulfate, offering advanced solutions that support various industrial applications. While BASF is widely recognized for its broad portfolio of inorganic chemicals, such as salts and catalysts, it also develops products related to calcium sulfate, particularly in the construction and chemical processing sectors. BASF’s expertise in chemical synthesis and formulation allows it to produce high-quality calcium sulfate-based additives and accelerators, such as R+D HyCon GYP 1789 L, which is used to accelerate the hydration reaction of gypsum in construction applications. This improves the performance and setting times of gypsum-based materials, making BASF a preferred supplier for the building industry. Beyond construction, BASF’s calcium sulfate products contribute to sectors such as agriculture, pharmaceuticals, and food processing by operating as raw materials or functional additives.

Key Players

- BASF

- Euro Industrial Chemicals Ltd.

- Foodchem International Corporation

- GMCI

- HALOGENS

- Jigs Chemical

- Junsei Chemical Co., Ltd.

- Knauf Group

- LafargeHolcim

- Nikunj Chemicals

- Oasis Fine Chem

- Saint-Gobain

- The Kish Company, Inc.

- USG Corporation

- XI'AN FUNCTION MATERIAL GROUP CO., LTD

Industry Developments

April 2025: SUL4R-PLUS inaugurated a new calcium sulphate fertilizer plant in Marissa, Illinois. The facility features a production capacity of 100,000 tons per year, establishing it as a key regional supplier. The expansion targets rising demand for premium calcium sulphate fertilizers, prized for enhancing soil structure and supplying vital nutrients to crops.

April 2025: CropLife announced that its new SUL4R-PLUS fertilizer plant opened in Marissa, IL, is repurposing an old concrete site. The facility will supply local farmers with granular sulfur-calcium fertilizer to enhance crop productivity, as stated by CEO Terry Gill.

October 2023: Saint-Gobain expanded its African operations by acquiring Global Gypsum Company, a leading Sub-Saharan gypsum wallboard producer.

Calcium Sulfate Market Segmentation

By Product Type Outlook (Volume, Kilotons; Revenue, USD Million, 2020–2034)

- Gypsum (Natural and Synthetic)

- Anhydrite (Natural and Synthetic)

By Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2020–2034)

- Technical Grade

- Food Grade

- Pharma Grade

- Others

By End-Use Industry Outlook (Volume, Kilotons; Revenue, USD Million, 2020–2034)

- Food and Beverages

- Cosmetic and Personal Care

- Building and Construction

- Chemical and Petrochemical

- Pulp and Paper

- Agriculture

- Pharmaceutical and Healthcare

- Others

By Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Calcium Sulfate Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3,697.75 million |

|

Market Size Value in 2025 |

USD 4,169.88 million |

|

Revenue Forecast by 2034 |

USD 12,379.11 million |

|

CAGR |

12.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume, Kilotons; Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3,697.75 million in 2024 and is projected to grow to USD 12,379.11 million by 2034.

The global market is projected to register a CAGR of 12.9% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are BASF; Euro Industrial Chemicals Ltd.; Foodchem International Corporation; GMCI; HALOGENS; Jigs Chemical; Junsei Chemical Co., Ltd.; Knauf Group; LafargeHolcim; Nikunj Chemicals; Oasis Fine Chem; Saint-Gobain; The Kish Company, Inc.; USG Corporation; and XI'AN FUNCTION MATERIAL GROUP CO., LTD.

The building and construction segment dominated the market in 2024.

The gypsum segment is expected to witness the fastest growth during the forecast period.