Gypsum Board Market Share, Size, Trends, Industry Analysis Report

By Product (Wallboard, Ceiling Board, Pre-decorated Board, Others); By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Sep-2022

- Pages: 114

- Format: PDF

- Report ID: PM1272

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

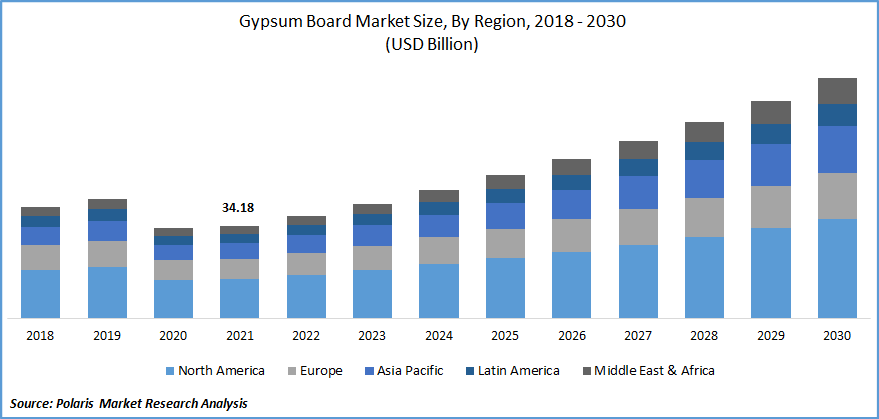

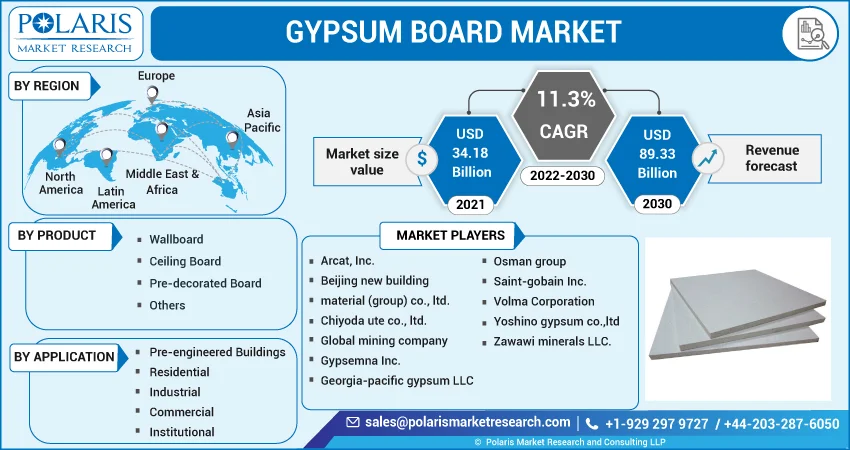

The global gypsum board market was valued at USD 34.18 billion in 2021 and is expected to grow at a CAGR of 11.3% during the forecast period. The key factor which is boosting the market growth is the country's expanding single-family and multi-family housing demand. Due to the manufacturer's capacity to offer cutting-edge patterns and textures on its surfaces, the tendency of making aesthetic changes to building structures is on the rise, which is predicted to rise the product's absorption in high-end building applications.

The Gypsum Board Market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Know more about this report: Request for sample pages

One of the most popular gypsum materials utilized worldwide is the gypsum board. These boards come in a variety of varieties, including standard product, humidity resistance board, fire proof board, transportable board, and others. The product is a variety that is used the most across the globe.

The products are a type of lightweight building material that is frequently used inside or outside of residential or non-residential buildings for barriers, walls, and ceilings. They could be directly affixed to wood and metal frames or pre-existing surfaces utilizing bolts, nails, or adhesives and are frequently referred to as drywall, plasterboard, or chipboard.

Gypsum boards differ from plywood, hardboard, and chipboard in that they have a non-combustible core and offer sound control, variety, quality, and simplicity. As a result, they are widely used and act as a quick substitute for the old-fashioned lath and plaster.

One of the primary sectors suffering the most losses as a result of the worldwide pandemic COVID-19 is the gypsum board industry. Due to COVID-19, the use of the product as interior wall and ceiling covering materials in commercial and residential buildings has been severely disrupted.

In a few damp places, such as basement walls, bathrooms, kitchens, laundry rooms, and restrooms, the product is also used as a tile backer. The suspension of international travel, lockdown laws, and safety requirements in many developing nations have delayed construction projects and altered the future of the businesses. Covid 19 has generally harmed the gypsum board market.

Due to labor and raw material shortages brought on by the SARS-CoV-2 pandemic, the product costs have increased globally. However, even during the pandemic period, several industrial actors proposed the creation of specialist infrastructure. One such example is Saint Gobain India, which in August 2020 built a new 600-bed hospital in just 17 days to treat coronavirus patients. The company used specialist gypsum plasterboard-based drywall made from gypsum rock mined naturally.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The product is widely utilized in the architecture and construction sector for a wide range of applications, including ornamentation, ceiling designs, dividing walls, acoustic insulation, and many more. These boards' adaptability and ease of use make them ideal for a wide range of applications in the building and construction sector. One of the main factors contributing to the product's increased global adoption is its minimal weight. The use of this board also results in a sizable cost reduction and further savings for the user.

Additionally, the consumer has the freedom and flexibility to select the design based on its intended use and level of comfort. Customers can also modify designs because major players offer this option along with several pre-sample designs. Players also offer online visualization tools to customers to make the design selection process easier and more enjoyable.

Report Segmentation

The market is primarily segmented based on product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

Residential market segment is expected to witness fastest growth

The growing urban population and rising demand for visually pleasing building materials are projected to assist the segment's expansion. For instance, according to the United Nations, from 751 million in 1950 to 4.2 billion in 2018, the global urban population has dramatically increased. By 2050, it is anticipated that 68 percent of the global population would be urban residents.

Additionally, a growing number of construction projects in important economies like China, India, Brazil, Russia, and the US is projected to boost product demand in this market. Globally expanding commercial construction projects are increasing demand for building supplies with low environmental effects, which is bolstering market expansion.

Gypsum is frequently utilized in external wall and roofing applications in pre-engineered buildings (PEBs). It is frequently used in industrial structures because it makes it simple to install windows and doors and still offers security. Pre-engineered structures are extremely affordable and portable.

Furthermore, PEBs are favored over more traditional options like steel because of the design versatility and simple manufacture they provide. The most popular product used in institutional settings is laminated wallboards, which have the base layer glued to the base layer and the second finished layer stapled to the wall. As more K-12, school construction projects are underway, institutional construction activities are anticipated to rise quickly over the coming years.

Wallboards market segment accounted for the highest gypsum board market share in 2021

Wallboards have been the most popular product category as a result of their widespread acceptance as an alternative to plaster. During the anticipated years, rising demand for environmentally friendly construction is anticipated to drive product demand. Additionally, the product's continued innovation is projected to improve its uptake in high-end construction applications. These boards are commonly used in commercial applications because they offer optimal surface durability and color preservation while allowing flexibility for changing workspace configurations.

Due to their capacity to improve the architectural design and aesthetics of building structures, other gypsum-based goods like sheathing, plaster base, and lath are becoming more popular on the market. Plaster-based panels have a unique gypsum core and a multi-layered laminated face paper that provides a strong plaster bond, resistance to sagging, quick installation, and control over water absorption.

Ceiling board market segment Industry is expected to hold the significant revenue share

Ceiling board is increasingly taking the place of other traditional materials like plaster in interior walls and ceilings. These ceiling boards offer excellent stiffness and core strength while enhancing thermal and sound insulation in buildings at a relatively cheaper cost. The need for ceiling boards is projected to rise as commercial development projects spread over the globe expand in number.

The market demand in North America is expected to witness significant growth

The market is anticipated to grow as a result of the region's recovering construction sector. The market in North America is still developing, however, the region's demand is heavily influenced by remodeling and rework projects. Furthermore, because environmental regulations are becoming stricter in the area, major players are eager to cut their overall carbon footprint and switch to more sustainable practices.

The Asia Pacific market is anticipated to benefit from lucrative growth prospects provided by emerging economies. In comparison to other regions of the world, Asia Pacific is experiencing rather strong growth in the construction business. Additionally, the region's commercial investment and activity levels are rising quickly, which is likely to boost market expansion. When it comes to recycling trends, Europe dominates the market. The expansion of recycling activities in the area will be supported by politicians and the region's highly sensitive consumers to the environment.

Collection and recycling rates in European nations for the material are significantly higher than those in emerging economies. The ongoing social and political unrest and economic volatility in these areas limit market expansion. It is projected that favorable government regulations for building projects, rising foreign investment, and public-private partnerships in the main economies will open up new growth opportunities for the industry's players. However, it is anticipated that the increase will be hampered by fluctuating raw material prices and mining regulations in large economies.

Competitive Insight

Some of the major players operating in the global market include Arcat, Inc., Beijing new building material (group) co., ltd., Chiyoda ute co., ltd., Global mining company, Gypsemna Inc., Georgia-pacific gypsum LLC, National gypsum properties LLC, Osman group, Saint-gobain Inc., Volma Corporation, Yoshino gypsum co.,ltd, and Zawawi minerals LLC.

Recent Developments

In March 2021, National Gypsum Company recently introduced a multi-website site that gives an unrivaled customer experience for designers, contractors, interior designers, distributors, property owners, and other tourists. National Gypsum Company is the exclusive services company of dependable, high-performance building items manufactured by its entities and advertised under the Gold Bond, PermaBASE, and ProForm brand names.

In September 2021, Eagle County granted permission for American Gypsum's wallboard factory to expand by 99.2 acres of its 830-acre mine. The business is the sole wallboard production facility in the state of Colorado.

Gypsum Board Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 34.18 billion |

|

Revenue forecast in 2030 |

USD 89.33 billion |

|

CAGR |

11.3% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Arcat, Inc., Beijing new building material (group) co., ltd., Chiyoda ute co., ltd., Global mining company, Gypsemna Inc., Georgia-pacific gypsum LLC, National gypsum properties LLC, Osman group, Saint-gobain Inc., Volma Corporation, Yoshino gypsum co.,ltd, and Zawawi minerals LLC. |

We provide our clients the option to personalize the Gypsum Board Market report to suit their needs. By customizing the report, you can get data as per your format and definition. Also, the customization option allows you to gain a deeper dive into a specific segment, region, customer, or market competitor.

Browse Our Top Selling Reports:

Endometrial Ablation Market Size, Share 2024 Report

Artificial Intelligence (AI) in Diagnostics Market Size, Share 2024 Report

Healthcare Cybersecurity Market Size, Share 2024 Report

Dental Suction Systems Market Size, Share 2024 Report

Infertility Treatment Market Size, Share 2024 Report