Carbon Fiber Reinforced Plastic Market Size, Share, Trends, Industry Analysis Report

By Product (Thermosetting CFRP, Thermoplastic CFRP), By Material, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6419

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

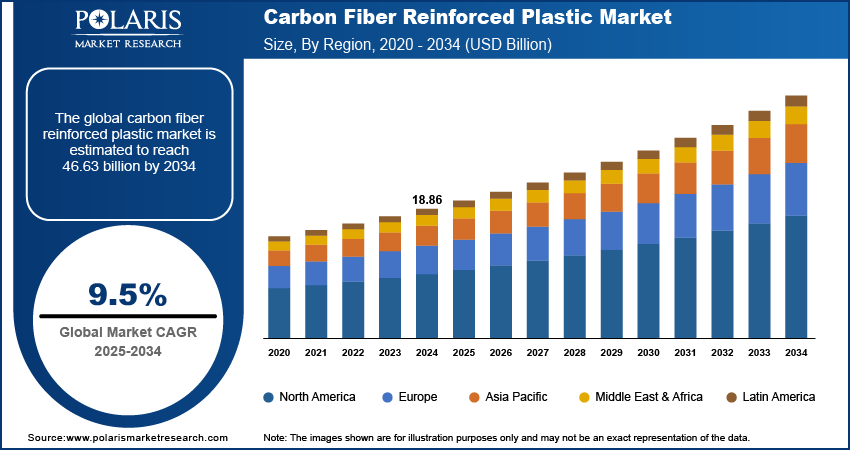

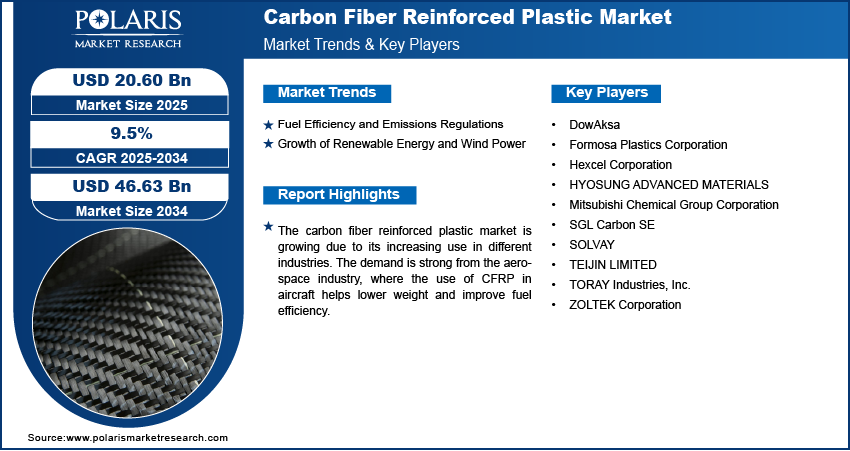

The global carbon fiber reinforced plastic (CFRP) market size was valued at USD 18.86 billion in 2024 and is anticipated to register a CAGR of 9.5% from 2025 to 2034. The demand for lightweight materials in industries such as aerospace and automotive is a key driver for the industry expansion. This is because using CFRP helps improve fuel efficiency and reduce emissions. Also, the growing need for clean energy and sustainable solutions is boosting demand, especially for making longer, more efficient wind turbine blades.

Key Insights:

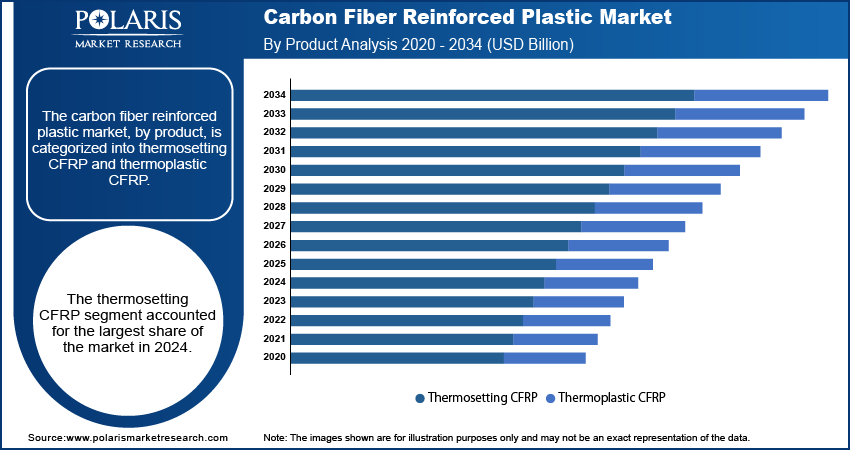

- By product, the thermosetting CFRP segment held the largest share in 2024, as it has a long history of use and proven performance in demanding industries.

- By material, the PAN-based segment dominated in 2024 owing to its widespread use due to its strong tensile properties and cost-effectiveness.

- By application, the aerospace industry led the market in 2024, due to high demand for lightweight and high-strength materials.

- By region, Asia Pacific held the largest revenue share in 2024, driven by rapid industrial growth and a strong manufacturing base.

Industry Dynamics

- The rising need for lightweight materials in the aerospace and automotive industries is a major driver. Carbon fiber reinforced plastic helps reduce the overall weight of vehicles and aircraft, which leads to better fuel efficiency and lower emissions. This is in line with government rules for clean air.

- A growing focus on clean energy solutions is also a significant driver, especially in the wind energy sector. The use of advanced composites in manufacturing longer and more efficient wind turbine blades allows for greater energy capture and a higher power output from each turbine.

- Increasing applications in sports equipment and civil engineering are also boosting demand. These materials are used for their high strength and light weight, which improves performance in products such as bicycles and tennis rackets, as well as for structural reinforcement in bridges and buildings.

Market Statistics

- 2024 Market Size: USD 18.86 billion

- 2034 Projected Market Size: USD 46.63 billion

- CAGR (2025-2034): 9.5%

- Asia Pacific: Largest market in 2024

AI Impact on Carbon Fiber Reinforced Plastic Market

- Artificial intelligence accelerates innovation and reshapes the carbon fiber reinforced plastic (CFRP) market.

- In the market, the technology is used in various applications from materials discovery to manufacturing and sustainability.

- AI tools can iterate rapidly and suggest formulations that match or exceed commercial performance, often with minimal starting data.

- The tools monitor pressure, resin flow, and temperature during curing to reduce defects and ensure uniformity.

Carbon fiber reinforced plastic, or CFRP, is a strong and lightweight composite material made from carbon fibers set in a polymer matrix. This material is valued for its high stiffness and strength, along with its ability to resist corrosion. It is often used as a replacement for traditional materials such as steel and aluminum in different industries where performance and weight are crucial.

A few drivers for the CFRP demand are its growing use in sporting goods and its role in civil engineering. In sports, the material is used to make products such as tennis rackets, hockey sticks, and bicycles. This is because it makes the equipment lighter and stronger, which can help improve an athlete's performance. The growing number of people interested in sports and fitness around the world is boosting the demand for high-performance gear.

The increasing use of CFRP in civil engineering projects, such as strengthening buildings and bridges, is another driver. Its lightweight and high strength make it great for reinforcing structures without adding a lot of extra weight. For example, the CDC has reported that certain types of carbon fiber materials have been used in infrastructure projects to improve a structure's ability to withstand events such as earthquakes. This shows how the material can make buildings safer and more durable.

Drivers and Trends

Fuel Efficiency and Emissions Regulations: The push for better fuel efficiency and reduced greenhouse gas emissions in the transportation sector propels the demand for carbon fiber reinforced plastic (CFRP). As government regulations become stricter, vehicle and aircraft manufacturers are under pressure to produce lighter and more efficient designs. Using CFRP allows for a significant reduction in vehicle weight without compromising safety or performance. This weight saving directly translates to improved fuel economy for traditional vehicles and a greater range for electric vehicles, helping companies meet and even exceed new standards.

In a recent report, the U.S. Environmental Protection Agency (EPA) noted that the average new vehicle's real-world carbon dioxide emissions for year 2023 were the lowest on record. This was a reduction of 18 grams per mile compared to the previous year. This improvement is linked to the increased use of various technologies and materials, including lightweight materials. The use of advanced materials such as CFRP helps manufacturers continue to lower the overall weight of their vehicles and meet new emission targets. Therefore, these ongoing regulations and the industry's need for better efficiency are key factors driving the growth.

Growth of Renewable Energy and Wind Power: The global shift toward renewable energy sources is a major factor driving the demand for carbon fiber reinforced plastic, particularly in the wind energy sector. As countries aim to meet climate goals, there is a big focus on building more wind farms. The effectiveness of wind turbines is directly linked to the size and strength of their blades. Using CFRP makes it possible to manufacture longer, stronger, and more aerodynamic blades. These larger blades can capture more wind energy, making the turbines more efficient and helping to increase the overall power output of a wind farm.

According to the World Meteorological Organization's (WMO) report, "How Climate Insights Drive a More Reliable Renewable Energy Transition" from March 2025, global wind power installed capacity surpassed 1,000 gigawatts in 2023, which was a 13% increase from 2022. This report also states that wind power capacity is expected to reach about 3,000 gigawatts by 2030, which is in line with the goals of the UAE Consensus from COP28. This growing need for more wind power capacity directly leads to a higher demand for the materials used to build wind turbines. This ongoing global expansion of the renewable energy sector, especially wind power, is a significant driver.

Segmental Insights

Product Analysis

Based on product, the segmentation includes thermosetting CFRP and thermoplastic CFRP. The thermosetting CFRP segment held the largest share in 2024. Thermosetting CFRP is known for its high stiffness, strength, and ability to handle extreme temperatures and chemical exposure, making it a reliable choice for structural components. These materials undergo an irreversible chemical reaction during curing, which gives them a stable shape and excellent dimensional stability. This is especially important for critical applications in aircraft parts, satellite components, and military equipment where high performance and reliability are a must. The established manufacturing processes and supply chains for thermosetting composites also contribute to their strong position, as many key end-use industries have long-standing relationships with these materials and a high level of confidence in their use for complex and high-load applications.

The thermoplastic CFRP segment is anticipated to register the highest growth rate during the forecast period. This is because these materials offer unique benefits, such as a faster production cycle and the ability to be re-formed and recycled. Unlike thermosets, thermoplastics can be melted and reshaped, which allows for quicker manufacturing methods such as injection molding and thermoforming. This makes them very appealing to high-volume industries, including the automotive sector, where production speed is key. The ability to be recycled is a major advantage for companies focused on sustainability and meeting environmental regulations. For example, thermoplastics can be reused at the end of a product's life, which reduces waste and lowers the overall environmental impact. This focus on efficiency and sustainability is expected to drive strong growth for this sub-segment in the coming years as industries continue to seek more advanced and eco-friendly material solutions.

Material Analysis

Based on material, the segmentation includes pan-based and pitch-based. The pan-based segment held the largest share in 2024. This is due to its high tensile strength and moderate elastic modulus, which make it well-suited for a wide range of uses, especially in demanding applications. PAN-based carbon fiber is the most common and widely produced type of the material and has been used for decades in industries such as aerospace and defense. Its reliable performance, well-established production methods, and broad application across sectors, including automotive and wind energy, have contributed to its leading position. The widespread adoption of PAN-based carbon fibers in aircraft structures, vehicle parts, and sporting goods contributes significantly to its dominance.

The pitch-based segment is anticipated to register the highest growth rate during the forecast period. Pitch-based carbon fibers are known for their extremely high elastic modulus, or stiffness, as well as excellent thermal and electrical conductivity. This makes them ideal for specialized and high-tech applications, such as thermal management in electronics and high-performance structural components where stiffness is more important than tensile strength. As industries such as aerospace and electronics continue to innovate, the demand for these very specific properties is growing. This, along with ongoing improvements in manufacturing processes to make pitch-based fibers more cost-effective, is driving their strong future growth.

Application Analysis

Based on application, the segmentation includes automotive, aerospace, wind turbines, sport equipment, molding & compounding, construction, pressure vessels, and others. The aerospace segment held the largest share in 2024. This is because the aerospace sector has been a long-time and major user of CFRP, relying on it for its high strength-to-weight ratio. The material allows for significant weight reduction in aircraft, which directly translates to better fuel efficiency and lower operating costs for airlines. It is used in key components such as wings, fuselage sections, tail assemblies, and interior structures of both commercial and military aircraft. The strict safety and performance standards in this sector, combined with the need for materials that can withstand extreme conditions, make CFRP an ideal and well-established choice. The ongoing backlog of orders for new aircraft and the trend of using more aluminum composites and other composites in aircraft design are key factors that help this segment maintain its leading position.

The automotive segment is anticipated to register the highest growth rate during the forecast period. The increasing focus on electric vehicles (EVs) and the need to meet strict emissions and fuel efficiency standards are key drivers for this growth. By using CFRP, car manufacturers can reduce the overall weight of a vehicle, which for EVs, directly helps to extend the battery range. This is a critical factor for consumers. While CFRP has long been used in high-end sports cars and luxury vehicles, advancements in production technologies and cost-effective manufacturing methods are now making it more accessible for mainstream, high-volume production. This shift, combined with the global push for cleaner transportation, is expected to make the automotive sector a major growth engine in the coming years.

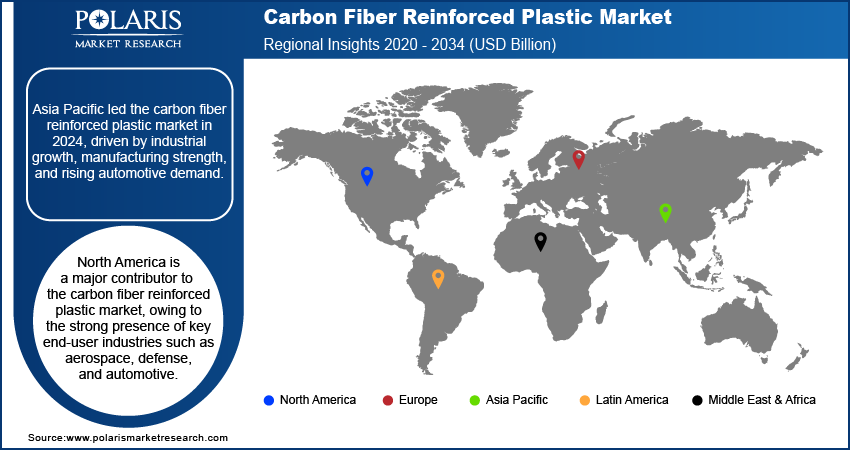

Regional Analysis

The Asia Pacific carbon fiber reinforced plastic market accounted for the largest share in 2024, due to fast industrialization and a growing focus on infrastructure development. The rising demand for passenger vehicles, coupled with government efforts to lower vehicle emissions, is boosting the use of lightweight materials in the automotive sector. The region is also a major player in renewable energy, especially wind power, which uses a lot of composites for manufacturing turbine blades. The presence of major manufacturing countries and a large customer base makes this region a key driver for the global sector.

China Carbon Fiber Reinforced Plastic Market Outlook

China is a leading country in the Asia Pacific market, and its rapid economic and industrial growth makes it a major consumer of CFRP. The country has made big investments in developing its wind energy sector and is a leader in wind turbine production, which requires large amounts of carbon fiber. There is also a major focus on the automotive sector, particularly in the fast-growing electric vehicle sector, where manufacturers are looking for ways to reduce vehicle weight to extend battery range. The ongoing push for domestic manufacturing and a large-scale focus on infrastructure and construction projects are all contributing factors to the high demand for CFRP in the country.

North America Carbon Fiber Reinforced Plastic Market Trends

North America is a major contributor to the global carbon fiber reinforced plastic market. This is mainly because of the strong presence of key end-user industries such as aerospace, defense, and automotive. The region's focus on technological innovation and the development of high-performance materials has boosted the use of CFRP in critical applications. Strict environmental regulations aimed at reducing carbon emissions also drive the adoption of lightweight materials, especially in the automotive sector, as manufacturers work to improve fuel efficiency and increase the range of electric vehicles.

U.S. Carbon Fiber Reinforced Plastic Market Analysis

In North America, the U.S. is a significant region for CFRP. The country has a robust aerospace and defense sector, which is a key consumer of the material for building lighter and more fuel-efficient aircraft. There is also a strong push toward renewable energy, with a growing number of wind energy projects that require large, durable blades made from advanced composites, including automotive composites. The automotive sector in the U.S. is increasingly using CFRP to meet stricter efficiency standards, particularly for electric vehicle battery enclosures, to reduce overall vehicle weight and improve performance.

Europe Carbon Fiber Reinforced Plastic Market Analysis

Europe is a leader in the adoption of advanced materials such as CFRP, largely because of its strong manufacturing base in the automotive, aerospace, and wind energy sectors. The region has a big focus on sustainability and is leading the way in developing closed-loop recycling systems for composites. This is helping to reduce waste and create a more circular economy for these materials. Europe's clear policy and regulatory framework, which promotes lightweighting and sustainable manufacturing, has a positive impact on the industry growth. The region's commitment to clean energy projects further supports the demand for CFRP in making longer and more efficient wind turbine blades.

The Germany carbon fiber reinforced plastic market is a key country in Europe, with a strong manufacturing and engineering background that makes it a significant user of advanced composites. The country has a very active automotive sector, which is a major driver for the use of CFRP in producing lighter and more fuel-efficient cars, including both traditional and electric models. Germany is also a leader in wind energy, and its efforts to build more powerful wind turbines create a steady demand for high-strength composite materials. This strong domestic sector and focus on innovation help to drive the market in Germany.

Key Players and Competitive Insights

The carbon fiber reinforced plastic market is home to several major players, including Toray Industries, Inc., Hexcel Corporation, Teijin Limited, SGL Carbon SE, and Mitsubishi Chemical Corporation. The competitive landscape is shaped by companies focusing on product innovation, expanding their production capacity, and creating strategic partnerships to meet the growing demand from key industries. Companies are also working on developing cost-effective and more sustainable solutions, such as materials that can be recycled or produced with a lower environmental impact.

A few prominent companies in the industry include TORAY Industries, Inc., Hexcel Corporation, TEIJIN LIMITED, SGL Carbon SE, Mitsubishi Chemical Group Corporation, SOLVAY, HYOSUNG ADVANCED MATERIALS, DowAksa, Formosa Plastics Corporation, and ZOLTEK Corporation.

Key Players

- DowAksa

- Formosa Plastics Corporation

- Hexcel Corporation

- HYOSUNG ADVANCED MATERIALS

- Mitsubishi Chemical Group Corporation

- SGL Carbon SE

- SOLVAY

- TEIJIN LIMITED

- TORAY Industries, Inc.

- ZOLTEK Corporation

Carbon Fiber Reinforced Plastic Industry Developments

April 2025: TORAY Industries, Inc. announced a new product collaboration with HEAD for a more sustainable tennis racquet. The new racquet uses TORAY's bio-circular carbon fibers, which supports the move toward more environmentally friendly sporting goods.

June 2024: Teijin Carbon Europe GmbH received ISCC PLUS certification for producing carbon fiber from sustainable raw materials.

Carbon Fiber Reinforced Plastic Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Thermosetting CFRP

- Thermoplastic CFRP

By Material Outlook (Revenue – USD Billion, 2020–2034)

- PAN-Based

- Pitch-Based

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Automotive

- Aerospace

- Wind Turbines

- Sport Equipment

- Molding & Compounding

- Construction

- Pressure Vessels

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Carbon Fiber Reinforced Plastic Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 18.86 billion |

|

Market Size in 2025 |

USD 20.60 billion |

|

Revenue Forecast by 2034 |

USD 46.63 billion |

|

CAGR |

9.5% |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 18.86 billion in 2024 and is projected to grow to USD 46.63 billion by 2034.

The global market is projected to register a CAGR of 9.5% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few key players in the market include TORAY Industries, Inc., Hexcel Corporation, TEIJIN LIMITED, SGL Carbon SE, Mitsubishi Chemical Group Corporation, SOLVAY, HYOSUNG ADVANCED MATERIALS, DowAksa, Formosa Plastics Corporation, and ZOLTEK Corporation.

The thermosetting CFRP segment accounted for the largest share of the market in 2024.

The pitch-based segment is expected to witness the fastest growth during the forecast period.