Cell Counting Market Size, Share, Trends, Industry Analysis Report

: By Product (Instruments and Consumables & Accessories), Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 118

- Format: PDF

- Report ID: PM2595

- Base Year: 2024

- Historical Data: 2020-2023

Cell Counting Market Overview

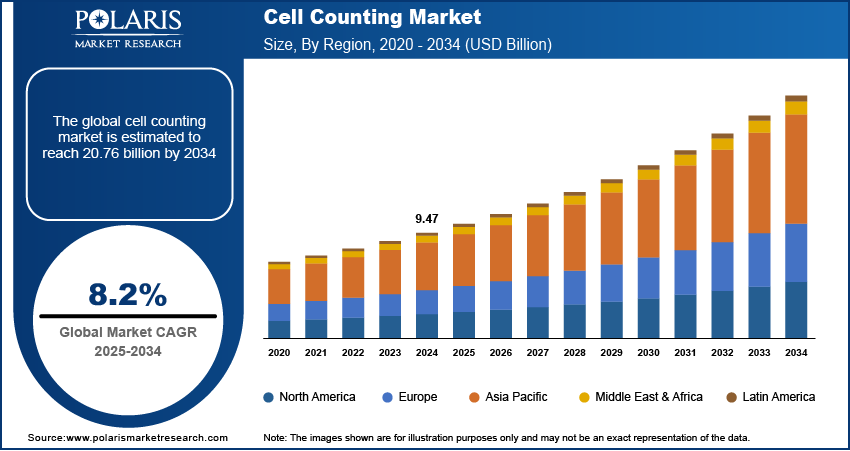

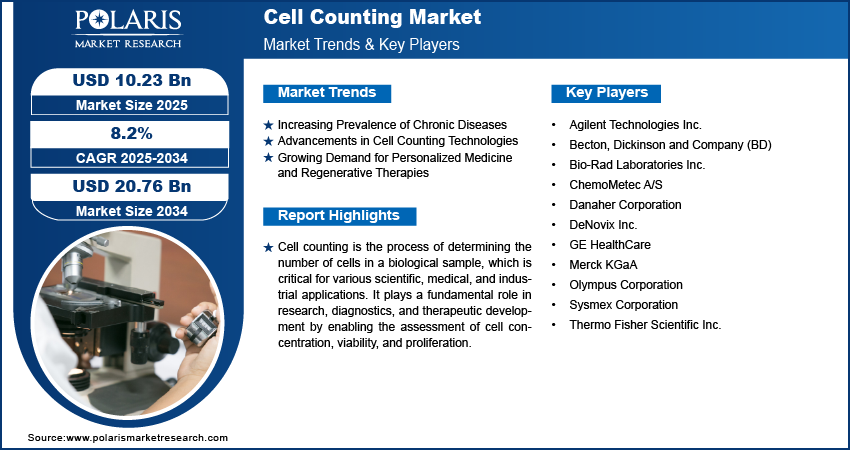

The cell counting market size was valued at USD 9.47 billion in 2024. The market is projected to grow from USD 10.23 billion in 2025 to USD 20.76 billion by 2034, exhibiting a CAGR of 8.2% during 2025–2034.

The cell counting market encompasses a range of products and technologies used to quantify and analyze cells in various biological and medical applications. It includes automated cell counters, manual counting methods, and advanced imaging systems that assist in research, diagnostics, and pharmaceutical development. The market plays a crucial role in fields such as biotechnology, clinical diagnostics, and life sciences research, where accurate cell measurement is essential for disease diagnosis, drug discovery, and monitoring cellular responses. The cell counting market expansion is driven by the growing need for precise and efficient cell analysis in healthcare and research institutions, contributing to advancements in medical treatments and scientific discoveries.

To Understand More About this Research: Request a Free Sample Report

The increasing prevalence of chronic diseases, which has led to higher demand for diagnostic and research applications, drive the cell counting market demand. Additionally, the expansion of biotechnology and pharmaceutical industries, along with the rising investments in life sciences research, is propelling the adoption of advanced cell counting technologies. Technological advancements, such as automation and artificial intelligence in cell analysis, have also improved accuracy and efficiency, making these tools more accessible to laboratories and healthcare facilities. Furthermore, government initiatives and funding in biomedical research are expected to support market growth, raising innovation and the development of more sophisticated cell counting solutions.

Cell Counting Market Dynamics

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases, such as cancer, diabetes, and cardiovascular disorders, has significantly heightened the demand for accurate cell counting technologies. Cell counting is integral in diagnosing these conditions, monitoring disease progression, and evaluating treatment efficacy. For instance, as per WHO, in 2021, noncommunicable diseases (NCDs) were responsible for at least 43 million deaths, accounting for 75% of global fatalities unrelated to the pandemic. This underscores the ongoing need for precise cell analysis in managing such diseases. This increasing prevalence of chronic diseases necessitates advanced diagnostic tools, thereby propelling the cell counting market development.

Advancements in Cell Counting Technologies

Technological innovations have revolutionized cell counting methodologies, enhancing accuracy, efficiency, and throughput. The development of automated cell counters and advanced flow cytometry techniques has streamlined cell analysis processes. In May 2023, Sysmex Corporation launched the XF-1600, a clinical flow cytometry solution, along with related products in Japan, exemplifying the industry's commitment to innovation. Such advancements in cell counting technologies improve diagnostic capabilities and expand the applicability of cell counting in research and clinical settings, thereby driving the cell counting market growth.

Growing Demand for Personalized Medicine and Regenerative Therapies

The rising shift toward personalized medicine and regenerative therapies has amplified the need for precise cell counting. Accurate cell analysis is crucial in tailoring treatments to individual patients and in developing regenerative approaches. The increasing focus on drug discovery, stem cell research, and regenerative medicine has heightened the demand for precise cell counting technologies across academic, clinical, and industrial settings. This cell counting market trend highlights the expanding role of cell counting in modern medical practices, thereby fueling market growth.

Cell Counting Market Segment Insights

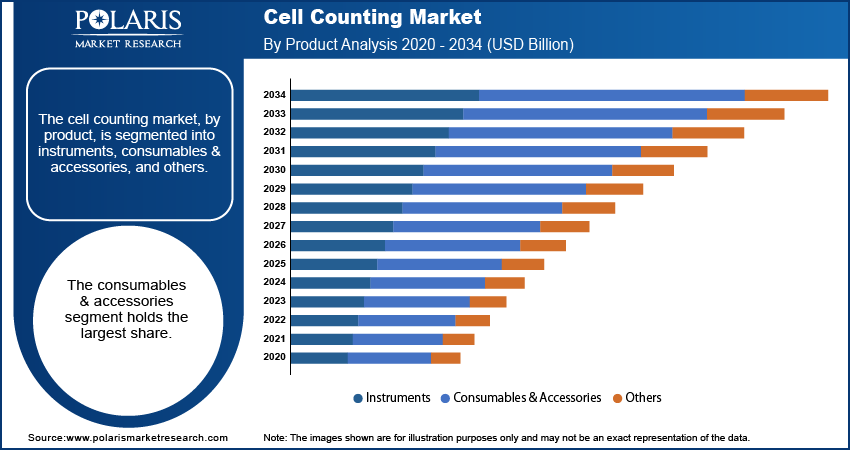

Cell Counting Market Assessment by Product Outlook

The cell counting market, by product, is segmented into instruments and consumables & accessories. In 2024, the consumables & accessories segment accounted for a larger share of the cell counting market revenue. This dominance is attributed to the high usage volume of consumables such as reagents, microplates, and assay kits, which are essential for routine laboratory operations. The continuous need for these items ensures a steady demand, strengthening their substantial market presence. Additionally, the introduction of innovative products has further propelled the growth of this consumables & accessories segment.

The instruments segment is expected to experience the highest growth rate within the cell counting market during the forecast period. This surge is driven by technological advancements that enhance the accuracy and efficiency of cell analysis. The development of automated systems has improved reproducibility and reduced manual errors, leading to increased adoption in various research areas such as cancer research, immunology, and neurology. For example, in November 2021, a novel cell counter called RapID Cell Counter tool was developed collaboratively by researchers from the Dennis Lab and the Simó Lab at the University of California. It was introduced to enable rapid and reliable quantification of cell density within user-defined boundaries. Such innovations are expanding the applicability of cell counting instruments, contributing to their rapid growth in the market.

Cell Counting Market Assessment by Application Outlook

By application, the cell counting market is segmented into complete blood count, automated cell counters, manual cell counters, stem cell research, cell-based therapeutics, bioprocessing, toxicology, and others. The complete blood count segment dominated the cell counting market share in 2024. This prominence is attributed to its fundamental role in diagnosing and monitoring various health conditions, including anemia, infections, and blood disorders. The routine use of complete blood count tests in medical assessments, preoperative evaluations, and ongoing patient monitoring underscores its critical importance in clinical practice. As the prevalence of blood-related disorders continues to rise, the demand for reliable cell counting technologies in this segment remains robust, supporting its leading position in the market.

The stem cell research segment is expected to experience the highest CAGR over the forecast period. This acceleration is driven by significant investments in regenerative medicine and the increasing focus on developing innovative therapies for chronic diseases and injuries. Accurate cell counting is essential in stem cell research to assess cell viability, proliferation, and differentiation, which are critical parameters in advancing treatment development and conducting clinical trials. As research in this area expands, the demand for precise and efficient cell counting technologies grows, propelling the rapid advancement of this segment within the market.

Cell Counting Market Evaluation by End Use Outlook

The cell counting market, by end use, is segmented into hospitals and diagnostic laboratories, research and academic institutes, pharmaceutical and biotechnological companies, and others. The research and academic institutes segment held the largest share in 2024. This prominence is attributed to their extensive engagement in research on chronic diseases, stem cells, and regenerative medicine, which necessitates precise cell-counting methodologies. The increasing number of publications and clinical trials in fields such as cancer research and immunology further amplifies the demand for reliable cell-counting technologies within these institutions. Additionally, substantial government funding for innovative projects supports the continuous adoption and advancement of cell counting instruments and consumables in academic settings.

The pharmaceutical and biotechnological companies segment is experiencing the highest growth rate. This surge is driven by the critical role of accurate cell counting in the preclinical testing of new drug candidates and vaccines, which is essential for evaluating therapeutic efficacy and toxicity. The emergence of biologics and advanced therapies, such as CAR T-cell therapies, has heightened the demand for precise cell counting during production and quality control processes. These advancements enhance throughput and reduce development costs, contributing to the rapid expansion of this segment.

Cell Counting Market by Regional Outlook

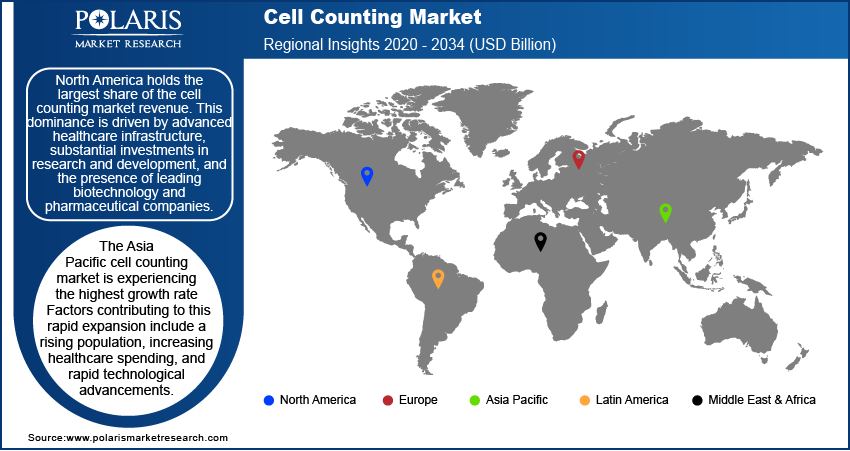

The cell counting market exhibits distinct trends across various regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Each region's market dynamics are influenced by factors such as healthcare infrastructure, research and development investments, the prevalence of chronic diseases, and the presence of key industry players.

According to the cell counting market statistics, North America held the largest market share in 2024. This dominance is driven by advanced healthcare infrastructure, substantial investments in research and development, and the presence of leading biotechnology and pharmaceutical companies. The region's emphasis on precision medicine and personalized treatments further fuels the demand for accurate cell counting technologies. Additionally, continuous technological advancements, including the integration of automation and digital health solutions into cell counting systems, contribute to market growth in North America.

The Asia Pacific cell counting market is experiencing the highest growth rate. Factors contributing to this rapid expansion include a rising population, increasing healthcare spending, and rapid technological advancements. The growing prevalence of chronic diseases and infectious conditions in countries such as China and India has heightened the demand for precise diagnostics and advanced medical technologies. Furthermore, the expansion of the biopharmaceutical sector in Asia Pacific, coupled with a focus on innovative therapies and drug development, propels the adoption of cell counting technologies in the region.

Cell Counting Market – Key Players and Competitive Insights

The competitive landscape of the cell counting market is characterized by intense competition among these key players, who focus on continuous innovation and strategic initiatives to strengthen their market positions. Companies invest significantly in research and development to introduce advanced technologies that enhance the accuracy, efficiency, and throughput of cell counting processes. Product launches, collaborations, partnerships, and mergers and acquisitions are common strategies employed to expand product portfolios and geographic reach. These strategies underscore the dynamic nature of the market and the emphasis on technological advancements to meet the evolving needs of end users.

The cell counting market features several prominent companies actively offering relevant products and services. These include Agilent Technologies Inc.; Becton, Dickinson and Company (BD); Bio-Rad Laboratories Inc.; ChemoMetec A/S; Danaher Corporation; DeNovix Inc.; GE HealthCare; Merck KGaA; Olympus Corporation; Sysmex Corporation; and Thermo Fisher Scientific Inc. These companies are recognized for their contributions to the development and distribution of cell counting instruments and consumables, catering to various research, clinical, and industrial applications.

Thermo Fisher Scientific Inc. is a global company headquartered in Waltham, Massachusetts, USA. It offers a comprehensive range of cell counting products, including automated cell counters, flow cytometers, microscopes, and related consumables. These offerings cater to diverse applications in research, diagnostics, and biopharmaceutical production, aligning with the company's commitment to advancing cell analysis technologies.

Danaher Corporation, based in Washington, D.C., USA, operates in the cell counting through its subsidiaries, such as Beckman Coulter Inc. and Molecular Devices. The company provides a variety of instruments and consumables, including automated cell counters and flow cytometry systems. These products are integral to research and clinical diagnostics, supporting applications in disease monitoring and therapeutic development.

List of Key Companies in Cell Counting Market

- Agilent Technologies Inc.

- Becton, Dickinson and Company (BD)

- Bio-Rad Laboratories Inc.

- ChemoMetec A/S

- Danaher Corporation

- DeNovix Inc.

- GE HealthCare

- Merck KGaA

- Olympus Corporation

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

Cell Counting Industry Developments

- October 2024: BD introduced its first robotics-compatible reagent kits, designed to enhance automation in single-cell research. Developed in collaboration with Hamilton, these kits streamline workflows and improve efficiency in genetic sequencing for oncology and immunology applications.

- September 2024: Logos Biosystems launched the LUNA-III automated cell counter, designed for precise bright field cell counting. This advanced instrument enhances efficiency in cell analysis, leveraging sophisticated imaging technology to provide accurate and reproducible results suitable for a variety of applications in cell culture and research.

- August 2024: DeNovix launched the CellDrop FLi Automated Cell Counter, featuring upgraded hardware and expanded applications. Utilizing advanced machine-learning algorithms, it enhances cell counting accuracy across a wide range of sample types.

Cell Counting Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Instruments

- Spectrophotometers

- Flow Cytometers

- Hemocytometers

- Automated Cell Counters

- Microscopes

- Others

- Consumables & Accessories

- Reagents

- Microplates

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Complete Blood Count

- Automated Cell Counters

- Manual Cell Counters

- Stem Cell Research

- Cell-Based Therapeutics

- Bioprocessing

- Toxicology

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Pharmaceutical and Biotechnological Companies

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest f Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest f Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest f Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest f Latin America

Cell Counting Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 9.47 billion |

|

Market Size Value in 2025 |

USD 10.23 billion |

|

Revenue Forecast by 2034 |

USD 20.76 billion |

|

CAGR |

8.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The cell counting market has been segmented into detailed segments of product, application, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The cell counting market growth and marketing strategy focuses on technological advancements, strategic partnerships, and geographic expansion. Companies invest in research and development to enhance automation, accuracy, and efficiency in cell counting technologies. Collaborations with research institutes and healthcare organizations help drive innovation and expand product adoption. Additionally, market players adopt mergers and acquisitions to strengthen their portfolios and increase global reach. Digital marketing strategies, participation in scientific conferences, and regulatory approvals further support market penetration and brand visibility.

FAQ's

The cell counting market size was valued at USD 9.47 billion in 2024 and is projected to grow to USD 20.76 billion by 2034.

The market is projected to register a CAGR of 8.2% during the forecast period.

North America held the largest share of the market in 2024.

A few key players in the market include Agilent Technologies Inc.; Becton, Dickinson and Company (BD); Bio-Rad Laboratories Inc.; ChemoMetec A/S; Danaher Corporation; DeNovix Inc.; GE HealthCare; Merck KGaA; Olympus Corporation; Sysmex Corporation; and Thermo Fisher Scientific Inc.

The consumables & accessories segment accounted for the largest market share in 2024. This dominance is attributed to the high usage volume of consumables such as reagents, microplates, and assay kits, which are essential for routine laboratory operations.

Cell counting is the process of quantifying the number of cells in a sample, typically used in biological and medical research, diagnostics, and bioprocessing. It is essential for assessing cell concentration, viability, and growth in various applications, including disease diagnosis, drug development, and stem cell research. Cell counting can be performed manually using a microscope and a hemocytometer or through automated methods such as flow cytometry, image-based counters, and spectrophotometry. Accurate cell counting is crucial for ensuring reproducibility in experiments, monitoring patient health, and optimizing biopharmaceutical production.