Cell Therapy Technologies Market Size, Share, Trends, Industry Analysis Report

: By Therapy Type (Allogeneic Therapies and Autologous Therapies), Technology, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 120

- Format: PDF

- Report ID: PM2626

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

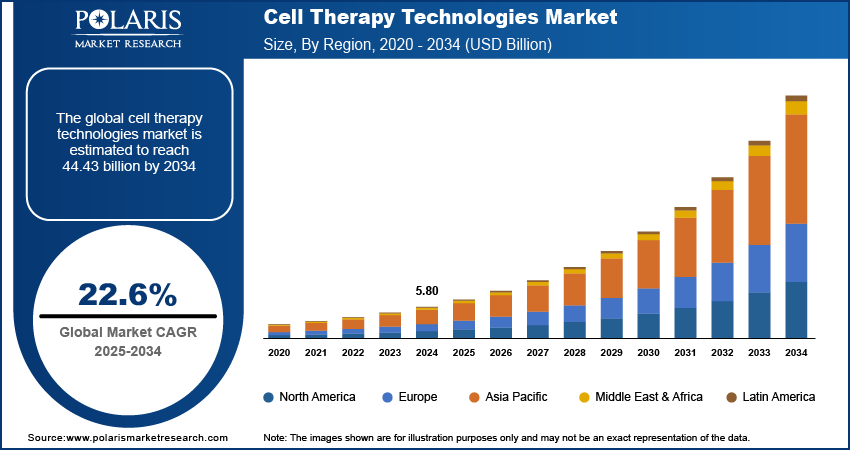

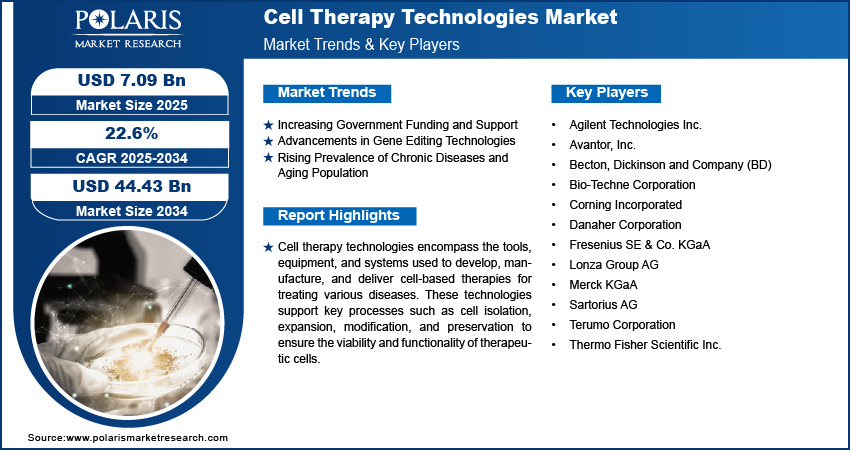

The cell therapy technologies market size was valued at USD 5.80 billion in 2024, growing at a CAGR of 22.6% during 2025–2034. Growing approval of cell-based therapies and growing investments in regenerative medicine are a few of the key factors driving market growth.

Key Insights

- The autologous therapies segment led the market in 2024. The personalized nature of these treatments reduces the risk of immune rejection and adverse reactions.

- The genome editing technology segment is registering the highest growth rate, owing to advancements in tools like CRISPR-Cas9 and increased demand for genome editing solutions.

- North America dominates the market, owing to the region’s advanced healthcare infrastructure and the presence of a supportive regulatory environment.

- Asia Pacific is registering the highest growth rate, primarily due to growing awareness of alternative therapies and rising investments and supportive policies.

Industry Dynamics

- Increased funding and support from governments globally for research and development of cell therapies is a key factor fueling market demand.

- Advancements in gene editing technologies, which have improved the efficiency and precision of genetic modifications, are fueling the adoption of cell therapy technologies.

- The rising prevalence of chronic diseases is expected to create several opportunities for market participants.

- Complex regulatory approval processes of cell therapy technologies may present market challenges.

Market Statistics

2024 Market Size: USD 5.80 billion

2034 Projected Market Size: USD 44.43 billion

CAGR (2025-2034): 22.6%

North America: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

The cell therapy technologies market encompasses a wide range of tools, equipment, and systems used in the research, development, and production of cell-based therapies. These technologies play a crucial role in advancing regenerative medicine by enabling the manipulation, expansion, and preservation of living cells for therapeutic applications. The market is growing due to the increasing adoption of cell-based treatments for conditions such as cancer, autoimmune disorders, and degenerative diseases. As advancements in biotechnology continue to evolve, the demand for innovative and efficient cell processing technologies is rising, further expanding the market size.

Several factors, including increasing investments in regenerative medicine, rising approvals for cell-based therapies, and technological advancements that enhance efficiency and scalability, boost the cell therapy technologies market growth. Governments and private organizations are actively funding research initiatives to develop advanced treatments, boosting growth opportunities for key industry players. Additionally, the growing prevalence of chronic diseases and the need for personalized medicine are creating significant opportunities in the market. As a result, the market is expected to witness steady growth, with a strong market forecast pointing toward continued innovation and expansion in the coming years.

Market Dynamics

Increasing Government Funding and Support

Governments worldwide are recognizing the potential of cell therapies to revolutionize medical treatments and are consequently increasing funding and support for research and development in this field. For instance, the National Institutes of Health (NIH) in the US has various programs for grants for advancing cell-based therapies aimed at treating a range of diseases, including cancer and degenerative disorders. This financial commitment underscores the government's dedication to fostering innovation in regenerative medicine. Similarly, the European Union has launched initiatives to support collaborative research projects focusing on cell therapy technologies, demonstrating a global trend toward governmental investment in this sector. Such funding accelerates scientific discoveries and facilitates the translation of research into clinical applications, thereby driving cell therapy technologies market growth.

Advancements in Gene Editing Technologies

Recent advancements in gene editing technologies, particularly CRISPR-Cas9, have significantly enhanced the precision and efficiency of genetic modifications in cell therapies. A 2024 study published in NCBI detailed how CRISPR-Cas9 was utilized to correct genetic defects in patient-derived cells, offering promising avenues for treating hereditary diseases. These advancements have enabled the development of more effective and personalized cell therapies, reducing the risk of immune rejection and improving patient outcomes. The ability to edit genes with high accuracy has opened new possibilities in treating conditions previously deemed untreatable, thereby increasing the demand for advanced cell therapy technologies and propelling cell therapy technologies market expansion.

Rising Prevalence of Chronic Diseases and Aging Population

The global increase in chronic diseases, coupled with an aging population, has intensified the need for innovative therapeutic solutions. According to the World Health Organization's 2021 report, chronic conditions such as cardiovascular diseases, diabetes, and cancer remain the leading causes of mortality worldwide. Additionally, the WHO report highlights that by 2030, one in six individuals globally will be aged 60 years and above, a demographic shift associated with a higher incidence of chronic illnesses. Cell therapies offer potential treatments for these conditions by promoting tissue regeneration and modulating immune responses. Hence, the rising prevalence of chronic diseases boosts the cell therapy technologies market demand.

Segment Insights

Market Assessment – By Therapy Type

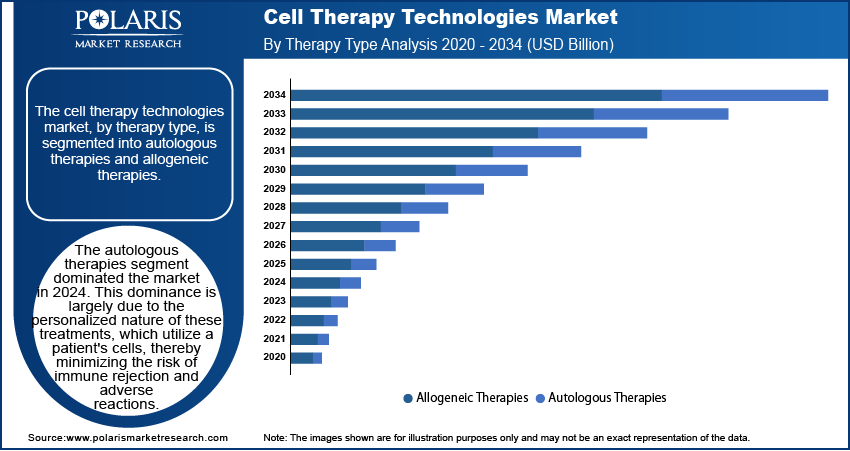

The cell therapy technologies market, by therapy type, is segmented into autologous therapies and allogeneic therapies. The autologous therapies segment dominated the cell therapy technologies market share in 2024. This dominance is largely due to the personalized nature of these treatments, which utilize a patient's cells, thereby minimizing the risk of immune rejection and adverse reactions. The increasing adoption of autologous therapies, particularly chimeric antigen receptor (CAR) T-cell therapies, has significantly contributed to their market prominence. These therapies have shown favorable outcomes in treating various cancers and genetic disorders.

The allogeneic therapies segment is expected to experience significant growth over the forecast period. Unlike autologous treatments, allogeneic therapies use cells sourced from donors, offering advantages such as immediate availability and the potential for large-scale manufacturing, which can reduce costs and broaden patient access. The increasing focus on developing innovative allogeneic treatments is evident in the growing number of clinical trials and research collaborations. For instance, in September 2021, Adaptimmune Ltd. partnered with Genentech to explore the use of induced pluripotent stem cell (iPSC)-derived allogeneic therapies to create T-cells with enhanced proliferation capacity compared to mature T-cells. Such initiatives highlight the potential of allogeneic therapies to provide off-the-shelf solutions for various diseases, thereby fueling the cell therapy technologies market growth.

Market Evaluation– By Technology

The cell therapy technologies market, by technology, is segmented into somatic cell technology, cell immortalization technology, viral vector technology, genome editing technology, and cell plasticity technology. The viral vector technology segment holds the largest share of the cell therapy technologies market revenue in 2024. This prominence is attributed to its critical role in delivering genetic material into cells, a fundamental process in developing gene therapies and certain cell-based treatments. Viral vectors are employed to introduce therapeutic genes into patient cells, enabling the correction of genetic disorders or the enhancement of cell functions to combat diseases such as cancer. The effectiveness and reliability of viral vector systems have led to their widespread adoption in clinical applications and research, thereby solidifying their leading position in the market.

The genome editing technology segment is experiencing the highest growth rate within the cell therapy technologies market. Advancements in tools such as CRISPR-Cas9 have revolutionized the ability to precisely modify genetic material, opening new avenues for treating a variety of diseases at the genetic level. The increasing focus on personalized medicine and the potential to correct mutations responsible for hereditary conditions have propelled the demand for genome editing solutions. As research and development efforts continue to expand in this area, genome editing technology is rapidly gaining traction, contributing significantly to the cell therapy technologies market development.

Market Evaluation – By Application

The cell therapy technologies market, by application, is segmented into musculoskeletal, cardiovascular, gastrointestinal, neurological, oncology, dermatology, wound and injuries, ocular, and others. The oncology segment accounted for the largest cell therapy technologies market share in 2024. This dominance is primarily attributed to the increasing adoption of cell-based therapies, such as chimeric antigen receptor (CAR) T-cell treatments, which have shown favorable outcomes in treating various cancers.

The musculoskeletal segment is experiencing the highest growth rate driven by extensive research into regenerative treatments aimed at repairing or regenerating damaged musculoskeletal tissues. Researchers are exploring the use of engineered or native skeletal progenitor cells to directly stimulate tissue repair and rejuvenate musculoskeletal structures. The increasing prevalence of musculoskeletal conditions, coupled with advancements in cell therapy techniques, is propelling the rapid expansion of this segment.

Regional Insights

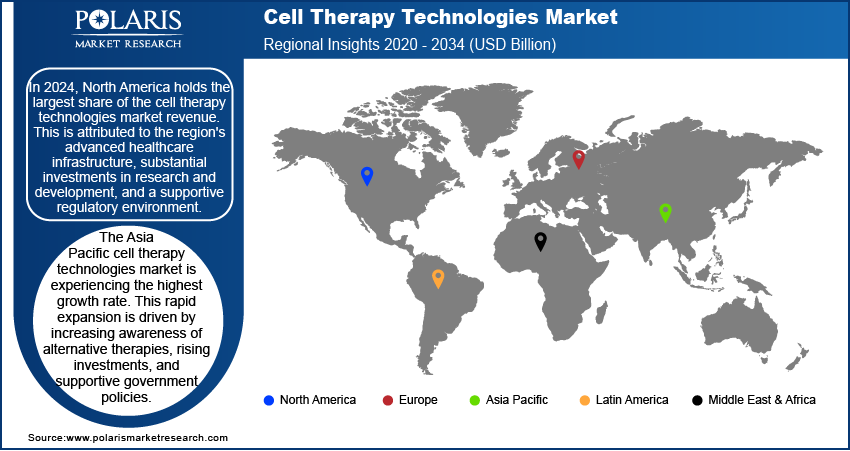

The cell therapy technologies market, by region, is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Each region exhibits distinct growth patterns influenced by factors such as healthcare infrastructure, investment in research and development, regulatory frameworks, and the prevalence of target diseases.

North America holds the largest share of the cell therapy technologies market revenue. This is attributed to the region's advanced healthcare infrastructure, substantial investments in research and development, and a supportive regulatory environment. The US, in particular, has witnessed collaborations between research institutions and major pharmaceutical companies, fostering innovation and accelerating the development of cell-based therapies. In June 2022, Ematics partnered with Bristol Myers Squibb to advance allogeneic cell therapy programs, highlighting the region's commitment to advancing cell therapy technologies.

The Asia Pacific cell therapy technologies market is experiencing the highest growth rate. This rapid expansion is driven by increasing awareness of alternative therapies, rising investments, and supportive government policies. China is at the forefront, with initiatives to develop local manufacturing capabilities and research infrastructure. In October 2024, Sino-Biocan (Shanghai) Biotech Ltd launched the WUKONG Automated Cell Processing System, enhancing efficiency in cell therapy production. Additionally, collaborations between domestic and global biotech firms are accelerating clinical development and production of innovative cell therapies, further propelling market growth in the region.

Key Players and Competitive Insights

The cell therapy technologies market features several prominent companies actively contributing to its advancement. A few key players include Thermo Fisher Scientific Inc.; Danaher Corporation; Merck KGaA; Lonza Group AG; Sartorius AG; Agilent Technologies Inc.; Avantor, Inc.; Bio-Techne Corporation; Fresenius SE & Co. KGaA; Becton, Dickinson and Company (BD); Corning Incorporated; and Terumo Corporation. These organizations offer a range of products and services essential for cell therapy research, development, and manufacturing, thereby playing a significant role in the market's growth.

The competitive landscape of the cell therapy technologies market is characterized by continuous innovation and strategic collaborations. Companies are investing in research and development to introduce advanced technologies that enhance the efficiency and scalability of cell therapy processes. Additionally, partnerships and acquisitions are common strategies employed to expand product portfolios and geographic reach. The market's dynamic nature fosters a competitive environment where organizations strive to meet the evolving demands of cell-based therapies.

Thermo Fisher Scientific Inc., headquartered in Waltham, Massachusetts, USA, provides a comprehensive suite of products and services for the cell therapy sector. Their offerings include cell culture media, reagents, and advanced cell processing systems, supporting various stages of cell therapy development and manufacturing. Thermo Fisher's commitment to innovation and quality makes it a vital contributor to the market.

Lonza Group AG, based in Basel, Switzerland, specializes in life sciences and offers extensive solutions for cell therapy applications. Their services encompass cell line development, process development, and large-scale manufacturing capabilities. Lonza's expertise in navigating regulatory landscapes and ensuring compliance positions it as a key player in advancing cell therapy technologies.

List of Key Companies

- Agilent Technologies Inc.

- Avantor, Inc.

- Becton, Dickinson and Company (BD)

- Bio-Techne Corporation

- Corning Incorporated

- Danaher Corporation

- Fresenius SE & Co. KGaA

- Lonza Group AG

- Merck KGaA

- Sartorius AG

- Terumo Corporation

- Thermo Fisher Scientific Inc.

Cell Therapy Technologies Industry Developments

- March 2025: AstraZeneca announced its agreement to acquire EsoBiotec, a Belgian biotechnology company specializing in in-vivo CAR-T cell therapies, for up to USD 1 billion. This acquisition aims to enhance AstraZeneca's capabilities in developing innovative cell therapies for cancer and autoimmune diseases, offering treatments through simple injections rather than traditional, more complex procedures.

- November 2023: Novartis entered into a strategic licensing agreement with Legend Biotech to develop and manufacture chimeric antigen receptor (CAR-T) therapies targeting delta-like ligand protein 3 (DLL3), including the candidate LB2102 for large cell neuroendocrine carcinoma.

Cell Therapy Technologies Market Segmentation

By Therapy Type Outlook (Revenue – USD Billion, 2020–2034)

- Allogeneic Therapies

- Autologous Therapies

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- Somatic Cell Technology

- Cell Immortalization Technology

- Viral Vector Technology

- Genome Editing Technology

- Cell Plasticity Technology

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Musculoskeletal

- Cardiovascular

- Gastrointestinal

- Neurological

- Oncology

- Dermatology

- Wound and Injuries

- Ocular

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 5.80 billion |

|

Market Size Value in 2025 |

USD 7.09 billion |

|

Revenue Forecast by 2034 |

USD 44.43 billion |

|

CAGR |

22.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The cell therapy technologies market size was valued at USD 5.80 billion in 2024 and is projected to grow to USD 44.43 billion by 2034.

The market is projected to register a CAGR of 22.6% during the forecast period.

North America held the largest share of the market in 2024.

A few key players in the cell therapy technologies market include Thermo Fisher Scientific Inc.; Danaher Corporation; Merck KGaA; Lonza Group AG; Sartorius AG; Agilent Technologies Inc.; Avantor, Inc.; Bio-Techne Corporation; Fresenius SE & Co. KGaA; Becton, Dickinson and Company (BD); Corning Incorporated; and Terumo Corporation.

The oncology segment accounted for the largest share of the market in 2024.

Cell therapy technologies refer to the tools, systems, and solutions used in the research, development, and production of cell-based therapies. These technologies play a crucial role in manipulating, processing, and delivering therapeutic cells to treat various diseases, including cancer, autoimmune disorders, and genetic conditions. The field encompasses a wide range of products, such as cell culture media, bioreactors, cell separation systems, cryopreservation equipment, and genome editing tools. These technologies enable researchers and healthcare providers to engineer, expand, and maintain viable therapeutic cells before they are administered to patients. The demand for advanced cell therapy technologies continues to grow due to increasing clinical applications and advancements in regenerative medicine and personalized treatments.