Cellular Foam Concrete Market Size, Share, Trends, & Industry Analysis Report

: By Foaming Agent (Synthetic and Natural), By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5772

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

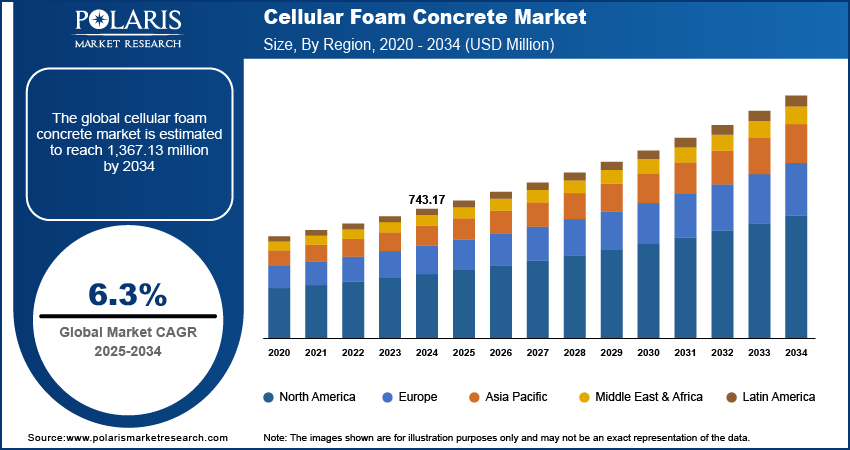

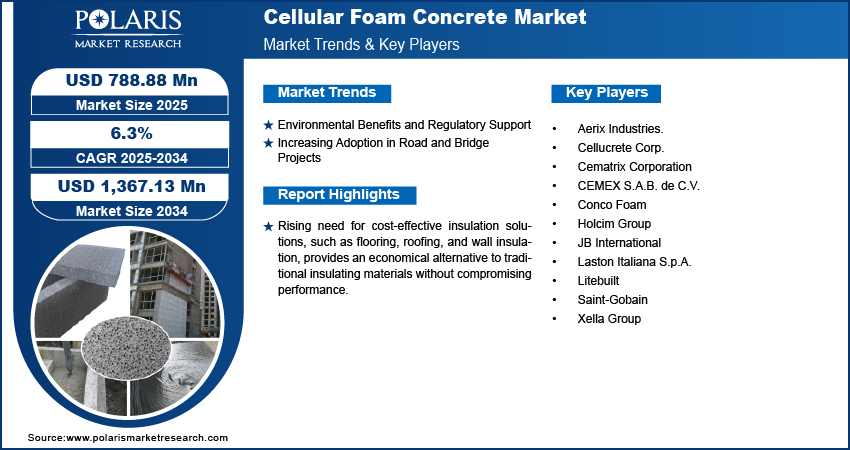

The global cellular foam concrete market size was valued at USD 743.17 million in 2024 and is projected to register a CAGR of 6.3% during 2025–2034. Rising demand for lightweight construction materials is driving the use of cellular foam concrete. It offers reduced structural load, making it ideal for high-rise buildings and infrastructure projects requiring weight-efficient materials.

Cellular foam concrete is a construction material made by mixing cement, water, and pre-formed foam to create a lightweight, thermally insulating, and structurally efficient concrete. It is widely used in building construction, road projects, and insulation applications due to its low density and high energy absorption. Growing focus on energy efficiency, such as its excellent thermal insulation properties, helps reduce heating and cooling costs, supporting global sustainability goals and green building standards.

Rising need for cost-effective insulation solutions such as flooring, roofing, and wall insulation, provides an economical alternative to traditional insulating materials without compromising performance. Additionally, ongoing research into improving strength-to-weight ratios and fire resistance is expanding its applicability across diverse construction segments.

To Understand More About this Research: Request a Free Sample Report

Market Dynamics

Environmental Benefits and Regulatory Support

Cellular foam concrete is gaining momentum due to its environment friendly properties and alignment with global sustainability goals. The material requires significantly less cement and aggregates, resulting in reduced carbon emissions during production. Its lightweight nature also lowers transportation energy and structural load, further minimizing the environmental footprint. Governments and regulatory bodies are actively encouraging the use of sustainable construction materials through green building codes, tax incentives, and public infrastructure mandates. For instance, in October 2024, the Biden-Harris Administration launched a series of strategic initiatives aimed at enhancing the development and utilization of advanced and sustainable construction materials across the US. This regulatory push, combined with heightened awareness of climate change, is driving the adoption of cellular foam concrete in projects focused on carbon neutrality and resource efficiency. Builders and developers are increasingly integrating this material to meet both performance and compliance targets without compromising on cost-effectiveness.

Increasing Adoption in Road and Bridge Projects

The road and bridge construction industry is witnessing a notable shift toward lightweight, high-performance materials such as cellular foam concrete. Its low density, excellent flowability, and self-compacting characteristics make it ideal for filling voids, backfilling retaining walls, and stabilizing embankments. Engineers value its ability to reduce soil settlement and enhance long-term structural stability, particularly in soft soil conditions. The rapid placement and reduced need for compaction also shorten construction timelines and labor costs. Transportation authorities and infrastructure planners are adopting cellular foam concrete to improve durability and reduce lifecycle maintenance in critical transportation projects. Its growing track record in real-world applications is reinforcing confidence in its structural and economic advantages.

Segment Insights

Market Assessment by Foaming Agent

Based on foaming agent, the segmentation includes synthetic and natural. In 2024, the synthetic segment accounted for the largest share, primarily driven by its superior stability, consistent bubble structure, and compatibility with diverse cementitious mixes. Synthetic foaming agents enable better control over density and compressive strength, which is crucial for applications requiring uniform quality and structural performance. Construction professionals favor these agents due to their long shelf life and adaptability across a wide temperature range, making them suitable for both on-site and precast operations. Their ability to produce fine, stable foam leads to higher quality cellular concrete, especially in large-scale infrastructure and residential construction, where reliability and efficiency are prioritized.

The natural segment is projected to register the highest CAGR during the forecast period, due to rising demand for eco-friendly, biodegradable construction inputs. Natural foaming agents, typically derived from plant-based or protein-rich materials, are increasingly preferred in projects emphasizing green certification and low environmental impact. Their lower toxicity and reduced ecological footprint align with evolving sustainability standards and construction practices focused on resource conservation. Innovations in bio-based or natural surfactant formulations have also enhanced performance, enabling broader application in both structural and insulation-grade cellular concretes. This shift is attracting attention from developers and contractors committed to environmentally responsible building solutions.

Market Evaluation by End Use

Based on end use, the segmentation includes residential, commercial, industrial, infrastructure, and others. In 2024, the residential segment dominated the market, fueled by increased demand for lightweight, thermally insulating materials in multi-story housing, affordable houses, and energy-efficient home construction. Cellular foam concrete is being widely used in non-load-bearing walls, building thermal insulation, and soundproofing layers, offering both functional and cost-saving advantages. Its pumpability and self-compacting properties allow faster construction in dense urban areas where space constraints demand streamlined building solutions. The material’s compatibility with modular and prefabricated systems also supports the rapid pace of urban housing development. Homebuilders are implementing cellular foam concrete to meet growing expectations for sustainability, comfort, and reduced project timelines.

The commercial segment is projected to experience the highest CAGR over the forecast period, driven by expanding applications in office complexes, shopping centers, and institutional buildings where structural efficiency and thermal performance are critical. Developers are utilizing cellular foam concrete for floor leveling, fire-resistant partitions, and roofing systems due to its lightweight and insulating characteristics. Demand is further propelled by sustainability mandates and the shift toward green commercial architecture. The ability to reduce dead loads and enhance energy performance without compromising on strength or design flexibility is attracting interest from architects and contractors aiming to optimize performance across large-scale, high-traffic facilities.

Regional Analysis

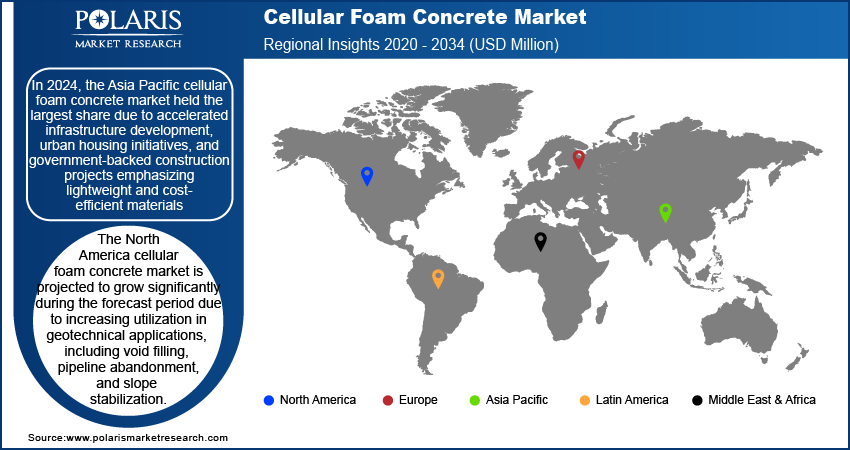

In 2024, the Asia Pacific cellular foam concrete market held the largest share due to accelerated infrastructure development, urban housing initiatives, and government-backed construction projects emphasizing lightweight and cost-efficient materials. For instance, China is increasing its strategic initiatives for urban renewal, focusing on the construction of sustainable, strong, and intelligent urban environments. This approach aims to enhance livability while encouraging high-quality economic development through innovative planning and infrastructure investments. Rapid industrialization has heightened the need for versatile construction solutions suitable for changing soil conditions and complex architectural demands. The region’s construction sector is embracing cellular foam concrete for its adaptability in both structural and non-structural components, particularly in crisis zones where load reduction is critical. Widespread availability of raw materials and increasing adoption of advanced building technologies have also contributed to the strong market footprint across both public and private construction sectors.

The China cellular foam concrete market holds the largest revenue share in Asia Pacific due to its massive volume of infrastructure and urban housing projects, many of which are part of national initiatives such as the Belt and Road. Developers are integrating cellular foam concrete in large-scale developments for sub-base fills, insulation, and lightweight backfilling, where efficiency and cost control are essential. Domestic production capabilities for synthetic foaming agents and automated mixing equipment have enhanced scalability, while regulatory support for green buildings is driving preference for low-carbon materials. Continuous investments in sustainable construction practices secure the country’s leadership in this market segment.

The North America cellular foam concrete market is projected to grow significantly during the forecast period due to increasing utilization in geotechnical applications, including void filling, pipeline abandonment, and slope stabilization. Engineers and contractors are turning to cellular foam concrete for its ability to meet both performance and environmental requirements in critical infrastructure upgrades. Public and private investments in rebuilding aged transportation systems are further driving demand. The shift toward energy-efficient, high-performance buildings is also fostering adoption in residential and commercial construction. Advancements in formulation and on-site production technologies are enabling broader application across diverse construction environments. The increase in bridge construction is fueling the use of lightweight materials. The ASCE's 2025 Infrastructure Report Card states there are over 623,000 bridges in the US, with 49.1% in "fair" condition, 44.1% in "good" condition, and 6.8% in "poor" condition. The number of fair bridges continues to exceed those in good condition.

The Europe cellular foam concrete market is experiencing steady growth driven by strong environmental regulations and a growing focus on circular economy principles in construction. Developers are prioritizing sustainable materials that reduce structural load and carbon footprint while delivering effective thermal and acoustic insulation. The region’s mature construction sector is incorporating cellular foam concrete in both retrofit and new-build projects, especially in areas requiring lightweight fill materials. Increased adoption of green building certifications and energy performance standards is reinforcing the shift toward low-emission construction technologies. Research initiatives promoting innovation in bio-based foaming agents and material recycling are further sustaining market momentum.

Key Players & Competitive Analysis Report

The competitive landscape of the cellular foam concrete market is defined by continuous technology advancements, strategic alliances, and a focus on sustainable product innovation. Industry analysis reveals a strong importance on expansion strategies targeting high-growth sectors such as infrastructure development, residential housing, and commercial construction. Companies are actively engaging in joint ventures and post-merger integration to strengthen regional supply chains and accelerate product customization capabilities. Mergers and acquisitions are streamlining operations and enhancing access to proprietary foaming technologies and equipment. New product launches containing improved density control, thermal insulation, and fire resistance are aligning with green construction standards. Strategic partnerships between material suppliers and construction firms are enhancing project delivery efficiency. Competitors are also investing in mobile production units and automation to serve complex job sites more effectively. The market is increasingly influenced by the integration of lightweight materials, low-carbon formulations, and engineered cementitious composites designed for next-generation construction solutions.

List of Key Companies

- Aerix Industries.

- Cellucrete Corp.

- Cematrix Corporation

- CEMEX S.A.B. de C.V.

- Conco Foam

- Holcim Group

- JB International

- Laston Italiana S.p.A.

- Litebuilt

- Saint-Gobain

- Xella Group

Cellular Foam Concrete Industry Developments

In January 2025, Aerix Industries partnered with ConsTruc Industries aimed at advancing global innovation in low-density cellular concrete (LDCC). This partnership seeks to leverage their combined expertise and resources to enhance the development, production, and application of LDCC solutions, which are characterized by their lightweight properties and enhanced thermal and acoustic performance.

Cellular Foam Concrete Market Segmentation

By Foaming Agent Outlook (Revenue, USD Million, 2020–2034)

- Synthetic

- Natural

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Residential

- Commercial

- Industrial

- Infrastructure

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Netherlands

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Malaysia

- Latin America

- Argentina

- Brazil

- Mexico

- Middle East & Africa

- UAE

- Saudi Arabia

- Israel

- South Africa

Cellular Foam Concrete Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 743.17 million |

|

Market Size Value in 2025 |

USD 788.88 million |

|

Revenue Forecast by 2034 |

USD 1,367.13 million |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 743.17 million in 2024 and is projected to grow to USD 1,367.13 million by 2034.

The global market is projected to register a CAGR of 6.3% during the forecast period.

In 2024, North America held a significant share due to robust pharmaceutical and biotechnology manufacturing infrastructure and sustained capital investments in advanced healthcare and laboratory technologies.

A few of the key players are Aerix Industries., Cellucrete Corp., Cematrix Corporation, CEMEX S.A.B. de C.V., Conco Foam, Holcim Group, JB International, Laston Italiana S.p.A., Litebuilt, Saint-Gobain, and Xella Group.

In 2024, the synthetic segment accounted for the largest share, primarily driven by its superior stability, consistent bubble structure, and compatibility with diverse cementitious mixes.

In 2024, the residential segment dominated the market, fueled by increased demand for lightweight, thermally insulating materials in multi-story housing, affordable houses, and energy-efficient home construction.