Cellulite Treatment Market Size, Share, Trends, Industry Analysis Report

By Procedure Type (Noninvasive Treatment, Minimally Invasive Treatment, Topical Treatment), By Cellulite Type, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 118

- Format: PDF

- Report ID: PM5830

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

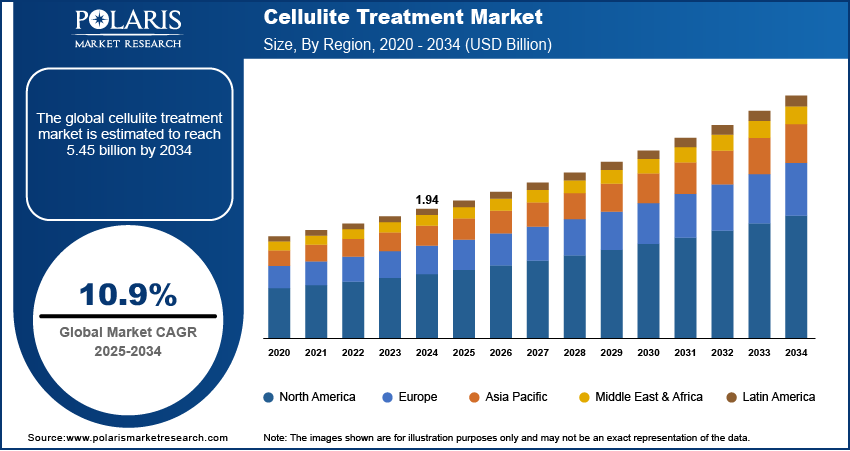

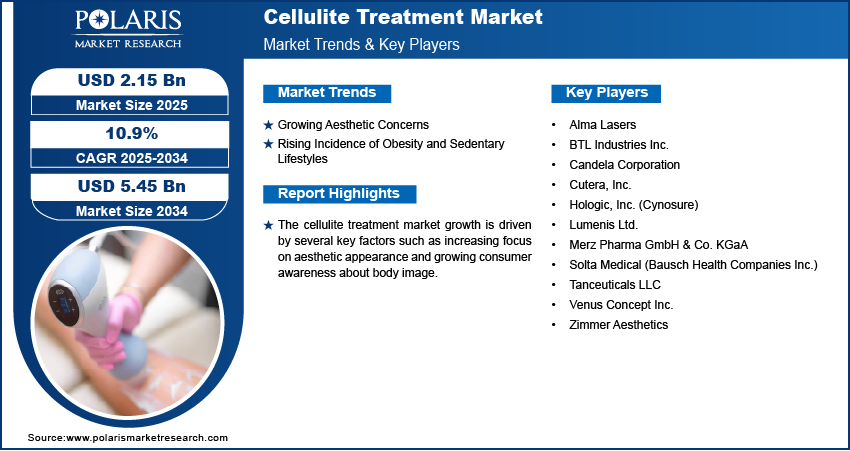

The global cellulite treatment market size was valued at USD 1.94 billion in 2024 and is anticipated to register a CAGR of 10.9% from 2025 to 2034. The market growth is mainly driven by a rising focus on aesthetic appearance and increased awareness of available treatments of cellulite. Also, the growing number of people dealing with obesity and related lifestyle disorders contributes significantly to the demand for various cellulite reduction options.

The cellulite treatment market includes various procedures and products designed to reduce the dimpled, uneven appearance of skin, primarily on the thighs, buttocks, and abdomen. These treatments aim to improve skin texture, stimulate collagen production, and enhance blood circulation for a smoother look.

To Understand More About this Research: Request a Free Sample Report

The increasing focus on aesthetic appearance and growing consumer awareness about body image drive the demand for cellulite treatments. There is a strong desire among individuals to maintain a youthful and appealing look, which drives the demand for cosmetic procedures such as cellulite treatment. This trend is amplified by social media and evolving beauty standards, leading more people to seek solutions for cellulite-related concerns.

The rising prevalence of obesity and related lifestyle conditions propels the market growth. As obesity rates increase globally, so does the occurrence of cellulite, which is often linked to excess body fat. According to the World Health Organization (WHO), the worldwide prevalence of obesity has seen a substantial rise over the past few decades. This growing health challenge often leads individuals to seek various body sculpting and contouring solutions, including those for cellulite reduction, to improve their overall appearance and self-confidence.

Industry Dynamics

Growing Aesthetic Concerns

The increasing awareness and emphasis on physical appearance and body aesthetics significantly boost the demand for cellulite treatment. Modern beauty standards, often influenced by media and social platforms, encourage individuals to seek cosmetic solutions to improve their body contour and skin texture. People are increasingly conscious of imperfections such as cellulite and are actively seeking effective ways to address them.

A study published in the Aesthetic Surgery Journal Open Forum in 2024, titled "Cellulite and the Aesthetic Management of the Buttocks and Thighs: 6 Cases Illustrating Targeted Verifiable Subcision as Part of a Multimodal Approach to Lower Body Rejuvenation," highlighted that cellulite affects various aspects of daily life, including clothing choices and self-perception, often leading patients to seek care. This underscores the psychological impact of cellulite and how the desire for an improved aesthetic appearance strongly drives demand for cellulite treatments.

Rising Incidence of Obesity and Sedentary Lifestyles

The global rise in obesity rates and the prevalence of sedentary lifestyles are major factors contributing to the market growth. While cellulite can affect individuals of all body types, it is often more noticeable or exacerbated in those with higher body fat percentages. The increasing number of overweight and obese individuals naturally leads to a larger pool of potential customers seeking cellulite reduction solutions.

Data released by the World Health Organization (WHO) in a report titled "One in eight people are now living with obesity," stated that more than 1 billion people worldwide were suffering from obesity in 2022. It also noted that the global prevalence of obesity among adults has more than doubled since 1990. This significant increase in obesity directly correlates with a higher likelihood of cellulite development, thereby boosting the demand for various cellulite treatment options and driving the market growth.

Segmental Insights

Procedure Type Analysis

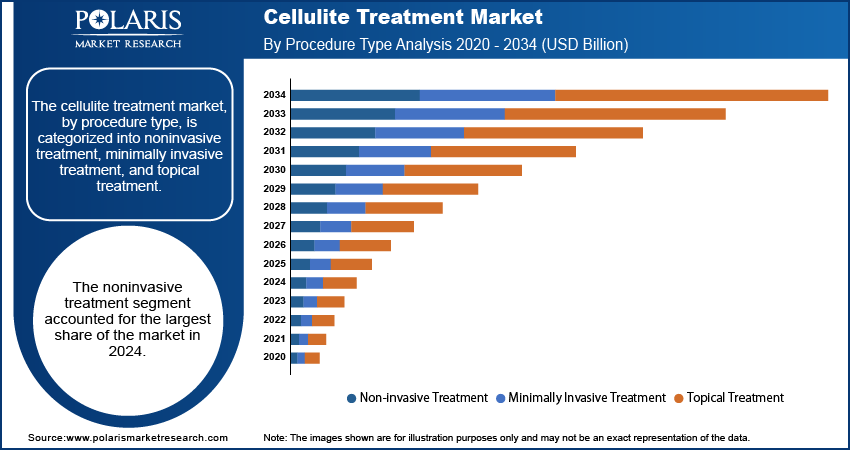

The noninvasive treatment segment held a larger share in 2024. This dominance is mainly attributed to the appealing benefits of these procedures such as minimal downtime, reduced risk compared to surgical options, and growing technological advancements that enhance their effectiveness. People increasingly prefer noninvasive methods such as radiofrequency, ultrasound, and cryolipolysis as they provide noticeable improvements in skin texture and contour without the need for incisions or extensive recovery periods. For instance, a study published in the Aesthetic Surgery Journal Open Forum in 2024, titled "Improvement in Cellulite Appearance After a Single Treatment Visit With Acoustic Subcision," highlighted that certain noninvasive acoustic subcision devices require no anesthesia or downtime, making them a well-tolerated option for patients.

The minimally invasive treatment segment is anticipated to register the highest growth rate during the forecast period. This growth is fueled by a rising preference for procedures that offer more significant and longer-lasting results than noninvasive options, yet still involve less risk and recovery time than traditional surgery. These treatments, such as subcision and laser-assisted procedures, target the structural causes of cellulite more directly. Research in The Journal of Drugs in Dermatology in 2018, in an article titled "Three-Dimensional Analysis of Minimally Invasive Vacuum-Assisted Subcision Treatment of Cellulite," showcased significant improvement in dimple depth and overall appearance with minimally invasive vacuum-assisted subcision, demonstrating patient satisfaction and efficacy.

Cellulite Type Analysis

The soft cellulite segment held the largest share in 2024. This type of cellulite is often associated with aging and post-menopausal women, as skin loses elasticity and collagen over time, making the dimpling more visible. The widespread prevalence of soft cellulite among a significant portion of the adult female population drives a consistent demand for various aesthetic treatments aimed at improving skin laxity and reducing fat accumulation. For example, a review published in Aesthetic Surgery Journal Open Forum in 2024, titled "Cellulite and the Aesthetic Management of the Buttocks and Thighs," notes that cellulite can deeply affect an individual's self-perception, reinforcing the strong patient desire to treat this common concern.

The hard cellulite segment is anticipated to register the highest growth rate during the forecast period. Hard cellulite is characterized by its firm, compact nature, often appearing in younger individuals who are active and have good muscle tone, making it more resistant to common treatments. The increasing awareness and desire among these individuals for effective solutions lead to a higher demand for advanced treatment modalities that can specifically address the dense fibrous tissue associated with this type. Studies, such as one published in The Journal of Clinical and Aesthetic Dermatology in 2023, titled "A Retrospective Pragmatic Longitudinal Case-Series Clinical Study to Evaluate the Clinical Outcome of Triple-Frequency Ultrasound in Treatment of Cellulite," highlight the ongoing development and effectiveness of new technologies, such as triple-frequency ultrasound, which specifically target and show promising results for more stubborn forms of cellulite.

End Use Analysis

The clinics and beauty centers segment held the largest share in 2024. These facilities are often preferred for individuals seeking cosmetic enhancements due to their specialized focus on personal or medical aesthetic procedures, offering a discreet and dedicated environment. They are equipped with a wide range of advanced technologies and staff who are experts in addressing various beauty concerns, including cellulite. This specialized approach makes them highly attractive to patients.

The clinics and beauty centers segment is anticipated to register the highest growth rate during the forecast period, driven by the increasing consumer demand for noninvasive and minimally invasive cellulite reduction methods. As individuals prioritize treatments with less downtime and fewer risks, clinics and beauty centers are rapidly adopting innovative technologies and expanding their service offerings to meet these preferences. Many cosmetic procedures, including a significant number of minimally invasive aesthetic treatments, are commonly performed in such specialized settings. This ongoing adoption of new techniques and commitment to patient convenience continues to boost their presence in the market.

Regional Overview

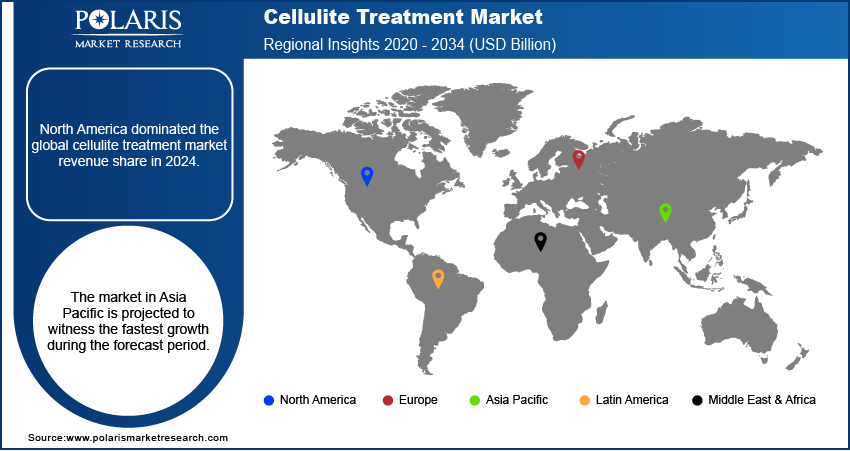

The North America cellulite treatment market held the largest share in 2024, driven by a strong consumer focus on aesthetic appeal and wellness. The region benefits from an advanced healthcare infrastructure and high disposable incomes, allowing for greater access to various cosmetic procedures. There is also a high level of consumer awareness regarding available treatments, including advanced noninvasive and minimally invasive options. This strong demand is further supported by the presence of many key players in the aesthetic industry who continuously introduce new technologies and solutions.

US Cellulite Treatment Market Insight

In North America, the US is a major contributor. The country sees a substantial demand for aesthetic and cosmetic procedures, partly due to a rising obesity rate and a growing preference for minimally invasive treatments. For instance, according to data from the Centers for Disease Control and Prevention (CDC), in 2022, obesity affected approximately 42% of adults in the US, contributing to a higher incidence of cellulite. This demographic trend, combined with ongoing advancements in treatment technologies and a strong marketing presence, continues to propel the market forward in the US.

Europe Cellulite Treatment Market Assessment

Europe represents a substantial region of the global cellulite treatment market, influenced by increasing beauty consciousness and the widespread availability of advanced aesthetic clinics. The region's aging population also contributes to the demand, as cellulite often becomes more visible with age due to changes in skin elasticity. Moreover, the prevalence of overweight individuals and sedentary lifestyles across various European countries, as noted by Eurostat, further drives the need for effective cellulite reduction solutions. This leads to a steady adoption of both topical and device-based treatments across the continent. The Germany cellulite treatment market contributes significantly in Europe. The country benefits from a robust healthcare system and a strong emphasis on aesthetic well-being among its population. There is a high demand for a range of cosmetic procedures, including those targeting cellulite, as evidenced by the large number of both surgical and nonsurgical aesthetic procedures performed. This, combined with the presence of skilled professionals and continuous advancements in treatment methods, positions Germany as an important hub for cellulite treatment in Europe.

Asia Pacific Cellulite Treatment Market Overview

The Asia Pacific cellulite treatment market is rapidly emerging, fueled by increasing disposable incomes, a growing awareness of aesthetic trends, and improving healthcare infrastructure across many developing nations in the region. There is a rising desire among both men and women to enhance their physical appearance, leading to greater adoption of various cosmetic procedures, including cellulite treatments. The region also benefits from a growing medical tourism sector, where individuals from across the world seek cost-effective yet high-quality aesthetic solutions. The China cellulite treatment market holds a significant share in Asia Pacific. The country is witnessing a surge in aesthetic consciousness, especially within its urban populations, driven by social media influence and evolving beauty standards. This has led to a notable increase in the demand for cosmetic treatments. According to the National Health Commission of China, there has been a considerable increase in outpatient cosmetic procedures over the past five years, reflecting the country's focus on new technologies and treatments for body contouring and cellulite reduction.

Key Players and Competitive Insights

The competitive landscape of the cellulite treatment market is characterized by a mix of established global players and specialized regional companies. Competition is intense, with companies constantly innovating to offer more effective, safer, and less invasive treatment options. Key strategies involve research and development into new technologies, expanding product portfolios to cover various cellulite types, and strategic partnerships to increase market reach.

A few prominent companies in the industry include Hologic, Inc. (Cynosure); Merz Pharma GmbH & Co. KGaA; Lumenis Ltd.; Cutera, Inc.; Candela Corporation; Zimmer Aesthetics; BTL Industries Inc.; Alma Lasers; Venus Concept Inc.; and Solta Medical (Bausch Health Companies Inc.). These companies actively offer a wide range of cellulite treatment solutions, including devices for noninvasive and minimally invasive procedures, as well as topical products.

Key Players

- Alma Lasers

- BTL Industries Inc.

- Candela Corporation

- Cutera, Inc.

- Hologic, Inc. (Cynosure)

- Lumenis Ltd.

- Merz Pharma GmbH & Co. KGaA

- Solta Medical (Bausch Health Companies Inc.)

- Tanceuticals LLC

- Venus Concept Inc.

- Zimmer Aesthetics

Industry Developments

March 2025: Alma Lasers announced the global debut of the latest edition of its award-winning aesthetics platform, Alma Harmony. This new multiplatform offers technological upgrades and an enhanced intelligent interface for personalized patient treatments.

February 2025: Merz Aesthetics launched Ultherapy PRIME® in the EMEA at the 2025 IMCAS World Congress. This new platform represents the next generation of nonsurgical skin lifting treatments.

Cellulite Treatment Market Segmentation

By Procedure Type Outlook (Revenue – USD Billion, 2020–2034)

- Noninvasive Treatment

- Minimally Invasive Treatment

- Topical Treatment

By Cellulite Type Outlook (Revenue – USD Billion, 2020–2034)

- Soft Cellulite

- Hard Cellulite

- Edematous Cellulite

By End-use Outlook (Revenue – USD Billion, 2020–2034)

- Hospitals

- Clinics & Beauty Centers

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Cellulite Treatment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.94 billion |

|

Market Size in 2025 |

USD 2.15 billion |

|

Revenue Forecast by 2034 |

USD 5.45 billion |

|

CAGR |

10.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.94 billion in 2024 and is projected to grow to USD 5.45 billion by 2034

The global market is projected to register a CAGR of 10.9% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include Hologic, Inc. (Cynosure); Merz Pharma GmbH & Co. KGaA; Lumenis Ltd.; Cutera, Inc.; Candela Corporation; Zimmer Aesthetics; BTL Industries Inc.; Alma Lasers; Venus Concept Inc.; and Solta Medical (Bausch Health Companies Inc.).

The noninvasive treatment segment accounted for the largest share of the market in 2024.

The minimally invasive treatment segment is expected to witness the fastest growth during the forecast period.