Chromatography Resin Market Size, Share, Trends, Industry Analysis Report

By Type (Natural, Synthetic, Inorganic), By Technique, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 123

- Format: PDF

- Report ID: PM1247

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

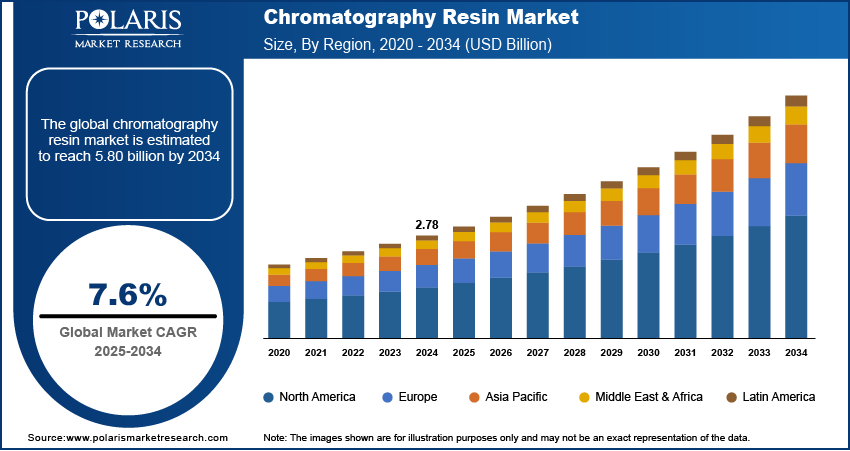

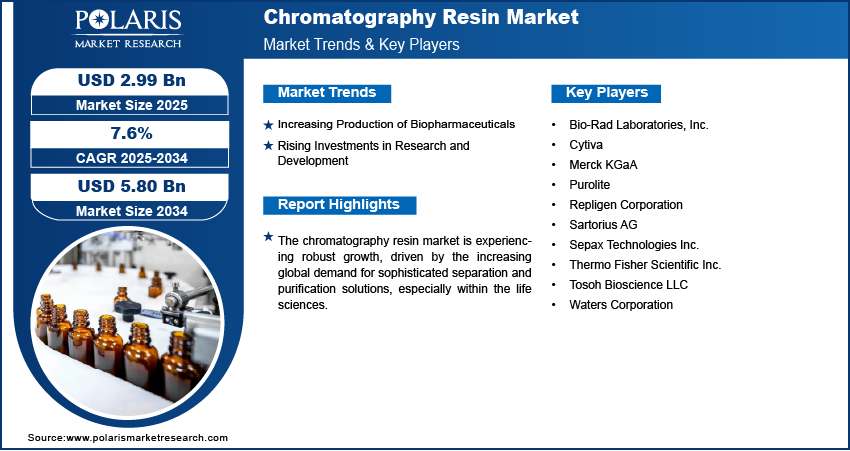

The global chromatography resin market size was valued at USD 2.78 billion in 2024 and is anticipated to register a CAGR of 7.6% from 2025 to 2034. The market growth is primarily driven by the growing demand for biopharmaceuticals, especially for producing monoclonal antibodies and vaccines.

Key Insights

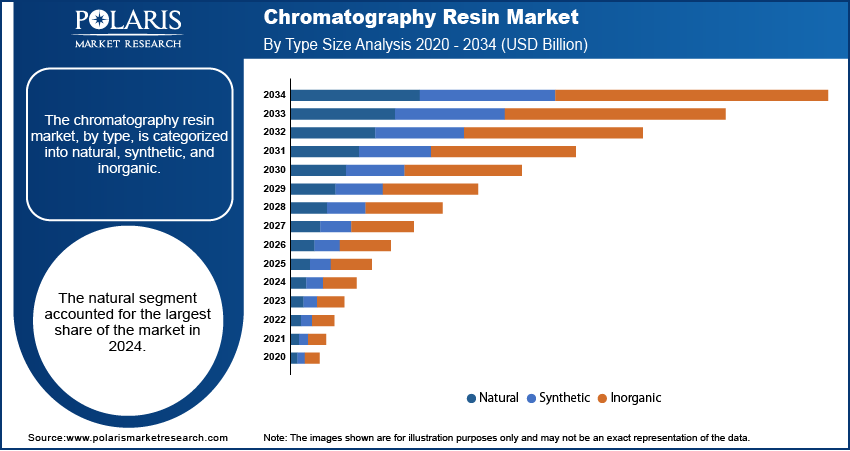

- By type, the natural segment held the largest share in 2024. Their dominance is attributed to their excellent biocompatibility and minimal non-specific binding, which are highly valued in the purification of sensitive biological molecules in the biopharmaceutical sector and other life science applications.

- By technique, the ion exchange chromatography segment held the largest share in 2024. Its widespread use and leading position are attributed to its broad applicability, cost-effectiveness, and established role in efficiently purifying a diverse range of charged biomolecules, making it fundamental in both laboratory and industrial settings.

- By end use, the pharmaceutical & biotechnology segment held the largest share in 2024. This is a reflection of the critical and indispensable role chromatography resins play in every stage of drug discovery, development, and high-volume manufacturing processes for various therapeutics, ensuring the purity and safety of pharmaceutical products.

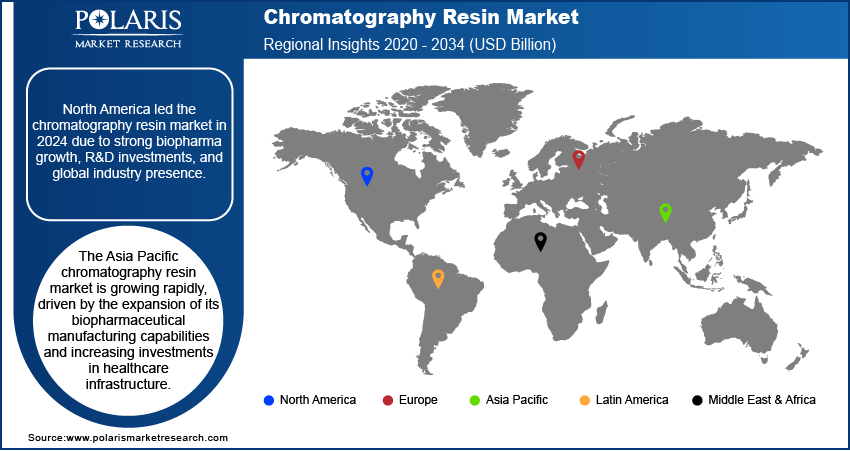

- By region, North America led the global chromatography resin market in 2024. This leadership is primarily driven by its highly developed biopharmaceutical industry, significant investments in research and development, and the presence of numerous global pharmaceutical and biotechnology companies in the region.

Industry Dynamics

- The increasing development and production of biologics, such as monoclonal antibodies, vaccines, and gene therapies, significantly boost the demand for chromatography resins.

- Increased funding and activities in life sciences, particularly in drug discovery and development, drive the need for advanced separation and purification technologies.

- The rising shift toward personalized treatments and high-throughput screening methods requires more sophisticated and efficient chromatography solutions.

- The strict quality control and purity requirements for pharmaceutical and biotechnology products necessitate the use of high-performance chromatography resins.

Market Statistics

- 2024 Market Size: USD 2.78 billion

- 2034 Projected Market Size: USD 5.80 billion

- CAGR (2025–2034): 7.6%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Chromatography resins are crucial materials used in separation science to purify and separate various components from complex mixtures. These resins are typically made from porous materials that interact with molecules, allowing for their isolation based on properties such as size, charge, or binding affinity. They are essential in many industries, including pharmaceuticals, biotechnology, and food & beverages.

The continuous evolution and adoption of advanced and large and small scale bioprocessing technologies are significant drivers for the chromatography resin market growth. Modern biomanufacturing increasingly favors approaches that offer greater efficiency, higher throughput, and reduced processing times, such as continuous chromatography and single-use systems. These innovative methods necessitate chromatography resins that possess enhanced durability, improved binding capacities, and faster flow rates to maximize productivity and streamline the purification workflow. The development of resins compatible with automated and integrated systems is crucial for meeting the demands of high-volume production of complex biologics.

The growing global emphasis on the development and production of biosimilars and generic versions of biologics is a substantial driver for the chromatography resin industry. As patents for blockbuster biologic drugs expire, there is an increasing push to create more affordable and accessible versions of these life-saving medicines. Manufacturing biosimilars requires robust and cost-effective purification processes that can achieve comparable purity and safety profiles to the original biologic. Chromatography resins play a central role in these purification strategies, enabling the necessary separation and isolation of target molecules at scale.

Drivers and Opportunities

Increasing Production of Biopharmaceuticals: The rapid expansion of the biopharmaceutical sector is a primary force behind the growth of the chromatography resin market. Biologics, including therapeutic proteins, antibodies, and vaccines, require extensive purification to ensure their safety, efficacy, and quality before they can be used in patients. Chromatography resins are indispensable in these downstream processing steps, enabling the separation and isolation of target molecules from complex mixtures with high purity. The increasing prevalence of chronic diseases and the development of novel treatments based on biologics amplify this demand.

Rising Investments in Research and Development: Significant investments in R&D activities across the pharmaceutical and biotechnology industries are a crucial driver for the market. These investments are aimed at discovering new drugs, developing innovative therapies, and improving existing manufacturing processes. As research becomes more complex and the molecules being studied are more delicate, there is a constant need for highly efficient and selective separation techniques. Chromatography resins play a vital role in various stages of R&D, from early-stage drug discovery and preclinical studies to clinical trials and process optimization.

The World Health Organization (WHO) frequently reports on global efforts in vaccine development, such as their "A Brief History of Vaccination" article, which details the ongoing advancements and the continuous need for research in this area. Such sustained global R&D efforts, often supported by government and public health organizations, lead to the creation of new biological entities that require advanced purification. This ongoing commitment to R&D directly fuels the demand for high-performance chromatography resins.

Segmental Insights

Type Analysis

Based on type, the segmentation includes natural, synthetic, and inorganic. The natural segment held the largest share in 2024. Natural resins, often derived from sources such as agarose and dextran, are highly valued for their exceptional biocompatibility and minimal non-specific binding, which are critical properties in the purification of sensitive biological molecules. Their widespread adoption is particularly evident in the biopharmaceutical industry, where they are essential for the production of high-purity therapeutic proteins, vaccines, and monoclonal antibodies. The well-established performance characteristics, coupled with their ability to preserve the integrity of complex biomolecules during separation, have cemented their dominant position. Furthermore, as industries increasingly prioritize sustainable and environmentally friendly manufacturing processes, the appeal of naturally derived resins continues to grow, supporting their sustained leading presence in the overall market landscape.

The synthetic segment is anticipated to register the highest growth rate during the forecast period, primarily driven by advancements in polymer chemistry, leading to the development of synthetic resins with enhanced mechanical strength, chemical stability, and tunable surface chemistries. These characteristics make synthetic resins highly versatile and suitable for demanding applications, including various forms of ion exchange and mixed-mode chromatography, which are gaining traction for their ability to offer superior resolution and selectivity. Their robust nature allows for greater reusability and enables high-throughput purification processes, which are increasingly important in modern industrial and research settings seeking to optimize efficiency and reduce operational costs.

Technique Analysis

Based on technique, the segmentation includes ion exchange, affinity, hydrophobic interaction, size exclusion, mixed mode, and others. The ion exchange segment held the largest share in 2024. This technique relies on the reversible adsorption of charged molecules to charged resin surfaces, making it highly effective for separating components based on their charge properties. Its versatility, scalability for both laboratory and industrial production, and relatively low cost compared to some other advanced techniques have made it a foundational method in pharmaceutical manufacturing, biotechnology, and even water treatment chemicals. The continuous demand for high-purity biological products, coupled with the technique's ability to be finely tuned for specific separation challenges, ensures its continued dominance in the chromatography landscape.

The mixed-mode chromatography segment is anticipated to record the highest growth rate during the forecast period. This accelerated expansion is attributed to its unique ability to combine multiple separation mechanisms, such as ion exchange, hydrophobic interaction, and hydrogen bonding, within a single resin. This multimodal approach offers superior selectivity and resolution, allowing for the purification of highly complex and challenging biomolecules, often in fewer steps than traditional single-mode techniques. The increasing complexity of new biopharmaceutical drugs, including gene therapies and bispecific antibodies, necessitates more sophisticated purification methods that mixed-mode chromatography can provide.

End Use Analysis

Based on end use, the segmentation includes pharmaceutical & biotechnique, food & beverage, water & environmental analysis, and other end uses. The pharmaceutical & biotechnique segment held the largest share in 2024. The increasing global burden of chronic and infectious diseases fuels a continuous demand for new therapeutics, especially biologics such as monoclonal antibodies and vaccines. Chromatography resins are indispensable in the purification processes of these complex molecules, ensuring the high purity and safety required by stringent regulatory standards. The substantial investments in research and development by pharmaceutical and biotech companies, aimed at developing innovative treatments and improving existing ones, further solidify this segment's dominant position.

The water and environmental analysis segment is anticipated to exhibit the highest growth rate during the forecast period. This accelerated growth is primarily driven by increasing global concerns regarding water quality and environmental pollution. Stricter environmental regulations worldwide are mandating more comprehensive and sensitive analysis of water, air, and soil samples to detect a wide array of contaminants, pollutants, and emerging micropollutants. Chromatography resins are crucial in these analyses for sample preparation, pre-concentration, and the separation of various chemical species, enabling accurate identification and quantification of harmful substances.

Regional Analysis

The North America chromatography resin market accounted for the largest share in 2024, driven by its highly developed biopharmaceutical industry and strong emphasis on research and development. The region benefits from a robust healthcare infrastructure, significant investments in life sciences, and the presence of numerous leading pharmaceutical and biotechnology companies. These factors collectively contribute to a high demand for advanced separation and purification solutions, which are essential for the production of biologics, vaccines, and personalized medicines. The adoption of advanced chromatography technologies and a continuous focus on innovation further propel the region's position.

U.S. Chromatography Resin Market Insight

The U.S. is a significant contributor to the North America chromatography resin market, largely due to its leading role in biopharmaceutical innovation and extensive R&D capabilities. The country's strong commitment to healthcare expenditure and the presence of global pharmaceutical leaders drive the constant need for high-purity materials in drug discovery services and manufacturing. The increasing development and commercialization of complex biologics and biosimilars necessitate the use of advanced chromatography resins. Furthermore, strict regulatory requirements for product purity and safety in the U.S. reinforce the demand for high-performance separation techniques across various applications.

Europe Chromatography Resin Market Trends

Europe represents a key region in the global chromatography resin market, characterized by its mature pharmaceutical industry and a strong focus on scientific research. The region's well-established academic and research institutions, coupled with significant public and private funding for biotechnology initiatives, contribute to a steady demand for chromatography resins. European countries are actively engaged in the development of novel therapeutic drugs and biosimilars, which require sophisticated purification methods. The presence of major chromatography resin manufacturers and a proactive approach toward adopting advanced bioprocessing technologies further support the market's expansion in this region.

The Germany chromatography resin market stands out as a major country. Its leadership is attributed to the substantial presence of global pharmaceutical companies and extensive research and development facilities. The country's focus on high-quality manufacturing standards and continuous innovation in biopharmaceutical production directly influence the demand for high-performance chromatography resins. Furthermore, Germany's efforts in environmental analysis and food safety play a critical role, requiring advanced separation techniques to meet stringent regulations and ensure product integrity.

Asia Pacific Chromatography Resin Market Overview

The Asia Pacific market is rapidly growing, driven by the expansion of its biopharmaceutical manufacturing capabilities and increasing investments in healthcare infrastructure. Countries in the region are witnessing a surge in drug discovery and development activities, particularly in the production of biosimilars and generic pharmaceuticals. The growing prevalence of chronic diseases and rising demand for accessible healthcare are fueling the need for efficient and cost-effective purification solutions. Additionally, the increasing focus on food safety and environmental monitoring contributes to the demand for chromatography resins across various applications in the region.

China Chromatography Resin Market Insights

China dominates the Asia Pacific market, due to its rapidly expanding pharmaceutical sector and substantial government support for biotechnology. The country has become a major hub for biopharmaceutical manufacturing and contract research, leading to a high demand for advanced separation technologies. Extensive investments in building large-scale production facilities and research centers, coupled with a growing focus on developing domestic biopharmaceutical capabilities, contribute to the robust adoption of chromatography resins. This strong industrial growth and emphasis on R&D are key factors propelling the market forward in China.

Key Players and Competitive Insights

The chromatography resin market features a competitive landscape with several key players vying for position, primarily driven by ongoing advancements in biopharmaceutical production and stringent purity requirements. These major participants focus on continuous innovation in resin technologies, aiming to enhance selectivity, binding capacity, and chemical stability, which are crucial for efficient and scalable purification processes. Companies often differentiate themselves through specialized product portfolios, catering to specific chromatography techniques such as affinity, ion exchange, and mixed-mode, or by offering custom solutions for unique bioprocessing challenges.

A few companies in the industry are Bio-Rad Laboratories, Cytiva, Merck KGaA, Purolite, Repligen Corporation, Sartorius AG, Sepax Technologies Inc., Thermo Fisher Scientific Inc., Tosoh Bioscience LLC, and Waters Corporation.

Key Players

- Bio-Rad Laboratories, Inc.

- Cytiva

- Merck KGaA

- Purolite

- Repligen Corporation

- Sartorius AG

- Sepax Technologies Inc.

- Thermo Fisher Scientific Inc.

- Tosoh Bioscience LLC

- Waters Corporation

Chromatography Resin Industry Developments

February 2025: Thermo Fisher Scientific announced its plans to acquire the purification and filtration business from Solventum, a move expected to enhance its capabilities in the bioprocessing and laboratory products space.

Chromatography Resin Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Natural

- Synthetic

- Inorganic

By Technique Outlook (Revenue – USD Billion, 2020–2034)

- Ion Exchange

- Affinity

- Hydrophobic Interaction

- Size Exclusion

- Mixed Mode

- Others

By End‑use Outlook (Revenue – USD Billion, 2020–2034)

- Pharmaceutical & Biotechnique

- Food & Beverage

- Water & Environmental Analysis

- Other End Uses

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Chromatography Resin Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.78 billion |

|

Market Size in 2025 |

USD 2.99 billion |

|

Revenue Forecast by 2034 |

USD 5.80 billion |

|

CAGR |

7.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.78 billion in 2024 and is projected to grow to USD 5.80 billion by 2034.

The global market is projected to register a CAGR of 7.6% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include Bio-Rad Laboratories, Cytiva, Merck KGaA, Purolite, Repligen Corporation, Sartorius AG, Sepax Technologies Inc., Thermo Fisher Scientific Inc., Tosoh Bioscience LLC, and Waters Corporation.

The natural segment accounted for the largest share of the market in 2024.

The ion exchange segment is expected to witness the fastest growth during the forecast period.