Clinical Communication and Collaboration Market Share, Size, Trends, & Industry Analysis Report

By Deployment (Hosted, On-premise), By Component (Solution, Services), By End-use (Hospitals, Clinical Labs, Physicians), By Region, And Segment Forecasts, 2025 - 2034

- Published Date:Aug-2025

- Pages: 130

- Format: PDF

- Report ID: PM4220

- Base Year: 2024

- Historical Data: 2020 - 2023

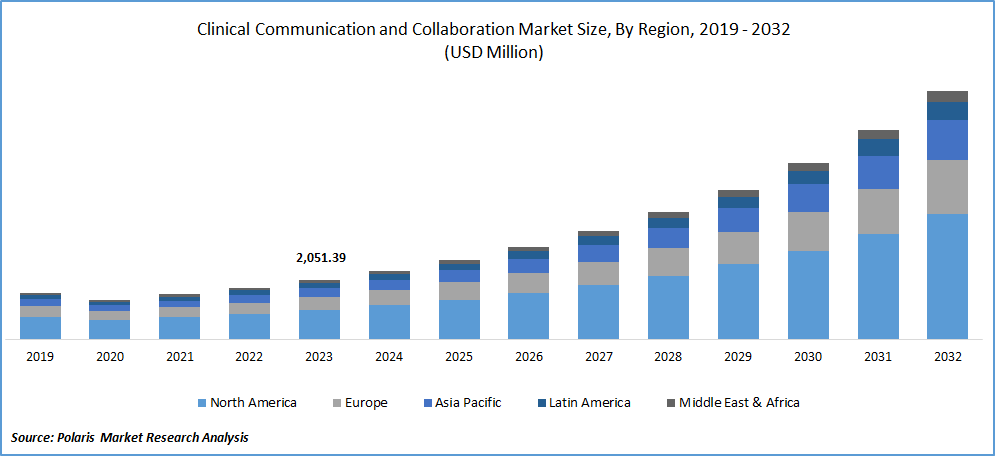

The Clinical Communication and Collaboration Market is expected to reach USD 2.01 billion in 2024, growing at a CAGR of 10.3% through 2034. The market is expanding due to the growing need for real-time communication, digital patient engagement, and the adoption of mobile-first clinical tools across healthcare institutions.

The Clinical Communication and Collaboration Market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

The healthcare industry is poised for growth with the ongoing digital transformation. Involvement in the digital health ecosystem empowers healthcare professionals with new technologies, enabling expansion into novel avenues. Additionally, the emergence of data-driven technologies is driving digitization and fostering automation throughout the healthcare sector. These technological advancements streamline communication and coordination among healthcare professionals.

To Understand More About this Research: Request a Free Sample Report

Smart devices bring substantial advantages to patients, facilitating more effective communication with care teams, improved access to medical records, and efficient completion of administrative tasks. Healthcare professionals now rely on dedicated handheld devices and smartphones designed for the healthcare ecosystem. This approach mitigates the challenges associated with device fragmentation, addressing past issues where clinicians had to use multiple devices like pagers and cell phones for communication and collaboration.

AI-driven telemedicine services represent a transformative force in enhancing healthcare services. This innovation is anticipated to revolutionize the entire value chain of patient care delivery and clinical practice by introducing new models of support and care. AI-powered telemedicine is employed to reduce hospital wait times, and predictive analytics play a role in identifying specialists more efficiently for telemedicine patients. The World Health Organization (WHO) recognizes the precise augmentation of AI in telemedicine across various domains, including tele-radiology, tele-pathology, and tele-dermatology.

Industry Dynamics

Growth Drivers

Integration of Mobile Devices Propels the Demand for Clinical Communication and Collaboration (CC&C) Solutions

The introduction of clinical mobility has eradicated error-prone procedures and manuals, replacing them with digital solutions that streamline processes, enhance patient identification accuracy, and elevate the quality of patient care. Collaboration tools facilitate the digital capture of information, enabling real-time transfer to clinical staff and reducing errors. Recent technological advances have significantly improved communication and coordination among healthcare professionals.

Clinical mobility has alleviated the strain on the healthcare system by enhancing workflow efficiencies, improving patient care, and optimizing the utilization of limited resources. Collaboration tools play a crucial role in digitally capturing information and transferring data in real-time to clinical staff, thereby minimizing errors. The adoption of Clinical Communication and Collaboration market (CC&C) systems has surged with the increased integration of smart devices in hospital settings.

Report Segmentation

The market is primarily segmented based on deployment, component, end use, and region.

|

By Deployment |

By Component |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Deployment Analysis

On-Premise Segment Held the Largest Share in 2024

The on-premise segment held the largest share. Healthcare organizations have established their IT infrastructure to address the increasing demand for data. Historically, these organizations were hesitant to embrace cloud-based deployment, showing a preference for on-premise solutions, where IT administrators have more control over physical data centers. Nevertheless, the demand for on-premise solutions is expected to decrease in the forecast period due to the elevated maintenance costs linked with this approach.

Cloud-based storage options provide a scalable and flexible environment at a lower cost compared to on-premise deployments, making them attractive to covered entities. The increasing presence of remotely located teams in need of a cloud-based platform for seamless sharing, collaboration, and communication across all locations is anticipated to drive the growth of this segment in the coming years. The cloud also enables healthcare professionals to access collaborative tools through their smartphones, offering flexibility for remote access and contributing to the adoption of cloud-based software. Additionally, it has enhanced the capability to record events and allows others to review the proceedings later.

Hosted segment is projected to grow at the fastest rate. Hosted solutions present a cost-effective alternative for healthcare organizations compared to maintaining and managing their own infrastructure. Rather than investing in costly hardware and dedicated IT resources, healthcare providers can access the required services through the cloud, offering a generally more affordable and scalable solution.

By End Use Analysis

Hospitals Segment Registered the Largest Market Share in 2024

The hospitals segment accounted for the largest share. The surge in COVID-19 cases has underscored the significance of contactless communication and collaboration in hospitals. Various companies have responded by providing collaboration solutions to organizations dealing with the pandemic at reduced or zero costs. Microsoft Corporation extended an offer to the United Kingdom National Health Service (NHS) staff to utilize Microsoft Teams for quick and efficient communication with their colleagues.

The Joint Commission has reported that 70% of medical errors stem from communication breakdowns. Given the intricate architectural structure of hospitals, there is a critical need for efficient communication and coordination within these facilities. The integration of clinical mobility into the hospital ecosystem has become an added advantage for enhancing operational efficiency. Additionally, it has been observed that technology-savvy patients derive comfort from using technology, bring their data with them, and are willing to share electronic health metrics with healthcare providers.

The clinical labs segment will grow at a rapid pace. Clinical laboratories generate a large volume of data that requires integration into electronic health record (EHR) systems. Clinical communication and collaboration (CC&C) solutions can play a crucial role in streamlining the integration of lab results and other pertinent data into EHRs. This facilitates healthcare providers in accessing and reviewing comprehensive patient information from a centralized location.

By Component Analysis

Solution Segment Held the Significant Market Revenue Share in 2024

The solution segment held the largest share. Solution providers are incorporating IoT into collaboration solutions to enhance operational efficiency and patient care in healthcare settings. The healthcare IoT ecosystem is configured to include well-ness applications, wearables, beacons, & smart devices. These technologies assist patients in adhering to their care programs and enable analytics. Hospitals utilize mobile phones & Bluetooth beacons to help patients and visitors navigate their large campuses. For instance, Boston Children’s Hospital has a way-finding application called MyWay, which provides turn-by-turn directions across its 12-building healthcare campus.

The service segment is projected to grow at a substantial pace. The introduction of a new communication and collaboration system in a healthcare environment necessitates training for staff members to operate the platform proficiently. Service providers offer training programs and ongoing support to ensure healthcare professionals can effectively utilize the Communication and Collaboration (CC&C) tools, optimizing their advantages and reducing disruptions during the transition phase.

Regional Insights

North America Region Held the Largest Share of the Global Market in 2024

The North America region dominated the market. The growth of the regional market is driven by the increasing healthcare spending in the U.S., where a significant number of hospitals have adopted clinical communication and collaboration solutions to advance their digital healthcare objectives. For instance, Columbia County Health System implemented collaboration tools, facilitating real-time conversations among care teams located in different geographical areas.

The Asia Pacific region is projected to grow at a rapid pace. The surge in patients utilizing telemedicine platforms and applications in response to the COVID-19 outbreak in the region has contributed to the increased adoption of digital health platforms in countries like Indonesia, Australia, & Singapore. Additionally, regional governments have supported the broader implementation of telemedicine as a tool to contain the spread of the virus, further driving its adoption.

Key Market Players & Competitive Insights

The demand for Clinical Communication and Collaboration (CC&C) solutions is projected to stay robust, with vendors seeking to distinguish themselves through partnerships and innovations. For instance, in May 2022, Mobile Heartbeat, a clinical collaboration software provider, revealed a collaboration with Stryker Corporation. This collaborative integration primarily aims to enhance the transmission of alerts from Stryker's iBed Wireless system to Mobile Heartbeat's extensive collaboration platform, MH-CURE.

Some of the major players operating in the global market include:

- Avaya LLC

- Cisco Systems, Inc.

- Halo Health Systems

- HILLROM & WELCH ALLYN (Baxter International)

- Intel Corporation

- Microsoft

- NEC Corporation

- Oracle

- Plantronics, Inc.

- Spok Holdings Inc.

- TNS Inc. (AGNITY Inc.)

- Vocera Communications

Recent Developments

- September 2025: Oracle launched its AI Center of Excellence for Healthcare. With the new centre, Oracle aims to help its customers maximize the value of AI across clinical and operational workflows.

- July 2025: Cisco revealed its collaboration with Peterborough Regional Health Centre (PRHC). The company stated that the partnership focuses on the development of a new Reactivation Care Centre. The center will be aimed at providing short-term recovery for patients who are shifting from the hospital to home.

- In March 2025 – Microsoft launches “Dragon Copilot” for healthcare professionals

- In April 2023, Mobile Heartbeat announced a new partnership with Akkadian Labs, a provider of advanced unified communications (UC) provisioning automation solutions for managed service providers and enterprises.

Clinical Communication and Collaboration Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 2.2 billion |

|

Revenue forecast in 2034 |

USD 5.2 billion |

|

CAGR |

10.30% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Power Source, By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Explore the market dynamics of the 2025 Clinical Communication and Collaboration Market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Rersearch Industry Reports. The analysis of Clinical Communication and Collaboration Market extends to a comprehensive market forecast up to 2034, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis.

Browse Our Bestselling Reports:

Healthcare Data Monetization Market Size, Share Research Report

Medical Device Testing Services Market Size, Share Research Report

Ophthalmic Drugs Market Size, Share Research Report

Post-Consumer Recycled Plastics Market Size, Share Research Report

Connected Medical Devices Market Size, Share Research Report

FAQ's

The global clinical communication and collaboration market size is expected to reach USD 5.2 billion by 2034

Avaya, Cisco Systems, Halo Health, Intel Corporation are the top market players in the market.

North America region contribute notably towards the global Clinical Communication and Collaboration Market.

The global clinical communication and collaboration market is expected to grow at a CAGR of 10.30% during the forecast period.

Deployment, component, end use, and region are the key segments in the Clinical Communication and Collaboration Market.