Cognitive Supply Chain Market Share, Size, Trends, Industry Analysis Report

By Technology (Machine Learning, Internet of Things, Others); By Deployment (On premise, Cloud); By End Use Industry; By Region; Segment Forecast, 2023- 2032

- Published Date:Nov-2023

- Pages: 118

- Format: PDF

- Report ID: PM3887

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

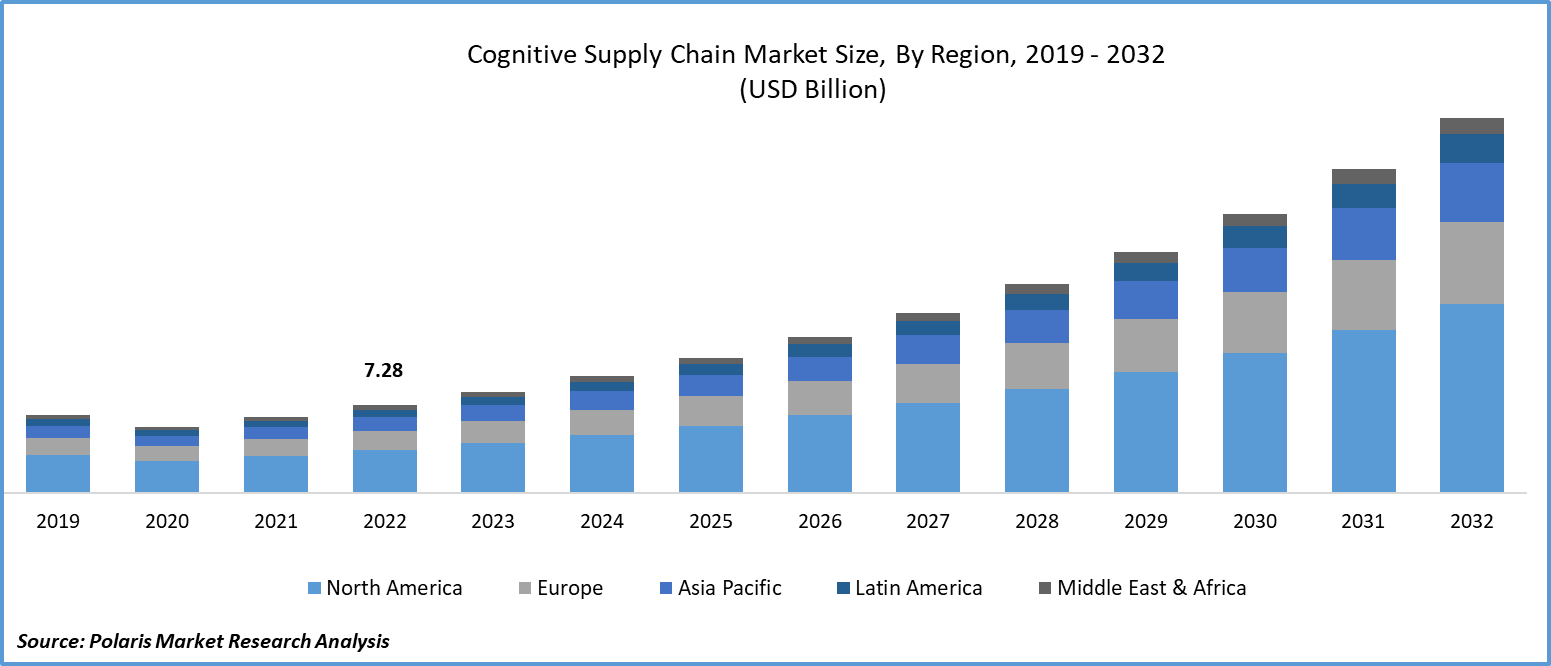

The global cognitive supply chain market was valued at USD 7.28 billion in 2022 and is expected to grow at a CAGR of 15.6% during the forecast period.

The rapid growth of e-commerce, especially during and post-pandemic, has accelerated the need for efficient and agile supply chains capable of handling large volumes of orders and diverse delivery requirements, making cognitive solutions crucial. Industries like pharmaceuticals and food must meet strict regulatory standards. Cognitive supply chain technologies ensure compliance by providing precise tracking, quality control, and transparency, meeting the rigorous requirements of these sectors.

To Understand More About this Research: Request a Free Sample Report

In addition, several companies are collaborating with other players to enhance their offerings to cater to the growing consumer demand.

- In May 2023, Accenture collaborated with Blue Yonder to provide cutting-edge technology and solutions, empowering organizations to revolutionize their supply chains, enhancing both efficiency and profitability.

As sustainability gains momentum, cognitive supply chain solutions play a pivotal role in reducing waste, optimizing transportation routes, and supporting environmentally responsible practices. This aligns with both corporate sustainability goals and the global shift towards greener supply chain operations. In an era of expanding global supply chains, cognitive supply chain solutions offer the opportunity for end-to-end visibility and control over complex international operations. This helps companies manage intricate supply networks efficiently.

The use of advanced predictive analytics driven by AI provides opportunities for companies to anticipate and prepare for supply chain disruptions, optimize inventory levels, and enhance demand forecasting accuracy. This proactive approach results in better resource allocation and cost reduction. Cognitive supply chain solutions enable dynamic inventory management. This ensures companies maintain optimal stock levels, reduce excess inventory, and minimize the risk of stockouts while mitigating waste and holding costs.

Post-COVID-19, the cognitive supply chain market has witnessed notable changes. Companies are prioritizing resilience and risk mitigation, leveraging cognitive solutions to enhance supply chain visibility and adaptability. Remote work integration has gained momentum, along with heightened demand forecasting capabilities to respond to shifting market dynamics. Supply chain realignment and diversification strategies are on the rise, while sustainability practices and data-driven decision-making have become central. Digital twin technology, regulatory compliance, last-mile optimization, and blockchain integration are key trends. Cognitive supply chain solutions are instrumental in helping companies recover and navigate the post-pandemic business landscape with greater agility and insight.

For Specific Research Requirements, Request for a Customized Research Report

Growth Drivers

- Data explosion, AI and machine learning advancements, and demand for real-time visibility is projected to spur the market demand

The proliferation of data in today's digital age, generated by sensors, IoT devices, and various supply chain processes, creates a vast pool of information. Cognitive supply chain solutions can harness this data to extract meaningful insights, driving smarter decision-making.

Ongoing developments in AI and machine learning algorithms enable cognitive supply chain solutions to perform increasingly complex tasks. These include more accurate demand forecasting, predictive maintenance, and optimization of supply chain operations, leading to enhanced overall efficiency.

Modern consumers and businesses demand real-time visibility into the supply chain. This has become essential for effectively responding to disruptions, shifting cognitive supply chain market demands, and ensuring seamless operations.

Report Segmentation

The market is primarily segmented based on technology, deployment, end use industry, and region.

|

By Technology |

By Deployment |

By End Use Industry |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Technology Analysis

- Internet of Things segment accounted for a significant share in 2022

The Internet of Things segment accounted for a significant share in 2022. IoT is a transformative force in cognitive supply chain management, offering real-time data and connectivity. It enables continuous tracking of assets, inventory, and shipments, granting valuable insights for decision-making. Predictive maintenance, powered by IoT sensors, minimizes downtime and maintenance expenses. Automated inventory tracking ensures optimal stock levels and minimizes shortages. IoT-driven demand forecasting aligns production with actual demand, improving efficiency. Quality control, route optimization, and cold chain management benefit from IoT, ensuring product integrity and reducing transportation costs. Supplier collaboration, sustainability monitoring, and resilience enhancement are key facets, further advancing supply chain efficiency and adaptability while boosting customer insights.

By Deployment Analysis

- On-premise emerged as the largest segment in 2022

The on-premise emerged as the largest segment in 2022. On-premise deployment for cognitive supply chain solutions involves hosting software and infrastructure within a company's physical facilities, offering control over data, customization, and robust security. This approach suits businesses with stringent data privacy requirements and customization needs. However, it comes with higher initial and ongoing costs, as companies must invest in hardware, maintenance, and data security. Scalability can be more challenging, and accessibility may be limited, making it less suitable for remote workforces.

By End Use Industry Analysis

- Manufacturing segment accounted for a significant share in 2022

The manufacturing segment accounted for a significant share in 2022. Cognitive supply chain solutions are reshaping manufacturing. By leveraging AI, machine learning, and advanced analytics, they predict equipment maintenance needs, enhance demand forecasting, and ensure real-time quality control. Dynamic inventory management optimizes stock levels, while supplier collaboration streamlines procurement. AI-powered production processes improve efficiency, reducing waste, and enabling customization. Compliance and traceability are ensured, and supply chains become more sustainable, with optimized transportation routes. This adaptability proved crucial during the COVID-19 pandemic. For global manufacturers, cognitive supply chains provide visibility and control over complex international operations, resulting in increased competitiveness and resilience.

Regional Insights

- North America emerged as the largest region in 2022

North America emerged as the largest region in 2022. The U.S. is at the forefront of adopting AI and IoT technologies in supply chain management. Companies are harnessing the power of artificial intelligence and the Internet of Things to gain real-time insights into their supply chains. AI-driven analytics and machine learning models are being utilized to optimize routes, enhance demand forecasting, and refine inventory management. These technologies enable supply chains to operate with greater agility and responsiveness. The exponential growth of e-commerce, accelerated by the COVID-19 pandemic, has propelled the demand for more efficient supply chain solutions. In North America, the rapid expansion of online retail and direct-to-consumer delivery models has intensified the need for advanced cognitive supply chain systems. These technologies facilitate the seamless movement of goods from distribution centers to end customers while ensuring on-time deliveries and reducing logistics costs.

The cognitive supply chain market in Asia-Pacific is experiencing robust growth, propelled by several key drivers. Countries like China, Japan, South Korea, and India are embracing cognitive supply chain technologies to manage complex logistics networks and meet growing e-commerce demands. Asia's manufacturing powerhouses utilize these solutions to optimize production and enhance supply chain visibility. Emerging markets in the region leverage cognitive supply chain tech to overcome traditional challenges. Logistics and transportation benefit from AI-driven route planning, while retail and consumer goods sectors rely on dynamic inventory management. Regulatory compliance, sustainability, and supply chain resilience are additional drivers of adoption.

Key Market Players & Competitive Insights

The cognitive supply chain sector exhibits a fragmented landscape, and competition is expected to intensify due to the active participation of numerous players. Prominent firms in this industry consistently introduce innovative strategies to bolster their market position. These key players prioritize strategies like forming partnerships and fostering collaborations to gain a competitive edge over their peers and establish a significant market presence.

Some of the major players operating in the global market include:

- Accenture plc

- Amazon Web Services

- C.H. Robinson Worldwide, Inc.

- Honeywell International Inc.

- IBM Corporation

- Intel Corporation

- JDA Software

- Microsoft Corporation

- NVIDIA Corporation

- Oracle Corporation

- SAP SE

- SAS Institute Inc.

- Savi Technology

- Siemens AG

- Terra Technology

Recent Developments

- In May 2023, Resilinc unveiled a strategic growth investment from Vista Equity Partners, aimed at bolstering product innovation, talent acquisition, and go-to-market operations, in response to the escalating demand for supply chains that are not only more resilient, but also sustainable, secure, and transparent.

- In March 2021, Cardinal Health joined forces with FourKites to establish an advanced cognitive supply chain. This collaboration is designed to improve the monitoring of medical equipment, pharmaceutical products, first aid supplies, and personal protective equipment (PPE) during their transit to hospitals, pharmacies, and various care facilities across the globe.

Cognitive Supply Chain Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 8.40 billion |

|

Revenue forecast in 2032 |

USD 31.10 billion |

|

CAGR |

15.6% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019-2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Technology, By Deployment, By End Use Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |