Commercial and Recreational Vehicle Market Size, Share, Trend, Industry Analysis Report

By Vehicle Type (Commercial Vehicle, Recreational Vehicle), By Fuel Type, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5952

- Base Year: 2024

- Historical Data: 2020-2023

Overview

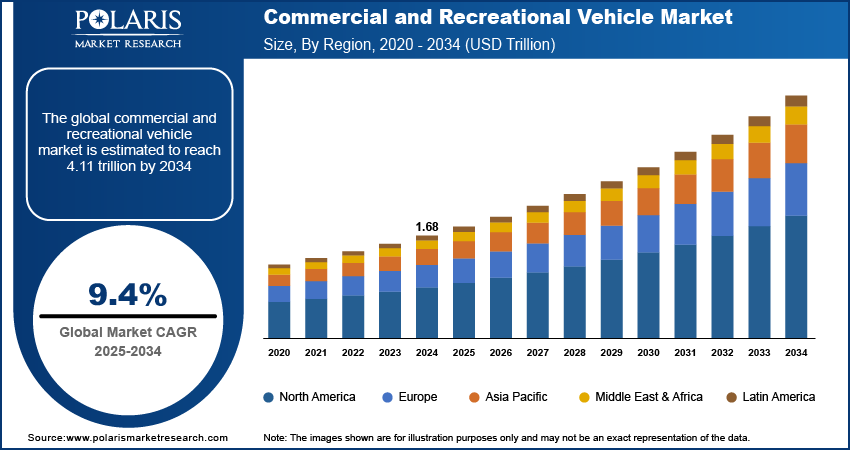

The global commercial and recreational vehicle market size was valued at USD 1.68 trillion in 2024, growing at a CAGR of 9.4% from 2025 to 2034. Key factors driving demand for commercial and recreational vehicle include the growth in online shopping, which has increased last-mile delivery needs, prompting fleet expansion of light commercial vehicles for urban and suburban logistics operations.

Key Insights

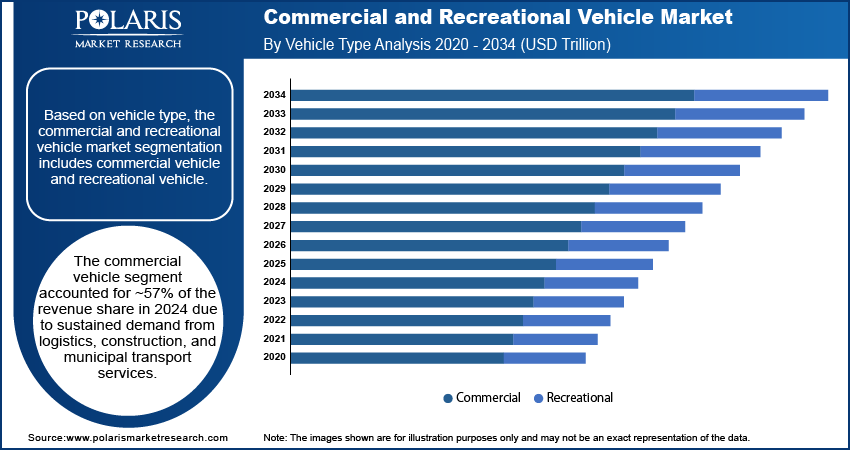

- The commercial vehicle segment accounted for ~57% of the revenue share in 2024.

- The diesel segment dominated the revenue share in 2024.

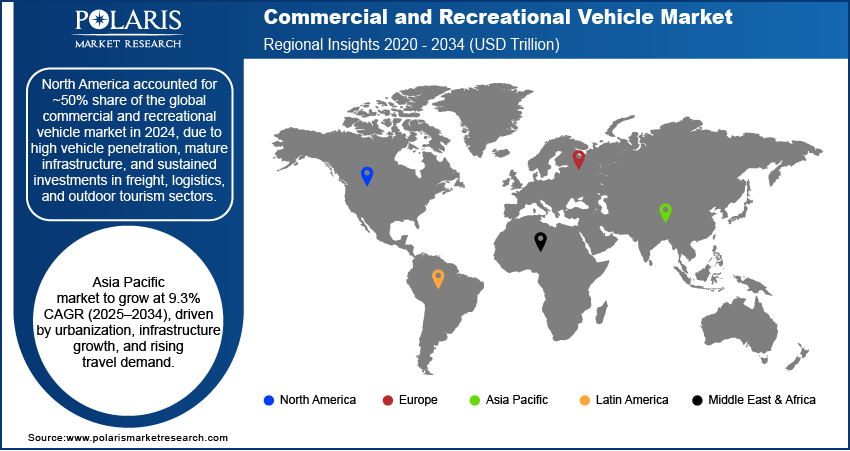

- North America accounted for ~50% share of the global commercial and recreational vehicle market in 2024.

- The U.S. held the dominant share of North America commercial and recreational vehicle landscape in 2024.

- The market in Asia Pacific is projected to register a CAGR of 9.3% from 2025 to 2034, owing to rapid urbanization, growing infrastructure development, and expanding middle-class demand.

- The market in China is expanding due to increasing investments in logistics, cold chain transportation, and long-distance freight operations that require commercial vehicle capacity.

The commercial and recreational vehicle landscape comprises vehicles designed for transporting goods and passengers for business or leisure activities. Commercial vehicles include buses, trucks, and vans used for logistics, construction, or public transit, while recreational vehicles (RVs) are used for travel, camping, and outdoor lifestyles. The industry includes sales, rental, maintenance, and customization services for both categories.

Surge in domestic travel and outdoor tourism is driving recreational vehicle demand, as families and individuals seek self-contained and flexible travel options amid rising health and safety concerns. Additionally, high consumer interest in customized interiors, off-road capabilities, and digital amenities is boosting aftermarket services and recreational vehicle conversions.

Third-party logistics and fleet operators are replacing older vehicles with more fuel-efficient, tech-enabled commercial models to reduce downtime and improve service levels. Moreover, environmental regulations and rising fuel prices are pushing fleet operators and recreational vehicle owners toward, adopting cleaner vehicle technologies, spurring growth in electric variants.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

- Rapid growth in online retail has significantly influenced the market dynamics of the commercial vehicle segment.

- Ongoing investments in public infrastructure projects are directly contributing to the expansion of the commercial and recreational vehicle market.

- Rising demand for electric and hybrid commercial vehicles, driven by government incentives and stricter emission norms, creates growth potential in sustainable transport solutions.

- High costs of advanced vehicle technologies and inadequate charging infrastructure hinder widespread adoption, particularly in developing regions.

Rise in E-commerce Logistics:

The fast growth of online shopping has had a big impact on the commercial vehicle market. According to the U.S. Department of Commerce, total retail e-commerce sales in the U.S. reached USD 1,858.5 billion in the first quarter of 2025, which is a 4.5% increase compared to the same period in 2024. E-commerce made up 16.2% of all retail sales in Q1 2025, slightly higher than 15.9% in Q1 2024. Last-mile delivery has become a key operational challenge, prompting logistics providers to invest in expanding and upgrading their fleets, especially light commercial vehicles. The surge in same-day and next-day delivery expectations is further accelerating the need for agile, fuel-efficient, and tech-enabled vehicles suitable for congested urban and suburban environments. This shift is contributing to the industry's growth by driving steady demand across e-commerce supply chains. The growing reliance on digital fulfillment models continues to expand market value, encouraging OEMs and fleet operators to align vehicle offerings with evolving logistics strategies.

Government Investments in Infrastructure:

Ongoing investments in public infrastructure projects is directly contributing to market expansion. Upgrades in highways, bridges, urban roadways, and smart city development are encouraging transport businesses to modernize their fleets to meet safety and regulatory standards. According to the U.S. Department of Transport, the Federal Highway Administration has allocated nearly USD 635 million for 22 small and medium-sized bridge projects across rural and urban areas, spanning states from Maine to Mississippi, Arizona, and Alaska. Improved road connectivity also enhances operational efficiency, reducing delivery times and vehicle maintenance costs, thereby strengthening the appeal of commercial transport solutions. These infrastructure developments are increasing demand for heavy-duty trucks, cargo vans, and buses, while also creating new opportunities in fleet financing and aftermarket services. Strong policy backing for electrified transport corridors further supports market value growth.

Segmental Insights

Vehicle Type Analysis

Based on vehicle type, the segmentation includes commercial vehicle and recreational vehicle. The commercial vehicle segment accounted for ~57% of the revenue share in 2024, due to sustained demand from logistics, construction, and municipal transport services. Fleet expansions by e-commerce, food delivery, and freight carriers are contributing to volume growth. Commercial buyers are prioritizing vehicles that offer fuel efficiency, digital fleet tracking, and low maintenance. Infrastructure investments and rising urban mobility requirements are also prompting public and private operators to invest in purpose-built trucks, vans, and buses. Increasing awareness about vehicle uptime and emission compliance is pushing fleet owners to adopt newer models, reinforcing the dominance of this segment.

The recreational vehicle segment is projected to grow at a robust pace in the coming years, owing to the rising consumer interest in road-based travel, camping, and outdoor recreation. Shifts in travel behavior post-pandemic have popularized self-contained travel, especially among families and retirees. Upgrades in RV interiors, mobile connectivity, and off-grid capabilities are increasing product appeal. OEMs are also launching compact and fuel-efficient designs that appeal to first-time buyers. Growing popularity of full-time RV living and remote work culture is expanding the market base beyond seasonal use, resulting in consistent year-round demand for new and used recreational vehicles.

Fuel Type Analysis

In terms of fuel type, the segmentation includes diesel, gasoline, electric, hybrid, and other. The diesel segment dominated the revenue share in 2024 due to its widespread use in long-haul trucking, construction fleets, and heavy commercial vehicles. Diesel engines offer high torque and fuel economy, making them suitable for transporting heavy loads across long distances. Existing infrastructure, including fueling stations and repair networks, supports diesel vehicle adoption across industries. Fleet operators value diesel vehicles for their longevity and cost efficiency under demanding operational cycles.

The electric segment is projected to experience the highest CAGR from 2025 to 2034, driven by decarbonization goals, regulatory mandates, and advancements in battery technology. Federal and state-level incentives are encouraging fleet electrification, especially in last-mile delivery and passenger transport. Reduced operational costs, quieter operation, and zero-emission performance are appealing to both commercial and recreational users. OEMs are rapidly expanding electric vehicle (EV) portfolios to include cargo vans, buses, and RVs, addressing a wider set of use cases.

Application Analysis

In terms of application, the segmentation includes commercial vehicle application and recreational vehicles application. The commercial vehicle application dominated the revenue share in 2024 due to high utilization across sectors such as logistics, construction, and public transport. Businesses rely heavily on these vehicles to maintain supply chain continuity, execute service contracts, and manage field operations. Fleet scalability, payload efficiency, and driver comfort features are influencing purchase decisions. High frequency of vehicle replacement in commercial applications further supports recurring demand and contributes to consistent revenue flow in this segment.

The recreational vehicles application segment is projected to grow at a rapid pace in the coming years, driven by a shift toward experiential travel and outdoor exploration. The increasing popularity of RV ownership among younger demographics and remote workers is expanding the user base. Advances in telematics, solar integration, and mobile living amenities are improving the utility and convenience of RVs. Rental platforms and peer-to-peer sharing models are also making recreational vehicles more accessible, fueling adoption across different income groups.

Regional Analysis

The North America commercial and recreational vehicle market accounted for ~50% of global market share in 2024, due to high vehicle penetration, mature infrastructure, and sustained investments in freight, logistics, and outdoor tourism sectors. Advanced manufacturing capabilities and strong aftermarket service networks continue to support demand for both commercial fleets and recreational vehicles. High disposable income levels and favorable credit systems are also enabling vehicle upgrades and new purchases across consumer and fleet categories. The presence of major OEMs and Tier 1 suppliers has enabled product innovation, particularly in electric drivetrains and advanced safety systems, strengthening market leadership. In April 2025, Harbinger launched serial production of its medium-duty electric vehicle (EV), manufactured in the U.S. This initiative marks a significant milestone in the transition to electrification within the sector, highlighting advancements in engineering and sustainable practices tailored for commercial applications. Government incentives for clean transportation and ongoing infrastructure projects are supporting market expansion.

U.S. Commercial and Recreational Vehicle Market Insight

The U.S. held the dominant share of the North America commercial and recreational vehicle landscape in 2024 due to its extensive use of commercial vehicles in sectors such as delivery, construction, and public transit. The growing popularity of outdoor recreation, national park travel, and remote working culture has also fueled demand for recreational vehicles. The U.S. benefits from large-scale vehicle financing options, robust dealership networks, and strong product availability across all price segments. Continuous innovation in vehicle customization, fleet management solutions, and smart vehicle technology also supports consumer and business adoption. Demand from both urban and rural regions keeps sales strong across light, medium, and heavy-duty vehicle classes.

Asia Pacific Commercial and Recreational Vehicle Market Trends

The market in Asia Pacific is projected to register a CAGR of 9.3% during 2025–2034, owing to rapid urbanization, growing infrastructure development, and expanding middle-class demand for both private travel and commercial transport solutions. Rising investments in road connectivity and e-commerce logistics are increasing the uptake of commercial vehicles in emerging economies. The rise in domestic tourism and outdoor recreation trends is also boosting the recreational vehicle segment. Local manufacturing capabilities are being enhanced to meet rising demand across both categories, reducing cost barriers and increasing accessibility. Technological adoption, particularly in electrification and connected vehicles, is accelerating market maturity across key economies.

China Commercial and Recreational Vehicle Market Overview

The industry in China is expanding due to increasing investments in logistics, cold chain transportation, and long-distance freight operations that require commercial vehicle capacity. According to the International Energy Agency, in 2024, China's electric light commercial vehicle (LCV) sales increased by nearly 90% to reach approximately 450,000 units. Rising disposable income and changing lifestyle preferences are contributing to recreational vehicle adoption, particularly among urban dwellers. National policies supporting electric vehicle production and purchase subsidies for commercial fleets are creating a favorable environment for growth. Strong local manufacturing ecosystems and aggressive OEM innovation cycles help bring new models to market faster. A growing preference for domestic travel experiences and mobile lifestyles among the younger generation is also positively influencing RV demand.

Europe Commercial and Recreational Vehicle Market Assessment

The market in Europe is projected to register the highest CAGR of 9.8% from 2025 to 2034 due to the increasing adoption of low-emission and electric commercial vehicles, driven by tightening environmental regulations. The rise of sustainable tourism, coupled with growing awareness of eco-conscious travel, is also fueling interest in electric and hybrid recreational vehicles. Government support for clean transport infrastructure and incentives for fleet electrification are encouraging investment across the public and private sectors. High levels of vehicle customization and strong growth in rental-based RV models are enhancing accessibility for a broader range of consumers. Expansion of cross-border transport and logistics networks is further supporting long-term demand across the region.

Key Players and Competitive Analysis

The competitive landscape is shaped by robust industry analysis, highlighting a dynamic mix of legacy manufacturers and new entrants investing in differentiated product offerings. Companies are implementing expansion strategies focused on electric and hybrid drivetrains, telematics, and modular designs to meet evolving regulatory and consumer demands. Strategic alliances and joint ventures between automakers and technology firms are driving innovation in autonomous driving systems, battery management, and real-time vehicle tracking.

Mergers and acquisitions are enabling portfolio diversification and supply chain integration, particularly in light of rising demand for last-mile delivery vehicles and leisure-based RVs. Post-merger integration efforts are focused on harmonizing product platforms, enhancing R&D capabilities, and streamlining distribution networks. Technology advancements in lightweight materials, connected mobility, and AI-powered fleet management systems are setting new performance benchmarks. Manufacturers are also aligning closely with aftermarket service providers and financing partners to enhance lifecycle value and customer retention in both commercial and recreational segments.

Key Players

- BAIC Group Co., Ltd

- BYD Company Limited

- Daimler Truck Holding AG

- Dongfeng Motor Group Company Limited

- Ford Motor Company

- Iveco Group N.V.

- Leyland Trucks

- Mercedes-Benz Group AG

- Nissan Motor Co. Ltd.

- Northwood Manufacturing

- REV Recreation Group

- Swift Group Limited

- Thor Industries Inc.

- Trigona SA

- Winnebago Industries Inc.

Industry Developments

- May 2025: Winnebago launched the all-new Thrive, a modern, lightweight travel trailer designed to elevate comfort and design standards.

- July 2024: War Horse All Terrain launched a new line of luxury camper vans designed for rugged outdoor adventures.

Commercial and Recreational Vehicle Market Segmentation

By Vehicle Type Outlook (Revenue, USD Trillion, 2020–2034)

- Commercial Vehicle

- Light Commercial Vehicles (LCVs)

- Heavy Trucks

- Buses & Coaches

- Others

- Recreational Vehicle

- Motorhomes

- Class A

- Class B

- Class C

- Towable RVs

- Fifth Wheel

- Travel Trailer

- Camping Trailer

- Motorhomes

By Fuel Type Outlook (Revenue, USD Trillion, 2020–2034)

- Diesel

- Gasoline

- Electric

- Hybrid

- Other

By Application Outlook (Revenue, USD Trillion, 2020–2034)

- Commercial Vehicle

- Transportation & Logistics

- Construction & Mining

- Agriculture & Forestry

- Public Transportation

- Utility & Maintenance Services

- Emergency Services

- Others

- Recreational Vehicle Application

- Leisure & Travel

- Adventure & Sports

- Camping & Overlanding

- Others

By Regional Outlook (Revenue, USD Trillion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Commercial and Recreational Vehicle Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.68 trillion |

|

Market Size in 2025 |

USD 1.84 trillion |

|

Revenue Forecast by 2034 |

USD 4.11 trillion |

|

CAGR |

9.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD trillion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.68 trillion in 2024 and is projected to grow to USD 4.11 trillion by 2034.

The global market is projected to register a CAGR of 9.4% during the forecast period.

North America accounted for ~50% of global market share in 2024 due to high vehicle penetration, mature infrastructure, and sustained investments across freight, logistics, and outdoor tourism sectors.

A few of the key players in the market are BAIC Group Co., Ltd; BYD Company Limited; Daimler Truck Holding AG; Dongfeng Motor Group Company Limited; Ford Motor Company; Iveco Group N.V.; Leyland Trucks; Mercedes-Benz Group AG; Nissan Motor Co. Ltd.; Northwood Manufacturing; REV Recreation Group; Swift Group Limited; Thor Industries Inc.; Trigona SA; and Winnebago Industries Inc.

The commercial vehicle segment accounted for ~57% of the revenue share in 2024 due to sustained demand from logistics, construction, and municipal transport services.

The diesel segment dominated the revenue share in 2024 due to its widespread use in long-haul trucking, construction fleets, and heavy commercial vehicles.